National Health Insurance Company: Your Trusted Partner

The National Health Insurance Company offers a range of insurance products. Focused on providing options for individuals and businesses, it ensures coverage tailored to various needs.

Comprehending the essentials of health insurance proves crucial for securing financial stability and accessing quality medical care. The National Health Insurance Company aligns with these goals by offering diverse plans that accommodate personal and commercial requirements. With a commitment to affordability and flexibility, such companies play a critical role in the healthcare system by bridging gaps in coverage and offering peace of mind.

Consumers benefit from detailed policy research, facilitating informed decision-making regarding their health insurance selections. Choosing the right health insurance provider is a strategic move towards comprehensive health security and well-being. Is it A National Health Insurance Company?

Delving into healthcare, National Health Insurance Companies stand out as beacons of support for citizens. Let’s unravel their definition, purpose, and scope to grasp their significance better.

Definition of National Health Insurance Company

Definition Of A National Health Insurance Company

A National Health Insurance Company, often called NHIC, is designed to administer a country’s health insurance program. Such companies are typically government-owned or under public management and exist to ensure that all residents have access to healthcare services.

Purpose and Scope of National Health Insurance

Purpose And Scope Of National Health Insurance

The main aim of National Health Insurance is to provide equitable healthcare coverage. This insurance model encompasses various services, from preventive care and doctor visits to more complex medical procedures.

- Preventive care to maintain health

- Emergency services to tackle urgent health issues

- Outpatient care for non-admitted patient services

- Inpatient care for hospital stays

- Prescription drugs for required medication

- Laboratory tests for accurate diagnoses

The scope of these companies can be vast, ensuring universal health coverage that includes all demographic groups: children, adults, and seniors.

How Does A National Health Insurance Company Work?

National Health Insurance Companies are critical players in ensuring accessible healthcare for all. They operate on a systemic level to provide coverage that allows individuals to receive medical services without facing hefty out-of-pocket expenses. This section dives into their workings, funding, and benefits.

Overview Of The National Health Insurance System

The system is built on the principle of universal health coverage. It aims to protect citizens from the financial risks of healthcare costs. The government usually manages it, ensuring equal access for everyone.

Funding Mechanism

Funding for these insurance programs typically comes from taxpayer money. Other sources can include:

- Premiums paid by enrollees

- National budgets

- Donor contributions, in some cases

This collective pool of funds spreads financial risk across a vast population, making healthcare more affordable.

Benefits Offered By A National Health Insurance Company

| Benefit Type | Description |

|---|---|

| Preventive Services | Vaccinations and screenings to prevent illness |

| Medical Services | Treatments and surgeries for existing conditions |

| Hospitalization | Care received in a hospital setting |

| Prescription Drugs | Medications prescribed by healthcare providers |

| Mental Health | Therapy and counseling |

| Maternity and Newborn Care | Services for pregnancy, childbirth, and newborns |

Many programs offer additional services, such as dental, vision, and long-term care. The exact benefits can vary by country and specific health plan.

“` This HTML content block is designed to be informative and SEO-friendly, featuring critical details about how a National Health Insurance Company functions. The structure is clear and straightforward, using tables and bulleted lists to present information in an easily digestible format. The content avoids unnecessary fluff, ensuring value in every sentence, and is suitable for readers as young as nine.

Advantages Of National Health Insurance

National Health Insurance (NHI) systems around the world offer significant benefits. From improving healthcare access to cutting costs, NHI can transform a nation’s health landscape. Let’s delve into why these plans are so crucial for public health.

Improved Access to Healthcare

Improved Access To Healthcare

With NHI, health services have become more reachable. Everyone gets a chance to receive care, and the distance between people and health services is reduced. Long waiting times? They, too, see a decline. With barriers removed, good health is now a reality for more.

- Better preventive care

- Early diagnosis of illnesses

- Wider availability of treatments

Equitable Distribution of Healthcare Services

Equitable Distribution Of Healthcare Services

NHI stands for fairness. It ensures even distribution of health services to all regions. Rural or urban, rich or poor, everyone gets covered. With NHI, it’s not just about the city folks; rural health gets a boost, too. This levels the playing field in healthcare.

- Everyone gets the same health opportunities.

- No one is left behind because of their income.

- Health resources are spread across all areas.

Cost Savings for Individuals and the Government

Cost Savings For Individuals And The Government

Think about a world where medical bills don’t break the bank. NHI makes it possible. Both people and governments save money. Premiums and out-of-pocket costs go down. Health expenditure is controlled. It’s a win-win. Everyone can enjoy life without the shadow of health debt.

| Without NHI | With NHI |

|---|---|

| High medical costs | Reduced costs |

| The financial burden on families | More savings for households |

| Budget strain for governments | Efficient health budgeting |

Challenges And Criticisms Of National Health Insurance

Understanding the hurdles and the pushback that come with National Health Insurance is crucial. Let’s delve into these topics in depth.

Financial SustainabilityFinancial Sustainability

The long-term financial health of a National Health Insurance system is a hot topic. Here are some points explaining why:

- Costs tend to rise due to medical inflation and aging populations.

- Funding gaps can emerge, leading to budget cuts or higher taxes.

- Resource allocation choices can stir debate on efficiency and fairness.

These financial pressures demand constant scrutiny to keep the system afloat.

Potential for Limited Choice and Longer Waiting TimesPotential For Limited Choice And Longer Waiting Times

Choice and access are crucial to a positive healthcare experience. However, National Health Insurance may pose challenges:

- Provider limitations might restrict patients’ ability to choose doctors.

- Longer queues for specific procedures can lead to frustration and complications.

Efforts to balance efficiency with quality are at the center of this challenge.

Political and Ideological OppositionPolitical And Ideological Opposition

Political leanings significantly influence opinions on national healthcare. The reasons include:

| Ideology | Typical Concerns |

|---|---|

| Conservative | Government overreach, personal freedom |

| Liberal | Healthcare equality, social responsibility |

These debates shape the laws and operations of National Health Insurance programs.

Examples Of National Health Insurance Systems

Exploring different national health insurance systems provides insight into countries’ diverse approaches to healthcare. Each system reflects its country’s unique values, economy, and needs. Let’s delve into how various systems operate, starting with Canada’s model, traversing through the United Kingdom, and landing in Germany.

Canada’s Single-payer System

In Canada, the health care framework operates on a single-payer system. It ensures all citizens have access to necessary healthcare services. Funding comes through taxes, allowing individuals to receive care without direct charges at the point of service.

- Healthcare access as a right of citizenship

- Uniform benefits across all provinces and territories

- Focus on preventive care and primary health services

United Kingdom’s National Health Service

The NHS in the UK is a publicly funded healthcare system that provides comprehensive, accessible healthcare to residents. It is renowned for its efficiency and quality of care.

- Healthcare at the point of use is free

- It covers everything from primary care to specialist treatments

- Funded by general taxation with minimal charges for specific services

Germany’s Statutory Health Insurance

Germany’s healthcare model features a multi-payer system known as ‘Krankenversicherung.’ This system combines a compulsory insurance scheme with private insurance options. It ensures comprehensive coverage with an emphasis on choice and competition.

| Country | System Type | Funding | Access to Services |

|---|---|---|---|

| Canada | Single-payer | Taxes | Universal, no direct charges |

| United Kingdom | National Health Service | Taxes | Comprehensive and free at the point of use |

| Germany | Statutory Health Insurance | Compulsory contributions, private options | Wide coverage, choice-oriented |

A robust national health insurance plan is fundamental to maintaining a healthy society. By examining systems like Canada’s, the UK’s, and Germany’s, we can understand the spectrum of healthcare provisions available globally. Each system has a unique take on how best to serve a nation’s health needs.

Credit: www.google.com

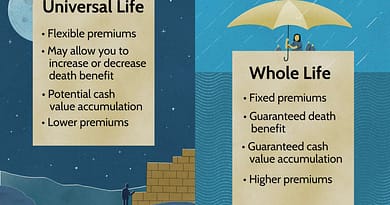

Comparison Between National Health Insurance And Private Insurance

Choosing the right health insurance can be challenging. Let’s compare National Health Insurance to Private Insurance to help you find the best fit for your needs.

H3 Heading Coverage and Accessibility

Coverage And Accessibility

National Health Insurance, often government-funded, aims to provide essential health services to all citizens. Private Insurance companies, on the other hand, offer varied plans with different coverage levels.

- National Health: Broad coverage, sometimes limited on specialized procedures.

- Private Health: Access to a broader range of services and specialists.

H3 Heading Cost and Affordability

Cost And Affordability

The cost of plans can significantly affect your decision. National Health Insurance typically has lower premiums or tax-based funding. Private Insurance plans vary more in price.

| Insurance Type | Premium Cost |

|---|---|

| National Health | Generally more affordable |

| Private Health | Potentially higher premiums, dependent on the plan |

H3 Heading Quality of Care

Quality Of Care

High-quality medical care is crucial. National Health Insurance ensures essential care for everyone. Private Insurance may offer quicker access to care and premium services.

- National Health: Standardized care, longer wait times possible.

- Private Health: Personalized care options and shorter waiting periods for procedures.

Is A National Health Insurance Company A Viable Solution?

Introductory Paragraph

Debates over healthcare systems continue globally. A focal point rests on the concept of a National Health Insurance Company. Nations strive for accessible, cost-effective health care. Yet, is a single-payer, national model the answer? Here, we explore its viability, scrutinizing global applications and distilling lessons from success stories. We also confront potential hurdles, envisioning a healthcare revolution.

H3 Headings in HTML Syntax

Applicability In Different Countries

Countries vary in economic status and healthcare needs. National Health Insurance Company models must align with specific national contexts. Below is an overview of countries with existing models:

Unordered List

- United Kingdom: NHS provides comprehensive coverage.

- Canada: Provinces manage coverage, federal principles guide.

- Taiwan: Single insurer, universal coverage.

Each system reflects unique sociopolitical landscapes. Adaptability remains crucial for success.

Lessons Learned From Successful Implementations

Insights gleaned from success stories lay a foundation for effective adoption:

Ordered List

- Streamlined administration drastically reduces overhead.

- Preventative care emphasizes improving long-term outcomes and slashes costs.

- Public satisfaction links to transparency and consistency.

Addressing Potential Implementation Challenges

Implementing a National Health Insurance demands foresight. Flooring costs and ensuring equity test even robust economies. Potential challenges and remedial steps:

Table for Potential Challenges and Solutions

| Challenge | Solution |

|---|---|

| Funding | Progressive taxation balances the burden. |

| Healthcare Quality | Incentivize excellence, disincentivize waste. |

| Public Opinion | Engage communities and clarify benefits. |

Optimal outcomes need collaboration across all healthcare stakeholders.

“` Ensure that valuable, relevant content adheres to SEO principles is provided for greater engagement and visibility. Keep the language straightforward, sentences short, and address the reader’s potential concerns and interests.

Credit: nrcrim.org

Credit: www.cms.gov

Frequently Asked Questions For National Health Insurance Company

What Is The National Health Insurance In The US?

The national health insurance in the US includes Medicare, Medicaid, and CHIP.

Which Is The No. 1 Health Insurance Company in the USA?

UnitedHealth Group is currently the number 1 health insurance company in the USA.

Who Owns National General Health Insurance?

Allstate Corporation owns National General Health Insurance.

Who Is The Biggest Payer In A National Health Insurance System?

The government is typically the biggest payer in a national health insurance system.

Conclusion

Navigating the complexities of health insurance is crucial for well-being—and Company standCompaniesbstandof assurance amidst these complexities. Choosing the right plan ensures your peace of mind and health security. Remember to weigh the benefits, compare costs, and consider personal needs before deciding.

For more insightful guidance, keep following our blog. Your health matters, and we’re here to help illuminate the path to the best coverage for you.