Vermont Health Insurance: Your Gateway to Wellness

Vermont health insurance offers a variety of plans to residents through the state marketplace. Coverage options are designed to meet diverse healthcare needs and budgets.

Navigating Vermont health insurance is crucial for securing affordable and comprehensive coverage for individuals and families. This beautiful New England state provides access to various health insurance plans, ensuring residents can find the right fit for their medical requirements.

The marketplace, often called Vermont Health Connect, is the central hub for selecting insurance plans. It streamlines the decision-making process by offering clear comparisons of available options. By exploring this platform, Vermonters can take advantage of subsidies, apply for Medicaid if eligible, and enroll in a plan that aligns with their healthcare goals. Ensuring proper health coverage is a legal necessity and a step towards peace of mind in managing health and well-being.

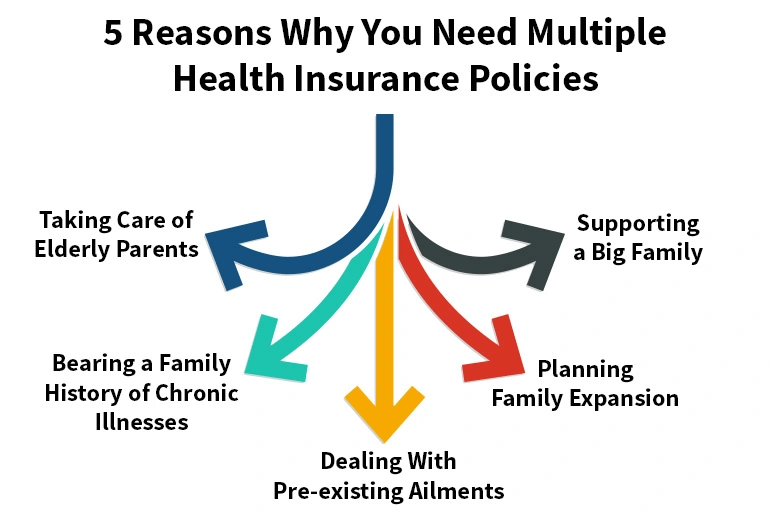

The Importance Of Health Insurance In Vermont

Health insurance is a critical factor in maintaining the well-being of Vermonters. Without it, managing health-related costs can become overwhelming. In Vermont, as in other states, health insurance offers a safety net for both routine and unexpected care. Let’s explore the costs involved in healthcare and the impact of going uninsured.

Cost Of Healthcare In Vermont

The cost of healthcare services can be high. Many Vermont residents rely on health insurance to help cover these expenses. Here are some average costs to consider:

| Service | Average Cost without Insurance |

|---|---|

| Doctor’s Visit | $150 |

| Specialist Visit | $250 |

| Emergency Room Visit | Over $1,200 |

These costs can quickly lead to financial hardship without the buffer of health insurance.

Impact Of Lack Of Health Insurance

Not having health insurance in Vermont has serious repercussions. Here’s a list of potential impacts:

- Delayed medical care due to cost concerns

- Increased risk of serious health issues going undetected

- High out-of-pocket costs for emergency or essential services

- Financial stress from medical bills

Lack of insurance can lead to worse health outcomes and more significant financial strain. Ensuring access to health insurance is crucial for the safety and stability of Vermont families.

Credit: integrativedentalvt.com

Types Of Health Insurance Plans Available In Vermont

Understanding health insurance options in Vermont can feel overwhelming. This guide simplifies the choices available. Vermont residents can access private plans, state-run marketplaces, and federal programs. Each type caters to different needs and budgets.

Private Health Insurance

Vermont offers a variety of private health insurance plans. These plans come from companies outside of government programs. They vary in cost and coverage. Residents select plans based on their specific health needs and financial means. In Vermont, you can find:

- Health Maintenance Organizations (HMOs) require policyholders to choose a primary care physician.

- Preferred Provider Organizations (PPOs) offer more flexibility in selecting healthcare providers.

- Exclusive Provider Organizations (EPOs): Allow using doctors and hospitals within the plan’s network.

- High Deductible Health Plans (HDHPs) are often combined with Health Savings Accounts (HSAs).

Vermont Health Connect

Vermont Health Connect is the state’s health insurance marketplace. It serves as a one-stop shop for health plans. Through this platform, Vermonters can:

- Compare insurance plans side by side.

- Qualify for income-based subsidies.

- Enroll in a plan that fits their budget and health needs.

Vermont Health Connect offers plans from different insurers. It includes coverage levels known as “metal” tiers. Each tier has its balance of monthly premiums and out-of-pocket costs.

Medicaid And Medicare Options

Medicaid is a state and federally-funded program. It provides health coverage to eligible low-income adults, children, pregnant women, elderly adults, and people with disabilities. Medicare is for people aged 65 or older and for younger individuals with specific disabilities. In Vermont, these options include:

| Program | Eligibility | Coverage |

|---|---|---|

| Medicaid (Green Mountain Care) | Low-income families, individuals | Hospital visits, doctor appointments, preventive care, and more |

| Medicare | Residents 65+, young people with disabilities, ALS, or ESRD | Parts A and B for hospital and medical, and Part D for prescription drugs |

Both programs help secure affordable healthcare. They ensure eligible Vermonters receive necessary medical services.

Key Factors To Consider When Choosing Health Insurance In Vermont

Settling on the right health insurance can be a puzzle. In Vermont, options abound, but finding the perfect fit requires evaluating several vital aspects. Each piece forms part of a comprehensive healthcare picture, from layers of coverage to cost concerns and the significant matter of provider reach.

Coverage And Benefits

Explore what each plan offers. Benefits vary across different policies. Vermonters should look for plans that include:

- Preventive care services

- Emergency care options

- Prescription drug coverage

- Mental health services

Review for any additional perks, such as wellness programs or discounts. Noting exclusions is equally essential.

Cost And Affordability

An insurance plan must fit your budget. Consider:

| Cost Type | Explanation |

|---|---|

| Premiums | The monthly charge for your plan. |

| Deductibles | What you pay before insurance kicks in. |

| Copayments/Coinsurance | Your share for services like a doctor’s visit. |

| Out-of-pocket maximum | The most you will pay in a plan year. |

Assess overall value, not just the premium costs. A cheap plan might become expensive if it doesn’t cover essential services.

Provider Networks And Accessibility

Your doctors should be in-network. This makes care more affordable. Check if the plan includes the following:

- Local healthcare providers and facilities

- Specialists you have already visited

- Hospitals nearby in case of an emergency

Also, consider travel coverage if you are often out of state. Ensure the plan has a reasonable selection of providers you can access.

Credit: fastpacehealth.com

Recent Changes And Updates In Vermont Health Insurance Policies

Welcome to our exploration of the dynamic landscape of Vermont health insurance. With policy shifts and updates, it’s crucial to stay informed. Vermonters have experienced notable changes in their health coverage. Understanding these changes can significantly impact choices and care.

Legislative Changes

Recent legislative developments have reshaped health insurance in Vermont. Key acts and bills bring changes to coverage, premiums, and benefits. Stay ahead by reviewing these major policy shifts:

- Expansion of Eligibility: More Vermont residents now qualify for coverage due to updated income guidelines.

- Telehealth Services: Enhanced access to telemedicine caters to the need for remote healthcare, a shift primarily influenced by recent global events.

- Prescription Drug Monitoring: Initiatives to control medication costs have been introduced, offering financial relief to many.

Impact Of National Healthcare Trends

National trends play a pivotal role in shaping local health insurance policies. Vermont adapts to these shifts for optimal healthcare delivery. Two significant impacts include:

- Affordable Care Act (ACA) Amendments: Federal changes to the ACA affect Vermont’s health insurance landscape, often resulting in adjusted plan options and subsidies.

- Technological Advancements: Adopting cutting-edge health technologies influences insurance policy updates for broader coverage.

Challenges Faced By Vermont Residents In Accessing Health Insurance

The quest for health insurance in Vermont presents unique challenges. Residents face issues stemming from geographical and economic factors. Understanding these hurdles is crucial for anyone navigating the Green Mountain State’s healthcare landscape.

Rural Healthcare Access

In Vermont’s picturesque yet remote regions, accessing healthcare services is daunting. Mountains and valleys, though beautiful, create physical barriers to medical facilities. This rural reality means long travel times for many Vermonters, complicating emergencies and routine care visits.

- Healthcare facilities are sparse.

- Travel times to appointments are long.

- Public transportation options are limited.

Services might also be limited for those who can reach a provider. Smaller communities often lack specialized care, leading to further travel to larger cities. These hurdles can delay or deter individuals from seeking care, impacting overall community health.

Affordability Concerns

The cost of healthcare remains a pressing concern for Vermont residents. Despite initiatives to make insurance more accessible, many Vermonters find premiums and out-of-pocket costs prohibitively expensive. The dilemma is multifaceted:

| Issue | Impact |

|---|---|

| High Premiums | The strain on household budgets |

| Deductibles | Paying more before benefits kick in |

| Prescription Costs | Limited access to essential medication |

Plans that may appear affordable often skimp on coverage, leaving many to wrestle with the decision to pay for higher premiums or risk inadequate coverage. Children, older people, and those with chronic conditions feel this pinch the most.

Initiatives And Programs To Improve Health Insurance Access In Vermont

Vermont stands out with its progressive initiatives and programs regarding health insurance access. Green Mountain State ensures all residents have the necessary health coverage. Let’s explore the ways Vermont is making health insurance accessible and affordable.

Community Health Centers

Vermont’s community health centers are at the forefront of providing affordable health care. They serve as a safety net for those without insurance. These centers offer a range of services:

- Primary care

- Preventive care

- Dental services

- Mental health supports

With a pay-what-you-can model, these centers make sure money is not a barrier to health care.

State Subsidy Programs

Vermont’s subsidy programs reduce health insurance costs. One critical program is Dr. Dynasaur, which covers children and pregnant women. Another crucial initiative is the Medicaid program, which supports low-income adults. Let’s break down these programs:

| Program | Eligibility | Benefits |

|---|---|---|

| Dr. Dynasaur | Children & pregnant women | Comprehensive coverage |

| Medicaid | Low-income adults | Varied health services |

These programs work together to ensure residents can get the care they need.

Comparison Of Vermont Health Insurance System With Other States

The Vermont Health Insurance System stands out in the United States. This section compares it with other states. We look at coverage rates and health outcomes.

Coverage Rates

Vermont boasts high coverage rates. This means most Vermonters have health insurance. Let’s see how it stacks up:

| State | Coverage Rate |

|---|---|

| Vermont | 96% |

| Texas | 78% |

| California | 90% |

| Florida | 80% |

Vermont leads with one of the highest insurance coverage rates in the nation.

Health Outcomes

Let’s dive into the health outcomes Vermont offers.

- Life expectancy: Vermont is higher than most.

- Chronic disease rates: They are lower here.

- Preventive services: Vermont excels in offering these.

Compared to others, Vermont shows better health outcomes. Residents live longer, healthier lives.

Future Prospects For Health Insurance In Vermont

The landscape of health insurance in Vermont stands at a crossroads. With new technologies and policies on the horizon, residents may see significant changes in the coming years. Let’s delve into what the future may hold for health insurance in the Green Mountain State.

Potential Policy Changes

Vermont lawmakers constantly seek ways to improve healthcare. Key focus areas include affordability, coverage, and service quality.

- Subsidy Boosts will help more people afford insurance.

- The expansion of Medicaid will cover a more significant portion of the population.

- Drug Pricing Control is aimed at keeping medication costs manageable.

These policy changes could reshape the health insurance system, making it more accessible and user-friendly.

Integration Of Telemedicine

Telemedicine is a game-changer in healthcare. Vermont residents could soon enjoy:

- Virtual Doctor Visits save time and travel.

- Remote Monitoring of chronic conditions for better management.

- Electronic Prescriptions for faster, safer medication dispensing.

With telemedicine, Vermont’s health insurance could offer more efficient and convenient care.

Credit: thinkvermont.com

Frequently Asked Questions Of Vermont Health Insurance

How Much Does Health Insurance Cost In Vermont?

The cost of health insurance in Vermont varies based on coverage and income. Average monthly premiums can range from $400 to $600 before any subsidies are applied.

Is Healthcare Good In Vermont?

Vermont’s healthcare is generally regarded as high-quality, with accessible services and numerous top-rated hospitals. The state consistently ranks well in national healthcare comparisons.

What Is The Vermont Health Plan?

The Vermont Health Plan (TVHP) offers health insurance products to individuals, employers, and Medicare beneficiaries in Vermont, emphasizing quality coverage and wellness.

What Is Vermont State Insurance Called?

Vermont’s state-provided insurance program is called Green Mountain Care. It encompasses Medicaid and Dr. Dynasaur, ensuring residents can access health coverage.

Conclusion

Navigating Vermont health insurance options can seem daunting at first. Yet, digesting the provided information makes making an informed choice more straightforward. Remember, the right coverage is critical to ensuring peace of mind and protecting your health. Seek advice and review plans annually, as your needs may change.

The investment in your well-being is invaluable.