Small Business Health Insurance Maryland : Affordable Options & Benefits

Small Business Health Insurance Maryland can find suitable health insurance options through various providers, ensuring the well-being of their employees. Small business health insurance in Maryland offers numerous benefits, including affordable coverage, access to a vast network of medical professionals, and compliance with state and federal regulations.

By exploring available policies and comparing their coverage and costs, small business owners can select the most suitable health insurance plan for their employees. Making the correct choice not only protects the well-being of employees but also contributes to the overall success and growth of the business.

The Importance Of Small Business Health Insurance

In Maryland, providing health insurance for employees is crucial for small businesses. It not only plays a vital role in the well-being of employees but also benefits the company in various ways.

Benefits Of Providing Health Insurance To Employees

- Employee Retention: Offering health insurance can help retain valuable employees.

- Employee Morale: Health coverage boosts morale and productivity.

- Attracting Talent: Health benefits attract skilled employees.

Legal Requirements For Small Businesses In Maryland

Small businesses in Maryland must comply with state laws regarding employee health insurance. It’s essential to stay informed and fulfill all legal obligations.

Tax Benefits For Small Businesses Offering Health Insurance

| Tax Benefits | Description |

|---|---|

| Tax Deductions | Small businesses may be eligible for tax deductions on premiums paid. |

| Small Business Health Care Tax Credit | Businesses with 25 full-time equivalent employees may qualify for a tax credit. |

Credit: www.uhc.com

Options For Small Business Health Insurance In Maryland

Options for Small Business Health Insurance in Maryland

Group Health Insurance Plans

Group health insurance plans in Maryland offer coverage for a group of employees. It provides benefits at a lower cost due to group rates.

Health Maintenance Organizations (HMOs)

HMOs in Maryland require members to choose a primary care physician and get referrals to see specialists. They generally have lower out-of-pocket costs.

Preferred Provider Organizations (PPOs)

PPOs allow employees to see any doctor, specialist, or healthcare provider without a referral. This flexibility usually comes with higher premiums.

Health Savings Accounts (has)

HSAs are tax-advantaged accounts that allow employees to save money for medical expenses. They are paired with high-deductible health plans.

Maryland Health Connection Marketplace

The Maryland Health Connection Marketplace allows small businesses to explore and purchase health insurance options that suit their needs and budget.

Choosing The Right Small Business Health Insurance Plan

Finding the right health insurance plan for your small business in Maryland can be complex. It’s essential to consider the needs of your employees and the coverage options available. Researching and comparing different plans can help you make an informed decision that meets your budget and your employees’ healthcare needs.

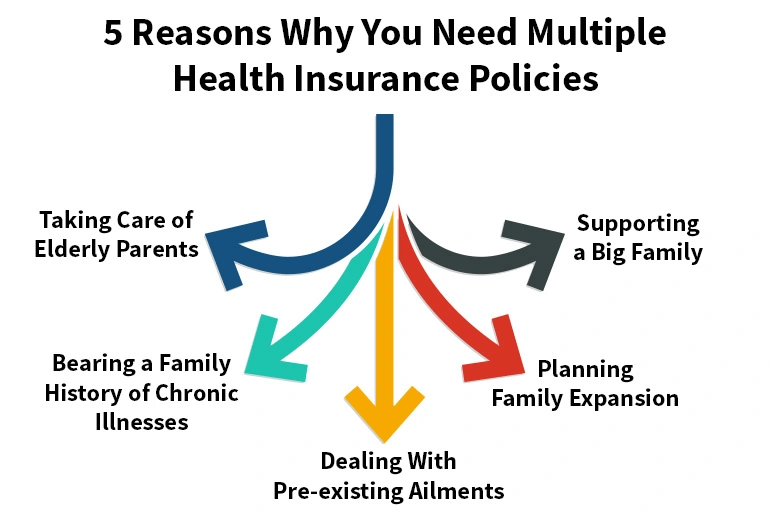

Assessing The Needs Of Your Employees

When choosing the right small business health insurance plan, the first step is to assess the needs of your employees. Understand that every employee may have different healthcare requirements, so it’s crucial to have a plan that caters to their diverse needs. This ensures employees feel valued and supported, boosting employee satisfaction and productivity.

Considering Costs And Affordability

One of the critical factors to consider when selecting a small business health insurance plan is its costs and affordability. As a small business owner, you want to provide your employees comprehensive coverage while ensuring the plan falls within your budget. Consider not only the premiums but also the deductibles, copayments, and out-of-pocket maximums. Striking a balance between cost and coverage is vital to ensure that your business and employees can afford the plan without compromising quality healthcare.

Access To Provider Networks

Access to a wide range of healthcare providers is another crucial aspect when choosing a small business health insurance plan. Please ensure the plan offers an extensive provider network, including primary care physicians, specialists, hospitals, and clinics. This allows your employees to have the flexibility to choose their preferred healthcare providers without facing unnecessary limitations. In addition, having access to a robust provider network enhances the likelihood of receiving prompt medical care whenever needed.

Coverage And Services Offered

While evaluating small business health insurance plans, carefully analyze the coverage and services offered. Ensure the plan covers essential health benefits, including preventive care, hospitalization, prescription drugs, and mental health services. Consider your employees’ specific needs, such as vision or dental coverage. A comprehensive plan that addresses the particular healthcare requirements of your employees will not only keep them healthy but also minimize the financial burden of medical expenses. In conclusion, choosing the right small business health insurance plan involves assessing the needs of your employees, considering costs and affordability, ensuring access to provider networks, and evaluating the coverage and services offered. By thoroughly considering these factors, you can provide your employees with a plan that meets their healthcare needs and fits within your budget. Ultimately, investing in the well-being of your employees is a wise business decision that fosters a healthy and productive work environment.

Credit: twitter.com

How To Shop For Small Business Health Insurance In Maryland

When starting a small business, it’s essential to consider the well-being of your employees. In Maryland, offering health insurance can be a valuable perk to attract and retain top talent, but navigating the small business health insurance world can be complex. Still, with the right approach, you can find a plan that meets your employees’ needs and budget. Here’s how to shop for small business health insurance in Maryland.

Researching Insurance Providers

Begin your search for small business health insurance in Maryland by researching different insurance providers. Look for reputable companies that offer plans tailored to small businesses. Check for customer reviews and ratings to gauge the satisfaction levels among current policyholders.

Comparing Plan Options And Pricing

Once you’ve identified potential insurance providers, compare their plan options and pricing. Consider the coverage provided, including benefits such as doctor visits, hospital stays, and prescription drugs. Pay careful attention to the pricing structure, including premiums, deductibles, and co-pays.

Reading And Understanding Plan Documents

Before making any decisions, carefully read and understand the plan documents the insurance providers provide. Pay attention to the plans’ terms and conditions, exclusions, and limitations. Ensure the plans align with the needs of your employees and provide the necessary coverage.

Consulting With Insurance Brokers Or Agents

It can be beneficial to seek guidance from insurance brokers or agents specializing in Maryland’s small business health insurance. They can provide valuable insights into the available plans and help you navigate the complexities of insurance terminology. Additionally, they can help you secure the best possible deal for your business.

Navigating The Enrollment Process For Small Business Health Insurance

Understanding the enrollment process is crucial for providing your employees with small business health insurance in Maryland. Navigating the complexities of health insurance enrollment can be overwhelming for small business owners. This guide will walk you through the essential steps of the enrollment process, from enrollment periods to submitting required documentation, to streamline the process and ensure your business and employees are covered.

Enrollment Periods And Deadlines

Understanding the enrollment periods and deadlines is crucial when it comes to offering health insurance to your employees. Remember that the eligible enrollment periods can vary, and missing a deadline could result in a gap in coverage for your employees.

Collecting Employee Information

Collecting accurate and up-to-date employee information is vital for a seamless enrollment process. Employee names, social security numbers, and dependent information are essential for precise enrollment and coverage.

Completing Application Forms

Completing the application forms accurately and thoroughly ensures a smooth enrollment process. Be sure to double-check all information provided on the forms to avoid delays or errors in the application process.

Submitting Required Documentation

Submitting the necessary documentation, such as proof of eligibility and employee details, is a critical step in enrollment. Ensuring all required documents are accurate and complete will expedite the application process and prevent potential complications.

Managing Small Business Health Insurance Costs

As a small business owner in Maryland, managing health insurance costs for your employees is a crucial aspect of running your business. Understanding the factors contributing to these costs can help you make informed decisions that protect your employees’ well-being while keeping expenses manageable. This article will explore key strategies to manage Maryland’s small business health insurance costs.

Understanding Premiums, Deductibles, And Copayments

When considering health insurance plans for your small business, it’s essential to understand the three main components that make up the costs: premiums, deductibles, and copayments.

- Premiums: These are the monthly fees you and your employees pay for the insurance coverage. Premiums vary depending on the plan you choose and the level of coverage provided. It is essential to compare different plans and consider the needs of your employees when selecting the best option.

- Deductibles: A deductible is the amount your employees need to pay out of pocket for covered services before the insurance coverage kicks in. Lower deductible plans typically have higher premiums, while higher deductible plans have lower premiums. Evaluating your employees’ healthcare needs can help determine the optimal balance between premiums and deductibles.

- Copayments: Copayments, or copays, are fixed amounts that your employees pay when they receive medical services. For example, a copay might be required for a doctor’s visit or prescription medication. Understanding the copay amounts and how they vary across different plans is essential for comparing costs and choosing the most cost-effective strategy.

Implementing Wellness Programs

Promoting wellness among your employees can help reduce healthcare expenses in the long run. By implementing wellness programs, you can empower your employees to adopt healthy habits, prevent chronic diseases, and minimize the need for expensive treatments. Wellness programs can include initiatives such as exercise challenges, nutrition education, and stress management workshops. Encouraging your employees to prioritize their well-being benefits their health and helps control healthcare costs for your small business.

Exploring Cost-saving Strategies

When it comes to managing small business health insurance costs, there are various cost-saving strategies you can explore:

- Shop around: Compare different health insurance providers to find the most competitive rates and comprehensive coverage.

- Encourage preventive care: Emphasize regular check-ups and preventive screenings to identify and treat health issues early at a lower cost.

- Consider a high-deductible plan with a health savings account (HSA): This combination can offer you and your employees lower monthly premiums and tax advantages.

- Implement telemedicine: Offer virtual healthcare options, which can be cost-effective and convenient for non-emergency medical consultations.

Evaluating Provider Networks And Negotiating Rates

Evaluating provider networks is crucial when selecting health insurance plans for your small business. Ensure your insurance plan includes a wide range of healthcare providers in Maryland, ensuring your employees have access to quality care. Also, please don’t hesitate to negotiate rates with insurance providers. By leveraging the collective buying power of your small business, you can secure more favorable rates and insurance options.

Understanding Employee Rights And Protections

Coverage Continuation And Portability

Workers in Maryland have the right to continue their health insurance coverage after leaving their jobs.

Anti-discrimination Laws

Employers must not discriminate against employees based on gender, race, or disability when offering health insurance benefits.

Employee Privacy And Confidentiality

Employees’ health information must be kept confidential and only shared as necessary for insurance purposes.

Employee Grievances And Appeals

Employees can raise complaints or appeals if they feel their health insurance benefits have been unfairly denied.

Common Challenges Faced By Small Businesses In Offering Health Insurance

Small businesses in Maryland often encounter several hurdles when providing health insurance for their employees. These challenges can significantly impact their ability to offer comprehensive and affordable coverage, affecting both the company and its workforce.

Affordability And Budget Constraints

Small businesses may need help with the affordability of health insurance plans due to tight budgets. This can limit their options and make it challenging to provide competitive employee benefits.

Limited Plan Options

The limited plan options available for small businesses can restrict their ability to find a suitable health insurance package that meets the diverse needs of their workforce.

Employee Retention And Recruitment

Health insurance plays a crucial role in employee retention and recruitment, but small businesses may need to offer comprehensive health benefits to attract and retain talent.

Complexities Of Insurance Administration

The complexities of insurance administration can overwhelm small business owners as they must navigate the intricate processes and regulations involved in managing health insurance for their employees.

Credit: www.ramseysolutions.com

Frequently Asked Questions Of Small Business Health Insurance Maryland

What Are The Benefits Of Small Business Health Insurance In Maryland?

Small business health insurance in Maryland provides employees access to affordable healthcare, improving their well-being and productivity. It also helps small businesses attract and retain top talent, enhancing their competitiveness in the market.

How Can Small Businesses In Maryland Find Affordable Health Insurance Plans?

Small businesses in Maryland can explore health insurance options through state-based marketplaces, insurance brokers, and professional organizations. Comparing different plans and seeking subsidies or tax credits can help them find affordable coverage that meets their employees’ needs.

What Are The Legal Requirements For Small Business Health Insurance In Maryland?

Small businesses in Maryland with a certain number of employees must offer health insurance coverage per the state’s regulations. Additionally, they must comply with the Affordable Care Act’s employer mandate, ensuring adequate and affordable coverage for their employees.

How Does Small Business Health Insurance Benefit Employee Retention And Satisfaction?

Small business health insurance in Maryland demonstrates a commitment to employee welfare, fostering loyalty and satisfaction among the workforce. It also reduces financial stress related to healthcare costs, leading to higher job satisfaction and lower organizational turnover rates.

Conclusion

Securing health insurance for your small business in Maryland is crucial for the well-being of both your employees and your business. By offering comprehensive coverage options, you can attract and retain top talent while providing the necessary protection against unexpected medical expenses.

With the right health insurance plan, your small business can thrive in Maryland’s competitive market and ensure the health and success of your workforce. Stay informed about the latest regulations and options to make well-informed decisions that benefit your business and employees.