Small Business Health Insurance New York : Affordable Coverage Options

Small Business Health Insurance New York offers coverage for small businesses looking for affordable and comprehensive healthcare options for their employees. In New York, small businesses can choose from a range of health insurance plans to meet the needs of their employees and comply with state regulations.

These plans may include essential health benefits such as preventive care, hospitalization, maternity care, and prescription drugs. Providing health insurance to employees can attract and retain top talent, help small businesses save on taxes, and improve employee satisfaction and productivity.

The Importance Of Health Insurance For Small Businesses

Small business health insurance in New York is crucial for employers’ and employees’ success and well-being. The following vital areas highlight the importance of providing health insurance to small businesses:

Providing Protection For Employees

Offering health insurance coverage protects employees from unexpected medical expenses.

Attracting And Retaining Talent

Access to health insurance is a valuable benefit that can attract top talent and retain skilled employees.

Ensuring Business Continuity

Health insurance coverage promotes employee well-being, reducing absenteeism and ensuring smooth business operations.

Understanding Small Business Health Insurance In New York

Understanding Small Business Health Insurance in New York

Minimum Requirements For Coverage

- Small business health insurance in NY must cover at least 50% of employee premiums

- Employers with 100 or fewer employees are eligible for small business insurance in NY

Available Plans And Options

Small businesses in NY can choose between multiple healthcare plans

Options include HMOs, PPOs, EPOs, and POS plans for flexibility

Cost Considerations

| Factors Affecting Costs | Key Cost Considerations |

|---|---|

| Number of Employees | Premiums may vary based on the total number of employees covered in |

| e Level | Higher coverage levels might result in increased premiums |

Navigating The Small Business Health Insurance Marketplace

When providing health insurance for your small business in New York, navigating the marketplace can feel overwhelming. However, with the proper knowledge and guidance, you can find the perfect insurance provider with the right coverage and rates for your needs. This article will walk you through the essential factors to consider in making informed decisions about small business health insurance in New York.

Finding The Right Insurance Provider

Finding the right insurance provider is one of the first steps in navigating the small business health insurance marketplace. With numerous providers available, it is crucial to research and compare options to ensure you make the best choice for your business.

Here are some key points to consider:

- Check the provider’s reputation and stability in the insurance industry.

- Look for providers that have experience working with small businesses.

- Read reviews and testimonials from other small business owners to gauge their satisfaction.

- Consider the provider’s network of healthcare professionals and hospitals to ensure convenient access to quality care for your employees.

By finding the right insurance provider, you can rest assured that your small business is in good hands.

Comparing Coverage And Rates

Comparing coverage and rates is crucial in navigating the small business health insurance marketplace. It’s essential to compare the different plans offered by various insurance providers to see which aligns best with your budget and coverage needs.

| Factors to Consider | Explanation |

|---|---|

| Monthly Premiums | The cost you pay to the insurance provider every month for coverage. |

| Deductibles | The amount you must pay out-of-pocket before insurance coverage begins. |

| Copayments/Coinsurance | The amount you pay for specific services or prescriptions is usually after the deductible is met. |

| Out-of-Pocket Maximum | The maximum amount you have to pay for covered services, after which the insurance company covers 100% of the cost. |

| Prescription Drug Coverage | Please ensure the plan covers the medications your employees need at an affordable cost. |

| Preventive Services | Does the plan cover preventive services like vaccinations, screenings, and wellness programs? |

While low-cost plans may seem attractive, they might have higher deductibles or limited coverage. Weigh the costs against the coverage offered to find the right balance for your small business.

Applying For Coverage

It’s time to apply for coverage after identifying the insurance provider and comparing coverage and rates. The application process can vary depending on the provider, but generally, it involves the following steps:

- Gather the necessary information, such as employer identification number (EIN) and employee details.

- Fill out the application accurately and thoroughly, ensuring all required documentation is attached.

- Apply to the insurance provider within the specified timeframe.

Once your application is submitted, the provider will review it and notify you of the next steps. Please follow up with any additional information or requests from the provider as soon as possible.

Understanding the application process allows you to navigate it smoothly and ensure a seamless transition to your small business health insurance plan.

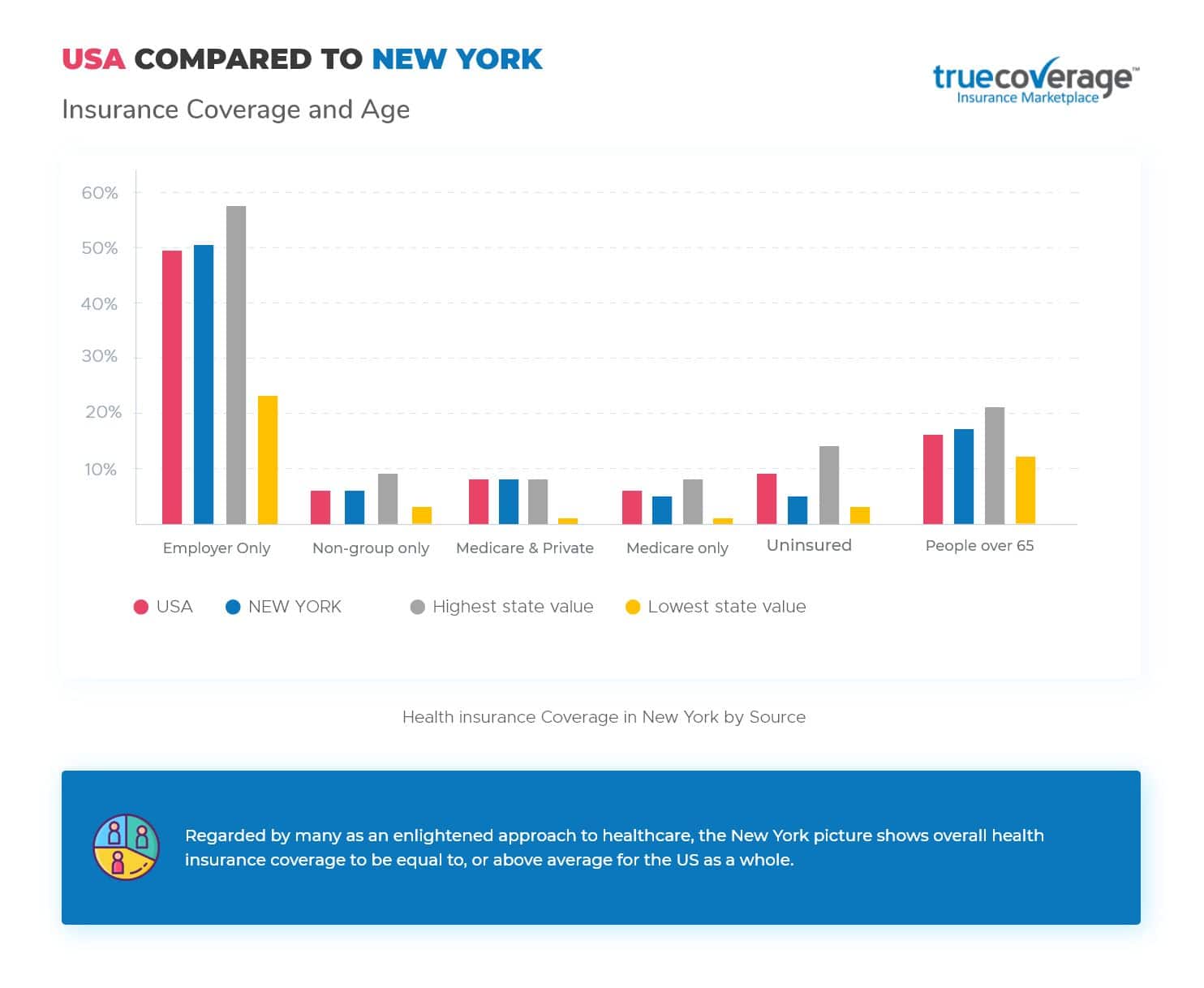

Credit: truecoverage.com

Small Business Health Insurance Regulations In New York

As a small business owner in New York, understanding health insurance regulations is crucial. Small business health insurance regulations in New York are governed by federal and state laws, ensuring employers and employees have access to essential health benefits while maintaining compliance.

Compliance With Federal And State Laws

Tiny New York businesses must comply with federal and state laws when offering health insurance to their employees. The Affordable Care Act (ACA) sets forth federal guidelines for small business health insurance, while New York state laws may include additional requirements.

Essential Health Benefits

New York requires small business health insurance plans to cover essential health benefits, including preventative care, emergency services, prescription drugs, and mental health and substance abuse treatment. These benefits ensure that employees have access to comprehensive healthcare coverage.

Rules For Employers And Employees

Employers in New York must adhere to specific rules when offering health insurance to their employees. For example, small businesses with a certain number of employees may be required to provide health insurance or face penalties. Additionally, employees have rights when enrolling in a small business health insurance plan and accessing the necessary coverage.

Managing Costs And Controlling Premiums

Welcome to our blog post on small business health insurance in New York! This section will explore critical strategies for managing costs and controlling premiums and crucial considerations for small business owners seeking affordable and adequate health insurance solutions.

Implementing Wellness Programs

Wellness programs have emerged as game-changers in small business health insurance. Encouraging employees to adopt healthier lifestyles leads to lower healthcare expenses and improves productivity and morale in the workplace. Such programs can include fitness challenges, nutritional guidance, and stress management workshops. By fostering a culture of well-being, employers can gradually reduce healthcare costs and, in turn, minimize premiums.

Negotiating With Insurance Providers

When minimizing premiums, diligent negotiation with insurance providers is paramount for small business owners. Leveraging the power of a collective bargaining approach by collaborating with other small businesses can yield significant advantages. Conducting thorough market research and comparing offerings from multiple insurers can enable enterprises to secure cost-effective plans meeting their specific needs. Companies can exercise control over premium costs by skillfully negotiating terms and rates.

Maximizing Tax Benefits

Entrepreneurs navigating the complexities of small business health insurance in New York must pay attention to the potential tax benefits of health coverage. Familiarizing oneself with tax incentives and credits for offering employee health insurance is crucial. Seeking guidance from financial advisors and tax professionals can ensure businesses capitalize on available deductions and credits, mitigating the economic burden associated with premiums.

Credit: www.nytimes.com

Potential Challenges For Small Businesses

Small businesses in New York face several potential challenges when offering health insurance to their employees. These challenges can often make it difficult for small business owners to navigate the complex landscape of health insurance options and find affordable plans that meet the needs of their workforce. Understanding these challenges is crucial to making informed decisions and providing adequate healthcare coverage to employees.

Affordability Concerns

One of the significant hurdles small businesses face is health insurance affordability. Providing healthcare coverage to employees can be a considerable burden, especially for companies with limited resources. Small businesses often need help finding insurance plans that are both comprehensive and affordable, as premiums can be high and exceed their budget.

In addition, small businesses typically have a smaller pool of employees to spread the cost of insurance premiums, which can further increase the price per person. This makes it challenging for small businesses to offer competitive benefits packages to attract and retain talented employees.

| Affordability Concerns | Solutions |

|---|---|

| High insurance premiums | Explore different insurance providers and compare prices to find the most competitive rates. Consider joining a group purchasing alliance to access discounted rates. |

| Limited budget | Look for cost-sharing alternatives, such as high-deductible health plans (HDHP), health savings accounts (HSA), or health reimbursement arrangements (HRA). |

| Inability to attract talent | Consider alternative benefits, such as flexible work schedules, professional development opportunities, or wellness programs, to compensate for high insurance costs. |

Limited Plan Options

Another challenge for small businesses in New York is the limited selection of health insurance plans. Unlike larger companies, small businesses may not have the bargaining power or negotiating leverage to access a wide range of plan options. This can limit their ability to find plans that align with their employees’ healthcare needs.

The lack of choice can also result in plans not customized to a small business’s requirements. Each company has unique employee demographics and healthcare needs, and having limited plan options can make finding coverage that suits these requirements challenging.

- Insurance carriers may limit small businesses to a small selection of plans

- The available plans may not provide adequate coverage for the specific needs of a small business

- Customizing plans according to employee demographics and preferences can be limited

Understanding Complex Terminology

Health insurance policies and terminologies can be complex, especially for small business owners needing a background in the field. Understanding the intricacies of insurance benefits, deductibles, copayments, networks, and other technical jargon can be challenging and time-consuming.

This lack of knowledge can lead to confusion and potential mistakes in selecting the most suitable plans for small businesses and their employees. Small business owners must invest time and effort into educating themselves about health insurance to make informed decisions.

- Complex terminologies can make it challenging for small business owners to understand insurance policies

- Lack of knowledge can result in selecting inadequate or inappropriate coverage

- Investing time in learning about health insurance is crucial for making informed decisions

Resources And Support For Small Businesses

Small businesses in New York can tap into various resources and support to navigate the complexities of health insurance.

Government Assistance Programs

Government assistance programs provide financial aid to eligible small businesses in New York to cover their health insurance costs.

Insurance Brokers And Consultants

Professional insurance brokers and consultants can help small businesses in New York find the right health insurance plans that suit their needs.

Educational Workshops And Seminars

Attending educational workshops and seminars can empower small business owners in New York with the knowledge to make informed decisions about health insurance.

Planning: Future Trends And Considerations

Impact of Healthcare Reforms:

Healthcare reforms influence small businesses in New York, shaping their health insurance choices.

Emerging Insurance Technologies:

New technologies are revolutionizing the insurance industry, offering innovative solutions for small businesses.

Preparing for Changing Workforce Needs:

Adapting to evolving workforce demands is crucial for small businesses to remain competitive and attract top talent.

Credit: peakinsuranceadvisors.com

Frequently Asked Questions Of Small Business Health Insurance New York

What Are The Key Benefits Of Small Business Health Insurance In New York?

Small business health insurance in New York offers comprehensive coverage, including medical, dental, and vision benefits, at competitive rates. It also financially protects employees and their families, promoting a healthier and more satisfied workforce.

How Can Small Businesses In New York Qualify For Group Health Insurance Plans?

Small businesses in New York can qualify for group health insurance plans by having a minimum number of eligible employees, typically between 2 and 50. Additionally, the company must meet specific participation and contribution requirements specified by the insurance provider.

What Factors Should Small Business Owners Consider When Selecting Health Insurance In New York?

Small business owners in New York should consider coverage options, network accessibility, premium costs, and the flexibility to tailor plans to their employees’ needs. It’s essential to assess the range of benefits and the level of customer service the insurance provider provides.

How Does Small Business Health Insurance In New York Impact Employee Retention?

Small business health insurance in New York can enhance employee retention by offering attractive benefits that contribute to a positive work environment. It demonstrates a commitment to the well-being of employees and their families, creating a sense of loyalty and job satisfaction within the organization.

Conclusion

Providing health insurance to your employees is essential to ensure your small business thrives in New York. By offering comprehensive coverage, you attract top talent and foster an environment of employee loyalty and well-being. With a range of options available, it is crucial to consider the needs of your business and your employees carefully.

By taking proactive steps to secure small business health insurance, you are investing in the long-term success of your company and the overall health and happiness of your workforce.