Select Health Insurance : The Ultimate Guide for Choosing the Right Plan

Select Health Insurance; selecting a plan that meets your needs and budget is crucial.

Credit: medium.com

Why Health Insurance Is Important

Health insurance offers financial protection against unexpected medical bills, covering costs that could be prohibitively expensive.

Health insurance provides access to a network of healthcare providers, ensuring timely and appropriate care for your medical needs.

Health insurance ensures financial stability by mitigating the risk of high medical costs and loss of income during illness or injury.

Credit: www.npr.org

Factors To Consider When Choosing Health Insurance

When selecting the right health insurance plan, evaluating several vital factors that can impact your coverage and costs is crucial. Here are the essential considerations to keep in mind:

Coverage

Coverage refers to the medical services and treatments a health insurance plan pays for. Please ensure the plan includes essential benefits such as hospital stays, doctor visits, and preventive care.

Premiums

Premiums are the monthly payments you make to keep your health insurance coverage. Please consider how the premium fits your budget without compromising the necessary coverage.

Network Of Healthcare Providers

Check the network of healthcare providers that work with the insurance plan. Ensure your preferred doctors and hospitals are in-network to avoid additional costs.

Deductibles And Out-of-pocket Costs

Understand the deductible – the amount you need to pay before your insurance begins covering costs. Also, be aware of your out-of-pocket maximum to know the limit on what you might have to pay in a year.

Prescription Drug Coverage

Look into the plan’s prescription drug coverage, especially if you require medications. Check if your prescribed drugs are covered and assess the related costs.

Types Of Health Insurance Plans

Health insurance plans come in various forms, offering different benefits and coverage options to meet individual needs. Understanding the different types of health insurance plans can help you make an informed decision when selecting the right plan for you and your family. Let’s explore each type in detail:

Health Maintenance Organization (HMO)

An HMO is a type of health insurance plan that typically requires choosing a primary care physician (PCP) from a network of doctors. Your PCP will coordinate your medical care and refer you to specialists within the network when necessary. With an HMO, you generally need a referral to see a specialist, but the premium and out-of-pocket costs are usually lower than other plans.

Preferred Provider Organization (PPO)

A PPO is another common type of health insurance plan. It provides more flexibility than an HMO, as seen from both in-network and out-of-network healthcare providers. The out-of-pocket costs are higher if you see a provider outside the network. PPO plans usually do not require referrals to a specialist, allowing you to see the right healthcare professional without unnecessary delays.

Exclusive Provider Organization (EPO)

An EPO plan is similar to an HMO in that you must choose a primary care physician from a network of providers. However, unlike an HMO, an EPO typically does not require a referral to see a specialist. This plan offers a balanced approach, combining an HMO’s lower premiums and out-of-pocket costs with the excellent choice of PPO providers.

Point Of Service (pos)

A POS plan is a hybrid between an HMO and a PPO. It gives you the option to choose between in-network and out-of-network healthcare providers. With a POS plan, you are required to select a primary care physician who will be responsible for managing your healthcare. If you need to see a specialist, your PCP can refer you within or outside the network. While staying in-network will help minimise your out-of-pocket costs, you can seek care from providers outside the network when needed.

High-deductible Health Plans (hdhp)

An HDHP is a type of health insurance plan with a higher deductible, meaning you must pay a significant out-of-pocket amount before your insurance coverage kicks in. However, HDHPs often have lower monthly premiums, making them attractive to those on tight budgets. These plans are usually combined with a Health Savings Account (HSA), which allows you to set aside tax-free funds to cover your medical expenses.

Medicare And Medicaid

Medicare and Medicaid are federal health insurance programs designed to cover specific populations. Medicare is available for individuals 65 or older or with particular disabilities, while Medicaid is designed to assist low-income individuals and families. These programs offer comprehensive healthcare coverage, although specific eligibility criteria and coverage may vary.

Assessing Your Health Insurance Needs

Assessing your health insurance needs is essential in ensuring financial security and access to quality healthcare. Before selecting a health insurance plan, evaluating various factors impacting your coverage and cost is critical. By examining your current health condition, future health needs, budget, and family’s health history, you can make an informed decision that aligns with your specific requirements.

Evaluate Your Current Health Condition

Assess your health status to determine the type of coverage you may need. Consider any ongoing medical conditions, prescription medications, and the frequency of doctor visits. This evaluation will give you insight into the coverage required for your current healthcare needs.

Consider Future Health Needs

Anticipate potential health requirements in the future, such as planned medical procedures, preventive care, or possible lifestyle changes that could impact your health. Factoring in these future needs will help ensure your health insurance plan remains suitable as your circumstances evolve.

Analyse Your Budget

Review your financial resources to establish a budget for health insurance. Assess your ability to pay premiums, deductibles, and out-of-pocket expenses. Consider your monthly income and other financial obligations to determine the affordability of various health insurance options.

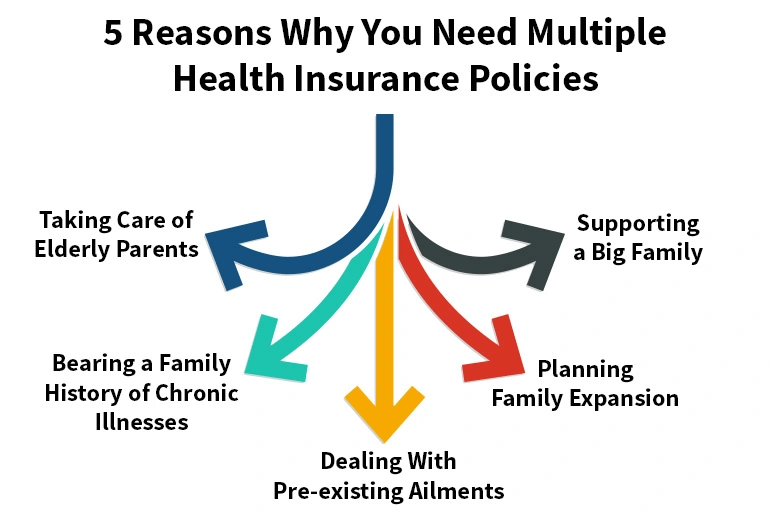

Determine Your Family’s Health History

Understanding your family’s health history can provide insight into potential hereditary conditions or predispositions that may impact your health in the future. This information is essential for choosing a health insurance plan that adequately addresses your family’s unique healthcare needs.

Understanding Health Insurance Terminology

Understanding Health Insurance Terminology is crucial for anyone looking to navigate the complexities of healthcare coverage. Familiarising yourself with the terms and concepts will make choosing the right plan easier and utilising the benefits effectively. This section will break down key health insurance terms, allowing you to make informed decisions about your coverage.

Premium

The premium is the amount you pay for your health insurance each month. It is a fixed cost, regardless of whether you use medical services.

Deductible

The deductible is the amount you must pay for covered services before your insurance starts to pay. Once you meet your deductible, your insurance covers some of the costs.

Copayments And Coinsurance

Copayments are fixed for certain services, such as doctor visits or medications. Coinsurance is a percentage of the cost of a service you are responsible for. Both are forms of cost-sharing between you and your insurance company.

Out-of-pocket Maximum

The out-of-pocket maximum is the most you must pay for covered services in a plan year. Once you reach this limit, your insurance company pays 100% of the covered services.

Network

A network is a group of doctors, hospitals, and other healthcare providers contracted with your insurance company to provide services at a discounted rate. Staying in-network can help reduce your out-of-pocket costs.

Preventive Care

Preventive care includes screenings, vaccinations, and counselling to prevent illness or detect conditions early when they are easier to treat. Many insurance plans cover preventive care at no cost to you.

Prior Authorization

Prior authorisation is obtaining approval from your insurance company before receiving certain services or medications. This ensures that the treatment is deemed medically necessary and may be covered by your plan.

In-network Vs Out-of-network

Healthcare providers in your insurance company’s network are considered in-network. Visiting an out-of-network provider may incur higher out-of-pocket costs, and some services may not be covered.

Comparing Health Insurance Options

Choosing the right health insurance plan can be daunting, but it’s an important decision that requires careful consideration. You can find a plan that meets your needs and budget by comparing different health insurance options. Here are some key factors to consider when comparing health insurance plans:

Request And Review Plan Summaries

Before making any decisions, requesting and reviewing plan summaries from various health insurance providers is crucial. These summaries provide a detailed breakdown of the coverage and benefits offered by each plan. Please take the time to carefully read and compare the plan summaries to understand what is included and excluded.

Compare Coverage And Benefits

When comparing health insurance options, it’s essential to examine the coverage and benefits provided by each plan. Look for coverage of doctor visits, hospital stays, prescription medications, preventive care, and specialist consultations. Consider your specific healthcare needs and prioritise which benefits are most important to you.

Creating a table comparing the coverage and benefits each health insurance plan offers may be helpful. This allows for an easy visual comparison, making it easier to identify the strengths and weaknesses of each option.

Evaluate Costs

Cost is a significant factor in choosing a health insurance plan. Evaluate the costs associated with each plan, including premiums, deductibles, copayments, and out-of-pocket maximums. Consider your budget and how much you can pay in premiums and other expenses.

It’s important to note that while a plan with lower premiums may seem more affordable, it may have higher deductibles and copayments. On the other hand, a plan with higher premiums might provide lower out-of-pocket costs. Could you evaluate these factors about your expected healthcare needs?

Research Customer Reviews

Research and read customer reviews of the health insurance providers you are considering. Look for feedback on the quality of customer service, ease of claim process, and overall satisfaction with the coverage and benefits. Customer reviews can provide valuable insights into the experiences of others and help you make an informed decision.

Check Provider Networks

One crucial aspect of health insurance is the provider network. Please ensure that the health insurance plan you select includes a network of healthcare providers such as doctors, specialists, clinics, and hospitals that are conveniently located and meet your healthcare needs.

If you have specific healthcare providers you prefer, check if they are included in the network. Additionally, consider the flexibility of the network and if you need referrals to see specialists or can directly access them.

By following these steps and comparing health insurance options based on plan summaries, coverage and benefits, costs, customer reviews, and provider networks, you can make an informed decision that suits your healthcare needs and budget.

Common Pitfalls To Avoid When Selecting Health Insurance

Common Pitfalls to Avoid When Selecting Health Insurance

Not Fully Understanding The Policy Terms

Reading and comprehending all policy terms are crucial to avoid misunderstandings later.

Overlooking Coverage Limitations

Please keep in mind any restrictions on coverage to avoid unexpected out-of-pocket expenses.

Ignoring The Network Of Providers

Please ensure that your preferred doctors and hospitals are in-network to access quality care.

Choosing A Plan Based Solely On Cost

Please consider cost and coverage to select a plan that meets your needs.

Credit: www.nerdwallet.com

Tips For Navigating The Health Insurance Selection Process

Selecting health insurance can feel overwhelming, with many options. Here are some tips to help you make an informed decision:

Identify Your Must-have Features

Make a list of essential features your health insurance must provide. Determine what is crucial to your health and budget.

Seek Professional Advice

Consult a health insurance advisor for insightful guidance tailored to your needs and preferences.

Ask For Recommendations

- Reach out to friends or family members for trusted recommendations on health insurance providers in your area.

- Consider online forums for valuable feedback from individuals with similar circumstances.

Read And Understand The Fine Print

- Review the policy documents thoroughly to understand coverage limits and exclusions.

- Pay attention to co-pays, deductibles, and out-of-pocket maximums.

Consider Supplemental Insurance

You can explore the option of supplemental insurance to enhance your coverage and fill potential gaps in your primary plan.

Frequently Asked Questions For Select Health Insurance

What Are The Key Benefits Of Having Health Insurance?

Health insurance provides financial protection against medical expenses, including doctor visits, hospitalisation, and prescription drugs. It also offers preventive care and encourages timely medical attention.

How Do I Choose The Right Health Insurance Plan For My Needs?

When selecting a health insurance plan, consider your medical needs, the network of doctors and facilities, coverage for prescription drugs, and the cost. It’s essential to compare different plans to find the one that works best for you.

Should I include My Family Members In My Health Insurance Policy?

Yes, most health insurance plans allow you to include your family members, such as your spouse and children, in your policy. This ensures your loved ones are also covered for medical expenses and healthcare needs.

Conclusion

To make the right choice for health insurance, prioritise your individual needs and circumstances. By comparing plans based on coverage, network, cost, and benefits, you can ensure you’re getting the best fit for your healthcare needs. Remember to consider any future health needs or life changes that may require adjustments to your coverage.

Please take the time to carefully evaluate your options and make an informed decision that will help you and your family.