How to Get Credentialed With Insurance Companies Mental Health: Expert Tips for Success

How to Get Credentialed With Insurance Companies Mental Health, complete provider applications and submit necessary documentation promptly. You can start by researching insurer requirements and preparing all documents beforehand.

Building a solid professional network in the mental health field can provide valuable insights and connections for successful credentialing efforts. Maintaining clear communication with insurance companies throughout the process is essential to address any potential issues promptly. By following these steps diligently, mental health professionals can increase their chances of being credentialed with insurance companies efficiently and effectively.

Credit: www.linkedin.com

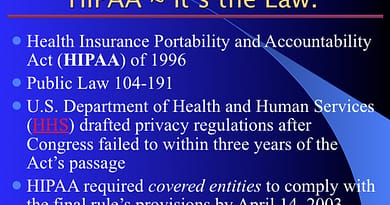

Understanding Insurance Credentialing

Understanding Insurance Credentialing:

Mental health professionals are crucial in supporting and treating those in need. However, to ensure that insurance companies cover their services, they need to go through the credentialing process. Understanding insurance credentialing is vital for mental health practitioners who want to expand their patient base and provide services to a broader range of individuals.

Importance of Credentialing:

Insurance credentialing is how insurance companies recognise and approve mental health professionals. The importance of credentialing must be balanced. Being credentialed with insurance companies provides numerous benefits for mental health providers, including:

- Increased access to a larger patient pool

- Expanded practice growth and development

- Enhanced credibility and trustworthiness

- Streamlined billing and reimbursement processes

By being credentialed, mental health professionals can attract more patients with insurance coverage, thereby increasing their client base and revenue streams. It opens opportunities for professional growth and collaboration with other healthcare providers. Additionally, being credentialed gives mental health professionals the advantage of a streamlined billing process, ensuring prompt and accurate reimbursement for their services.

Process Overview:

The insurance credentialing process can seem daunting, but understanding its various steps can help mental health professionals navigate it more effectively. Here is a brief overview of the process:

- Evaluate insurance networks: Mental health professionals should research and identify the insurance networks that align with their practice and patient demographics.

- Gather necessary documents: Providers must gather all the required documents, such as licenses, certifications, diplomas, and malpractice insurance.

- Complete applications: Professionals must fill out and submit applications to the desired insurance networks, ensuring accurate and up-to-date information.

- Submit supporting documents: Along with the applications, providers must submit supporting documents, including copies of licenses, certifications, and other required credentials.

- Follow-up and review: After submitting the applications, mental health professionals should follow up with the insurance companies to ensure their applications are reviewed and processed.

- Contract negotiation: Once approved, providers may need to negotiate contracts with insurance companies, including payment rates and terms.

While the credentialing process may take time and effort, it is a necessary step for mental health professionals who want to expand their practice and work with insurance-reimbursed clients. The benefits and opportunities that come with credentialing far outweigh the initial investment.

By understanding the importance of credentialing and familiarising themselves with the overall process, mental health providers can navigate this journey successfully and reap the rewards of being in-network with insurance companies.

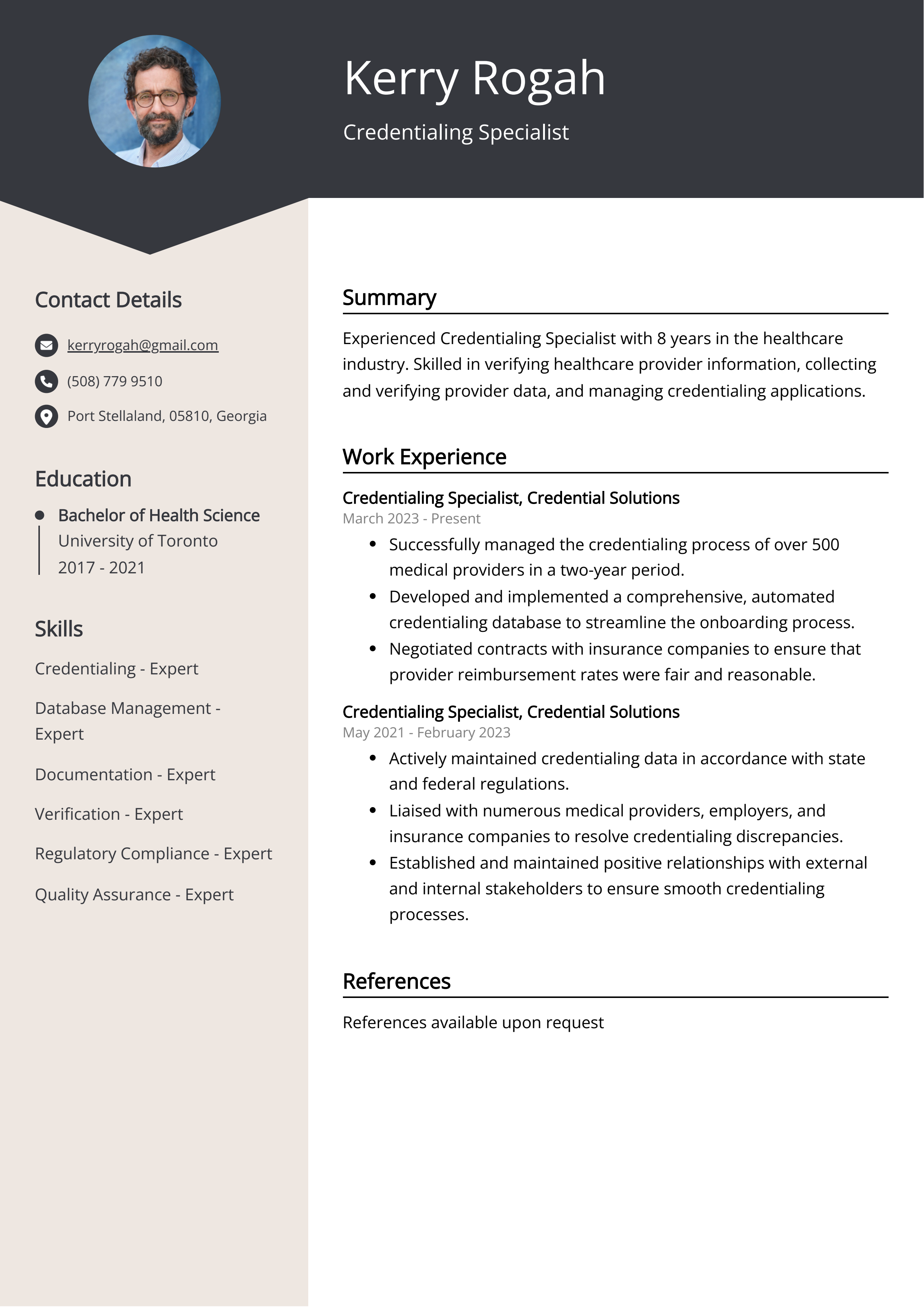

Credit: resumaker.ai

Qualifications And Requirements

When credentialing with insurance companies for mental health services, meeting specific qualifications and requirements is crucial.

Education And Licensure

- Master’s degree in counselling psychology or a related field.

- Licensure as a mental health counsellor, social worker, psychologist, or psychiatrist.

Insurance Panels’ Criteria

- Clear background check and professional references.

- Proof of malpractice insurance.

Preparing Your Application

Prepare your application for insurance company credentialing by following these steps:

Gathering Necessary Documents

- Gather personal identification documents such as driver’s license and social security card.

- Collect educational certificates, professional licenses, and malpractice insurance information.

- Obtain background checks, drug screenings, and immunisation records as required.

Completing Application Forms

- Fill out all application forms accurately and completely.

- Submit proof of education, training, and current licensure.

- Provide all requested information about your practice and insurance coverage.

Navigating The Credentialing Process

Gain access to insurance networks as a mental health provider by navigating the credentialing process. Submit the required documents and complete applications to start accepting insurance clients. Streamline the process by staying organised and following guidelines closely.

Timelines And Deadlines

Navigating the credentialing process with insurance companies can be a complex and time-consuming, but understanding the timelines and deadlines involved can help streamline the process. It’s important to note that every insurance company may have different requirements and timeframes, so it’s crucial to carefully review each company’s guidelines and stay organised with your application materials. When you start the credentialing process, you can start by identifying the specific deadlines the insurance company sets. These deadlines typically include submission dates for the initial application, additional required documentation, and any follow-up inquiries. Meeting these deadlines is essential to ensure the credentialing process is completed on time.

Communication With Insurance Companies

Effective and timely communication with insurance companies is vital throughout the credentialing process. When you begin your application, please keep open lines of communication with the insurance company’s credentialing department. Please respond to requests for additional information or clarifications to ensure a smooth flow of information. When talking with insurance companies, please be sure to maintain a professional tone and concisely organise your messages. It’s important to emphasise your qualifications, experience, and commitment to providing quality mental health services. Keep a record of all written correspondence and make any necessary follow-up calls to stay updated on the progress of your application. Additionally, familiarise yourself with the preferred method of communication of the insurance company. Some companies prefer email communication, while others prefer fax or phone calls. Following the preferred communication method can help facilitate effective exchanges and reduce potential delays. Just to remind you, communication with insurance companies is a two-way street. If you encounter any challenges or have questions during the credentialing process, please don’t hesitate to contact the insurance company for help. Overall, navigating the credentialing process for mental health providers requires careful attention to timelines and deadlines and effective communication with insurance companies. By staying organised, proactive, and responsive, you can increase your chances of successfully getting credentialed and broaden your access to clients within the insurance network.

Understanding Contract Terms

Discover how to successfully navigate contract terms and become credentialed with insurance companies in the mental health field. Gain valuable insights and knowledge to streamline the process and achieve tremendous success in your practice.

Understanding Contract Terms When getting credentialed with insurance companies for mental health, it’s crucial to understand the contract terms. This includes fee schedules, treatment authorisation requirements, and more. These terms are essential for a smooth and successful credentialing process. H3 Headings in HTML syntax: “` HTML

Fee Schedules

Fee schedules outline the reimbursement rates that insurance companies will pay for your services. Understanding these schedules helps you determine fair compensation for your services and ensures that you are fairly compensated for the care you provide.

Treatment Authorization Requirements

I want you to know that understanding the treatment authorisation requirements is essential for ensuring your clients receive the necessary care without delays. This may involve understanding the pre-authorization process for specific treatments and therapies, ensuring clients can access the care they need promptly.

“` By understanding these contract terms, mental health professionals can navigate the credentialing process more effectively and ensure their clients receive the care they need.

Credit: m.facebook.com

Maintaining Your Credentialing Status

To maintain your credentialing status with insurance companies for mental health services, ensure all necessary documentation is current and meets their requirements. Stay informed about any changes or updates to the credentialing process, and promptly address any issues that may arise to avoid potential delays in receiving reimbursements for your services.

Maintaining Your Credentialing Status Re-credentialing Requirements To maintain your credentialing status with insurance companies for mental health services, it’s essential to understand the re-credentialing requirements. Insurance companies typically require mental health providers to re-credential every certain number of years, often between 2 to 3 years. This process ensures that providers still meet the qualifications and standards to provide services to insured individuals. Please complete the re-credentialing process to maintain your credentialing status, impacting your ability to bill and receive service reimbursement. Updates and Changes Staying informed about updates and changes in the credentialing process is crucial for maintaining your status. Insurance companies frequently update their requirements and criteria for credentialing. Providers must stay aware of these updates and ensure they meet the new standards. This could include changes in documentation requirements, quality measures, or new licensing and certification requirements. Being proactive in understanding and implementing these updates is vital to maintaining a smooth credentialing process. In conclusion, mental health providers can ensure they retain their credentialing status with insurance companies by staying informed on re-credentialing requirements and keeping up with updates and changes. This allows them to continue providing crucial services to insured individuals and ensures they can receive proper reimbursement for their work.

Dealing With Rejections Or Delays

Getting credentialed with insurance companies can be a complex process, and unfortunately, rejections or delays are not uncommon. Understanding the common reasons for rejections and navigating the appeal process can help mental health professionals overcome these obstacles and get the necessary insurance credentials. This section will discuss the common reasons for rejections and guide how to navigate the appeal process effectively.

Common Reasons For Rejections

Rejections from insurance companies can be disheartening, but understanding the reasons behind them can help mental health professionals address the issues and improve their chances of approval. Here are some common reasons for rejections:

| Reason | Description |

|---|---|

| Missing or Incomplete Documentation | Insufficient or inaccurate documentation is one of the most common reasons for rejections. Please ensure all required forms, licenses, and supporting documents are properly completed and included. |

| Errors or Discrepancies in Application | Even minor errors or discrepancies in the application can lead to rejections. Could you double-check all information, including personal details, educational history, and professional experience? |

| Insufficient Experience or Credentials | Insurance companies may require mental health professionals to have a certain level of experience or specific credentials. Your application may only be accepted if your qualifications meet their requirements. |

| Non-Compliance with Network Needs | Insurance companies often have specific network needs that must be met. Your application may only be accepted if your speciality or location meets their requirements. |

Appeal Process

If your application gets rejected, keep hope. Insurance companies typically provide an appeal process allowing you to provide additional information or correct errors. Here are some steps to follow when navigating the appeal process:

- Contact the Insurance Company: Reach out to the insurance company’s credentialing department to understand the reason for the rejection and request specific guidance on the appeal process.

- Gather Additional Documentation: Based on the feedback received, could you gather any required documentation or information? Please make sure that all documents are accurate and complete and address the reasons for rejection.

- Submit a Formal Appeal Letter: Write a clear and concise appeal letter addressing the reasons for rejection, providing supporting evidence, and highlighting your qualifications. Use this opportunity to showcase your expertise and commitment to providing quality mental health services.

- Follow-up regularly: Please contact the insurance company’s credentialing department to track the progress of your appeal. Be proactive in providing any additional information they may request.

- Consider Professional Assistance: If navigating the appeal process becomes overwhelming, consider seeking professional assistance from a credentialing specialist or a consultant specialising in insurance credentialing.

Just to remind you, persistence is critical when dealing with insurance companies. Each rejection or delay is an opportunity to learn and improve your application. By understanding the common reasons for rejections and being proactive in the appeal process, mental health professionals can increase their chances of successful credentialing with insurance companies.

Tips For Success

Are you looking to become an in-network mental health provider with insurance companies? Start by researching each company’s specific credentialing requirements. Prepare all necessary documentation, such as licensure, malpractice insurance, and completed application forms. Submit your application and follow up regularly to ensure a smooth and timely process.

Tips for Success Building a Strong Network Professional networking essential for credentialing success. Attend industry events and conferences to connect with key players. Establish rapport with existing providers for referrals and recommendations: Utilise social media platforms to engage and network with industry professionals. I’m looking for professional help if you need a mentor or coach for guidance and support. Consider hiring a credentialing specialist for expert assistance. Seek out training or workshops to enhance your credentialing knowledge. Take the time to invest in your professional development and growth.

Frequently Asked Questions For How To Get Credentialed With Insurance Companies Mental Health

How Do I Become Credentialed With Insurance Companies For Mental Health Services?

To become credentialed, you’ll need to complete the application process for each insurance company, provide documentation of your qualifications, and adhere to their specific requirements for practice standards and billing procedures.

What Qualifications Do I Need To Get Credentialed With Insurance Companies For Mental Health?

Typically, you’ll need a state-issued professional license and malpractice insurance to meet the specific educational and training requirements outlined by the insurance companies you plan to work with.

What Are The Benefits Of Getting Credentialed With Insurance Companies For Mental Health Practitioners?

Getting credentialed can expand your client base, provide a predictable payment structure, increase your professional credibility, and make mental health services more accessible and affordable to a broader range of individuals.

How Long Does The Credentialing Process Take With Insurance Companies For Mental Health Professionals?

The timeline can vary depending on the insurance company. Still, completing the credentialing process typically takes several weeks to a few months, including submitting applications, providing documentation, and awaiting approval.

Conclusion

To conclude, obtaining credentials with insurance companies for mental health services is crucial for practitioners looking to care for a broader range of patients. You can successfully navigate the credentialing journey by familiarising yourself with the necessary steps, staying organised, and persevering through the application process.

Remember to maintain open communication with insurance companies and seek support from professional organisations to ensure your success. Start today and expand your reach in the mental health field.