Health Insurance for Visitors in USA: Get Coverage Now

Health Insurance for Visitors in USA. It varies in cost and is available through Tokio Marine-HCC Medical Insurance Services. While not legally required, travel medical insurance is recommended due to the high healthcare costs in the US.

When visiting the United States, even a simple doctor visit can cost hundreds of dollars, with an ambulance ride or ER treatment potentially reaching thousands. Visitors’ insurance typically covers new medical conditions, injuries, or accidents after the policy’s effective date.

For reliable travel insurance and visitor health coverage in the USA, consider options from providers like Tokio Marine-HCC Medical Insurance Services or other reputable insurers. Protecting yourself with the right insurance can provide peace of mind during your visit to the US.

Credit: www.visitorinsuranceservices.com

Importance Of Health Insurance For Visitors

Health insurance for visitors to the USA is crucial for ensuring access to quality healthcare and financial protection. When traveling to a foreign country like the USA, secure health insurance provides peace of mind, knowing that any unexpected medical expenses will be covered. The importance of health insurance for visitors cannot be overstated, especially considering the high costs of medical care in the US.

Coverage Benefits

Visitors’ health insurance offers various coverage benefits, including medical emergencies, hospitalization, doctor’s visits, prescription drugs, and emergency medical evacuation. Comprehensive coverage ensures visitors can seek medical attention without worrying about exorbitant out-of-pocket expenses.

Financial Protection

Health insurance for visitors provides essential financial protection by safeguarding visitors from the economic burden of unexpected medical bills. Without insurance, even minor medical treatment in the US…….. can result in significant expenses, potentially depleting savings or causing financial hardship for visitors.

Types Of Health Insurance Plans

When planning a visit to the United States, it is imperative to consider health insurance coverage. The US…….. healthcare system is known for its high costs, making it essential for visitors to have adequate insurance. Several types of health insurance plans are tailored for visitors, each with features and benefits. Understanding these options is crucial to ensure proper coverage during your stay in the US.

Travel Medical Insurance

Travel medical insurance is designed to provide temporary health coverage for travelers visiting the US. It offers medical protection for emergencies, such as sudden illness or injuries during the trip. This type of insurance can cover medical expenses, hospitalization, emergency medical evacuation, and repatriation. It is tailored to the specific needs of travelers and provides peace of mind during their stay in the US.

Visitor Health Insurance

Visitor health insurance is another essential option for individuals visiting the USS. It provides coverage for medical treatment and healthcare services required during the visit. This type of insurance encompasses a range of benefits, including doctor visits, prescription drugs, hospitalization, and emergency services. Visitor health insurance offers a safety net for unexpected medical expenses, ensuring visitors can access quality healthcare without financial burden.

Key Factors To Consider

When considering health insurance for visitors in the USA, it is crucial to assess various vital factors that can significantly impact their coverage and peace of mind.

Coverage Limits

Understanding the coverage limits of the health insurance plan is essential to ensure that visitors are adequately protected in case of medical emergencies.

Pre-existing Conditions Coverage

Check whether the health insurance plan covers pre-existing conditions to avoid complications or exclusions during the visitor’s stay in the USA.

Emergency Services Coverage

Emergency services coverage is critical as it ensures that visitors can access immediate medical assistance in case of unexpected health issues or accidents.

Comparison Of Different Insurance Providers

For visitors to the USA, health insurance is crucial. Comparing the available insurance providers will help you make an informed decision and understand the coverage options and cost differences various insurance companies offer.

Coverage Options

Before finalizing your health insurance plan, examining the coverage options provided by different insurance providers is essential. Here are some key aspects to consider:

- Medical expenses coverage:

- Inpatient hospitalization

- Outpatient consultation

- Prescription medications

- Laboratory tests

- Emergency medical evacuation:

- Transportation to the nearest adequate medical facility

- Arrangement of a medical escort, if required

- Repatriation of remains:

- Return of mortal remains in case of unfortunate demise

- Coordination of necessary documents and logistics

Cost Comparison

When comparing health insurance providers, it’s crucial to consider the cost differences associated with various plans. Here are a few factors to keep in mind:

- Premiums:

The monthly or annual amount you pay to maintain your health insurance coverage.

- Deductibles:

The amount you need to pay out-of-pocket before your insurance coverage starts.

- Co-pays and co-insurance:

Additional costs may apply when visiting healthcare providers or receiving specific medical treatments.

- Network coverage:

Ensure the insurance provider has a comprehensive network of healthcare providers.

Thoroughly comparing coverage options and cost differences can help you find the most suitable health insurance provider for your needs and budget.

Guidelines For Choosing The Right Plan

When selecting a health insurance plan for visitors in the USA, consider factors like coverage scope, network hospitals, cost, and duration. Evaluate the policy’s benefits and limitations to ensure it meets the visitor’s specific needs during their stay in the country.

Conduct thorough research and comparison before securing the visitor’s most suitable health insurance plan.

Duration Of Stay

Consider the length of your visit when selecting a health insurance plan. Short-term plans are suitable for brief stays, while long-term plans provide more comprehensive coverage.

Age Restrictions

Check for any age limitations imposed by the insurance provider. Some plans may have age restrictions that could impact eligibility for coverage.

Coverage For Specific Medical Conditions

Ensure the plan covers any pre-existing conditions or specific medical needs you may have. Review the policy details to confirm adequate coverage for your medical requirements.

When choosing a health insurance plan for your visit to the USA, consider the duration of stay, age restrictions, and coverage for specific medical conditions.

Standard Exclusions In Visitor Health Insurance

Understanding the standard exclusions that may apply to health insurance for visitors to the USA is essential. While visitor health insurance covers a wide range of medical expenses, certain situations and services may not. Awareness of these exclusions can help visitors make informed decisions about their healthcare needs during their stay in the USA.

Routine Medical Check-ups

Routine medical check-ups are essential for maintaining good health. However, most visitor health insurance plans do not cover them. These check-ups typically include general health screenings, vaccinations, and preventive services. Visitors to the USA should remember that they must pay out-of-pocket for these services.

High-risk Activities

Engaging in high-risk activities during your visit to the USA can come with potential health risks. While visitor health insurance typically covers unexpected accidents and illnesses, it may not cover injuries or medical expenses incurred from participating in high-risk activities such as extreme sports, bungee jumping, rock climbing, or skydiving. Visitors who plan on participating in these activities should consider purchasing additional insurance coverage to ensure they are protected.

Understanding the standard exclusions in visitor health insurance can help visitors make well-informed decisions about their healthcare needs. While routine medical check-ups and high-risk activities may not be covered, visitor health insurance provides valuable coverage for unexpected accidents and illnesses. It is essential for visitors to carefully review their insurance policy and consider purchasing additional coverage if necessary.

Tips For Making Claims

Making health insurance claims in the USA can be crucial. Understanding the required documentation and the claim process is essential to ensure a smooth experience in medical emergencies. Below are vital tips to remember when making health insurance claims as a visitor to the USA.

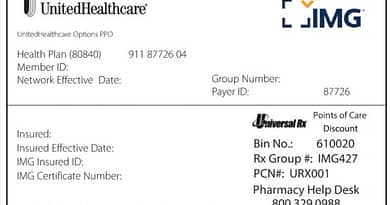

Documentation Required

Specific documentation is essential when claiming your health insurance as a visitor in the USA. The following documents are generally required to process a claim:

- Medical bills and receipts

- Doctor’s diagnosis and treatment reports

- Proof of identification and insurance coverage

- Completed claim form provided by the insurance company

Claim Process

The claim process for health insurance as a visitor in the USA usually involves the following steps:

- Notify the insurance provider: Inform your insurance provider about the medical treatment and the need to file a claim.

- Submit documentation: Compile and submit all the required documentation, including medical bills and receipts.

- Review and processing: The insurance company will process the claim based on the provided documentation.

- Claim settlement: Once the claim is processed, the insurance provider will settle the claim amount per the policy terms and coverage.

Credit: www.forbes.com

Future Trends In Visitor Health Insurance

Telemedicine Services

Telemedicine services are expected to play a significant role in the future of visitor health insurance in the USA. This innovative approach allows visitors to access medical consultations and specialist services remotely, reducing the need for in-person visits and providing more convenient and efficient healthcare options.

Integration With Travel Plans

Visitor health insurance is anticipated to become more integrated with travel plans, offering comprehensive coverage for medical emergencies and travel-related incidents. This approach ensures visitors can access a seamless experience, addressing healthcare needs and travel contingencies under a single insurance plan.

Credit: www.path2usa.com

Frequently Asked Questions

Can Visitors Get Health Insurance In The US?

Visitors can get health insurance in the US and the USA through specific insurance agents and brokers. Visit USA. HealthCare offers coverage but doesn’t meet the minimum standards required by the healthcare reform law. Travel medical insurance is strongly recommended due to high healthcare costs.

How Much Is Travelers Insurance In The US?

Travelers’ insurance costs in the US vary depending on factors. They can range from $50 to $150 per trip, depending on coverage and duration.

Can A Non-Us Citizen Get Private Health Insurance for Visitors in USA?

Non-US citizens, including qualified non-citizens like green card holders, can get private health insurance in the US, purchase coverage through specific insurance agents and brokers, and may also be eligible for financial assistance. Travel medical insurance is strongly recommended for US tourists due to the high cost of healthcare.

Do Tourists Need Travel Insurance For The USU.S.A.

Travel insurance is not required in the USU.S.A. It is strongly recommended due to high healthcare costs.

Conclusion

Due to high healthcare costs, visitors’ insurance is crucial when traveling to the USU.S.A.ue. Consider Visit USA-HealthCare for coverage, but it may not meet all standards. Travel medical insurance is strongly recommended to avoid hefty expenses. Stay protected and enjoy your trip worry-free.