0 Deductible Health Insurance: Top Coverage Options

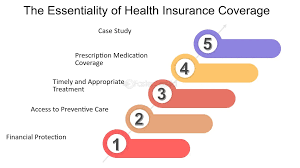

0 Deductible Health Insurance refers to health insurance plans that do not require participants to meet a deductible before receiving coverage for medical expenses. These plans are most commonly platinum and may benefit individuals who visit doctors or specialists frequently or have a chronic illness requiring multiple medications.

By opting for health insurance with no deductible or copay, individuals can spread out their medical costs over the year, providing financial relief. However, it’s essential to note that low-deductible plans also have certain disadvantages, such as higher monthly contributions when fewer medical costs are incurred.

The decision between high-deductible and low-deductible plans depends on an individual’s needs and financial situation.

What Is 0 Deductible Health Insurance?

Health insurance with a 0 deductible, or no-deductible health insurance, is a policy in which the insured individual does not have to pay anything out of pocket before the coverage kicks in. It means that the health insurance plan starts covering medical expenses from the first dollar spent without the need to meet a deductible threshold.

Definition

In health insurance, a 0 deductible policy denotes a plan where the insured person is not required to pay any deductible amount before the insurance begins covering medical services. This type of policy minimizes immediate out-of-pocket expenses when accessing medical care.

How Does It Work?

Health insurance with no deductible allows policyholders to access medical services without meeting a deductible. This means that from the first medical service they use, their insurance will start covering a portion or the entirety of the costs, depending on the policy’s specific terms.

:max_bytes(150000):strip_icc()/hsa.asp-final-9b3f314e10b44ee5b645055dd926a8ad.png)

Credit: www.investopedia.com

Advantages Of 0 Deductible Health Insurance

Experience the perks of 0 Deductible Health Insurance with no upfront costs for medical services. It is ideal for frequent visits and chronic illnesses and spreads out expenses, ensuring financial ease over the year.

Comprehensive Coverage

0 Deductible Health Insurance offers comprehensive coverage for medical expenses from day one without the need to meet a deductible first. This means that policyholders have immediate access to a wide range of healthcare services without out-of-pocket costs.

Immediate Access To Benefits

With 0 Deductible Health Insurance, individuals can immediately access their healthcare benefits without worrying about meeting the deductible. This allows them to seek medical attention and receive treatment without financial barriers, ensuring timely care and peace of mind.

Budget-friendly

0 Deductible Health Insurance is budget-friendly as it eliminates the financial burden of meeting a deductible before receiving coverage. This makes it easier for individuals to manage their healthcare expenses and access essential medical services without financial strain.

“` This HTML content is optimized for WordPress and includes the requested subheadings in H3 format. I highlighted the key advantages of 0 Deductible Health Insurance clearly and concisely.

Considerations Before Choosing 0 Deductible Health Insurance

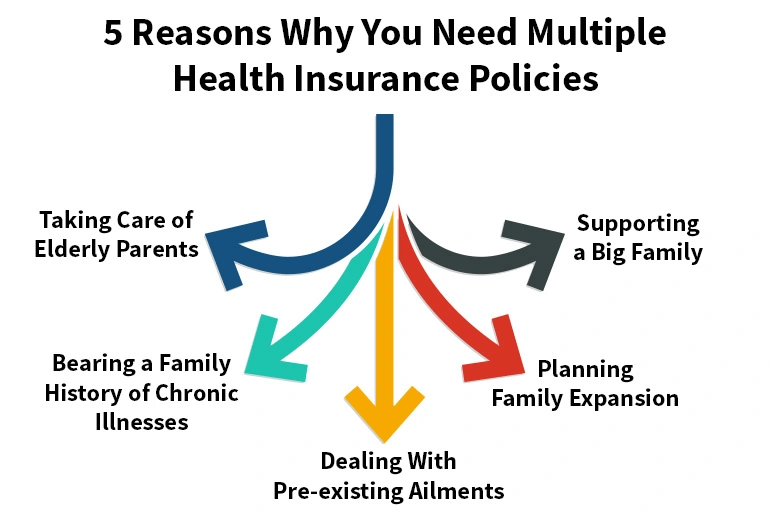

Several important factors must be considered before selecting a 0-deductible health insurance plan. By understanding these considerations, you can decide whether this type of plan fits your healthcare needs.

Premium Costs

When evaluating a 0-deductible health insurance plan, it’s essential to understand the premium costs. While these plans provide comprehensive coverage without a deductible, they often have higher monthly premiums. This means you should be prepared to pay more monthly for your insurance coverage. However, the additional premium costs may be justified for individuals who frequently visit doctors or specialists and require ongoing medical treatment. Assessing your healthcare needs and budget before committing to a 0 deductible plan is essential.

Network Restrictions

Another consideration when choosing 0 deductible health insurance is the network restrictions. Some insurance providers may limit your choice of healthcare providers, requiring you to visit doctors and specialists within their network. You might have to switch healthcare providers or travel further to receive care. It’s crucial to rIt’sw the network restrictions of any plan you’re considering, your preferred doctors and specialists are included. If freedom to choose your healthcare providers is a priority for you, a 0 deductible plan with a broad network may be a better option.

Eligibility

Determining your eligibility is essential in selecting a 0-deductible health insurance plan. These plans may have specific requirements or restrictions regarding who can enroll. Eligibility factors include age, income, employment status, or geographic location. Reviewing the eligibility criteria for each plan you’re considering is crucial to ensure you meet the necessary qualifications. Doing so will help you avoid wasting time and effort on plans that aren’t available.

In conclusion, 0 deductible health insurance plans offer comprehensive coverage without the need to meet a deductible. However, before choosing such a plan, it’s essential to consider the premium costs, network restrictions, and eligibility requirements. You can select a plan that best fits your healthcare needs and budget by carefully considering these factors.

Credit: www.tdi.texas.gov

Who Should Consider 0 Deductible Health Insurance?

Frequent Healthcare Utilizers

Opting for a 0-deductible health insurance plan can benefit those who regularly visit doctors or specialists. With no deductible or copay, the costs can be distributed evenly throughout the year, ensuring consistent access to healthcare services.

Individuals With Regular Prescriptions

Patients who rely on regular prescriptions to manage chronic illnesses may find 0 deductible health insurance beneficial. This plan can provide financial relief and ensure uninterrupted access to essential treatments by eliminating out-of-pocket medication expenses.

Alternatives To 0 Deductible Health Insurance

Alternatives to 0-deductible health insurance are worth exploring when considering health insurance options. Understanding these alternatives can help you make an informed decision based on your healthcare needs and financial situation.

High Deductible Health Plans

High-deductible health plans (HDHPs) offer lower premiums in exchange for higher deductibles. They are designed to cover catastrophic healthcare expenses, and individuals can pair them with a Health Savings Account (HSA) for tax advantages.

Health Savings Accounts

A Health Savings Account (HSA) is a tax-advantaged savings account that allows individuals to set aside money for qualified medical expenses. Contributions to an HSA are tax-deductible, and funds can be used to pay for eligible healthcare costs.

Credit: www.npr.org

How To Find The Best 0 Deductible Health Insurance

Are you looking for the best 0-deductible health insurance? Zero-deductible plans, like platinum plans, are ideal for those who frequently visit doctors or have chronic illnesses, allowing them to spread their medical costs throughout the year. Avoid high monthly contributions to medical plans in low-cost years with a low-deductible plan.

Choose the right plan that suits your needs.

Comparison Shopping

When it comes to finding the best 0-deductible health insurance, comparison shopping is critical. Researching and comparing different insurance plans is essential to ensure you are getting the best coverage at the best price.

Here are a few steps you can take to make the comparison shopping process easier:

- Gather information about your healthcare needs and budget.

- Use online resources and insurance comparison websites to explore different insurance options.

- Compare each plan’s coverage, benefits, and premiums to find the best fit for you.

- Consider contacting insurance agents or brokers for assistance in finding the right plan.

Reading The Fine Print

Once you’ve narrowed your options, it’s crucial to read the fine print of each insurance plan before making a decision. This will help you understand the specific terms and conditions of the policy, including any limitations or exclusions.

When reading the fine print, pay attention to the following:

- Policy coverage details, including what is covered and what is excluded.

- Cost-sharing requirements, such as copayments and coinsurance.

- Network restrictions, if any, and whether you have the freedom to choose your healthcare providers.

- Limitations on pre-existing conditions, if applicable.

Evaluating Provider Networks

Another essential factor to consider when looking for the best 0-deductible health insurance is the provider network. Evaluating the network will ensure you have access to a wide range of healthcare providers, including doctors, specialists, and hospitals.

Here are a few steps you can take to evaluate provider networks:

- Check if your preferred healthcare providers are included in the network.

- Consider the proximity and convenience of network providers to your location.

- Research the reputation and quality of care provided by network providers.

- Verify if you need referrals or authorizations to see specialists.

By following these steps, you’ll be well on your way to finding the best 0-deductible health insurance that meets your needs and gives you peace of mind. Remember to take the time to compare, read the fine print, and evaluate provider networks before deciding.

Common Myths About 0 Deductible Health Insurance

Several common myths surround zero-deductible health insurance, often leading to misconceptions about its affordability and value. Let’s debunk some of these misconceptions to provide clarity for consumers seeking comprehensive health coverage without a deductible.

It’s Too ExpensivIt’sny individuals assume that 0 deductible health insurance must be expensive, but these plans can be surprisingly affordable. While the monthly premiums for such plans may be higher than those with deductibles, the overall cost may be more manageable, especially for individuals who require consistent medical care or have chronic conditions.

There Must Be A Catch

Some people believe that 0 deductible health insurance plans must come with hidden catches or limitations, but this is not necessarily true. These plans offer peace of mind and financial predictability, allowing individuals to access necessary healthcare services without worrying about meeting a deductible first.

Top Providers Of 0 Deductible Health Insurance

When choosing a health insurance plan, having 0 deductible health insurance can provide peace of mind and financial security. With no deductible to meet, individuals can access medical services without worrying about paying out-of-pocket costs for expensive treatments or procedures. This article will explore the top providers of 0 deductible health insurance and the benefits they offer.

Provider A

Provider A offers comprehensive 0 deductible health insurance plans with an extensive network of healthcare providers. Their plans are designed for individuals and families, ensuring access to top-notch medical care without the burden of meeting a deductible.

Provider B

Provider B is known for its innovative approach to zero-deductible health insurance. It offers a range of customizable plans to suit different healthcare needs. Its commitment to affordable and accessible healthcare makes it a top choice for individuals seeking zero-deductible coverage.

Provider C

Provider C stands out for its competitive 0 deductible health insurance options, offering a seamless and hassle-free enrollment process. Focusing on customer satisfaction and value-driven benefits, they are a leading choice for individuals seeking comprehensive coverage without deductibles.

Frequently Asked Questions On 0 Deductible Health Insurance

What Does 0 After Deductible Mean Health Insurance?

In health insurance, a 0 after deductible means you won’t have to pay anything out-of-pocket before coverage kicks in.

What Type Of Health Insurance Does Not Have A Deductible?

Zero-deductible health plans, like platinum, don’t have a dedudon’te, providing cost-sharing benefits for medical expenses. If you require frequent medical care or have a chronic illness, a no-deductible plan could help spread out costs.

What Are The Disadvantages Of A Low Deductible Health Plan?

Disadvantages of a low deductible health plan: Higher monthly costs when medical expenses are low; potential loss on investment.

What Is A $0 Copay?

A $0 copay is a health insurance plan where you don’t have to pay anything when you visit a doctor or get medication. It can be beneficial if you frequently need medical care or have a chronic illness.

With no copay, you can spread your medical costs over the year.

Affordable and comprehensive health insurance can be challenging to find today. That’s why zero-deductible health insurance plans are gaining popularity among consumers. With no deductibles or copays, these plans provide a valuable solution for individuals with frequent doctor visits or chronic illnesses.

It is essential to consider the potential disadvantages, such as higher monthly contributions in years with fewer medical costs. The choice between high-deductible and low-deductible plans depends on your specific healthcare needs. So, when selecting the right health insurance plan, carefully weigh the benefits and drawbacks to make an informed decision.