Choose the Statement That is True About Health Insurance: Clearing Misconceptions

Choose the Statement That is True About Health insurance, essential for covering medical expenses and protecting individuals from financial burdens. I think it’s important to understand your policy.

Regarding health insurance, having the right coverage can make all the difference in your well-being. With various options available, you should be able to choose a policy that meets your needs. It is essential to comprehend your health insurance’s terms, benefits, and limitations to ensure adequate coverage when needed.

Lack of understanding can lead to unexpected costs or denied claims. Make informed decisions to safeguard your health and financial stability.

Credit: www.bu.edu

The Basics Of Health Insurance

When managing your health, understanding how health insurance works is fundamental. Your health insurance plan can dictate the care you receive and its associated costs. Whether through an employer or purchased independently, it’s vital to grasp the basics of health insurance before choosing a plan.

How Health Insurance Works

Health insurance is designed to help cover the cost of medical expenses, providing a level of financial protection against unforeseen medical emergencies or routine healthcare expenses. It works by individuals or employers paying a premium to an insurance company, who agree to cover a portion of the costs associated with medical services. When a covered illness or injury occurs, the insurer pays for or reimburses the expenses of medical treatment, tests, prescriptions, and preventive care services. Understanding the scope of coverage and out-of-pocket expenses is crucial for making informed decisions about your healthcare.

Types Of Health Insurance Plans

There are various health insurance plans, each with features and benefits. Some of the most common plans include:

- Health Maintenance Organization (HMO): This type of organisation requires individuals to choose a primary care physician and obtain referrals for specialist care.

- Preferred Provider Organization (PPO): This organisation offers a network of preferred providers and allows individuals to seek care outside the network, albeit with higher out-of-pocket costs.

- Exclusive Provider Organization (EPO): Similar to a PPO, but without coverage for out-of-network care, except in emergencies.

- Point of Service (POS): This plan combines elements of HMO and PPO plans, allowing members to choose in-network or out-of-network care with different levels of coverage.

Each plan has its own set of rules and costs, so it’s essential to compare and select the one that best fits your healthcare needs and budget.

Credit: www.simonandschuster.com

Key Factors To Consider

When considering health insurance, it’s crucial to verify the accuracy of the policy details provided. Understanding the coverage limitations and exclusions is essential for making an informed decision. Ensuring that the chosen Statement aligns with the specific health insurance requirements is vital.

Key Factors to Consider Coverage Options Costs and Premiums In-Network Providers When selecting health insurance, consider coverage options, costs, and in-network providers. Understanding the key factors that will impact your healthcare decisions is essential. Coverage options vary among health insurance plans, including doctor visits, prescriptions, and hospital stays. Costs and premiums are critical in choosing health insurance, considering deductibles, co-pays, and monthly expenses. In-network providers are healthcare professionals who agree with insurers to provide services at discounted rates. It’s crucial to ensure your preferred healthcare providers are in-network. Comparing insurance plans based on these factors can help you make an informed decision that meets your healthcare needs.

Common Misconceptions

Common misconceptions about health insurance can lead to clarity and understanding for individuals seeking coverage. Let’s debunk some myths to help you make informed decisions.

Health Insurance Equals Healthcare

Health insurance doesn’t automatically mean you have access to quality healthcare services.

Understanding the coverage limitations and network providers is crucial for accessing healthcare.

Pre-existing Conditions

Contrary to popular belief, pre-existing conditions don’t disqualify you from obtaining health insurance.

Some policies may have waiting periods or higher premiums for pre-existing conditions.

Selecting The Right Plan

Regarding health insurance, selecting the right plan is crucial in ensuring you have the coverage you need for your healthcare needs. It can be overwhelming to navigate the numerous options available. Still, by understanding your needs, comparing plans, and using preventive services, you can make an informed decision that meets your needs.

Assessing Your Needs

Assessing your healthcare needs is the first step in choosing the right health insurance plan. Consider factors such as your current health status, ongoing medical treatments, and the specific services you anticipate needing in the upcoming year. By evaluating your needs, you can determine the level of coverage that will best suit your healthcare requirements.

Comparing Plans

After evaluating your needs, it’s essential to compare different health insurance plans to find the one that aligns with your requirements and budget. Look into factors such as premiums, deductibles, co-pays, and coverage for prescription drugs. By comparing plans side-by-side, you can identify the one that offers the best value and coverage for your needs.

Utilising Preventive Services

Many health insurance plans offer coverage for preventive services such as vaccinations, screenings, and wellness programs at no additional cost. By taking advantage of these services, you can proactively manage your health and detect any issues early, leading to better health outcomes and lower healthcare costs in the long run.

Navigating The Healthcare System

Understanding the ins and outs of healthcare can be daunting. The jargon, paperwork, and maze-like system can be overwhelming. However, when managing your health insurance, knowledge is power. This section will help demystify some critical aspects of the healthcare system you need to know.

Understanding Deductibles And Copayments

Before diving into the intricacies of health insurance, let’s start with two critical terms: deductibles and copayments. Deductibles are the amount you must pay out of pocket before your insurance starts covering costs. Think of it as a threshold you must cross for your benefits to kick in. Copayments are fixed amounts you pay for specific services or prescriptions frequently made during the visit.

With increasing deductibles and copayments becoming the norm in many health insurance plans, it’s crucial to understand their implications on your budget. For instance, if your plan has a $1,000 deductible, you must pay that amount before your insurance covers any medical expenses. Once you reach the deductible, your insurance provider will start sharing the cost of your healthcare, usually coinsurance.

Using Health Savings Accounts

If you’re looking for a smart way to save up for medical expenses, a Health Savings Account (HSA) might be the answer. An HSA is a tax-advantaged savings account that saves you money for healthcare costs. Your contributions to your HSA are tax-deductible, meaning you can save on your taxes while preparing for future healthcare expenses.

An HSA can be a powerful financial tool because the money you contribute rolls over from year to year, allowing you to build up savings for more significant medical expenses. I want you to know that HSA funds can only be used for qualified medical expenses, so please familiarise yourself with the IRS guidelines to avoid any unexpected penalties.

In conclusion, navigating the healthcare system can feel overwhelming, but understanding the basic concepts of deductibles, copayments, and the benefits of an HSA can empower you to make informed decisions about your healthcare. By mastering these fundamentals, you’ll be better equipped to manage your health insurance and take control of your healthcare costs.

Impact Of Life Changes

Life is filled with numerous twists and turns, and these changes can significantly impact our health insurance coverage. As we navigate through different stages in life, our health insurance needs may change. From job changes to shifts in family dynamics and even moving to a new location, it is crucial to understand how these life changes can affect our health insurance coverage. Let’s delve into the impact of these life changes and explore how they can alter our health insurance journey.

Job Changes

A job change is one of the most common triggers for a change in health insurance coverage. Whether it’s switching employers or experiencing a shift from full-time to part-time work, it’s crucial to understand how these changes can influence your health insurance options.

You may be eligible for employer-sponsored health insurance when you start a new job. This can provide comprehensive coverage and lower premiums than individual health insurance plans. It’s crucial to carefully review the benefits and coverage offered by your new employer to ensure it meets your unique healthcare needs.

You may lose access to employer-sponsored health insurance if you transition from a full-time position to part-time work or become self-employed. In such cases, you might need to explore alternative options, such as purchasing an individual health insurance plan or considering government-subsidized programs like Medicaid.

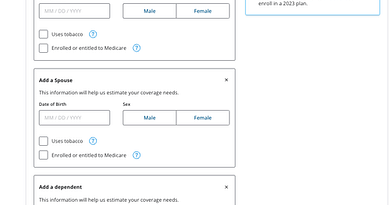

Family Dynamics

Life changes often involve shifts in family dynamics, which can impact our health insurance coverage. Marriages, divorces, births, adoptions, and the loss of a loved one all require adjustments to our health insurance plans.

When getting married, you and your spouse may have the option to obtain joint health insurance coverage through one spouse’s employer or explore individual plans to determine the most cost-effective option. Similarly, a divorce may result in losing spousal health insurance coverage, and you may need to seek alternative options to ensure continuous access to healthcare.

Welcoming a newborn or adopting a child requires adjustments to your health insurance coverage. Reviewing your policy and understanding the necessary steps to add your child to your plan or exploring coverage options through government programs like the Children’s Health Insurance Program (CHIP).

Moving

Relocating to a new area can also impact your health insurance coverage. When you move to a different state or region, you may need to reassess your health insurance options and determine if your current plan is still valid or need new coverage.

If your current health insurance plan is not accepted in your new location, could you research and select a new strategy that aligns with your needs? Moving can also be an opportunity to explore different insurance providers and identify plans that offer better coverage or lower premiums.

It’s essential to notify your health insurance provider and update your contact information as soon as possible after moving to ensure continuous coverage and avoid any potential lapses in benefits.

Resources For Assistance

Knowing that resources are available to help is essential when you understand health insurance. Whether you’re seeking government programs or considering the expertise of health insurance brokers, knowing where to turn for help can make a significant difference in navigating the complex world of health coverage.

Government Programs

Government programs are crucial in assisting individuals and families needing access to employer-sponsored or private health insurance options. Some popular government programs include:

- Medicaid – Designed for low-income individuals and families, Medicaid offers free or low-cost health coverage.

- The Children’s Health Insurance Program (CHIP) provides affordable health coverage for children in families who earn too much to qualify for Medicaid but cannot afford private insurance.

Health Insurance Brokers

Health insurance brokers are knowledgeable professionals who can offer guidance and assistance in finding the right health insurance plan. They can help you navigate the various options available and provide personalised recommendations based on your specific needs and budget. By leveraging their expertise, you can access a broader range of insurance products and make informed decisions about your healthcare coverage.

Staying Informed And Managing Your Health

Reviewing Policies Annually

Regularly reviewing your health insurance policy helps you stay updated on coverage changes.

- Schedule time each year to review policy details.

- Check for any new benefits or adjustments.

- Ensure your coverage aligns with your current health needs.

Maximising Benefits

You can maximise your health insurance benefits by understanding your policy’s offerings.

- Explore preventive care services covered at no cost.

- Utilize in-network providers for cost savings.

- Take advantage of wellness programs for additional benefits.

Credit: mededits.com

Frequently Asked Questions On Choose The Statement That Is True About Health Insurance.

What Is Health Insurance And How Does It Work?

Health insurance is a contract between an individual and an insurance company that helps cover medical expenses. When you have health insurance, you pay a monthly premium, and the insurance company helps pay for some of your medical costs, such as doctor visits, hospital stays, and prescribed medications.

Is Health Insurance Mandatory?

While health insurance is not mandatory in all countries, some countries have laws that require individuals to have coverage. It’s essential to check the regulations in your country to determine whether health insurance is mandatory.

What Are The Different Types Of Health Insurance Plans?

Several types of health insurance plans are available, including individual, family, employer-sponsored, and government-sponsored plans like Medicare and Medicaid. Each type of plan has its own eligibility criteria, coverage options, and cost structures. Choosing a plan that best fits your healthcare needs and budget is essential.

Conclusion

Understanding the factual statements about health insurance is crucial for making informed decisions. Individuals can select the best coverage by delving into the facts and dispelling myths. Ultimately, being well-informed and aware of the options is essential for securing adequate health insurance.