Can You Have Multiple Health Insurance : Exploring Your Coverage Options

Can You Have Multiple Health Insurance? Yes, it is possible to have multiple health insurance policies.

Credit: www.invisalign.com

Different Types Of Health Insurance Policies

Health insurance is essential for ensuring access to quality healthcare services when needed. Several types of health insurance policies are available, catering to different needs and preferences.

Employer-sponsored Health Insurance

Employer-sponsored health insurance is provided by companies to their employees as part of their benefits package. It typically offers coverage for medical expenses and sometimes includes dental and vision benefits.

Private Health Insurance

Private health insurance is purchased directly by individuals or families from a private insurance company. It offers various coverage options and benefits, allowing for customisation based on individual needs.

Government-sponsored Health Insurance

Government-sponsored health insurance programs, such as Medicare and Medicaid, are designed to cover specific populations, including older adults, low-income individuals, and people with disabilities. The government funds these programs to ensure access to healthcare services.

Factors To Consider When Having Multiple Health Insurance

Factors to consider when having multiple health insurance

Cost

Comparing premiums and out-of-pocket costs for each policy is essential.

Coverage Overlap

Could you ensure policies don’t duplicate coverage, leading to wasted expenses?

Coordination Of Benefits

Understand how benefits coordinate between policies to maximise coverage.

Network Limitations

Could you check providers in each plan’s network to avoid coverage limitations?

Steps To Take When Having Multiple Health Insurance

There are several essential steps to take regarding having multiple health insurance plans. Reviewing each policy’s coverage, coordinating benefits, and communicating with your insurance providers is crucial to ensure proper utilisation and avoid overlapping coverage.

Contact Your Insurance Providers

When you have multiple health insurance plans, you must contact each provider to inform them about your other coverage. This step is crucial as it allows both providers to coordinate benefits and ensures you receive the maximum coverage for your medical expenses.

Understand Your Coverage Options

Could you take the time to understand your coverage options under each health insurance plan fully? This includes knowing the extent of medical services covered, deductibles, co-pays, and any limitations or restrictions that may be in place. Understanding your coverage will help you decide which plan to use for various medical needs.

Keep Track Of Your Medical Expenses

Keeping track of your medical expenses is essential when you have multiple health insurance plans. Create a spreadsheet or use a dedicated app to record each medical expense you incur, including the date, description, amount, and which insurance plan was used. This helps you remain organised and ensures you have accurate documentation when it’s time to submit claims.

Submit Claims Correctly

When submitting claims for medical services, following the appropriate procedures for each insurance provider is important. Make sure to fill out all necessary forms accurately and provide any required documentation, such as itemised bills or receipts. Double-check that the claims are submitted to the correct insurance plan to avoid delays or discrepancies. Following these steps will help you navigate the process of having multiple health insurance plans. By contacting your insurance providers, understanding your coverage options, keeping track of expenses, and submitting claims correctly, you can maximise your benefits and minimise any potential billing issues. Please stay organised and proactive in managing your healthcare coverage to ensure a smooth experience.

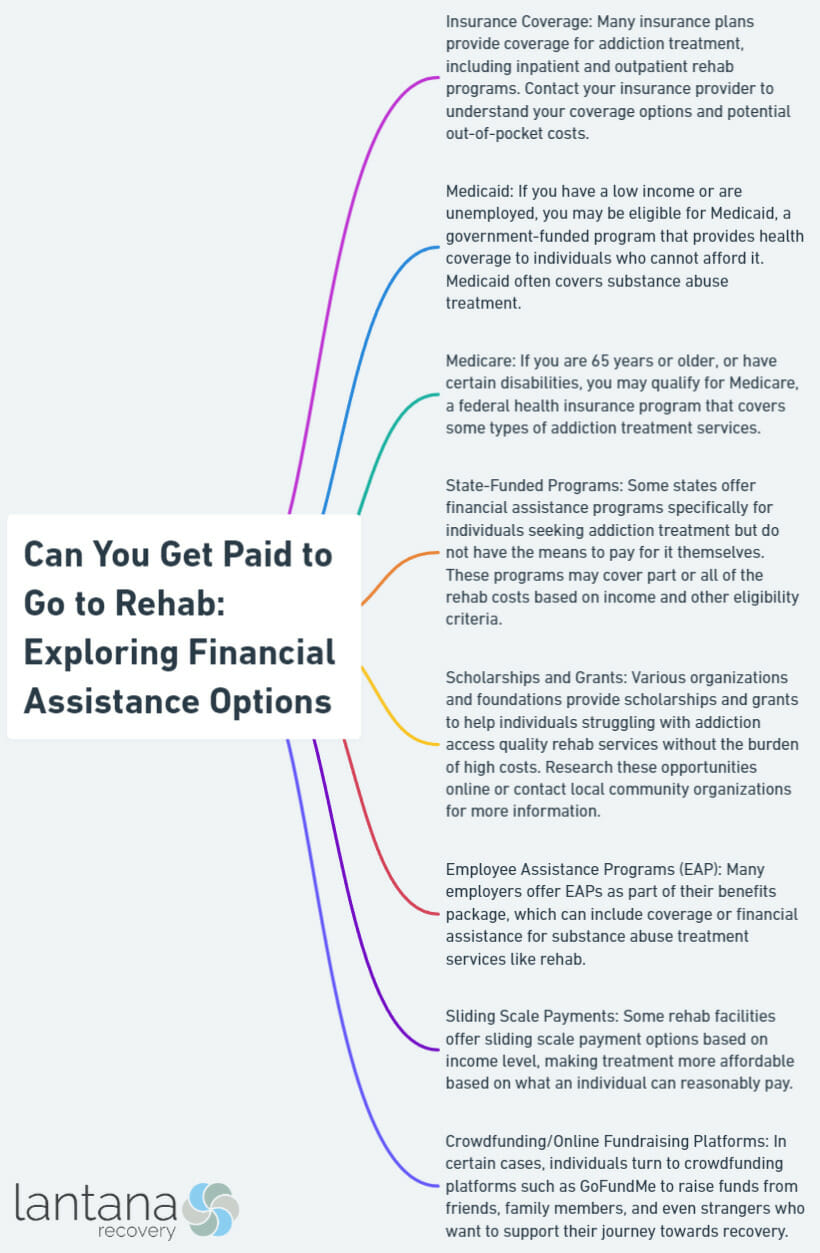

Credit: lantanarecovery.com

Common Misconceptions About Having Multiple Health Insurance

Several everyday things could be improved by having multiple health insurance policies.

Double Payments

One common misconception is that having multiple health insurance policies means double payments. However, this is different. When you have multiple policies, they work together to provide coverage, and you only pay the premiums for each policy individually.

Unlimited Coverage

Another misconception is that having multiple health insurance policies provides unlimited coverage. While various policies may offer broader coverage, they have limits and may not cover the same expenses. It’s essential to understand the details of each policy to avoid potential gaps in coverage.

Easy Reimbursement

Some individuals believe that having multiple health insurance policies guarantees easy reimbursement. However, navigating multiple policies can often complicate the reimbursement process. You may need to coordinate benefits between the policies to ensure proper reimbursement, which can be time-consuming and confusing.

Credit: www.facebook.com

Frequently Asked Questions On Can You Have Multiple Health Insurance

Can I Have Multiple Health Insurance Policies?

Yes, it’s possible to have multiple health insurance policies. Having coverage from more than one insurer can potentially broaden your healthcare options and provide additional financial protection. However, reviewing the terms, conditions, and coordination of benefits is essential to ensure you fully understand how the policies work together.

What Are The Benefits Of Having Multiple Health Insurance Policies?

Having multiple health insurance policies can offer added flexibility and broader coverage. It can reduce out-of-pocket costs and provide access to a more comprehensive network of healthcare providers. Additionally, multiple policies can increase the likelihood of full coverage for healthcare expenses in the event of a claim.

How Do Multiple Health Insurance Policies Coordinate Benefits?

When you have multiple health insurance policies, the coordination of benefits determines which insurer pays first and how the remaining costs are covered. This process ensures you don’t receive more benefits than the total expenses. Understanding the coordination of benefits is crucial to maximising your coverage while preventing overpayment.

Are There Any Downsides To Having Multiple Health Insurance Policies?

While having multiple health insurance policies can provide added coverage, it’s essential to consider the potential downsides carefully. These may include increased paperwork, potential for confusion during claims processing, and overlapping coverage that could lead to unnecessary premium expenses. It’s essential to weigh the benefits against the potential drawbacks.

Conclusion

Multiple health insurance policies can provide additional coverage and financial protection for individuals. It allows them to complement their existing insurance plans and address any gaps in coverage. However, it is essential to carefully consider the terms, benefits, and costs of each policy before deciding.

Exploring various options and seeking advice from insurance professionals can help determine the best approach for a person’s unique needs and circumstances. Multiple health insurance policies can offer added peace of mind and security during medical emergencies.