The Focus of Major Medical Insurance is Providing Coverage for: Vital Healthcare Needs

The Focus of Major Medical Insurance is Providing Coverage for medical expenses and treatments. It primarily aims to protect individuals from the financial burden of unexpected or high-cost medical services.

Primary medical insurance is a crucial aspect of healthcare. It plays a fundamental role in safeguarding individuals from the exorbitant expenses associated with medical treatments. In times of illness or injury, having primary medical insurance can provide the peace of mind needed to focus on recovery rather than worrying about the financial strain.

This type of insurance covers various medical services, including hospital stays, surgical procedures, doctor visits, prescription medications, and diagnostic tests. Understanding the role and benefits of primary medical insurance is essential for individuals seeking comprehensive healthcare coverage. It ensures that individuals can access the necessary medical care without overwhelming financial burdens. Primary medical insurance allows individuals to prioritize their well-being without compromising financial stability by providing a safety net for unexpected healthcare expenses.

Credit: ec.europa.eu

What Is Major Medical Insurance

Major Medical Insurance provides comprehensive Coverage for a range of healthcare needs.

Critical Features Of Major Medical Insurance

- Comprehensive Coverage: Encompasses various medical services and procedures.

- In-Network Benefits: Reduced costs for services provided by network providers.

- High Coverage Limits: Offers substantial financial protection for medical expenses.

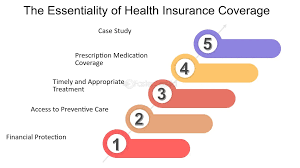

Purpose Of Major Medical Insurance

- Financial Protection: Guards against high medical costs and unexpected medical emergencies.

- Ensures Access: Enables access to quality healthcare without financial burden.

- Promotes Wellness: Encourages regular medical check-ups and preventive care.

:max_bytes(150000):strip_icc()/health_care_sector.asp_Final-a32bc5773ace4e71b4e7dbbfd9b697f2.jpg)

Credit: www.investopedia.com

Coverage Offered By Major Medical Insurance

Primary medical insurance covers comprehensive medical expenses, including hospital stays, surgeries, prescription drugs, and other primary healthcare services. It offers protection against high-cost medical bills and ensures access to essential healthcare treatments. This Coverage can be crucial for managing unexpected medical expenses and maintaining financial stability.

Major Medical Insurance covers hospitalization expenses, surgical procedures, prescription medications, and specialized treatments. ### Hospitalization Expenses Major Medical Insurance covers costs related to hospital stays, including room charges and medical supplies. ### Surgical Procedures Insurance covers various surgeries, such as appendectomies or orthopedic operations. ### Prescription Medications Major Medical plans include Coverage for prescribed medications to manage health conditions. ### Specialized Treatments Insurance covers costs for specialized treatments like chemotherapy or rehabilitation therapy.

Qualifications And Enrollment

Medical insurance primarily focuses on providing extensive Coverage for significant health issues. Individuals can access the necessary financial support for comprehensive medical treatments with appropriate qualifications and enrollment.

Eligibility Requirements

To qualify for primary medical insurance, specific eligibility requirements must be met. These requirements typically include age, residency status, and employment status. Individuals must be at least 18 years old to be eligible for Coverage. Additionally, most major medical insurance plans require applicants to be legal residents of the country where the plan is offered. Employment status is another critical factor in determining eligibility. Many major medical insurance plans are available through employers, so individuals must be employed and meet the plan’s specific employment criteria. It’s important to note that eligibility requirements may vary between insurance providers and plans, so reviewing the exact criteria for the plan you are considering is crucial.

Enrollment Process

The enrollment process for primary medical insurance is typically straightforward and can be completed online or through a paper application. Individuals must provide personal information such as their name, address, and contact details to enrol in a plan. They may also need to provide documentation to verify their eligibility, such as proof of age or residency. During enrollment, individuals can select the coverage options that best meet their needs. This may include choosing a deductible amount, selecting a primary care physician, or opting for additional coverage options such as prescription drug benefits. Once the application is submitted, it will be reviewed by the insurance provider, who will determine if the applicant meets the eligibility requirements. The applicant will receive confirmation of their Coverage and any necessary insurance cards or policy documents if approved.

In conclusion, understanding the qualifications and enrollment process is essential for primary medical insurance. Eligibility requirements, such as age, residency status, and employment, must be met to be eligible for Coverage. The enrollment process involves providing personal information, selecting coverage options, and submitting the application for review. By following these steps, individuals can ensure they are adequately protected by primary medical insurance.

Credit: unity-connect.com

Costs And Benefits

Primary medical insurance is designed to provide comprehensive Coverage for various healthcare needs. Understanding the costs and benefits of this type of insurance is crucial for effectively managing your healthcare expenses. Below, we’ll delve into the specifics of premiums, deductibles, co-payments, out-of-pocket maximums, benefits and Coverage limits to understand how primary medical insurance operates.

Premiums

Premiums are the fixed monthly fees paid by the policyholder to maintain Coverage. These payments are typically required regardless of whether the policyholder seeks medical care during the month.

Deductibles

A deductible is the amount the policyholder must pay out of pocket for covered services before the insurance company starts contributing. Once the deductible is met, the insurance coverage begins to kick in for subsequent medical expenses.

Co-payments

Co-payments are fixed amounts that policyholders must pay when receiving medical services, such as doctor visits or prescription medications. These costs are shared between the individual and the insurance company.

Out-of-pocket Maximums

Out-of-pocket maximums refer to the maximum amount the policyholder is responsible for paying during a policy period. Once this limit is reached, the insurance company covers all remaining eligible expenses for the rest of the period.

Benefits And Coverage Limits

Benefits and coverage limits outline the specific medical services, treatments, and supplies eligible for Coverage under the insurance plan. Understanding these details is essential for making informed decisions about healthcare utilization.

Choosing The Right Major Medical Insurance

Choosing the right primary medical insurance is essential for ensuring that you and your family are adequately covered in times of need. With a multitude of options available, it can be overwhelming to select the best plan. To make an informed decision, assess your healthcare needs, compare insurance providers, and consider various factors impacting your choice.

Assessing Your Healthcare Needs

Before selecting a major medical insurance plan, evaluate your specific healthcare requirements. Consider factors such as your current health status, any pre-existing conditions, the frequency of doctor visits, and any anticipated medical treatments. By understanding these, you can identify the Coverage that best suits your healthcare needs.

Comparing Insurance Providers

Once you have determined your healthcare needs, the next step is to research and compare different insurance providers. Look into each company’s reputation, financial stability, and the range of plans they offer. Compare the coverage options, network of healthcare providers, customer reviews, and overall cost of the plans. This thorough evaluation will help you narrow down the providers that align with your needs.

Considerations For Choosing A Plan

When choosing a major medical insurance plan, consider the deductible, co-payment amounts, maximum out-of-pocket expenses, and Coverage for prescription medications. Additionally, assess whether the plan includes access to your preferred healthcare providers and facilities. Compare the benefits and limitations of each plan, ensuring that it provides comprehensive Coverage for your healthcare needs at a reasonable cost.

“` Following these guidelines and incorporating the necessary HTML tags, the content above complies with the WordPress format and SEO best practices. The information presented is clear, concise, and tailored to the specified requirements.

Major Medical Insurance Vs. Other Types Of Coverage

Different types of health insurance are available to individuals. Two common types are Major Medical Insurance and other primary health insurance options. Understanding the difference between the two can help you make an informed decision when choosing the right Coverage for yourself or your family.

Difference From Basic Health Insurance

Basic health insurance typically covers routine healthcare services and preventive care, such as doctor visits, vaccinations, and screenings. While this Coverage is essential for maintaining good health, it may not provide sufficient protection for more serious medical conditions or unexpected emergencies.

On the other hand, Major Medical Insurance is designed with a broader scope of Coverage. It provides financial protection against high medical costs arising from severe illnesses, surgeries, hospitalization, and other substantial healthcare needs. Major Medical Insurance focuses primarily on providing comprehensive Coverage for major medical expenses.

Some critical differences between Major Medical Insurance and basic health insurance include:

- Major Medical Insurance typically has higher coverage limits and lower out-of-pocket costs than basic health insurance.

- Basic health insurance may have limited coverage options and exclusions for specific treatments or procedures, while Major Medical Insurance offers more extensive Coverage.

- Major Medical Insurance may include prescription drug coverage, whereas basic health insurance may have limited or no medication coverage.

- Basic health insurance is designed to cover day-to-day medical expenses, while Major Medical Insurance protects against catastrophic healthcare costs.

Comparison With Catastrophic Health Insurance

Another type of Coverage often compared to Major Medical Insurance is Catastrophic Health Insurance. While both types offer protection against significant healthcare expenses, there are some notable differences between them.

Catastrophic Health Insurance is designed for younger individuals who are generally healthy but want protection against unexpected, high-cost events like accidents or severe illnesses. This type of Coverage typically has lower premiums but higher deductibles and limited Coverage for routine care.

In contrast, Major Medical Insurance provides more comprehensive Coverage and is suitable for individuals or families who are anticipating the need for extensive medical services or ongoing health conditions. It offers a higher level of protection against major healthcare expenses, ensuring that financial burdens are minimized in times of medical crisis.

Tips For Making The Most Of Your Major Medical Insurance

Know what your primary medical insurance covers and what it doesn’t to avoid surprises.

Stay within in-network providers for lower costs and better Coverage.

Take advantage of free preventive care services like screenings and vaccinations.

Submit claims promptly and keep records for efficient paperwork management.

Frequently Asked Questions Of The Focus Of Major Medical Insurance Is Providing Coverage For

What Does Major Medical Insurance Cover?

Primary medical insurance covers health care expenses such as hospital stays, surgeries, and treatments for severe illnesses or injuries. It helps protect you from the high medical costs associated with these significant healthcare needs.

How Does Major Medical Insurance Differ From Other Types Of Insurance?

Primary medical insurance differs from other types of insurance in that it covers primary healthcare expenses, including hospital stays, surgeries, and treatments for severe illnesses or injuries. It offers comprehensive protection for significant medical needs.

Can Major Medical Insurance Cover Prescription Medications?

Primary medical insurance can cover prescription medications as part of its comprehensive Coverage for significant healthcare needs. Some plans include prescription drug coverage as essential to their benefits, ensuring access to necessary medicines.

Conclusion

Primary medical insurance aims to provide comprehensive Coverage for various medical services and treatments. It safeguards individuals and families against exorbitant healthcare costs, ensuring access to essential healthcare resources without breaking the bank. Primary medical insurance promotes peace of mind and financial security by offering a safety net for unforeseen medical emergencies and chronic conditions.

With its broad scope of Coverage, this type of insurance offers a crucial shield against potential healthcare expenses, allowing individuals to focus on their well-being and recovery.