Best Health Insurance for International Students in USA: Essential Coverage Guide

Best Health Insurance for International Students in USA: International students studying in the United States must have comprehensive health insurance coverage to ensure access to quality healthcare services and financial protection against medical expenses.

Finding the right health insurance plan can be challenging with various options available. However, by considering factors like affordability, coverage limits, network providers, deductibles, and other benefits, international students can select the best health insurance plan that suits their needs and budget.

We will explore some of the top health insurance options for international students in the USA.

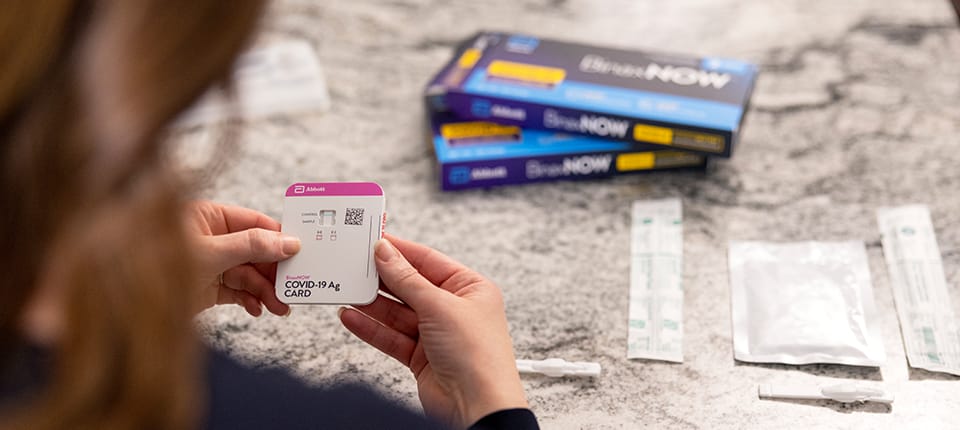

Credit: issuu.com

Importance Of Health Insurance For International Students

Health insurance for international students is crucial. Below are key reasons why international students in the USA need to have appropriate health insurance coverage.

Financial Protection

Health insurance provides financial security. It safeguards international students from high medical expenses that could otherwise cause financial strain.

Access To Quality Healthcare

Having health insurance ensures access to top-notch medical facilities. It enables international students to receive quality healthcare services promptly.

Credit: internationalaffairs.uchicago.edu

Factors To Consider When Choosing Health Insurance

When choosing health insurance as an international student in the USA, it’s essential to consider coverage for medical services, access to healthcare providers, the cost of premiums and deductibles, and any limitations or exclusions. Understanding these factors will help you find the best health insurance plan for your needs and budget.

Coverage Options

International students in the USA should prioritise coverage that includes both medical and non-medical emergencies.

In-network Providers

Choosing health insurance with a vast network of in-network providers can reduce out-of-pocket expenses.

Pre-existing Conditions

Consider health insurance plans that cover pre-existing conditions to avoid limitations on treatment options.

Prescription Drug Coverage

Please ensure your health insurance plan provides comprehensive coverage for prescription drugs to manage ongoing health needs. International students in the USA must consider key factors when choosing health insurance. Coverage options should include medical and non-medical emergencies. In-network providers’ networks should be comprehensive to reduce expenses. Choosing a plan covering pre-existing conditions prevents limitations. Prescription drug coverage is crucial for ongoing health management.

Top Health Insurance Options For International Students In The Usa

Ensuring you have the right health insurance coverage is crucial when studying abroad. Medical expenses can be extremely high in the United States, and having insurance can provide you with peace of mind and financial protection. This article highlights three top health insurance options for international students in the USA: Company A, Company B, and Company C.

Company A

Company A offers comprehensive health insurance plans for international students studying in the USA. Their plans provide coverage for both emergencies and routine medical care. With an extensive network of providers, students can access quality healthcare anywhere in the country.

- Key Features:

- Wide network of doctors and hospitals

- 24/7 multilingual customer service

- Access to preventative care services

- Coverage for prescription medications

Company B

Company B is excellent for international students seeking affordable, flexible health insurance options. They offer different plans tailored to meet the specific needs of students, ensuring they have access to quality healthcare without the burden of high costs.

- Key Features:

- Low-cost premium options

- Choice of deductibles

- Access to a network of healthcare providers

- Emergency medical evacuation coverage

Company C

If you are looking for a health insurance provider that offers comprehensive coverage and extensive benefits, consider Company C. Their plans are specifically designed for international students, ensuring they receive the necessary medical care while studying in the USA.

- Key Features:

- Wide range of coverage options

- In-network and out-of-network coverage

- Access to preventive care services at no extra cost

- Coverage for mental health services

It is essential to carefully evaluate these three top options to determine which fits your needs and budget. By selecting the right health insurance, you can enjoy your time as an international student in the United States while having peace of mind knowing that your health is protected.

Comparison Of Coverage And Costs

Having the right health insurance is essential for international students in the USA. Comparing coverage and costs for health insurance plans can help students decide on their healthcare needs. Here, we’ll compare coverage and costs, examining key factors like premiums, deductibles, out-of-pocket expenses, and coverage limitations.

Premiums

Premiums are the fixed monthly payments an international student must make to the insurance company to keep their coverage active. Students must find a plan with affordable premiums that fit their budget while offering comprehensive coverage.

Deductibles

Deductibles are the amount a student must pay out of pocket before the insurance plan covers their medical expenses. Finding a plan with a reasonable deductible is essential to avoid financial strain in medical emergencies.

Out-of-pocket Expenses

Out-of-pocket expenses include copayments, coinsurance, and any costs not covered by the insurance plan. Students need to consider these expenses when evaluating the affordability of a health insurance plan.

Coverage Limitations

Coverage limitations outline the specific services, treatments, or conditions the insurance plan may not fully cover. Understanding these limitations is crucial to ensure that the plan meets the student’s healthcare needs without unexpected gaps in coverage.

How To Apply For Health Insurance

When applying for health insurance as an international student in the USA, it’s essential to understand the process to ensure you have the coverage you need while studying abroad. Here’s a detailed guide on how to apply for health insurance, including eligibility requirements, the application process, and the required documentation.

Eligibility

To be eligible for health insurance as an international student in the USA, you typically need to be enrolled in a full-time course at a college, university, or other educational institution. Many insurance providers also require that you be in the country on a valid student visa. Additionally, some insurance plans may have specific eligibility criteria based on age and other factors, so it’s important to carefully review the requirements of each plan before applying.

Application Process

The application process for health insurance as an international student in the USA usually involves selecting a policy that best fits your needs and completing an online application form. Before choosing, you can explore different insurance providers and compare their coverage options, premiums, and benefits. Once you’ve decided on a plan, you can proceed with the application, providing the necessary information and documents as required.

Required Documentation

When applying for health insurance, you may be asked to provide specific documentation, such as a copy of your passport, proof of enrollment in an eligible educational institution, and a valid student visa. Additionally, some insurance plans may require you to submit proof of financial resources or a sponsor’s guarantee of payment. It’s important to carefully review the list of required documents provided by the insurance provider to ensure a smooth application process.

Credit: vaden.stanford.edu

Tips For Maximizing Health Insurance Benefits

When maximising your health insurance benefits as an international student in the USA, it’s essential to start by understanding your policy. Take the time to carefully review the terms and conditions of your insurance plan, as this will help you make the most informed decisions regarding your healthcare.

One of the key ways to get the most out of your health insurance plan is by seeking out in-network healthcare providers. These are doctors, specialists, hospitals, and clinics with a contract with your insurance company, meaning they will charge you lower rates for their services.

When looking for in-network providers, please take a look at the official list provided by your insurance company. This list will indicate which providers have agreed to the discounted rates, enabling you to receive the most affordable care.

You can take advantage of the preventive care services covered by your insurance. These services are designed to keep you healthy and catch potential health issues before they become more severe and expensive.

Examples of preventive care services include annual check-ups, vaccinations, screenings, and well-woman exams. Proactively scheduling and attending these appointments can save money and avoid more significant health problems in the long run.

You understand your health insurance’s coverage for emergency and urgent care situations. Emergencies can happen anytime, and being prepared will help you avoid financial stress during a medical crisis.

Know the nearest in-network emergency room and the procedure for seeking care during an emergency. Additionally, familiarise yourself with the appropriate steps for urgent care, such as seeking treatment at an urgent care centre instead of an emergency room for non-life-threatening conditions.

In conclusion, you can maximise your health insurance benefits as an international student in the USA by understanding your health insurance policy, seeking in-network providers, utilising preventive care services, and knowing how emergency and urgent care are covered. Being proactive with your healthcare will ensure your well-being and help protect your finances against unexpected medical expenses.

Common Health Insurance Terminology

Understanding common health insurance terminology is crucial for international students in the USA. Below, we break down key terms you need to know when choosing a health insurance plan.

1. Premium

The premium is the amount you pay for your health insurance plan, typically every month.

2. Deductible

The deductible is the amount you must pay out of pocket for covered services before your insurance plan starts to pay.

3. Co-pay

A co-pay is a set amount for a covered service or prescription drug, typically due at the time of service.

4. Out-of-network

Out-of-network refers to healthcare providers or facilities not part of your insurance plan’s network. Using out-of-network services may result in higher costs.

Support Resources For International Students

In the United States, international students can access various support resources to aid their health insurance needs. These sources are crucial in helping students navigate the complexities of healthcare coverage and ensure they receive the necessary support during their studies.

University Health Insurance Office

The University Health Insurance Office serves as a primary point of contact for international students seeking guidance on health insurance options.

- ` `

- Provides information on university-sponsored health insurance plans. ` `

- Offers assistance with filing claims and understanding policy details. ` `

- Coordinates with insurance providers to address student concerns promptly. ` `

International Student Services

International Student Services departments offer holistic support to international students, including vital resources related to health insurance.

- ` `

- Facilitates enrollment in university-endorsed health insurance programs. ` `

- Organize workshops and orientations to educate students on healthcare options. ` `

- Connects students with on-campus healthcare providers for convenient access to services. ` `

Insurance Provider’s Customer Service

Effective Insurance Provider Customer Service is essential for international students dealing with health insurance queries and claims.

- ` `

- Offers multilingual support to cater to the diverse student population. ` `

- Assists with benefit inquiries and coverage clarification. ` `

- Resolves billing and reimbursement issues promptly to alleviate student concerns. ` `

Frequently Asked Questions For Best Health Insurance For International Students in the USA

What Is The Best Health Insurance For International Students In The Usa?

The best health insurance for international students in the USA typically offers comprehensive coverage for medical expenses, including doctor’s visits, prescription drugs, and emergency care. Look for plans that include mental health services and coverage for pre-existing conditions.

How Can International Students In The Usa Find The Right Health Insurance?

International students in the USA can find the right health insurance by researching different insurance providers, comparing coverage options and premiums, and considering factors such as network providers, deductibles, and coverage limits. Some colleges and universities may also offer insurance options tailored to international students.

What Factors Should International Students Consider When Choosing Health Insurance?

International students in the USA should consider factors such as the extent of coverage, network providers and facilities, cost of premiums and deductibles, coverage for pre-existing conditions, mental health services, and access to emergency care. Also, I would like you to know that understanding the claims process and customer support is essential for a smooth experience.

Conclusion

In summary, finding the best health insurance for international students in the USA is crucial for their well-being and peace of mind. Students can make informed decisions that suit their needs and budget by considering coverage, cost, and network providers.

With comprehensive health insurance, students can focus on their studies and enjoy their time in the USA, knowing that they are protected in case of any medical emergencies.