Choose the Statement That is True About Health Insurance: Essential Tips for Understanding Coverage

Common Health Insurance Terms

Understanding the terminology is crucial when navigating the complex world of health insurance. Familiarising yourself with the standard health insurance terms can help you make informed decisions and effectively manage your healthcare coverage. Let’s look at some key terms when dealing with health insurance.

Network

A network refers to a group of doctors, hospitals, clinics, and other healthcare providers that have agreed to provide services to the members of a specific health insurance plan. Choosing healthcare providers within your network typically results in lower out-of-pocket costs.

Formulary

A formulary lists prescription drugs covered by your health insurance plan. It outlines which medications are included in the plan’s coverage and often categorises them based on cost tiers and coverage rules.

Out-of-pocket Maximum

The out-of-pocket maximum is the most you’ll have to pay for covered services in a policy period. Once you reach this limit, the health insurance plan will generally pay 100% of the covered benefits. Understanding this limit can help you plan and budget for healthcare expenses.

Prior Authorization

Prior authorisation is a requirement by some insurance plans that mandates approval from the insurer before specific treatments, procedures, or medications will be covered. This process ensures that the recommended treatment is medically necessary and cost-effective.

Tips For Navigating The Health Insurance Market

I want you to know that the coverage that meets your needs is essential when navigating the health insurance market. Understanding the actual benefits of a health insurance plan is crucial for making informed decisions about your healthcare. Comparing different plans and their offerings can help you find a suitable and cost-effective option.

Research And Compare Plans

When choosing the right health insurance plan, research and comparison are critical. Instead of unthinkingly selecting the first plan that comes your way, take the time to explore different options. Researching and comparing various plans will allow you to decide based on your needs and budget. Consider factors such as coverage, deductibles, copayments, and network providers. By carefully evaluating these aspects, you can find a plan that best suits your healthcare requirements.

Review Policy Details

Reviewing policy details is essential when navigating the health insurance market. It may seem time-consuming, but understanding the ins and outs of your policy is crucial for avoiding unexpected costs and challenges. Pay close attention to the terms and conditions and any exclusions or limitations that may impact coverage. By thoroughly reviewing the policy details, you can ensure that you are fully aware of what is covered and what isn’t, enabling you to make informed decisions when seeking medical care.

Seek Professional Advice

If you find the health insurance market overwhelming or confusing, seeking professional advice can be immensely helpful. Consulting with insurance agents or brokers specialising in health insurance can provide valuable insights and guidance. These professionals have in-depth market knowledge and can help you navigate the complexities of policies and coverage options. They can assess your needs and recommend suitable plans aligning with your requirements and budget. In summary, when navigating the health insurance market, conducting research and comparing different plans is crucial, as reviewing policy details thoroughly and seeking professional advice when needed. By following these tips, you can make well-informed decisions and ensure you have the right health insurance plan to meet your needs.

Credit: venngage.com

Frequently Asked Questions For Choose The Statement That Is True About Health Insurance

What Is The Importance Of Having Health Insurance?

Health insurance is essential for covering medical expenses and securing financial stability in case of illness or injury. It provides access to quality healthcare and offers peace of mind for individuals and families.

How Does Health Insurance Benefit Individuals?

Health insurance offers access to preventive care, illness treatment, and protection from high medical costs. It ensures timely medical attention and helps maintain overall well-being by covering various healthcare services and treatments.

What Factors Should Be Considered When Choosing Health Insurance?

When choosing health insurance, it’s crucial to consider coverage options, network of healthcare providers, premium costs, deductibles, and copayments. Understanding these factors helps individuals make informed decisions and select the most suitable health insurance plan.

Conclusion

You are choosing the right health insurance coverage that aligns with your needs and budget. You can make an informed decision by understanding the terms and conditions, considering deductibles and premiums, and comparing different plans.

Remember, health insurance provides peace of mind and financial security in the face of unexpected medical expenses. Prioritise your health and make a choice that ensures comprehensive coverage for you and your loved ones.

Choose the Statement That is True About health insurance, and ensure it covers your medical needs and fits your budget. It’s essential to compare plans.

Health insurance is a crucial aspect of financial planning as it covers medical expenses. The right insurance plan can contribute significantly to your well-being and peace of mind. With various options available in the market, understanding the factors to consider when choosing the most suitable health insurance plan is essential.

This comprehensive guide aims to simplify the process and help you make an informed decision about selecting the best health insurance coverage for you and your family. By exploring the critical aspects of health insurance, you can ensure you have the necessary protection for unexpected medical expenses.

What Is Health Insurance

Health insurance provides financial protection against medical expenses. A true statement about health insurance is that it helps cover the costs of healthcare services. Health insurance allows individuals to access necessary medical treatments without worrying about high expenses.

Definition

Health insurance, also known as medical insurance, is a type of insurance coverage that provides financial protection to individuals and families in the event of medical expenses. It is a contract between the insured and the insurance company whereby the insured pays a premium regularly in exchange for coverage for various healthcare services.

Purpose

Health insurance aims to ensure that individuals have access to necessary medical care while minimising the financial burden of healthcare expenses. It allows individuals to receive medical services, such as doctor visits, hospital stays, medications, and surgeries, without paying the total cost out of pocket.

Health insurance gives individuals peace of mind, knowing they have financial protection in case of unexpected medical expenses. It provides a safety net that helps to alleviate the financial stress that can arise from expensive medical treatments or emergencies.

Types Of Health Insurance

Employer-sponsored Insurance

Employer-sponsored insurance is offered by companies to employees. It often includes medical, dental, and vision coverage.

Individual Insurance

Individual insurance can be purchased directly by individuals from insurance companies or through the Health Insurance Marketplace.

Medicare

Medicare is a federal health insurance program for individuals over 65 or those with specific disabilities.

Medicaid

Medicaid is a state and federal program providing health coverage for low-income individuals.

Coverage And Benefits

Understanding the coverage and benefits of your health insurance policy is crucial for making informed decisions about your healthcare needs. Different policies offer various levels of coverage for other services and treatments.

Inpatient Services

Inpatient services require hospital or healthcare facility admission for intensive treatment, such as surgeries or overnight stays. They are typically covered by health insurance plans to a certain extent, with the policy outlining the specific coverage details and limitations.

Outpatient Services

Outpatient services refer to medical treatments or consultations that do not require an overnight stay at a hospital. These can include doctor’s visits, diagnostic tests, and minor procedures. Health insurance plans usually cover a portion of the costs for outpatient services based on the policy.

Prescription Drugs

Prescription drug coverage is essential to health insurance plans, as medications can be a significant part of healthcare costs. Policies vary regarding the drugs covered, copays, and formulary lists. Understanding your plan’s prescription drug coverage is essential to manage medication expenses effectively.

Preventive Care

Preventive care services help maintain overall health and prevent potential health issues. Many health insurance plans cover preventive care at no additional cost to the policyholder. This can include screenings, vaccinations, and wellness visits to promote a healthy lifestyle and early detection of potential health concerns.

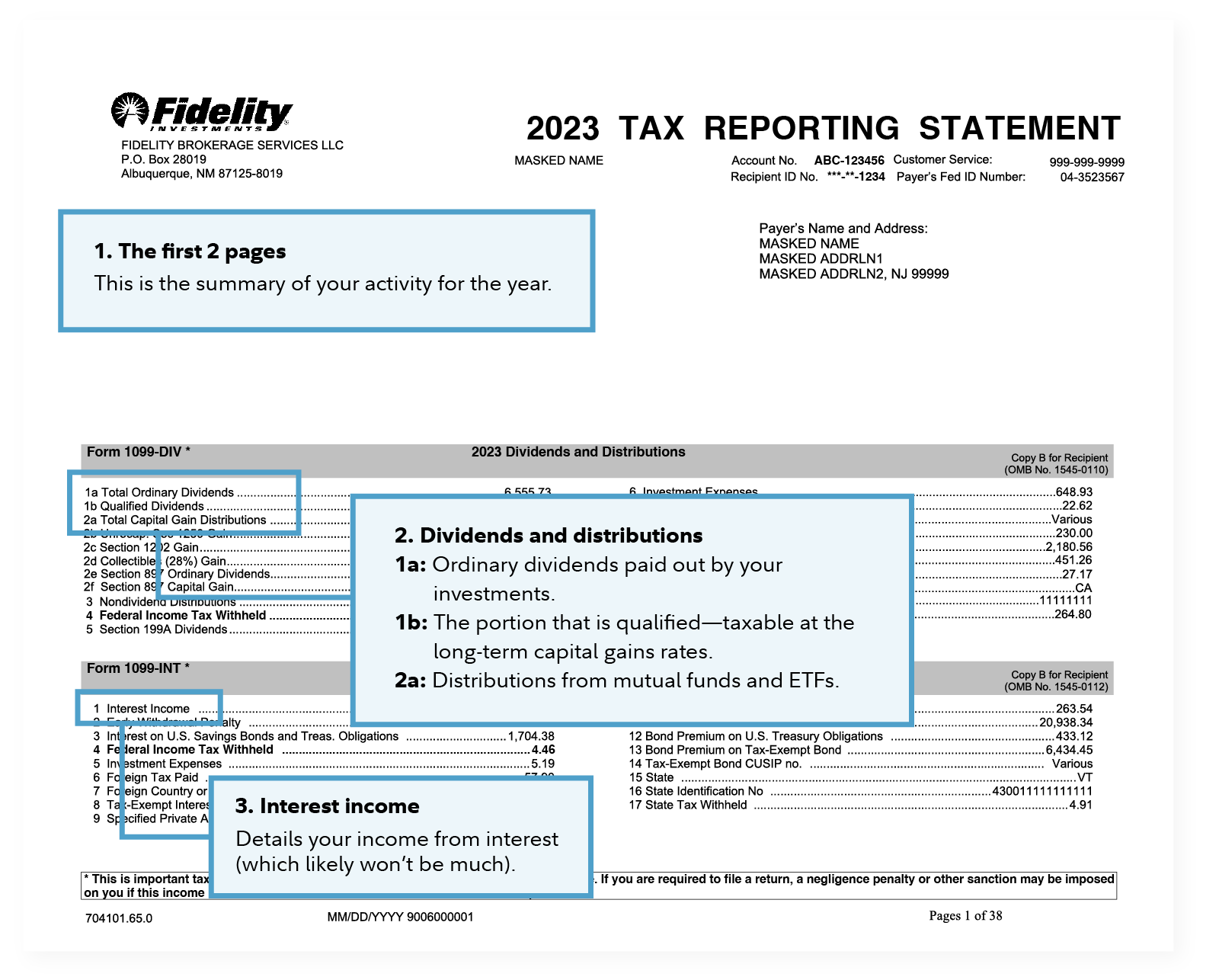

Credit: www.fidelity.com

Understanding Premiums, Deductibles, And Copayments

Understand how health insurance premiums, deductibles, and copayments work to choose the best coverage. Knowing the true statement about these aspects can help you navigate your policy effectively.

Premiums

Health insurance can often be complex, with various terms and concepts. One crucial aspect is the relationship between premiums, deductibles, and copayments. These three terms determine the cost of your health insurance coverage and play a significant role in your overall healthcare expenses. Let’s start by delving into the concept of premiums. Premiums refer to the amount you pay your insurance company regularly for your health insurance coverage. It is usually a monthly fee that you must pay, regardless of whether you use any healthcare services or not. Think of it as the membership fee to ensure your coverage remains active. Premiums can vary depending on age, location, coverage type, and desired coverage level. The higher your health care premium, the more significant your coverage range will likely be.

Conversely, if you select a lower premium plan, you’ll have less coverage and should pay more out-of-pocket for medical expenses. Understanding the relationship between premiums and coverage is crucial in selecting the right health insurance plan. Balancing the premium’s cost with your required coverage level is essential. While lower premiums may seem enticing, remember that they often come with high deductibles and copayments, requiring you to pay more out-of-pocket when you need medical services.

Deductibles

Now, let’s delve into deductibles, another crucial health insurance component. A deductible is the amount of money you must pay out-of-pocket for healthcare services before your insurance coverage begins to contribute. For example, if you have a $1,000 deductible, you will be responsible for paying the first $1,000 of your medical expenses before your insurance coverage kicks in. Deductibles can vary significantly depending on your insurance plan, ranging from a few hundred to several thousand dollars. Higher deductible plans often have lower premiums since you bear a higher upfront cost for your healthcare services.

Conversely, lower deductible plans usually have higher premiums, resulting in lower out-of-pocket costs when you seek medical treatment. Remember, deductibles typically reset every year, which means you need to meet your deductible again during the new plan year before your insurance coverage starts to pay for eligible services. Some plans may offer certain preventive services or routine check-ups exempt from deductibles, allowing you to receive essential healthcare without upfront expenses.

Copayments

Lastly, let’s explore copayments, also known as “copays.” A co-payment is a fixed amount you must pay for specific healthcare services after you’ve met your deductible. Unlike deductibles, which require you to pay a specified amount before insurance kicks in, copays are a predetermined cost you have to pay at the time of service. Copayments are commonly seen for doctor’s office visits, specialist consultations, prescription medications, and emergency room visits. For example, your health insurance plan may require a $20 copayment for a doctor’s visit. Every time you see a healthcare provider covered by your plan, you must pay $20; your insurance will cover the remaining costs. Copayments may vary depending on the service and provider.

Additionally, some health insurance plans may not require copayments for specific services or have different copayment amounts for various medical facilities. By understanding the concepts of premiums, deductibles, and copayments, you can make educated decisions when selecting a health insurance plan. You can assess your healthcare needs, budget, and potential medical expenses to determine the appropriate balance between premiums and out-of-pocket costs. Finding the right health insurance coverage is crucial for safeguarding your physical and financial well-being.

Factors To Consider When Choosing Health Insurance

When deciding on a health insurance plan, it’s crucial to carefully evaluate several key factors to ensure that your coverage meets your needs. Considering the following aspects when selecting a health insurance plan can help you make an informed decision that aligns with your healthcare requirements and financial circumstances.

Cost

Comparing the cost of different health insurance plans is essential when deciding. Assess the monthly premiums, deductibles, copayments, and coinsurance to determine the overall expenses associated with the plan.

Provider Network

Evaluating the provider network is crucial to determining which healthcare providers you can seek treatment. Confirm that your preferred doctors, specialists, and hospitals are included in the network to ensure convenient access to care.

Coverage Options

Understanding the coverage options offered by a plan is vital. Ensure the plan provides comprehensive coverage for essential services, including preventive care, hospitalisation, emergency services, and mental health support.

Prescription Drug Coverage

Consider the prescription drug coverage provided by each plan. Verify the formulary to guarantee that your required medications are covered and assess any associated copayments or coinsurance.

Additional Benefits

Exploring the additional benefits available can provide added value. Look for extra perks such as wellness programs, telemedicine services, vision, dental coverage, and maternity care benefits to enhance your overall healthcare package.

:max_bytes(150000):strip_icc()/bank-statement_final-bd27a49a155b44c8b1810bb7705bd34b.jpg)

Credit: www.investopedia.com

Common Health Insurance Terms

Understanding the terminology is crucial when navigating the complex world of health insurance. Familiarising yourself with the standard health insurance terms can help you make informed decisions and effectively manage your healthcare coverage. Let’s look at some key terms when dealing with health insurance.

Network

A network refers to a group of doctors, hospitals, clinics, and other healthcare providers that have agreed to provide services to the members of a specific health insurance plan. Choosing healthcare providers within your network typically results in lower out-of-pocket costs.

Formulary

A formulary lists prescription drugs covered by your health insurance plan. It outlines which medications are included in the plan’s coverage and often categorises them based on cost tiers and coverage rules.

Out-of-pocket Maximum

The out-of-pocket maximum is the most you’ll have to pay for covered services in a policy period. Once you reach this limit, the health insurance plan will generally pay 100% of the covered benefits. Understanding this limit can help you plan and budget for healthcare expenses.

Prior Authorization

Prior authorisation is a requirement by some insurance plans that mandates approval from the insurer before specific treatments, procedures, or medications will be covered. This process ensures that the recommended treatment is medically necessary and cost-effective.

Tips For Navigating The Health Insurance Market

I want you to know that the coverage that meets your needs is essential when navigating the health insurance market. Understanding the actual benefits of a health insurance plan is crucial for making informed decisions about your healthcare. Comparing different plans and their offerings can help you find a suitable and cost-effective option.

Research And Compare Plans

When choosing the right health insurance plan, research and comparison are critical. Instead of unthinkingly selecting the first plan that comes your way, take the time to explore different options. Researching and comparing various plans will allow you to decide based on your needs and budget. Consider factors such as coverage, deductibles, copayments, and network providers. By carefully evaluating these aspects, you can find a plan that best suits your healthcare requirements.

Review Policy Details

Reviewing policy details is essential when navigating the health insurance market. It may seem time-consuming, but understanding the ins and outs of your policy is crucial for avoiding unexpected costs and challenges. Pay close attention to the terms and conditions and any exclusions or limitations that may impact coverage. By thoroughly reviewing the policy details, you can ensure that you are fully aware of what is covered and what isn’t, enabling you to make informed decisions when seeking medical care.

Seek Professional Advice

If you find the health insurance market overwhelming or confusing, seeking professional advice can be immensely helpful. Consulting with insurance agents or brokers specialising in health insurance can provide valuable insights and guidance. These professionals have in-depth market knowledge and can help you navigate the complexities of policies and coverage options. They can assess your needs and recommend suitable plans aligning with your requirements and budget. In summary, when navigating the health insurance market, conducting research and comparing different plans is crucial, as reviewing policy details thoroughly and seeking professional advice when needed. By following these tips, you can make well-informed decisions and ensure you have the right health insurance plan to meet your needs.

Credit: venngage.com

Frequently Asked Questions For Choose The Statement That Is True About Health Insurance

What Is The Importance Of Having Health Insurance?

Health insurance is essential for covering medical expenses and securing financial stability in case of illness or injury. It provides access to quality healthcare and offers peace of mind for individuals and families.

How Does Health Insurance Benefit Individuals?

Health insurance offers access to preventive care, illness treatment, and protection from high medical costs. It ensures timely medical attention and helps maintain overall well-being by covering various healthcare services and treatments.

What Factors Should Be Considered When Choosing Health Insurance?

When choosing health insurance, it’s crucial to consider coverage options, network of healthcare providers, premium costs, deductibles, and copayments. Understanding these factors helps individuals make informed decisions and select the most suitable health insurance plan.

Conclusion

You are choosing the right health insurance coverage that aligns with your needs and budget. You can make an informed decision by understanding the terms and conditions, considering deductibles and premiums, and comparing different plans.

Remember, health insurance provides peace of mind and financial security in the face of unexpected medical expenses. Prioritise your health and make a choice that ensures comprehensive coverage for you and your loved ones.