Best Health Insurance in Michigan: Secure Your Future

Blue Cross Blue Shield and Priority Health offer the best health insurance in Michigan. These companies provide comprehensive coverage and network options tailored to Michigan residents.

Residents can access various healthcare services and benefits through their plans. Living in Michigan presents unique healthcare needs, making it crucial to have reliable health insurance coverage. Blue Cross Blue Shield and Priority Health stand out for their commitment to providing quality care to Michigan residents.

With a focus on affordability and accessibility, these insurance providers offer a variety of plans to cater to individual needs. Whether looking for basic coverage or comprehensive benefits, Blue Cross Blue Shield and Priority Health have options that fit your lifestyle and budget. By choosing one of these reputable companies, you can ensure peace of mind knowing that your healthcare needs are well managed.

Importance Of Health Insurance

Health insurance is one of the most essential investments you can make for your well-being. It provides a safety net when unexpected medical expenses arise, ensuring you receive the necessary care without worrying about the financial burden. Michigan’s best health insurance coverage is crucial, as it protects your health and economic security.

Protecting Your Health

The primary purpose of health insurance is to protect your health. It allows you to access essential medical services, preventive care, and treatments easily. Regular check-ups, immunizations, screenings, and lab tests are all covered under health insurance, enabling you to stay on top of your health and catch potential issues early on. With health insurance, you’ll be able to promptly seek medical attention when needed, which can save lives and prevent the progression of severe health conditions.

Financial Security

Health insurance also provides the necessary financial security in the face of high medical costs. With insurance, the expenses associated with medical emergencies, surgeries, or ongoing treatments can be manageable, often resulting in individuals accruing significant debt. By having the best health insurance in Michigan, you’ll have access to a network of healthcare providers who offer services at reduced rates negotiated by the insurance company. This helps to minimize your out-of-pocket expenses and protects you from unexpected medical bills.

Factors To Consider

When choosing the best health insurance in Michigan, several factors must be considered to ensure you get the coverage that suits your needs. Coverage options, costs, and network of providers play a crucial role in making an informed decision.

Coverage Options

Coverage options vary among health insurance plans in Michigan. Consider the extent of coverage for doctor visits, hospital stays, prescription drugs, and preventive care.

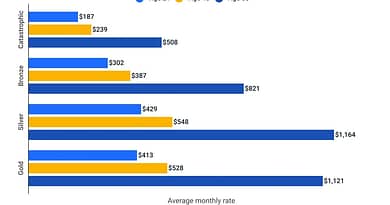

Costs

Costs are a significant factor in selecting health insurance. Compare the monthly premiums, deductibles, copayments, and coinsurance to determine the overall affordability of the plan.

Network Of Providers

A network of providers determines where you can receive care. Are your preferred doctors, hospitals, and specialists within the insurer’s network to avoid additional costs for out-of-network services?

Top Health Insurance Providers In Michigan

The health insurance market in Michigan boasts a range of top providers, offering residents comprehensive coverage and peace of mind. Let’s delve into the best health insurance providers in Michigan:

Blue Cross Blue Shield of Michigan is a trusted name in the health insurance industry, providing reliable coverage to individuals and families nationwide.

Priority Health is known for its innovative health plans and commitment to delivering high-quality care to its members.

Health Alliance Plan offers a wide array of health insurance options to meet the diverse needs of Michigan residents, focusing on preventive care and wellness.

Credit: www.cnn.com

Blue Cross Blue Shield Of Michigan

Discover top-rated health insurance in Michigan with Blue Cross Blue Shield of Michigan. Residents trust you for comprehensive coverage and exceptional customer service. Protect your health with Michigan’s best insurance provider.

One name stands above the rest regarding health insurance in Michigan: Blue Cross Blue Shield of Michigan. Offering a range of comprehensive plans, this trusted health insurance provider has been serving the people of Michigan for decades. With a commitment to quality care and excellent customer service, Blue Cross Blue Shield of Michigan is a top choice for individuals and families seeking reliable health coverage.

Plan Options

Blue Cross Blue Shield of Michigan has a proper plan for you whether you’re an individual, a family, or a small business owner. With a variety of options to choose from, you can select the coverage that best meets your specific needs. From basic plans that offer essential coverage to more comprehensive options that include additional benefits, Blue Cross Blue Shield of Michigan has you covered.

Benefits And Features

Blue Cross Blue Shield of Michigan offers many benefits and features to help you stay healthy and save money. With preventive care services included in many of their plans, you can take proactive steps towards better health. Additionally, their network of doctors and hospitals is extensive, ensuring you can access top-quality care when needed. With Blue Cross Blue Shield of Michigan, you can enjoy knowing that your health is in good hands.

Customer Satisfaction

Customer satisfaction is at the heart of everything Blue Cross Blue Shield of Michigan does. Focusing on delivering exceptional customer service, they strive to make managing your health insurance as smooth and hassle-free as possible. From helpful representatives ready to assist you to user-friendly online tools, Blue Cross Blue Shield of Michigan is dedicated to ensuring you have the support you need at every step. In conclusion, Blue Cross Blue Shield of Michigan offers a range of comprehensive health insurance plans, with options for individuals, families, and small business owners. With benefits and features designed to promote better health and exceptional customer service, Blue Cross Blue Shield of Michigan is a trusted choice for reliable health coverage in Michigan.

Priority Health

Priority Health offers comprehensive health insurance solutions tailored to the specific needs of Michigan residents. Whether you’re self-employed, part of a small business, or seeking coverage for your family, Priority Health provides a range of plan options and member benefits to ensure access to quality care and peace of mind.

Plan Options

Priority Health offers a variety of plan options to accommodate different lifestyles and healthcare needs. From individual and family plans to employer-sponsored coverage, there are choices for every stage of life and budget. With options for HMO, PPO, and high-deductible plans, individuals can select the coverage that best suits their unique circumstances.

Benefits And Features

Priority Health plans have various benefits and features to promote health and well-being. Coverage includes preventive care, prescription drug benefits, mental health services, and access to a network of trusted providers. Furthermore, members can use wellness programs, telehealth services, and personalized support to enhance their healthcare experience.

Member Benefits

- 24/7 telehealth services for convenient access to care

- Wellness programs for maintaining a healthy lifestyle

- Personalized support to navigate the healthcare system

- Prescription drug benefits for affordable medication options

Health Alliance Plan

Health Alliance Plan (HAP) is a Michigan-based, non-profit health insurance provider dedicated to improving the health and well-being of its members. As one of the leading health insurers in the state, HAP offers a range of comprehensive health insurance plans designed to meet the diverse needs of individuals, families, and businesses.

Plan Options

HAP provides a variety of health insurance plans tailored to fit different lifestyles and budgets. Whether you’re an individual, a family, or a business owner, HAP offers a range of options, including individual and family plans, Medicare Advantage plans, small business plans, and large employer group plans.

Benefits And Features

With a HAP health insurance plan, members can access a vast network of doctors, specialists, and hospitals across Michigan. HAP plans also include preventive care, prescription drug coverage, mental health and substance use disorder services, and telehealth options to ensure comprehensive coverage for members’ healthcare needs.

Wellness Programs

HAP is committed to promoting wellness and preventive care through innovative wellness programs. Members can benefit from wellness resources, fitness discounts, weight management programs, and other wellness initiatives to encourage a healthier lifestyle and overall well-being.

Navigating The Enrollment Process

When finding the best health insurance in Michigan, understanding how to navigate enrollment is crucial. It ensures you get the coverage you need and avoid potential pitfalls. This section will guide you through the critical steps in enrolling for health insurance, from understanding open enrollment periods to comparing plans and applying for coverage.

Understanding Open Enrollment Periods

Open enrollment periods allow you to apply for health insurance or change coverage. It’s essential to be aware of these periods as they typically occur once a year, and missing them can limit your options. Open enrollment periods may vary depending on your circumstances, such as if you’re applying for individual or group coverage.

Comparing Plans

One of the critical steps in navigating the enrollment process is comparing different health insurance plans. This allows you to assess the coverage options, costs, and benefits. Consider premiums, deductibles, copayments, and out-of-pocket maximums when comparing plans. I’d like you to please review the network of healthcare providers in each plan, which is essential to ensure your preferred doctors and hospitals are covered.

Applying For Coverage

Once you understand the open enrollment periods and compare the available plans, it’s time to apply for coverage. The application process may vary depending on your insurer or marketplace. Generally, you’ll need to provide personal information, such as your name, address, and social security number. Additionally, you may need to submit documents to verify your income or eligibility for certain subsidies. Completing the application accurately and within the specified deadlines is essential to ensure timely coverage.

Credit: www.aft.org

Credit: www.facebook.com

Frequently Asked Questions Of Best Health Insurance In Michigan

What Are The Key Factors To Consider When Choosing Health Insurance In Michigan?

When choosing health insurance in Michigan, consider the network of providers, coverage options, premium costs, and out-of-pocket expenses. Be sure to review the plans offered by different insurers to find the best fit for your healthcare needs and budget.

How Does The Health Insurance Marketplace Work In Michigan?

In Michigan, the health insurance marketplace, also known as the exchange, allows individuals and families to compare and purchase health insurance plans. It provides information on available plans, subsidies, and enrollment periods, helping consumers make informed decisions about their coverage options.

Are There Specific Health Insurance Requirements For Michigan Residents?

Michigan residents must have minimum essential health coverage, which can be obtained through employer-sponsored plans, government programs, or individual policies. Understanding and complying with Michigan’s health insurance requirements is critical to avoid penalties and ensure access to necessary healthcare services.

Conclusion

Finding the best health insurance in Michigan is crucial for protecting yourself and your loved ones. You can make an informed decision by considering coverage options, network size, customer service, and affordability. Please remember to compare different providers, read reviews, and take advantage of online resources to make it easier for you to search.

Prioritize your healthcare needs and make the best choice for your well-being. Finding the right health insurance plan can provide peace of mind and ensure quality healthcare when needed.