Level Funded Health Insurance : The Ultimate Guide

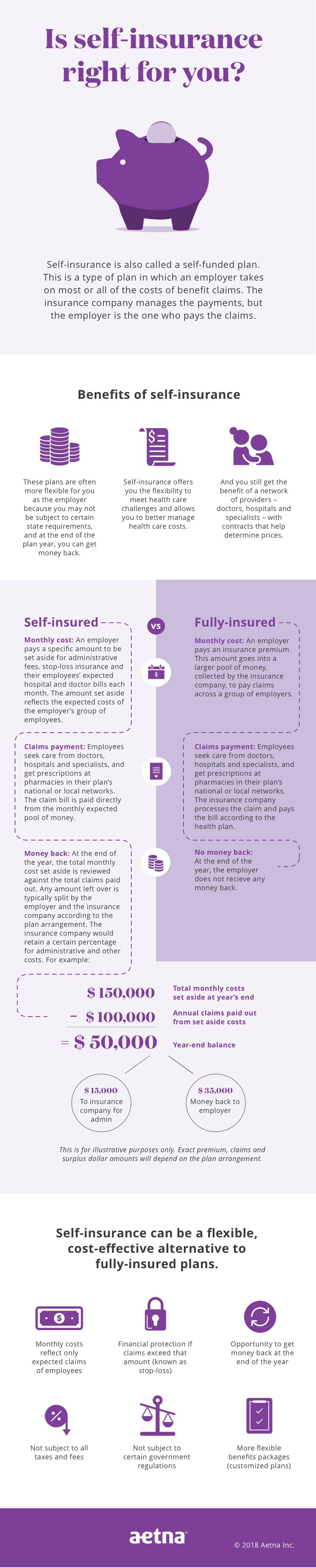

Level-funded health insurance is a unique type of partially self-funded insurance plan in which an employer pays a fixed monthly cost. These plans offer employers additional flexibility and cost control when providing health benefits to employees.

Unlike traditional self-funding, level-funded plans provide cost stability through predictable monthly payments, reducing risk and streamlining administration. It is an option for employers who want to move away from fully insured health care but are not yet ready for complete self-funding.

Level-funded health plans are based on plan participants’ medical claims, with savings shared and potential surplus refunds at the plan year’s end. They differ from graded-funded plans in that level-funded plans have a fixed budgeted payment to the insurer each month.

Credit: www.aetna.com

What Is Level Funded Health Insurance?

Level-funded health insurance is a unique partially self-funded insurance plan where an employer pays a monthly fixed cost. It offers employers additional flexibility and cost control when providing health benefits to employees.

Definition

Level-funded health insurance is a type of self-funded insurance plan in which the employer pays a fixed monthly payment to cover costs for administration and claims. It combines the flexibility of self-funding with the predictability of fixed monthly payments.

How It Works

The employer sets aside a predetermined monthly amount in level-funded health insurance to cover anticipated claims and administrative expenses. If the actual claims are lower than expected, the employer may receive a surplus refund at the plan year’s end.

Advantages Of Level-Funded Health Insurance

Level-funded health insurance offers potential cost savings due to the structure of sharing savings if medical claims are lower than expected.

Employers can customize their level-funded health insurance plans to fit the specific needs of their employees, providing more tailored coverage options.

With level-funded health insurance, employers can enjoy predictable budgeting as they pay a fixed monthly cost, helping them manage expenses more effectively.

Disadvantages Of Level-Funded Health Insurance

Level-funded health insurance can have advantages and disadvantages. Among the disadvantages are the potential for higher costs if claims exceed the expected amount, the lack of control over potential premium increases, and the need to manage and monitor claims more closely.

Risk Of Claims

One critical disadvantage of level funding is the risk of claims. In traditional fully funded plans, the insurance carrier assumes the risk for all medical claims. However, in a level-funded plan, the level-fundedyer assumes a portion of the risk, which can be a concern. If the claims of plan participants exceed the projected amount, the employer may be responsible for paying the additional costs out of pocket. This can create financial uncertainty for the employer and potentially lead to unexpected expenses.

Limited Control

Another disadvantage of level-funded health insurance is employers’ limited control over the plan. While employers have some control over plan design and benefit offerings, they have less control over the plan’s overall cost. The monthly payment in a level-funded plan is typically fixed and determined based on the projected claims for the year. If the actual claims exceed the projected amount, the employer may have limited options to control costs. They may be locked into a higher monthly payment without the ability to negotiate or adjust the plan mid-year.

Credit: www.linkedin.com

Is Level-Funded Health Insurance Right For Your Business?

Level-funded health insurance is an increasingly popular option for businesses looking for cost-effective and customizable healthcare coverage for their employees. This type of insurance provides the benefits of self-funding, such as more control over plan design and cost savings, with the financial predictability of a fully insured plan.

Factors To Consider

When deciding if level-funded health insurance is the right choice for your business, there are several important factors to consider:

- Employee Participation: Assess the number of employees and their overall health to determine if the risk is spread out enough for level funding.

- Financial Stability: Evaluate your business’s financial stability to ensure it can handle the potential risk of higher claims.

- Plan Customization: Consider the ability to tailor the plan to fit the specific needs of your employee population.

- Claims History: Review past claims history to gauge self-funding’s potential risk and cost implications.

Cost-benefit Analysis

Conducting a thorough cost-benefit analysis is essential when considering level-funded health insurance. You can make an informed decision by comparing the projected costs of a traditional fully insured plan with the potential savings and risks associated with level funding. Take into account factors such as:

- Premium Savings: Determine if the potential for lower premiums through self-funding outweighs the risk exposure.

- Claims Experience: Analyze the historical claims data to estimate the potential costs and savings with level funding.

- Administrative Expenses: Compare the administrative fees associated with self-funding versus a fully insured plan.

- Stop-Loss Coverage: Evaluate the need for stop-loss insurance and its impact on overall costs and risk management.

How To Implement Level-Funded Health Insurance

Implementing level-funded health insurance is a unique way for employers to offer health benefits to their employees. With level-funded plans, employers pay a fixed monthly cost, providing cost stability and flexibility in managing health insurance expenses. This partially self-funded insurance plan allows for potential surplus refunds if medical claims are lower than expected.

Assessing Employee Needs

Before implementing level-funded health insurance, assessing your employees’ needs is essential. Consider their demographics, such as age, gender, and family status, as well as their health conditions and preferences. This information will help you determine the appropriate coverage levels and benefits catering to their needs.

Choosing A Provider

Thorough research is crucial when selecting your level-funded health insurance plan provider. Look for reputable insurance companies that offer comprehensive coverage at competitive rates. Consider factors such as the provider’s network, reputation, customer service, and financial stability. Request quotes from multiple providers and compare the benefits, costs, and terms before deciding.

Educating Employees

Properly educating employees about the level-funded health insurance plan is essential for successful implementation. Explain the plan’s essential features, benefits, and cost-saving aspects. Provide educational materials, such as brochures and presentations, that describe the coverage details, the network of healthcare providers, and the claims process. Encourage employees to ask questions and address their concerns to ensure they fully understand their benefits and how to utilize them effectively.

Critical Features Of Level-Funded Health Insurance

Level Funded Health Insurance offers comprehensive coverage tailored to businesses’ needs. Let’s explore some key features that make this type of insurance stand out.

Self-funding Component

The self-funding component of Level Funded Health Insurance allows businesses to pay fixed monthly contributions. This gives them more control over their healthcare costs and potentially saves money in the long run.

Stop-loss Insurance

Stop-loss insurance is a crucial feature of Level Funded Health Insurance that protects against high claims. It ensures businesses are safeguarded from unexpected financial burdens due to significant medical expenses.

Claims Management Services

Claims management services are included in Level Funded Health Insurance to streamline the process of handling and processing claims. This service helps businesses efficiently manage their healthcare expenses and minimize administrative burdens.

Successful Examples Of Level-Funded Health Insurance

Level-funded health insurance offers a unique approach to managing healthcare costs while providing flexibility and cost control for employers. Let’s explore some successful examples of businesses benefiting from level-funded health insurance.

Case Study 1

Company X implemented a level-funded health insurance plan for its employees in this case study. By closely monitoring medical claims and expenses, Company X achieved cost savings and maintained a high level of coverage for its employees.

- Proactive cost management

- Transparent billing and reporting

- Employee satisfaction with benefits

Case Study 2

Company Y switched to a level-funded health insurance plan to gain more control over their healthcare spending. The results were remarkable, with Company Y experiencing a reduction in overall healthcare costs while providing comprehensive coverage to its employees.

- Customizable plan options

- Healthcare cost containment

- Improved employee retention

Credit: www.abtaba.com

Frequently Asked Questions On Level-Funded Health Insurance

What Is Level Funded United Healthcare?

Level-funded United Healthcare is a health plan in which the employer pays a fixed monthly cost. The employer may receive surplus refunds if medical claims are lower than expected.

What Is The Difference Between Graded Funded And Level Funded?

Level-funded health plans are based on participants’ medical claims. With level funding, a set monthly budget is paid to the insurer. Graded funding requires budgeting for potential liabilities to the insurer each month.

What Does Fully Funded Health Insurance Mean?

Fully funded health insurance refers to an employer-sponsored health plan where the company pays a fixed premium to the insurance carrier. The premium rates are fixed for a year and depend on the monthly number of employees enrolled in the plan.

It offers stability and predictability for employers.

What Is Level Funded Cigna?

Level-funded Cigna is a self-funded health plan where the employer pays a fixed monthly amount, offering cost stability and potential savings through predictable payments. This allows for flexibility and control in providing health benefits to employees.

Conclusion

Level-funded health insurance plans offer employers the flexibility and cost control they need when providing healthcare benefits to their employees. Unlike traditional self-funding, these plans offer cost stability through predictable monthly payments. With level-funded plans, employers only pay for the medical claims of plan participants, and any savings are shared through potential surplus refunds at the end of the plan year.

This unique insurance plan allows businesses to manage their healthcare costs effectively while offering comprehensive coverage to their employees.