Court Ordered Health Insurance After Divorce : Secure Your Post-Divorce Coverage

Court ordered health insurance after divorce ensures that one party is mandated to provide health coverage for the other party, typically the dependent spouse, as part of the divorce settlement. This obligation is legally binding and helps protect the other party’s access to medical services.

Credit: www.bryanfagan.com

Understanding Court-ordered Health Insurance

Court-ordered health insurance after a divorce can be critical to ensuring the well-being of all parties involved. Understanding the implications and requirements of court-ordered health insurance is essential for navigating the complexities of post-divorce arrangements.

What Is Court-ordered Health Insurance?

Court-ordered health insurance mandates that one party provides health insurance coverage for their ex-spouse or children post-divorce. This order is legally binding and requires the responsible party to maintain coverage as specified by the court.

Importance Of Court-ordered Health Insurance

- Ensures continued access to essential healthcare services

- Protects the financial stability of the receiving party

- Compliance with legal obligations set by the court

Determining The Need For Health Insurance

Factors Considered By The Court

- Parental income and ability to provide insurance

- Special health needs of the child

- Availability of affordable coverage options

Parental Agreement

Parental agreement on health insurance can influence court decisions.

Child’s Healthcare Needs

- Current health conditions

- Anticipated medical expenses

- Requirement for ongoing treatment

“` Determining the Need for Health Insurance Factors considered by the court: – Parental income and ability to provide insurance – Special health needs of the child – Availability of affordable coverage options Parental agreement: Parental agreement on health insurance can influence court decisions. Child’s healthcare needs: 1. Current health conditions 2. Anticipated medical expenses 3. Requirement for ongoing treatment

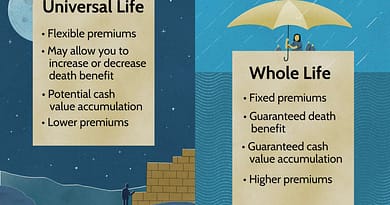

Types Of Court-ordered Health Insurance

Court-ordered health insurance after divorce typically involves the non-custodial parent providing health coverage for the children. This “employee” or “non-custodial” coverage falls under the Children’s Health Insurance Program (CHIP) or the Consolidated Omnibus Budget Reconciliation Act (COBRA). It is a legally mandated obligation.

Types of Court-Ordered Health Insurance

Private health insurance

Having court-ordered health insurance after a divorce can be crucial for ensuring your and your children’s well-being. Private health insurance is one option that may be ordered by the court to provide coverage for medical expenses. This type of coverage is typically obtained through an employer or purchased independently. Private health insurance allows you to choose from various healthcare providers and services.

Government-subsidized health insurance.

Another type of court-ordered health insurance is government-subsidized health insurance. This form of insurance refers to coverage the government provides to individuals who qualify based on specific criteria, such as income level, family size, and other factors. Government-subsidized health insurance programs, such as Obamacare or the Affordable Care Act, help individuals and families afford health coverage that meets their needs.

Medicaid or CHIP

The court may also order Medicaid or the Children’s Health Insurance Program (CHIP) as health insurance. These programs provide low-cost or free healthcare coverage to individuals and families with limited income. Medicaid is specifically designed to help those who can’t afford healthcare, while CHIP focuses on providing health insurance for children. Both programs offer various health services, including doctor visits, prescription medications, and hospital care. Regarding court-ordered health insurance after a divorce, several types may be considered. Private health insurance offers flexibility and choice, while government-subsidized health insurance provides affordable coverage for those who qualify. Medicaid and CHIP are options specifically tailored to individuals and families with limited income, ensuring everyone can access necessary healthcare services.

In conclusion, understanding the different types of court-ordered health insurance can help you navigate the process and ensure that you and your children receive the necessary coverage for your medical needs. Whether it’s private insurance, government subsidies, or Medicaid/CHIP, each option has its advantages and eligibility requirements. Discuss your options with a legal professional to determine the best course of action for your specific situation.

Who Pays For Court-ordered Health Insurance?

One key question often arises when it comes to court-ordered health insurance after a divorce: Who pays for It? This issue can be complex, and it’s essential to understand the different responsibilities of custodial and non-custodial parents and how premium costs are shared. Let’s explore each aspect in more detail.

Responsibility Of The Custodial Parent

- The custodial parent is typically responsible for obtaining health insurance coverage for the child(ren) following a divorce.

- This responsibility includes selecting a suitable health insurance plan that meets the court’s requirements and providing proof of coverage to the non-custodial parent and the court.

Contribution By The Non-custodial Parent

- Upon court order, the non-custodial parent must often contribute a portion of the health insurance premium for the child(ren).

- This contribution is typically outlined in the divorce decree or court order, specifying the percentage of the premium the non-custodial parent must pay.

Sharing The Premium Costs

- Sometimes, the court may order both parents to share the premium costs based on their incomes or financial capabilities.

- Both parents must communicate and cooperate to determine the most cost-effective and comprehensive health insurance coverage for their child(ren).

Navigating Insurance Coverage Terms

When navigating the complex world of insurance coverage terms, it’s essential to understand key concepts to ensure you have the best possible health coverage. Being familiar with these terms will help you make informed decisions about your health insurance after a divorce, from deductibles and copayments to in-network vs. out-of-network providers and coverage for pre-existing conditions.

Understanding Deductibles And Copayments

Deductibles are the amount you must pay out of pocket before your insurance coverage kicks in. Knowing your deductible is crucial as it directly affects how much you’ll have to pay for healthcare services.

Copayments are fixed amounts you pay for covered healthcare services, such as a doctor’s visit or prescription drugs after you’ve paid your deductible. Knowing your copayment amounts for different services is essential to anticipate healthcare costs.

In-network Vs. Out-of-network Providers

Visiting a healthcare provider in your insurance company’s network often lowers costs. In-network providers have negotiated rates with your insurance company, while out-of-network providers may lead to higher out-of-pocket expenses.

Understanding which providers are in-network and the potential costs associated with out-of-network care is essential in making informed decisions about your healthcare services.

Coverage For Pre-existing Conditions

Many individuals worry about maintaining coverage for pre-existing conditions after a divorce. It’s essential to understand your rights regarding these conditions and ensure that your health insurance plan provides adequate coverage for any pre-existing health issues you may have. Understanding the extent of coverage for pre-existing conditions can give you peace of mind and security regarding your healthcare needs.

Credit: www.legaleaseplan.com

Enforcing Court-ordered Health Insurance

Enforcing Court-Ordered Health Insurance

Court-ordered health insurance after divorce is a crucial aspect of ensuring the well-being of children. However, it is not uncommon for parties to face challenges in enforcing these orders. This blog post focuses on enforcing court-ordered health insurance, including consequences for non-compliance, modifications and adjustments, legal support, and available resources.

Consequences For Non-compliance

Non-compliance with court-ordered health insurance can have severe repercussions for the responsible party. Some of the potential consequences include:

- Contempt of court: Failure to comply with a court order can lead to a charge of contempt of court. This can result in fines, penalties, and even imprisonment.

- Loss of custody or visitation rights: If the non-compliance is considered a willful violation, the court may modify custody or visitation arrangements, diminishing the responsible party’s rights.

- Garnishment of wages or assets: The court may order wage garnishment or seize assets to enforce payment of health insurance obligations.

Modifications And Adjustments

Sometimes, circumstances may change after a court orders health insurance, necessitating modifications or adjustments. Here are vital factors to consider:

- Income changes: If the responsible party experiences a significant change in income, they may need to petition the court to modify the health insurance requirements accordingly.

- Insurance availability: If the existing health insurance coverage becomes unavailable or too expensive, parties may need to seek alternative options and request modifications from the court if necessary.

- Healthcare needs: In some cases, changes in a child’s healthcare needs may require court-ordered health insurance coverage adjustments. This could involve adding specific treatments or medications.

Legal Support And Resources

When facing challenges with court-ordered health insurance enforcement or seeking modifications, seeking legal support and utilizing available resources is essential. Here are some valuable options:

- Family law attorneys: Consult with experienced attorneys specializing in divorce and child custody matters. They can provide expert guidance and effectively advocate for your rights and interests.

- Legal aid organizations: Non-profit legal aid organizations offer valuable resources, including legal representation and advice for individuals who cannot afford private attorneys.

- Online legal platforms: Online platforms provide access to affordable legal services, enabling individuals to find legal help, obtain document templates, and navigate the process effectively.

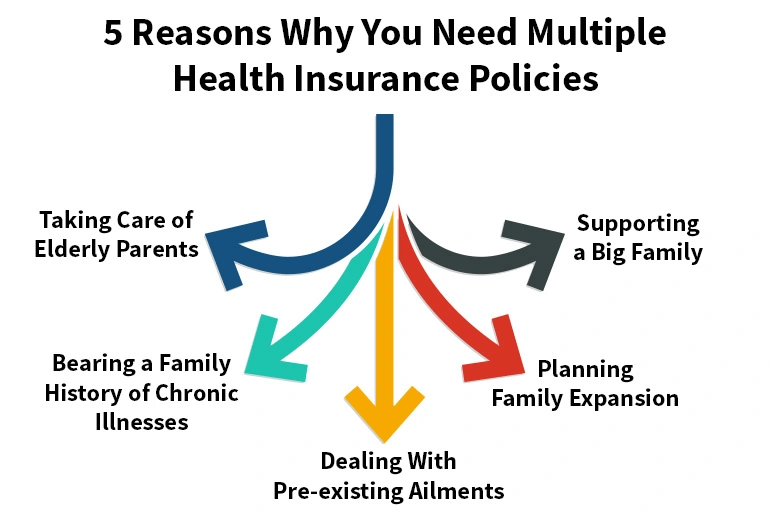

Exploring Alternative Options

When facing court-ordered health insurance after divorce, it’s pivotal to examine alternative options that can provide you with flexibility and control over your healthcare. Here are some viable alternatives to consider:

Health Savings Accounts

A health savings account (HSA) allows you to save money tax-free for medical expenses, offering financial security and potential long-term savings.

Healthcare Subsidies

Healthcare subsidies provide financial assistance for individuals to afford health insurance premiums, making it more manageable post-divorce.

Employer-sponsored Plans

Employer-sponsored plans offer comprehensive coverage at potentially lower costs, ensuring you have access to quality healthcare benefits.

Credit: www.rocketlawyer.com

Navigating Changes In Health Insurance

Updating Insurance Coverage

Court-ordered health insurance after divorce might necessitate updating coverage promptly.

Ensure coverage reflects current needs.

Review policy details for any necessary revisions.

Changing Providers

Adapting to a new healthcare provider may be required post-divorce.

Confirm the network status of the new provider under the court order.

Notify the previous provider of any changes in coverage.

Adjusting Coverage As Needed

Monitor insurance needs regularly for adequacy.

Adjust coverage based on changing health circumstances.

Stay informed on coverage adjustments to remain compliant.

Frequently Asked Questions For Court Ordered Health Insurance After Divorce

What Is Court-ordered Health Insurance After Divorce?

Court-ordered health insurance after divorce requires one party to provide health insurance for the other, typically for a certain period or until specific conditions are met. This ensures ongoing healthcare coverage for the ex-spouse and any children involved.

How Is Court-ordered Health Insurance Enforced?

Court-ordered health insurance is enforced through legal means, often outlined in the divorce decree. Legal action can be taken if the responsible party fails to provide the required coverage, including potential penalties or contempt of court charges.

Can Court-ordered Health Insurance Be Modified?

Yes, court-ordered health insurance can be modified under certain circumstances. Changes in employment, availability of alternative coverage, or shifts in the financial situation of either party can warrant modifications to the existing health insurance requirements. It’s advisable to seek legal counsel for such changes.

What Happens If Court-ordered Health Insurance Is Not Affordable?

If court-ordered health insurance is unaffordable for the responsible party, they can petition the court for a modification or seek alternative coverage options. It’s essential to address such challenges promptly and transparently through legal channels to avoid potential repercussions for non-compliance.

Conclusion

Court-ordered health insurance after divorce is crucial for ensuring the well-being of both individuals and their children. It provides financial security and access to necessary medical care. Understanding the process and requirements is essential to avoid pitfalls and ensure proper coverage.

By being knowledgeable and proactive, individuals can confidently navigate this aspect of divorce and ensure their family’s continued health and well-being.