Will My Health Insurance Work in Another State? Discover the Facts!

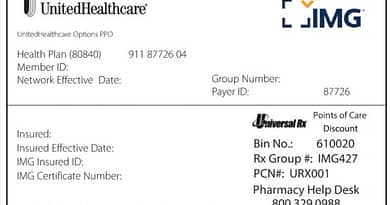

Will My Health Insurance Work in Another State? Depending on your plan type, Some plans, like PPOs, provide full access nationwide, while others, like HMOs, may only cover emergency services out of state.

It is essential to check your specific coverage before traveling. As a frequent traveler or someone planning a move, understanding how your health insurance works across state lines is crucial. Access to healthcare services in different states can vary based on your insurance plan.

This guide will provide insights into navigating health insurance coverage in another state, ensuring you have the necessary information to protect your health and well-being wherever you go.

:max_bytes(150000):strip_icc()/GettyImages-164241153-5c461d8bc9e77c00012f6d9c-ea9e79db362f459cae62e263346c45fe.jpg)

Credit: www.verywellhealth.com

Understanding Health Insurance Coverage

Whether your health insurance will work in another state depends on your plan type. PPO or OAP plans generally offer full access to providers in any state, while HMO or POS plans may only cover emergency services in different states.

It’s essential to understand your coverage before traveling or relocating.

Types Of Health Insurance Plans

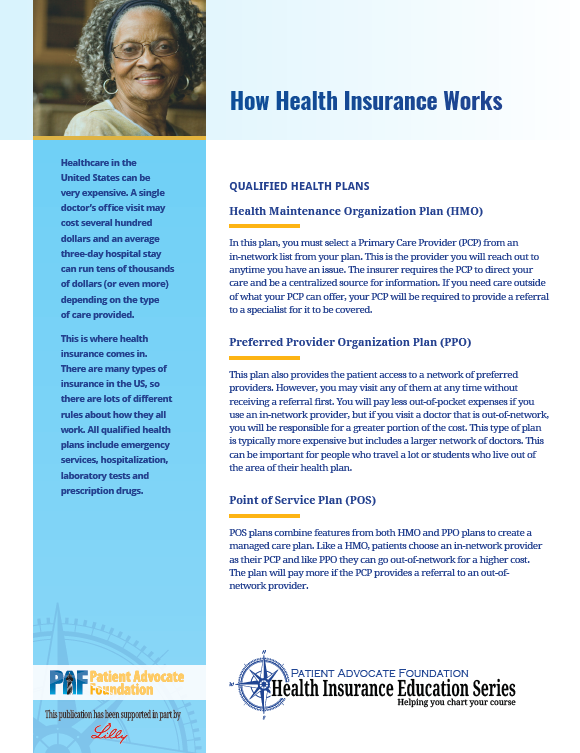

Health insurance plans in the United States typically fall into different categories, including Preferred Provider Organizations (PPO), Health Maintenance Organizations (HMO), Point of Service (POS), and Exclusive Provider Organizations (EPO). Each plan has its network of healthcare providers and coverage options, influencing how your insurance will work in another state.

In-network Vs. Out-of-network Coverage

Understanding the concept of in-network and out-of-network coverage is crucial for ensuring your health insurance works effectively in another state. In-network providers have contracted with your insurance company to provide services at a negotiated rate. In contrast, out-of-network providers do not have such agreements, potentially resulting in higher costs or limited coverage.

Interstate Coverage

One of the common concerns for individuals regarding health insurance is whether their coverage will work when they are in another state. Understanding the impact of different states on coverage and the protocol for emergencies is essential to ensure you are adequately protected while away from your home state.

Impact Of Different States On Coverage

Health insurance coverage varies from state to state, and depending on your plan type, you may have different access levels when seeking healthcare services in another state. For example, PPO or OAP plans typically provide full access to participating providers nationwide, whereas HMO or POS plans may only cover emergency services outside your home state. Reviewing your policy details to understand the limitations and options available when traveling or relocating is crucial.

Emergency Situations

In emergencies, they should seek immediate medical attention regardless of their location. Most health insurance plans, including HMOs, will cover emergency care in any state, ensuring you receive medical treatment without financial burdens. However, you must notify your insurance provider immediately following an emergency to facilitate the claims process smoothly.

Traveling With Health Insurance

When traveling with health insurance, it is essential to understand the coverage limitations that may apply. Certain plan types offer full access to any participating providers nationwide, while others may only cover emergency services outside your state.

Before embarking on your journey, verify with your insurance provider whether your plan extends beyond your state borders. Knowing what services and providers are included in your network while traveling is crucial.

Credit: www.starhealth.in

Employer-based Health Insurance

Your health insurance coverage may vary when you move to another state. Some plan types allow full access to participating providers in any state, while others may only cover emergency services. It’s essential to check the terms of your specific plan to understand how it will work in a different state.

Multi-state Employers

If you work for a company with offices or locations in multiple states, you may wonder if your employer-based health insurance will work if you move or travel to a different state. The answer to this question depends on the type of health insurance plan you have.

Cobra Coverage

COBRA (Consolidated Omnibus Budget Reconciliation Act) coverage temporarily extends your employer-based health insurance. It allows you to continue your health insurance coverage for a limited time after you leave your job. If you have COBRA coverage and move to another state, you can typically continue your coverage as long as the insurance provider offers plans. It’s important to note that COBRA coverage can be expensive since you’re responsible for the total cost of the premiums, including the portion your employer used to pay. If you’re considering COBRA coverage, compare the costs of other health insurance options available in your new state.

Codeensuring Coverage/code

If you’re concerned about whether your employer-based health insurance will work in another state, here are a few steps you can take to ensure coverage:

- Review your insurance policy: Read through your policy documents to understand your coverage and any limitations or restrictions that may apply when you’re in a different state.

- Contact your insurance provider: Contact your insurance provider and ask specific questions about coverage in other states. They can provide information on in-network providers and out-of-network coverage options.

- Research in-network providers: If you know you’ll be moving to a specific state, take the time to research in-network providers in that area. This will ensure access to healthcare services without facing out-of-network costs.

- Consider supplemental insurance: If your employer-based health insurance doesn’t provide comprehensive coverage in another state, you may want to explore supplemental insurance options. These plans can help fill any gaps in coverage and give you peace of mind while you’re away from your home state.

In Conclusion

While employer-based health insurance can offer valuable coverage, it’s essential to understand how it works when you’re in another state. Whether you’re part of a multi-state employer or have COBRA coverage, taking the necessary steps to ensure coverage can help you access the healthcare services you need, no matter where you are. Review your policy, contact your insurance provider, research in-network providers, and consider supplemental insurance if necessary. Taking these steps will help you navigate the complexities of employer-based health insurance in another state. Now, you can have peace of mind knowing you’re covered, no matter where life takes you.

College Students And Dependents

Regarding health insurance, college students and dependents often face unique challenges when living or studying in another state. Understanding the nuances of in-state versus out-of-state coverage and student health plans is essential to ensure seamless access to medical care.

In-state Vs. Out-of-state Coverage

In-state coverage:

- Provides access to in-network healthcare providers within the state where the policy is issued.

- May offer lower copayments and deductibles for services received within the state.

Out-of-state coverage:

- It may limit the choice of healthcare providers and hospitals outside the policy’s state of issuance.

- This could result in higher out-of-pocket costs for services obtained in a different state, especially with HMO or POS plans, which typically cover only emergency services outside the state.

Student Health Plans

Many colleges and universities offer student health plans catering to their enrolled students’ specific needs. These plans may include:

- Access to on-campus health clinics or affiliated medical facilities.

- Coverage for routine medical services, preventive care, and mental health support.

- Options for adding dependents to the student’s policy for an additional fee.

College students and dependents need to review the details of their student health plans, including any limitations related to out-of-state coverage and the process for seeking medical care while away from their home state.

Affordable Care Act Considerations

When moving to a different state, it is crucial to understand the implications of the Affordable Care Act (ACA) on health insurance. The ACA provides specific protections for consumer rights and offers marketplace options for individuals and families.

Protections For Consumer Rights

The Affordable Care Act ensures that consumers can access essential health benefits regardless of location. With a qualifying health insurance plan, you can receive coverage for crucial health services in any state.

Moreover, the ACA prohibits insurance providers from denying coverage or charging higher rates for non-emergency services received outside their preapproved medical network care. It gives consumers the peace that their health insurance will work in another state without facing exorbitant costs.

Marketplace Options

Under the ACA, individuals and families can access marketplace options to secure health insurance coverage in a new state. Moving permanently or temporarily to a different state, you can explore the options available through the Health Insurance Marketplace to find a suitable plan that meets your needs.

Enrolling in a plan through the Health Insurance Marketplace ensures that your health insurance will work in another state. This will allow you to access the necessary medical care without worrying about gaps in coverage or limitations based on location.

Credit: www.patientadvocate.org

Frequently Asked Questions

What Insurance Is Accepted In All 50 States?

Not all health insurance plans are accepted in all 50 states. PPO or OAP plans offer full access, while others may have limitations.

Can I Use Will My Health Insurance Work in Another State?

Some health plans like PPO or OAP allow full access to participating providers in any state. However, HMO or POS plans may only cover emergency services out of state. It’s essential to check your plan’s coverage for routine care in different states.

Is Health Insurance Valid In Other States?

Health insurance is valid in other states, but coverage may vary based on the plan type. PPO or OAP plans offer full access to participating providers nationwide, while HMO or POS plans may only cover emergency services. Always check your plan details before seeking care in another state.

Does It Matter What State I Live In For Health Insurance?

The answer to whether it matters what state you live in for health insurance depends on the plan type. PPO or OAP plans allow access to any provider in the network, regardless of your state in which. However, O or POS plans may only cover emergency services in another state.

Conclusion

Understanding your plan type is crucial when using health insurance in another state. PPO or OAP plans often offer full access nationwide, while HMO or POS plans may limit coverage. Consider your options carefully and choose a plan that suits your needs wherever you go.