Independent Health Insurance Brokers: Your Guide to Finding the Best Coverage

Independent Health Insurance Brokers in Austin, Texas, provide individual health plans and guide clients in finding the proper coverage. They also act as advocates, resolving issues with insurance carriers and ensuring fair claim resolutions.

Independent health insurance brokers are separate from insurance companies and offer a variety of policies to meet clients’ needs. They are dedicated to assisting residents and employers in finding the best health insurance policies and can easily manage client benefits.

With expertise and personalized service, independent brokers play a crucial role in navigating the complex health insurance landscape.

Credit: apollo-insurance.com

Benefits Of Using Health Insurance Brokers

Health insurance brokers play a crucial role in assisting individuals and businesses in navigating the complexities of the insurance market. By utilizing the services of health insurance brokers, clients can benefit in various ways, ensuring they make informed decisions tailored to their specific needs.

Acting As Your Advocate

- Health insurance brokers act as your advocate in resolving issues with insurance claims and coverage.

- They represent your interests in dealing with insurance carriers and alleviating your stress.

- Brokers ensure your concerns are addressed promptly, providing peace of mind.

Navigating The Complexities Of Insurance Policies

- Brokers assist in deciphering complex insurance policies, helping you understand the terms and coverage.

- They guide you through the selection process, ensuring you choose the most suitable policy for your needs.

- Brokers simplify the insurance jargon, making it easier for you to make informed decisions.

:max_bytes(150000):strip_icc()/Brokerage-general-agent_final-1d39312665474576a2807c0da9333344.png)

Credit: www.investopedia.com

Types Of Insurance Brokers

When it comes to finding the right insurance coverage, working with an independent health insurance broker can make all the difference. These professionals provide personalized assistance and access to a wide range of insurance options, ensuring individuals and businesses can find the best coverage for their needs. Types of insurance brokers can vary, with each type serving distinct markets and offering specialized services.

Retail Insurance Brokers

Retail insurance brokers primarily cater to individual consumers and families seeking personal insurance coverage such as health, life, and auto insurance. They work closely with clients to understand their specific needs and provide guidance on selecting the most suitable insurance plans. Retail brokers often have a strong understanding of the local insurance market, helping clients navigate through various options and find the coverage that aligns with their requirements and budget.

Commercial Insurance Brokers

On the other hand, commercial insurance brokers specialize in serving businesses and organizations. They assist in securing insurance policies tailored to the unique risks and challenges faced by commercial entities. From general liability and property insurance to specialized coverage for industries like construction and healthcare, commercial brokers have the expertise to analyze business needs and recommend comprehensive insurance solutions. Their in-depth knowledge of commercial insurance products and regulations enables businesses to mitigate risks and protect their assets effectively.

Difference Between Broker And Provider

An independent health insurance broker acts as your advocate, resolving any issues or changes you may have with your health coverage. They navigate the claims process and ensure a fair and timely resolution, working on your behalf with the insurance provider.

Advocacy And Claims Management

When it comes to health insurance, one of the key differences between a broker and a provider lies in advocacy and claims management. While an insurance provider decides whether to pay out the claims it receives or not, an independent health insurance broker works on your behalf to ensure your claim is managed quickly and efficiently. They serve as your advocate and help navigate the claims process, providing a fair and timely resolution.

Why Choose An Independent Health Insurance Broker?

There are several reasons why you should consider using an independent health insurance broker. First and foremost, they act as your advocate. In case of any issues with your health insurance claim or if you need to change your health coverage, your broker can take the stress off your shoulders. They’ll resolve problems with the insurance carrier on your behalf, so you don’t have to go through the hassle and worry. By choosing an independent broker, you gain access to their expertise and knowledge of the health insurance industry. They stay updated with the latest industry trends and regulations, ensuring you receive the most comprehensive coverage options tailored to your specific needs.

Benefits Of Independent Health Insurance Brokers

When it comes to managing your health insurance, independent brokers offer several benefits. Here are a few key advantages:

- Wide Selection of Plans: Independent brokers work with multiple insurance companies, allowing them to offer a wide variety of health insurance plans. This means they can help you find the plan that best meets your needs and budget. Personalized Assistance: Unlike insurance providers, independent brokers provide customized assistance throughout the entire process. They take the time to understand your unique situation and guide you in selecting the right plan for you and your family.

- Unbiased Advice: Independent brokers do not work for any specific insurance company. This means their advice is impartial and solely focused on finding the best plan for you. They have your best interests at heart.

- Continued Support: Your relationship with an independent broker doesn’t end once you’ve enrolled in a health insurance plan. They offer ongoing support, answering any questions or concerns you may have and assisting you with any future changes or claims.

In conclusion, when it comes to managing your health insurance, it’s essential to understand the difference between a broker and a provider. While an insurance provider handles the claims process, an independent broker serves as your advocate, ensuring a fair and timely resolution. By choosing an independent health insurance broker, you gain access to personalized assistance, unbiased advice, and a wide selection of plans. So, why not take advantage of their expertise and let them navigate the complex world of health insurance on your behalf?

Independent Insurance Agencies

Independent insurance agencies are separate from the insurance companies they represent, allowing them to offer insurance from more than one company and select the policies that best meet their customers’ needs.

Offering Insurance From Multiple Companies

This independence allows them to provide a range of options, giving clients a broader selection of policies and coverage. Since independent insurance agencies aren’t restricted to offering products from a single insurance company, they can tailor their recommendations to the unique needs and preferences of each customer.

EnsuringPersonalizedd Customer Service

Independent insurance agencies prioritize establishing rapport with their clients and delivering personalized, attentive service. They take the time to understand each client’s specific needs and provide tailored insurance solutions, ensuring that customers are adequately covered and well-informed about their policy options.

Advocating For the Client’s Best Interests

These agencies serve as advocates for their clients, managing claims effectively and efficiently and working to ensure a timely resolution. This personalized approach and advocacy set independent insurance agencies apart, ensuring that clients receive the support and assistance they need when dealing with insurance matters.

Finding The Best Health Insurance Coverage

Independent health insurance brokers act as advocates for individuals seeking the best coverage. They help navigate the process, resolving issues with insurance providers to ensure a fair and timely resolution. These brokers offer personalized assistance in selecting policies that precisely meet their clients’ needs. Utilizing Independent Insurance Agencies In Texas

As an individual looking for the best health insurance coverage in Texas, you might find yourself overwhelmed by the variety of options available. That’s where independent insurance agencies come in. These agencies act as your advocates, helping you navigate through the complex world of health insurance and find the coverage that suits your needs. Unlike insurance providers, independent insurance agencies are not tied to any specific company. Instead, they have the freedom to offer insurance plans from multiple providers, allowing them to select the policies that best meet your requirements.

Comparing Plans And Services

One of the critical advantages of utilizing independent insurance agencies is the ability to compare plans and services. These agencies have access to a wide range of health insurance options, giving you the opportunity to evaluate and compare different plans side by side. They can help you understand the details, benefits, and limitations of each plan, ensuring that you make an informed decision. Whether you are looking for comprehensive coverage, a specific network of healthcare providers, or affordable premiums, independent insurance agencies can provide you with personalized recommendations tailored to your unique needs. When comparing plans and services, it is essential to consider factors such as the coverage offered, the network of healthcare providers included, the cost-sharing arrangements, and the limitations or exclusions of each plan. Independent insurance agencies can guide you through this process, explaining the intricacies of each plan and helping you evaluate their pros and cons. By doing so, they help you find the best health insurance coverage that strikes the right balance between comprehensive coverage and affordability. In addition to comparing plans and services, independent insurance agencies can also assist you in navigating the enrollment process. They are knowledgeable about the latest regulations and requirements, ensuring that you understand the necessary steps and deadlines. Whether you are enrolling in a private health insurance plan or exploring options through the Health Insurance Marketplace, independent insurance agencies can simplify the process and ensure that you complete all the necessary paperwork accurately and on time.

To summarize, utilizing independent insurance agencies in Texas is an excellent strategy for finding the best health insurance coverage. These agencies act as your advocates, offering personalized recommendations and comparing plans and services from multiple providers. By leveraging their expertise and industry knowledge, you can navigate the complex world of health insurance with confidence and secure a policy that meets your unique needs. So, don’t hesitate to reach out to an independent insurance agency in Texas and start your journey towards optimal health coverage today.

Managing Benefits As A Broker

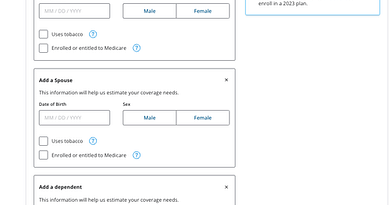

Being an independent health insurance broker involves various responsibilities, from assisting clients in finding the right coverage to managing benefits effectively. As a broker, ensuring smooth processes for quoting services and renewal procedures is crucial to providing top-notch service to clients.

Quoting Services

Quoting services play a vital role in helping clients understand their health insurance options. Brokers must meticulously compare different plans and provide accurate quotes based on clients’ needs and budgets.

Renewal Processes

Managing the renewal process efficiently is critical to maintaining solid relationships with clients. Brokers need to keep track of policy expiration dates, communicate effectively with clients about renewal options, and assist them in making informed decisions regarding their coverage.

Choosing The Right Insurance Broker

When selecting an independent insurance broker, evaluate their expertise and reputation.

Look for a broker who prioritizes a customer-centric approach.

Credit: auiinfo.com

Frequently Asked Questions

Why Should I Use A Health Insurance Broker?

Health insurance brokers act as your advocate, resolving issues with claims and coverage, saving you time and hassle.

What Are The Two Types Of Insurance Brokers?

There are two types of insurance brokers: retail and commercial. Retail brokers cater to individual clients, while commercial brokers focus on businesses.

What Is The Difference Between An Insurance Provider And A Broker?

An insurance provider sells policies, while a broker acts as an intermediary to help find the best coverage.

What Is an Independent Insurance Agency?

An independent insurance agency is a separate entity from the insurance companies it works with. It offers insurance from multiple companies and helps customers find the policies that best suit their needs.

Conclusion Utilizing an independent health insurance broker can save you time, hassle, and worry by acting as your advocate in navigating issues with your health insurance. They offer personalized assistance and the ability to select policies from multiple insurance companies that best meet your needs.

Trusting a broker can lead to a fair and timely resolution for your health coverage.