Health Insurance Montana : Secure Your Future with the Best Coverage

Health Insurance Montana offers comprehensive coverage for residents in the state, providing access to healthcare services and financial protection against medical expenses. With a wide range of plans and options available, individuals and families can find the right insurance coverage to meet their specific needs and budget.

Whether you’re looking for individual health insurance or a plan that covers your entire family, Health Insurance Montana offers peace of mind and security regarding your healthcare needs. Don’t leave your health to chance; get covered by Health Insurance Montana today.

Importance Of Health Insurance

In today’s unpredictable world, health insurance protects your well-being and financial security; we explore why having health insurance in Montana is crucial.

Financial Protection

Health insurance provides financial protection by covering medical expenses, ensuring unexpected healthcare costs do not burden you.

Access To Quality Healthcare

With health insurance, you gain access to quality healthcare, allowing you to seek timely treatment and preventive services to maintain your well-being.

Credit: www.amwellbeingTypes Of Health Insurance Plans

Understanding the various health insurance plans is crucial in finding the right coverage for your needs.

Individual Health Insurance

Individual health insurance plans provide coverage for a single person and can be personalized to meet specific healthcare needs.

Group Health Insurance

Group health insurance is obtained through an employer or organization, offering coverage to a group of people, making it cost-effective.

Medicaid

Medicaid provides health coverage to low-income individuals and families and is jointly funded by the state and federal governments.

Medicare

Medicare is a federal program that provides health coverage for individuals aged 65 and older and some younger individuals with disabilities.

Health Insurance Providers In Montana

There are several reputable health insurance providers in Montana. Understanding the options available to you is crucial in making an informed decision about your healthcare coverage. This article will outline Montana’s three leading health insurance providers: Blue Cross and Blue Shield of Montana, PacificSource Health Plans, and Montana Health CO-OP.

Blue Cross And Blue Shield Of Montana

Blue Cross and Blue Shield of Montana are the state’s most well-known health insurance providers. They offer a comprehensive range of health insurance plans designed to meet the diverse needs of individuals, families, and businesses. With a strong network of healthcare providers, policyholders can access quality care across the state.

pacific source Health Plans

PacificSource Health Plans is another prominent health insurance provider in Montana. They pride themselves on prioritizing the well-being of their members and bringing exceptional customer service. With various health insurance options, PacificSource caters to individuals, families, and businesses, ensuring everyone can find a plan that suits their needs and budget.

Montana Health Co-op

Montana Health CO-OP is a unique and community-focused health insurance provider in Montana. As a member-controlled organization, it prioritizes the interests of its policyholders and works to offer affordable and sustainable coverage options. Montana Health CO-OP provides health insurance and educates and empowers its members to make informed healthcare decisions.

Credit: www.simonandschuster.com

Affordable Care Act And Health Insurance

When understanding health insurance in Montana, the Affordable Care Act (ACA) is a pivotal factor. The ACA, also known as Obamacare, brought significant changes to the healthcare landscape in the United States, including Montana. In this section, we will delve into the impact of the ACA on Montana’s health insurance.

Overview Of The Affordable Care Act

The Affordable Care Act was enacted in 2010 to expand health insurance coverage, control healthcare costs, and improve the overall quality of care. It introduced several provisions, including establishing health insurance marketplaces, expanding Medicaid, and implementing consumer protections.

Impacts On Health Insurance In Montana

The ACA has profoundly impacted the availability and affordability of health insurance in Montana. It led to the establishment of the Montana Health Insurance Marketplace, where individuals, families, and small businesses can compare and purchase health insurance plans. Moreover, the expansion of Medicaid under the ACA has provided coverage to a more significant segment of the state’s population, particularly low-income adults.

Factors To Consider When Choosing A Health Insurance Plan

When choosing a health insurance plan, several important factors must be considered to ensure you get the coverage you need at a cost that fits your budget. Understanding the key aspects to look for can help you make an informed decision. Here are the essential factors to consider when selecting a health insurance plan:

Coverage Options

Coverage options are vital when choosing a health insurance plan. Ensure the plan covers essential services such as doctor visits, hospital stays, preventive care, prescription drugs, and mental health services.

Additionally, consider whether the plan offers coverage for alternative treatments, such as acupuncture or chiropractic care, if those are important to you.

Network Of Providers

Another critical factor to consider is the network of providers. Ensure the plan includes a network of doctors, hospitals, and specialists. This is essential to guarantee that you can receive care from providers who are conveniently located and accessible to you.

Moreover, consider whether the plan allows you to see specialists without needing a referral from a primary care physician.

Costs And Premiums

- Costs and premiums are significant considerations. Review the out-of-pocket costs, including deductibles, copayments, and coinsurance, to understand your financial responsibility when receiving care.

- Compare the premiums of different plans to find an option that fits your budget while offering comprehensive coverage.

Tips For Saving Money On Health Insurance

Are you looking to save on health insurance in Montana? Consider high-deductible plans or health savings accounts. Compare quotes online and explore bundling options to maximize savings. Additionally, staying healthy through preventive care can lower long-term costs and premiums.

Shop Around And Compare Plans

When saving money on health insurance in Montana, one of the most important tips is to shop around and compare different plans. Insurance providers offer a variety of plans with varying coverage options and costs. By taking the time to research and compare plans, you can find the one that best suits your needs and budget.

Here are some key points to keep in mind when shopping for health insurance:

- Obtain quotes from multiple insurance providers to compare costs and coverage.

- Consider the health services and benefits most important to you and ensure they’re included in the plan.

- Pay attention to the details of each plan, such as deductibles, copayments, and coinsurance.

- Look for any limitations or restrictions on services, such as network restrictions or pre-authorization requirements.

- Take into account the reputation and customer reviews of the insurance provider.

Consider High Deductible Plans

Another way to save money on health insurance in Montana is to consider a high-deductible plan. These plans typically have lower monthly premiums but higher deductibles. While you’ll need to pay more out-of-pocket before the insurance kicks in, these plans can be a cost-effective option for individuals who are generally healthy and don’t expect to require frequent medical services.

Before choosing a high-deductible plan, consider the following:

- Calculate your expected annual healthcare costs to determine if a high deductible plan is financially viable.

- Look for plans that offer Health Savings Accounts (HSAs), which allow you to save pre-tax dollars for medical expenses.

- Be aware of any preventive services that are covered before meeting the deductible.

- Consider the potential financial impact in case of unexpected medical emergencies.

Utilize Preventive Services

One of the best ways to save money on health insurance in Montana is to take advantage of preventive services covered by the plan. Preventive care focuses on keeping you healthy and detecting potential health issues early, which can ultimately result in lower healthcare costs in the long run.

Here are some key points to consider regarding preventive services:

- Ensure your plan covers preventive services like vaccinations, screenings, and annual check-ups.

- Schedule regular preventive visits with your primary care physician to catch any potential problems before they become more severe and costly.

- Take advantage of free preventive services, such as flu shots or certain screenings, that do not require you to meet your deductible.

- Stay informed about recommended preventive care guidelines and discuss them with your healthcare provider.

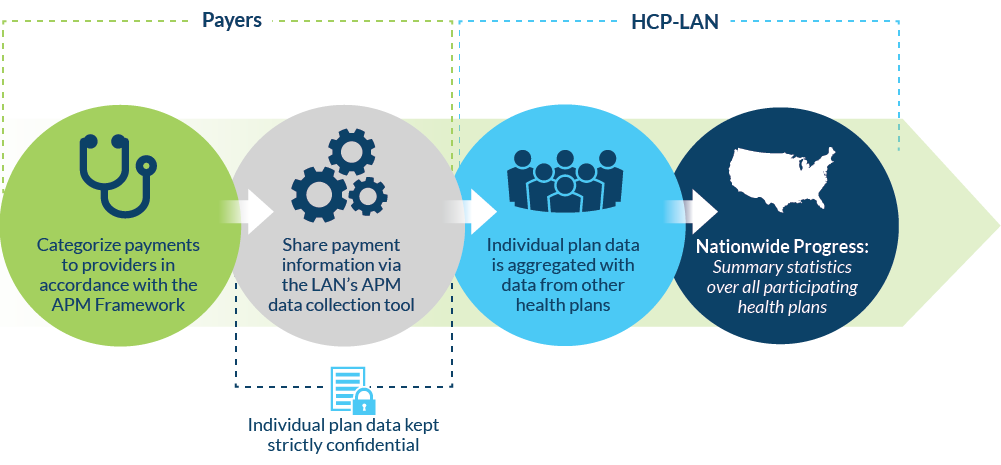

Credit: hcp-lan.org

Frequently Asked Questions On Health Insurance Montana

What Are The Benefits Of Having Health Insurance In Montana?

Health insurance in Montana provides financial protection for medical expenses, including doctor visits, hospitalization, and prescription medications. It also offers preventive care, mental health services, and coverage for pre-existing conditions, giving individuals peace of mind and access to quality healthcare.

How Does Health Insurance In Montana Work?

Health insurance in Montana operates by individuals paying a monthly premium in exchange for coverage of medical expenses. When seeking healthcare services, policyholders may need to pay deductibles, copayments, or coinsurance, with the insurance company covering the remaining costs according to the policy terms.

What Factors Should I Consider When Choosing A Health Insurance Plan In Montana?

When selecting a health insurance plan in Montana, it’s essential to evaluate the premium costs, provider network, coverage for prescription drugs, out-of-pocket expenses, and the overall quality and reputation of the insurance company—additionally, consider your specific healthcare needs when deciding.

decision

Health insurance in Montana offers essential protection for individuals and families, ensuring access to quality healthcare services. Whether you seek coverage for routine check-ups or unexpected medical emergencies, having a comprehensive health insurance plan can provide peace of mind and financial security.

By understanding the options available and selecting the right plan, you can safeguard your health and well-being. Don’t delay – priwellbeingour health and explore Montana’s various health insurance options today.