Life And Health Insurance License Texas: Start Your Lucrative Career!

Life And Health Insurance License Texas, you must complete pre-licensure education and pass the state licensing exam. This license allows individuals to sell life and health insurance products to clients in Texas.

Obtaining a Life and Health Insurance License in Texas is vital for individuals who wish to work in the insurance industry. This license enables professionals to sell life and health insurance policies to individuals and businesses, offering financial protection and security.

By completing the necessary educational requirements and passing the state licensing exam, individuals can gain the knowledge and skills to advise clients on the best insurance options available to meet their needs. This license opens up career opportunities and allows individuals to make a positive impact by helping others safeguard their well-being.

:max_bytes(150000):strip_icc()/how-does-insurance-broker-make-money.asp-dd3592141b3a440a97ea2bb842a15baf.jpg)

Credit: www.investopedia.com

What Is A Life And Health Insurance License?

What is a Life and Health Insurance License?

A life and health insurance license in Texas is a certification that grants individuals the legal authority to sell life and health insurance policies in the state. This license is essential for anyone wishing to pursue a career in the insurance industry and assists clients looking for coverage to protect their lives and health.

Requirements To Obtain A License

Specific requirements must be fulfilled to obtain a life and health insurance license in Texas. These requirements are set by the Texas Department of Insurance (TDI) to ensure that licensed agents are knowledgeable and qualified to assist clients with their insurance needs.

The requirements to obtain a life and health insurance license in Texas include:

- Completing a pre-licensing course: Prospective agents must complete a state-approved pre-licensing course with the necessary knowledge and understanding of insurance laws, policies, and ethics.

- Passing the licensing examination: After completing the pre-licensing course, individuals must pass the Texas life and health insurance licensing examination. This exam evaluates their understanding of insurance principles and regulations.

- Fingerprinting and background check: Applicants must undergo a fingerprinting process and a background check to ensure their suitability for holding a license and dealing with sensitive client information.

- Paying the licensing fees: Certain fees are associated with obtaining a life and health insurance license in Texas. These fees cover the cost of processing the application and maintaining the license.

Benefits Of Having A License

Obtaining a life and health insurance license in Texas opens up opportunities for individuals interested in the insurance industry. Here are some of the critical benefits of having a license:

- Expanded career options: Individuals can explore various career paths within the insurance industry with a life and health insurance license. They can work as insurance agents, brokers, consultants, or even start their own insurance agencies.

- Increased earning potential: Being a licensed insurance professional allows individuals to earn commissions and bonuses based on the policies they sell. The more policies they sell, the more they can earn, providing a potential for financial growth.

- Ability to provide valuable assistance: Individuals gain in-depth knowledge of insurance products and regulations by obtaining a license. This enables them to guide and assist clients, ensuring they make informed decisions when selecting insurance coverage.

- Building trust and credibility: Holding a life and health insurance license demonstrates professionalism and expertise in the field. Clients are more likely to trust licensed agents, increasing the likelihood of building long-term relationships and a solid reputation.

Credit: www.investopedia.com

Why Get A Life And Health Insurance License In Texas?

Obtaining a Life and Health Insurance License in Texas can open up opportunities for individuals looking to enter the insurance industry. Let’s explore why pursuing this license could be a beneficial career move.

Growing Demand For Insurance

The insurance industry in Texas is experiencing a surge in demand for life and health insurance products. Given the increasing population and the emphasis on financial security, individuals seek insurance coverage, creating a need for licensed professionals to provide these services.

Lucrative Career Opportunities

A Life and Health Insurance License in Texas can lead to lucrative career opportunities. Insurance agents can earn competitive commissions and bonuses while helping clients protect their health and financial well-being.

Steps To Obtain A Life And Health Insurance License In Texas

Steps to Obtain a Life and Health Insurance License in Texas

Pre-licensing Education

Complete accredited insurance pre-licensing education through a TDI-approved provider.

Study key insurance concepts, regulations, and ethics to prepare for the licensing exam.

Passing The Licensing Exam

Register for the Texas insurance licensing exam through Pearson VUE.

Pass the exam with a 70% or higher score to qualify for licensure.

Applying For A License

Apply online through the Texas Department of Insurance website.

Pay the required fees and undergo a background check for approval.

After you approve it, you will receive your Life and Health Insurance license to start practicing.

Credit: www.indeed.com

Key Topics Covered In The Licensing Exam

A Life and Health Insurance License in Texas involves passing a comprehensive licensing exam. This exam assesses your knowledge and understanding of various key topics related to insurance, giving you the foundation you need to excel in your professional endeavors in the insurance industry. Let’s look at the key topics covered in the Texas Licensing Exam.

Insurance Basics

In the licensing exam, you can expect questions that test your understanding of insurance fundamentals. This includes the basic concepts, terms, and principles that form the backbone of the insurance industry. Please show your knowledge of the insurance process, including how insurance policies are underwritten, issued, and serviced. Also, you’ll need to show your understanding of risk management and the role of insurance in mitigating potential risks.

Life Insurance Products

Life insurance is a crucial component of the insurance industry, and the Texas Licensing Exam will assess your knowledge of various life insurance products. You’ll need to understand the different types of life insurance policies available, such as term life insurance, whole life insurance, and universal life insurance. Furthermore, you’ll be tested on your understanding of the critical features of these policies, including premiums, death benefits, cash value accumulation, and policy dividends. You need to familiarize yourself with the nuances of each type of life insurance to excel in this section.

Health Insurance Products

With healthcare costs on the rise, the demand for health insurance is higher than ever. The Texas Licensing Exam evaluates your understanding of health insurance products and their unique challenges and associated requirements. You’ll be expected to comprehend the various types of health insurance plans, such as managed care plans, fee-for-service plans, and Health Maintenance Organization (HMO) plans. Moreover, you’ll need to demonstrate proficiency in understanding key health insurance terms, including healthcare providers, deductibles, copayments, and pre-existing conditions.

Texas Insurance Laws And Regulations

As an insurance professional in Texas, it’s crucial to have a thorough understanding of the laws and regulations that govern the insurance industry in the state. The Texas Licensing Exam will test your knowledge of the specific regulations that apply to life and health insurance. This includes understanding licensing requirements, advertising restrictions, policyholder rights, and ethical standards. It’s essential to study the relevant laws and regulations and stay updated with any changes to ensure you comply with legal obligations and can provide accurate guidance to clients.

In conclusion, the Texas Licensing Exam covers many topics to ensure that aspiring insurance professionals are well-equipped to navigate the complex world of life and health insurance. By focusing on insurance basics, life and health insurance products, and Texas insurance laws and regulations, you’ll have a solid foundation to excel in your licensing exam and confidently enter the insurance industry.

Tips To Prepare For The Licensing Exam

When it comes to obtaining a Life and Health Insurance License in Texas, preparation is critical. Properly preparing for the licensing exam can significantly increase your chances of passing on the first attempt. Here are some essential tips to help you prepare for the licensing exam:

Study The Exam Content Outline

Before diving into your study materials, familiarize yourself with the exam content outline. The outline will provide a detailed breakdown of the topics covered in the exam. Understanding the content outline will help you focus your study efforts on the most relevant material, ensuring you are well-prepared for the exam.

Take Practice Exams

Practice exams are an invaluable tool for preparing for the licensing exam. Practice exams allow you to assess your knowledge and identify areas requiring additional study. Simulating the exam environment as closely as possible when taking practice exams, including setting a timer and working under exam conditions, is essential.

Attend Exam Prep Courses

Exam prep courses can provide structured instruction and guidance from experienced professionals. Attending these courses can help you better understand the exam material and learn valuable test-taking strategies. Please look for reputable prep courses with a track record of helping students succeed on the licensing exam.

Renewing And Maintaining Your License

Renewing and maintaining your life and health insurance license in Texas is critical for insurance professionals. Understanding the renewal requirements, continuing education, and avoiding license penalties is essential to ensure compliance with regulations and to continue practicing in the insurance industry.

Renewal Requirements

Texas’s life and health insurance licenses are renewed every two years on the licensee’s birth month. The renewal process requires completing the appropriate forms and submitting the renewal fee through the Texas Department of Insurance (TDI) website. It is essential to ensure timely renewal to avoid any license expiration and related penalties.

Continuing Education

Continuing education is vital to maintaining your Texas life and health insurance license. Licensees must complete several hours of continuing education courses before the renewal deadline. The Texas Department of Insurance stipulates the requirements for continuing education, including courses on ethics and specialized topics relevant to the insurance industry.

Avoiding License Penalties

- Be proactive and plan to meet the renewal deadlines

- Ensure completion of the required continuing education hours

- Stay informed about any changes in renewal requirements set forth by the Texas Department of Insurance

The Benefits Of Specializing In Life And Health Insurance

Specializing in life and health insurance in Texas offers a rewarding career path with high demand and earning potential. Acquiring a license enables professionals to provide crucial financial protection and peace of mind to individuals and families, making a positive difference in their lives.

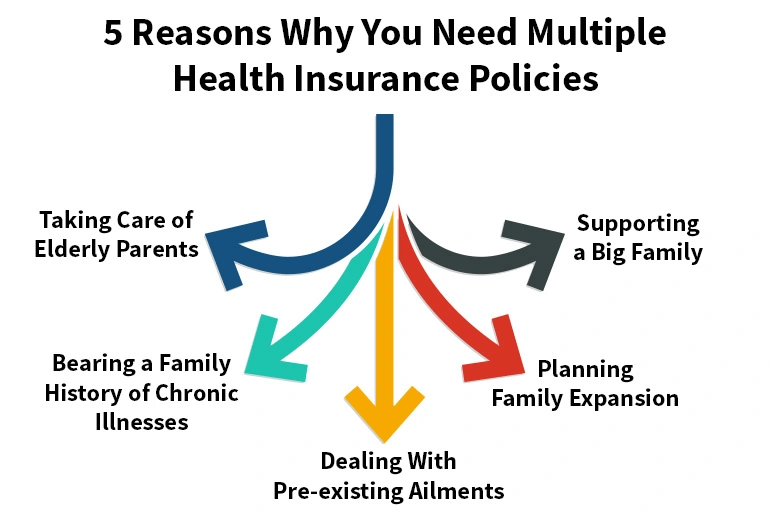

Expanding Your Client Base

Specializing in life and health insurance opens up many opportunities to expand your client base. By focusing on these specific areas, you can cater to individuals seeking these types of coverage, thus increasing your chances of securing new clients. When you specialize in life and health insurance, you become an expert in these fields, making connecting with potential customers actively looking for policies to protect their lives and well-being easier.

When you tailor your services to the life and health insurance market, you position yourself as a trusted advisor. Clients seeking guidance and expertise in these areas will be drawn to your specialization and are more likely to seek your assistance. This targeted approach allows you to stand out from competitors who offer general insurance services, giving you a competitive edge in a highly saturated market. By specializing, you can attract and retain clients who recognize the value of your specialized knowledge.

Higher Earning Potential

Apart from expanding your client base, specializing in life and health insurance also offers the potential for higher earnings. When you become an expert in these fields, you can provide more comprehensive coverage options that meet the specific needs of your clients. This specialization allows you to offer tailored policies with more excellent coverage and benefits, which can command higher premiums.

Additionally, as a life and health insurance specialist, you are better equipped to advise your clients on complex policies and explain the intricacies. This level of expertise instills confidence in your clients, making them more willing to invest in the policies you recommend. With higher premiums and increased policy sales, your earning potential amplifies significantly.

Furthermore, specializing in life and health insurance allows you to upsell additional coverage options to your existing client base. For example, if a client initially purchases a life insurance policy from you, you can recommend supplementary health coverage to enhance their overall protection. This cross-selling strategy benefits your clients by providing comprehensive coverage and boosts your earnings through increased policy sales.

Frequently Asked Questions On Life And Health Insurance License Texas

What Are The Requirements For Getting A Life And Health Insurance License In Texas?

To get a life and health insurance license in Texas, you must complete pre-licensing education, pass the state licensing exam, submit an application, and undergo a background check.

How Long Does Obtain A Life And Health Insurance License In Texas?

The time it takes to obtain a life and health insurance license in Texas varies depending on how quickly you complete the required education, pass the licensing exam, and submit your application. On average, it can take several weeks to a few months.

How Can I Prepare For The Life And Health Insurance Licensing Exam In Texas?

To prepare for the life and health insurance licensing exam in Texas, consider taking a pre-licensing course, studying the state-specific regulations and laws, and utilizing practice exams and study materials to ensure you are fully prepared.

Can I Sell Both Life Insurance And Health Insurance With A Single License In Texas?

You can sell life and health insurance in Texas with a single license. This allows you to offer your clients a broader range of products and services, increasing your earning potential and expanding your business opportunities.

Conclusion

In a rapidly changing world, obtaining a Life and Health Insurance License in Texas has become more critical than ever. Equipping yourself with this license gives you the necessary knowledge and skills to safeguard individuals’ well-being and financial security.

With the limitless opportunities in the insurance industry, getting licensed is a significant step towards a stable and fulfilling career. Ready to embrace this rewarding journey? Start your journey today and pave the way for a successful future in the insurance field.