Ambetter Health Insurance Review: Power Your Health with Affordable Coverage

Ambetter Health Insurance Review offers focused, compassionate, and coordinated care to improve beneficiaries’ health locally. Ambetter Health Insurance, provided by Centene Corporation, aims to enhance the health of its beneficiaries through community-based quality care.

Focusing on delivering compassionate and coordinated health services, Ambetter strives to offer affordable rates and comprehensive coverage. While some customers have raised concerns about high costs and limited network options, Ambetter remains a recognized player in the health insurance market.

As a prominent provider in Texas and beyond, Ambetter’s commitment to supporting the well-being of its members remains a crucial aspect of its offerings. With an emphasis on localized care and competitive rates, Ambetter stands out as an option worth considering for those seeking reliable health insurance coverage.

Credit: ambetter.superiorhealthplan.com

Coverage And Benefits

Ambetter Health Insurance offers a range of coverage and benefits to its policyholders. Understanding the specific medical services and prescription drug coverage Ambetter provides is vital to ensuring that it meets your healthcare needs. Let’s delve into the details of the coverage and benefits offered by Ambetter Health Insurance.

Medical Services

Regarding medical services, Ambetter Health Insurance provides comprehensive coverage for a wide range of healthcare needs. Whether it’s preventive care, specialist visits, or hospitalization, Ambetter ensures you can access quality medical services when you need them the most. With a focus on local care and compassionate delivery, Ambetter strives to address the diverse medical needs of its beneficiaries.

Prescription Drugs Coverage

Ambetter’s prescription drug coverage ensures that policyholders have access to the medications they require. The plans offered by Ambetter include various tiers for prescription drugs, catering to different medication needs. It is essential to review the specific formulary to determine the coverage for your prescription medications and ensure they are included in the plan.

Credit: m.facebook.com

Cost And Affordability

Based on an Ambetter Health Insurance Review, Ambetter offers affordable health insurance plans with good coverage. However, it is recommended that you contact your doctors beforehand to ensure they are on-network.

Cost and Affordability of Ambetter Health Insurance Premiums One of the critical factors to consider when choosing a health insurance plan is the premium, the amount you pay for coverage each month. With Ambetter Health Insurance, premiums are designed to be competitive, offering a range of options to suit different budget constraints. Deductibles and Copayments In addition to premiums, it’s essential to understand the deductibles and copayments associated with an insurance plan. Ambetter offers plans with varying deductible and copayment options, allowing individuals to select a strategy that aligns with their financial needs. According to Ambetter Health Insurance reviews, their plans have affordable premiums and reasonable deductibles, making them a viable option for individuals seeking cost-effective coverage. Ambetter’s commitment to providing affordable options for healthcare coverage ensures that individuals can access essential services without facing exorbitant costs. This dedication to affordability makes Ambetter a valuable consideration when choosing a health insurance provider.

Network Of Providers

Ambetter Health Insurance offers a comprehensive network of healthcare providers to ensure you have access to quality care.

In-network Providers

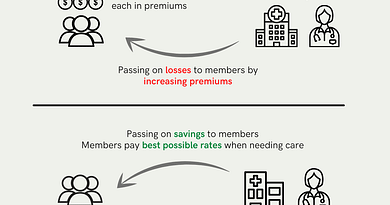

In-network providers are healthcare professionals and medical facilities that have agreements with Ambetter to offer services at discounted rates to policyholders.

Out-of-network Coverage

Out-of-network coverage allows you to receive medical care from providers outside Ambetter’s preferred network. However, coverage for out-of-network services may be limited and incur higher costs.

Customer Satisfaction

When looking for health insurance, customer satisfaction is a crucial factor to consider. You want to ensure that the insurance provider you choose offers quality service and the necessary tools and support for a seamless experience. In this Ambetter Health Insurance review, we will examine aspects of customer satisfaction, including service quality, online tools, and support.

Quality Of Service

Ambetter Health Insurance strives to provide its customers with top-notch service. With a commitment to focused, compassionate, and coordinated care, Ambetter aims to improve the health of its beneficiaries. Their approach centers on the belief that quality healthcare is best delivered locally. This means that you can expect personalized and attentive care from Ambetter.

Ambetter’s plans offer cheap rates without compromising coverage, making it an attractive choice for many individuals.

Online Tools And Support

Ambetter values the convenience and ease of online accessibility. They provide a range of online tools and support to ensure that you have all the resources you need at your fingertips. These tools include:

- Online portal for easy access to policy information and coverage details

- Appointment scheduling and reminders

- Prescription refill management

- Telehealth services for virtual consultations with healthcare professionals

With Ambetter’s online tools and support, you can manage your healthcare needs efficiently and conveniently from your home.

In conclusion, Ambetter Health Insurance strives to prioritize customer satisfaction by offering high-quality service and a range of online tools and support. Their commitment to personalized care and accessibility sets them apart in the health insurance industry.

Pros And Cons

Ambetter Health Insurance is popular among individuals and families seeking affordable healthcare coverage. Like any insurance provider, Ambetter has advantages and disadvantages. Understanding the pros and cons of Ambetter Health Insurance can help you decide whether it’s the right choice for you.

Advantages Of Ambetter Health Insurance

- Competitive rates

- Wide range of coverage options

- Accessible PPO (Preferred Provider Organization) options

- Comprehensive vision and dental benefits

- 24/7 member support

Disadvantages Of Ambetter Health Insurance

- Limitations on network providers

- High out-of-pocket costs for specific prescriptions

- Challenges with finding in-network physicians

- Some customers experienced difficulties with claim processing

Enrollment Process

Choosing the right health insurance is a crucial decision. Ambetter Health Insurance offers a streamlined and efficient enrollment process, making it easier for individuals and families to get the necessary coverage. Understanding how to enroll and crucial deadlines ensures a smooth and successful enrollment experience.

How To Enroll

Enrolling in Ambetter Health Insurance is a straightforward process. You can begin by visiting their official website or contacting their customer service representatives for assistance. Here’s a simple step-by-step guide to enrolling in Ambetter Health Insurance:

- Visit the Ambetter Health Insurance website

- Explore the available plans and coverage options

- Complete the online application form with your personal information

- Review and submit your application

- Receive confirmation of your enrollment status

Important Deadlines

It’s crucial to be aware of essential enrollment deadlines to ensure you don’t miss out on the opportunity to get coverage. Ambetter Health Insurance has specific deadlines for open enrollment, special enrollment, and renewal periods. Being mindful of these deadlines is essential to avoid gaps in coverage and ensure continuous access to healthcare services.

Credit: www.newhorizonscenterspa.org

Frequently Asked Questions On Ambetter Health Insurance Review

How Long Has Ambetter Insurance Been Around?

Ambetter insurance has been around for a significant amount of time.

What’s The Best Health Insurance?

Kaiser Permanente is the best health insurance provider, offering top-notch coverage and services. Aetna suits young adults, while Blue Cross Blue Shield suits the self-employed. UnitedHealthcare stands out for its extensive provider network.

What Type Of Insurance Is Ambetter Texas?

Centene Corporation offers Ambetter Texas as a Health Insurance Marketplace product. It focuses on providing compassionate and coordinated care to improve beneficiaries’ health.

What’s The Best Health Insurance In Florida?

The best health insurance in Florida includes Kaiser Permanente, Aetna, Blue Cross Blue Shield, and UnitedHealthcare.

Conclusion

In short, Ambetter Health Insurance offers competitive rates and convenient PPO options. While some users have reported high costs and limited coverage, others have found the plans affordable and comprehensive. Evaluating your specific healthcare needs before selecting a plan from Ambetter is essential.