Health Insurance New Mexico: Affordable Coverage Options

Health insurance New Mexico provides essential coverage for medical expenses and is crucial for residents in the state. With a focus on affordability and comprehensive benefits, health insurance in New Mexico offers individuals and families access to quality healthcare services when they need it most.

Whether you’re a freelancer, self-employed, or employed by a small business, having health insurance in New Mexico ensures you can receive necessary medical care without high out-of-pocket costs. From preventive care to emergency services, health insurance in New Mexico offers peace of mind and financial protection for individuals and families throughout the state.

Take your time with it – you can explore your options for health insurance in New Mexico today.

The Importance Of Health Insurance

Health insurance is vital to well-being, offering financial protection and access to quality healthcare. Let’s delve into the significance of having health insurance in New Mexico.

Peace Of Mind

Having health insurance provides peace of mind, knowing you’re covered in case of illness or injury.

Access To Quality Healthcare

Health insurance affords you access to quality healthcare services without financial burden.

Credit: obamacarefacts.com

Understanding Health Insurance In New Mexico

Navigate the complexities of health insurance in New Mexico with ease. Discover the coverage options and critical insights to make informed decisions for healthcare needs. Understanding the nuances of health insurance in New Mexico ensures access to quality care without unnecessary stress.

Required Coverage

Health insurance requirements in New Mexico include essential benefits like preventive care, prescription drugs, and maternity services.

Options For Coverage

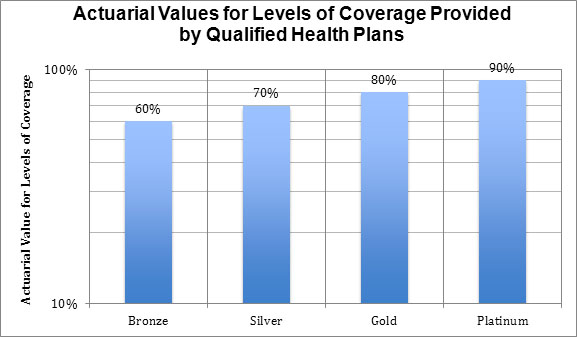

Residents in New Mexico have various options for health insurance coverage, such as employer-sponsored plans, Medicaid, Medicare, and individual marketplace plans.

Health Insurance Marketplace

The Health Insurance Marketplace in New Mexico offers a platform for individuals and families to compare and purchase health insurance plans that best suit their needs.

Key Factors To Consider When Choosing Health Insurance

Key Factors to Consider When Choosing Health Insurance

When it comes to choosing health insurance in New Mexico, there are several key factors that you need to consider. Understanding these factors will help you make an informed decision and ensure you get coverage that suits your needs. Below, I’d like to discuss three key factors when deciding on health insurance.

1. Coverage And Benefits

One of the most important factors to consider when choosing health insurance is the coverage and benefits it provides. You need to carefully assess what services and treatments are covered under the plan. Look for policies that offer comprehensive coverage for essential healthcare services, such as doctor visits, hospitalization, prescription drugs, and preventive care.

| Services and Treatments | Covered |

|---|---|

| Doctor Visits | Yes |

| Hospitalization | Yes |

| Prescription Drugs | Yes |

| Preventive Care | Yes |

2. Network Of Providers

The network of providers is another crucial factor to consider. Please check whether the insurance company’s network includes your preferred healthcare providers, such as doctors and specialists. Access to a vast network of providers ensures you can receive quality care without traveling long distances or paying out-of-network costs.

Unordered List: Find out about the network of providers

- Check if your current doctors and specialists are in-network

- Explore the network size and location of hospitals and clinics

- Consider the accessibility of providers near your workplace or residence

- Confirm the ability to see specialists without referrals

3. Affordability

Affordability is a significant consideration when choosing health insurance. You need to evaluate the premiums and out-of-pocket costs associated with the plan. Look for a balance between premiums and the coverage provided. Compare the cost-sharing features, such as deductibles, copayments, and coinsurance, to determine the overall affordability of the plan.

- Compare the monthly premiums of different plans

- Evaluate the deductible amount and whether it meets your budget

- Consider copayments and coinsurance for various healthcare services

- Analyze the annual maximum out-of-pocket limit for cost protection

Considering these critical factors in New Mexico, you can make a well-informed decision when choosing health insurance. Review each plan’s coverage and benefits, network of providers, and affordability to find the one that best meets your healthcare needs.

Credit: bewellnm.com

Navigating The Health Insurance Process In New Mexico

When navigating the health insurance process in New Mexico, understanding eligibility and enrollment, choosing the right plan, and applying for subsidies are crucial steps. Health insurance in New Mexico can be overwhelming, but with the proper guidance, you can make informed decisions that meet your healthcare needs.

Eligibility And Enrollment

Before choosing a health insurance plan, it’s essential to understand the eligibility criteria and enrollment process in New Mexico. Individuals and families may qualify based on income, employment status, or specific life events. It’s essential to check the eligibility requirements to ensure a smooth enrollment process.

Choosing The Right Plan

When selecting a health insurance plan in New Mexico, consider your healthcare needs and budget. Evaluate the coverage options, including primary care, specialists, prescription drugs, and emergency services. Compare the deductibles, premiums, and out-of-pocket costs to find a plan that aligns with your requirements.

Applying For Subsidies

Applying for subsidies can help lower the cost of health insurance in New Mexico for those who qualify. It’s essential to understand the income thresholds and eligibility criteria for subsidies. Completing the application accurately and providing the necessary documentation is crucial to securing financial assistance for your health coverage.

Common Health Insurance Terminology

Understanding common health insurance terminology is crucial for making informed decisions when choosing a health insurance plan. Familiarizing yourself with terms such as deductibles, premiums, co-payments, and coinsurance will help you navigate the complexities of health insurance and ensure you receive the coverage you need. Let’s delve into these fundamental concepts to discuss how they better impact your health insurance experience.

Deductibles

A deductible is the amount you must pay out of pocket for covered services before your insurance company starts to pay. For instance, if your deductible is $1,000, you pay the first $1,000 of covered expenses yourself. After you meet your deductible, you and your insurance company will share the costs according to your policy terms.

Premiums

Premiums are your regular payments to your insurance company to maintain your health coverage. They are typically paid monthly and are separate from the costs associated with services and treatments. The amount of your premium can vary based on factors such as age, location, and the level of coverage you select.

Co-payments And Coinsurance

- Co-payments: A co-payment is a fixed amount you pay for a covered healthcare service, typically due at the time of service. This fee is predetermined and can vary depending on the type of service you receive.

- Coinsurance: Coinsurance is your share of the costs of a covered healthcare service, usually calculated as a percentage. After you’ve met your deductible, you’ll pay coinsurance with your insurance company until you reach your out-of-pocket maximum.

Credit: google.com

Health Insurance Discounts And Programs In New Mexico

Residents of New Mexico have several options to explore when securing affordable and comprehensive health insurance. The state offers various programs and discounts to make healthcare coverage accessible to individuals and families. Whether you’re looking for Medicaid expansion, the CHIP program, or special enrollment periods, New Mexico has initiatives to ensure everyone can find a suitable health insurance plan.

Medicaid Expansion

Medicaid expansion is vital to New Mexico’s efforts to provide affordable healthcare to low-income individuals and families. The state expanded its Medicaid program under the Affordable Care Act, making coverage available to many previously uninsured residents. Through Medicaid, individuals and families with limited income can access comprehensive medical services, including doctor visits, hospital stays, prescription medications, and more. This program is crucial in promoting overall well-being and improving access to healthcare services for those most in need.

Chip Program

The Children’s Health Insurance Program (CHIP) is another essential resource for families in New Mexico. Designed to offer healthcare coverage specifically for children from low-income households who do not qualify for Medicaid, the CHIP program provides vital medical services. These services include preventive care, immunizations, doctor visits, hospitalizations, and prescription medications. The CHIP program ensures that children can access the healthcare they need to thrive and grow, regardless of their parent’s income level.

Special Enrollment Periods

New Mexico recognizes the importance of flexibility regarding health insurance coverage. That’s why the state offers special enrollment periods throughout the year. These time frames allow individuals and families to enroll in a health insurance plan or make changes outside the regular open enrollment period. Special enrollment periods typically occur when there are significant life events such as getting married, having a baby, losing other health coverage, or moving to a new area. This ensures that individuals who experience significant life changes have the opportunity to secure the health insurance they need promptly.

Potential Changes To Health Insurance In New Mexico

New Mexico’s health insurance landscape is subject to potential changes that can influence residents’ access to affordable healthcare.

Legislative Updates

Recent legislative updates in New Mexico have aimed to improve the state’s healthcare system, from promoting transparency in pricing to expanding coverage options.

Impact Of Federal Policies

The impact of federal policies on health insurance in New Mexico plays a significant role in shaping the affordability and availability of healthcare for its residents.

Resources For Health Insurance Information In New Mexico

Are you looking for health insurance resources in New Mexico? You can find reliable information on Health Insurance in New Mexico through various sources to help you make informed decisions about your healthcare coverage.

State Health Insurance Assistance Program

The State Health Insurance Assistance Program in New Mexico is a valuable resource for individuals seeking guidance and information on health insurance options. Run by trained counselors, this program provides free counseling services to help you navigate the complexities of health insurance in the state.

Health Insurance Brokers

Health insurance brokers in New Mexico are professionals who can assist you in finding the most suitable health insurance plan based on your individual needs and budget. These brokers know the state insurance market and can help you compare different plans to make an informed decision.

Online Tools And Resources

Various online tools and resources are available for residents of New Mexico to explore and learn more about health insurance options. These tools can help you compare different plans, understand insurance terms, and find coverage that fits your requirements.

Frequently Asked Questions For Health Insurance New Mexico

Is Health Insurance Mandatory In New Mexico?

Health insurance is mandatory in New Mexico, following the Affordable Care Act’s mandate.

What Are The Benefits Of Health Insurance In New Mexico?

Health insurance in New Mexico offers coverage for medical expenses, preventive care, prescription drugs, and mental health services.

How Can I Find Affordable Health Insurance In New Mexico?

You can explore the New Mexico Health Insurance Exchange to compare and purchase affordable health insurance plans or seek assistance from a licensed insurance agent.

Conclusion

Securing a health insurance plan in New Mexico is vital to protect yourself financially and ensure access to quality healthcare. Whether you opt for an employer-sponsored plan or explore individual options, understanding the coverage benefits, costs, and network providers is crucial.

By navigating the complexities of health insurance, you can safeguard your well-being and gain peace of mind. You can start your search today for the best health insurance plan that meets your needs for a healthier tomorrow.