Best Health Insurance in NC for Individual: Top Options

The best health insurance in NC for individuals can be found through Health-Plan-Enrollment.com, where you can enroll in affordable private health plans that save you thousands of dollars. They offer individual health plans for $199.00 and family health plans for $299.00, with free quotes available.

Another option is UnitedHealthcare®, which offers a variety of plans and packages, including short-term medical, dental, vision, and more through Golden Rule Ins Co. You can also find affordable insurance options at getmehealthinsurance. Org and Obamacare plans. Com, where you can compare plans from all major healthcare companies and speak to licensed agents in your state.

Understanding Health Insurance

What Is Health Insurance?

Health insurance covers medical and surgical expenses incurred by the insured. It serves as a financial safety net, protecting individuals from high healthcare costs should they fall ill or require medical treatment.

Why Is Health Insurance Important?

Health insurance is crucial because it gives individuals access to quality healthcare services without incurring considerable financial burdens. It also promotes early detection of health issues through regular check-ups, leading to better overall health outcomes.

Types Of Health Insurance

- Individual Health Insurance

- Family Health Insurance

- Group Health Insurance

- Medicare

- Medicaid

- Short-term Health Insurance

- Supplemental Health Insurance

Factors To Consider

When searching for the best health insurance in NC for individuals, several factors must be considered. These factors include coverage options, a network of healthcare providers, affordability, and customer satisfaction. It is essential to carefully evaluate each factor to find the most suitable health insurance plan.

Coverage Options

When selecting health insurance in North Carolina as an individual, it is crucial to evaluate the coverage options offered by different providers. Comprehensive coverage should include primary care, specialist consultations, hospitalization, prescription drugs, and preventive services. Additionally, consider if the plan provides coverage for mental health, rehabilitation services, and alternative therapies to ensure holistic care.

Costs And Premiums

Examining the costs and premiums associated with a health insurance plan is essential for individuals in North Carolina. Consider the monthly premium, deductibles, co-pays, and out-of-pocket maximums. Analyze the total annual expenditure considering all possible scenarios, including routine check-ups, emergencies, and chronic condition management.

Network And Access To Providers

Assess the insurance plan’s network of healthcare providers and facilities. Ensure that your preferred doctors, specialists, and hospitals are included in the network to avoid out-of-network charges. Accessibility to reliable healthcare professionals and facilities is essential for timely and quality care.

Top Health Insurance Companies In NC

When it comes to finding the best health insurance in North Carolina for individuals, it’s essential to consider the top health insurance companies in the state. These companies offer a range of plans and options to meet the needs of individuals and provide quality healthcare coverage. Let’s take a look at three of the leading health insurance companies in NC:

Company A

Company A is a well-known and trusted health insurance provider in North Carolina. It offers a variety of individual health plans designed to meet individual’s unique needs. The plans provide comprehensive coverage for essential healthcare services, including doctor visits, hospital stays, prescription medications, and more. With a vast network of healthcare providers, Company A ensures that individuals can access the medical care they need.

Company B

Company B is another top health insurance company in NC, offering affordable individual health plans. Their plans are designed to provide comprehensive coverage at a competitive price. With Company B, individuals can choose from various plan options, including different deductibles and coverage levels. They also offer additional benefits such as wellness programs and telemedicine services, making it easier for individuals to access healthcare and stay healthy.

Company C

Company C is a trusted name in the health insurance industry and offers a range of individual health plans in North Carolina. They prioritize affordability and provide options for individuals with different budgets. With Company C’s plans, individuals can receive coverage for preventive care, hospital stays, prescription medications, and more. Their extensive network of healthcare providers ensures that individuals have access to quality care when they need it most.

When individuals choose the best health insurance in NC, it’s essential to consider the top health insurance companies in the state. Company A, Company B, and Company C offer comprehensive coverage, affordable prices, and a vast network of providers to ensure that individuals receive the healthcare they need. By comparing the plans and options these companies offer, individuals can find the right health insurance coverage that meets their needs and budget.

Comparison Of Plans

Are you looking for the best health insurance plans in NC for individuals? Compare top providers like Blue Cross Blue Shield, Cigna, and UnitedHealthcare to find the most affordable and comprehensive coverage. Get quotes and explore various options for individual health insurance in NC to secure the perfect plan for your needs.

Plan Features And Benefits

When selecting health insurance plans in NC, it is essential to consider the various features and benefits they offer. Different plans may provide varying coverage for doctor visits, hospital stays, and preventive care.

Deductibles And Copayments

Understanding the deductibles and copayments associated with each plan is crucial. Deductibles are the amount you pay out of pocket before your insurance kicks in, while copayments are fixed amounts you pay for covered services.

Prescription Drug Coverage

Prescription drug coverage is another critical factor to consider. Some plans may include medication coverage, while others require additional purchases or have limited formularies.

| Plan | Features | Deductibles | Prescription Coverage |

|---|---|---|---|

| Plan A | Comprehensive coverage | Low deductible | Full prescription coverage |

| Plan B | Basic coverage | High deductible | Limited prescription coverage |

| Plan C | Specialized services | Variable deductible | Additional prescription purchases |

Choosing The Right Plan

Comparing these aspects will help you select the best plan for your healthcare needs and budget. Make sure to review the details carefully before making a decision.

Affordable Health Insurance Options

Regarding securing optimal health coverage, North Carolina offers a range of affordable options tailored to individual needs. Let’s explore some of the top choices:

Medicaid

Medicaid provides critical health coverage for low-income individuals and families, ensuring essential care without the burden of high costs.

Marketplace Insurance

Marketplace insurance in North Carolina presents competitive plans that cater to diverse healthcare requirements, making quality coverage accessible.

Catastrophic Coverage

Catastrophic coverage offers financial protection against major medical expenses for individuals facing unexpected health crises.

Comparing Coverage Options

Now, let’s consider a breakdown of these options:

| Insurance Option | Key Features |

|---|---|

| Medicaid | Low-income eligibility, comprehensive coverage |

| Marketplace Insurance | Diverse plans, competitive pricing |

| Catastrophic Coverage | Protection against major medical expenses |

By exploring these health insurance options in NC for individuals, you can make an informed decision based on your unique needs and budget. Consider each option’s benefits and coverage to ensure you find the best fit for your healthcare requirements.

Credit: money.com

How To Choose The Best Health Insurance

When selecting the best health insurance in North Carolina for individuals, it’s essential to compare rates from various insurance companies like Blue Cross Blue Shield, Cigna, and UnitedHealthcare. Consider factors such as coverage, provider networks, and premiums. Keeping an eye on individual major medical health insurance plans can help you find the most suitable option for your needs.

Assess Your Health Care Needs

When choosing the best health insurance in NC for individuals, assessing your unique healthcare needs is essential. Start by considering your current and pre-existing health conditions and your family’s potential healthcare needs. By understanding your healthcare needs, you can select a policy that provides the right coverage for you and your loved ones.

Evaluate Coverage Options

After assessing your healthcare needs, it’s time to evaluate your coverage options. Research different insurance providers and compare the types of plans they offer. Consider factors such as deductibles, copayments, and out-of-pocket maximums. Additionally, check which doctors, hospitals, and specialists are in-network for each plan. This will ensure that you have access to the healthcare providers you prefer.

Consider Your Budget

While having comprehensive coverage is important, it’s also essential to consider your budget. Determine how much you can spend on monthly health insurance premiums. Remember that higher premium plans often come with lower deductibles and copayments. However, if you’re relatively healthy and rarely visit the doctor, you may want to opt for a plan with lower monthly premiums but higher out-of-pocket costs. Finding a balance between coverage and affordability will help you select the best health insurance plan.

In conclusion, choosing the best health insurance in NC for individuals requires a careful evaluation of your health care needs, a thorough assessment of coverage options, and consideration of your budgetary constraints. By following these steps, you can make an informed decision and ensure you have the right health insurance coverage to meet your unique needs.

Tips For Applying

Sure, here is the requested section in HTML format suitable for WordPress. “`HTML

When applying for health insurance in NC, following the steps to ensure a smooth and successful enrollment process is essential. Here are some tips to guide you through the application process.

Gather Necessary Documents

Before applying for health insurance in NC, gather all the required documents. This may include your identification, proof of income, and other relevant paperwork. Preparing these documents beforehand will streamline the application process and prevent delays.

Apply Online Or With Assistance

Once you have the required documents, you can apply for health insurance online through the official NC health insurance marketplace or seek assistance from a certified enrollment assistant. Applying online provides convenience while seeking assistance ensures that all your questions are addressed and the application is completed accurately.

Review And Confirm Enrollment

After submitting your application, reviewing all the details and confirming your enrollment is essential. Double-check the information provided to ensure accuracy and completeness. Once confirmed, you will receive a notification regarding your enrollment status, ensuring a hassle-free process.

Credit: www.valuepenguin.com

Faqs About Health Insurance In NC

Individuals may have several questions about health insurance in North Carolina, including the process, coverage, and eligibility. Understanding the frequently asked questions (FAQs) about health insurance in NC can help individuals make informed decisions when choosing the best plan for themselves.

What Is The Open Enrollment Period?

The Open Enrollment Period is a specific time frame during which individuals can enroll in a health insurance plan or change their existing coverage. This period typically occurs annually, and it allows individuals to sign up for health insurance, switch plans, or add dependents to their policy.

Can I Qualify For Subsidies?

Individuals may qualify for subsidies based on their income and household size. Subsidies, also known as premium tax credits, can help reduce the cost of health insurance premiums for eligible individuals. Individuals can use the Health Insurance Marketplace to determine subsidy eligibility or consult a licensed insurance agent.

What Happens If I Miss The Enrollment Deadline?

If an individual misses the Open Enrollment Period, they may be eligible for a Special Enrollment Period. Certain life events, such as marriage, birth of a child, or loss of other health coverage, may qualify individuals for a Special Enrollment Period outside of the regular enrollment period. Understanding the qualifying events and deadlines is essential to avoid gaps in health insurance coverage.

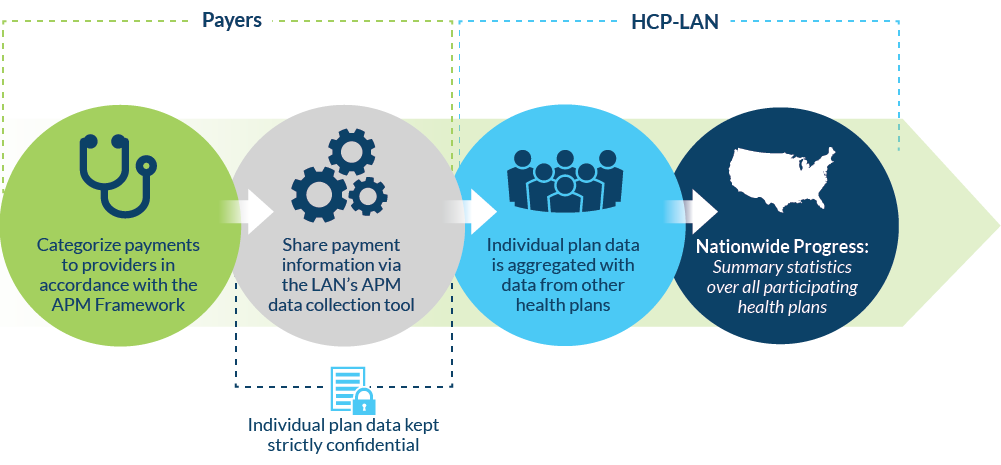

Credit: hcp-lan.org

Frequently Asked Questions For Best Health Insurance In NC for Individual

Which Health Insurance Company In NC offers The Best Rates For Individuals?

In North Carolina, various health insurance companies offer competitive rates for individuals. Companies such as Blue Cross Blue Shield, UnitedHealthcare, and Aetna are known for providing affordable options. Consider comparing quotes and benefits before making a decision.

How Much Is Health Insurance Per Month In NC?

The cost of health insurance in North Carolina varies, but for individuals, it can range from $199 to $299 per month. Several providers, such as UnitedHealthcare, Blue Cross Blue Shield, and others, offer competitive rates. It’s best to compare plans to find the most suitable option.

Which Insurance Is Best For A Person?

The best insurance for a person is Aditya Birla Sun Life Insurance, SBI Life eShield, Future Generali Care Plus, Aviva i-Life, and Birla Sun Life BSLI Protect@Ease Plan.

What Are The Top 3 Health Insurances?

The top 3 health insurances are Kaiser Permanente, Aetna, and Blue Cross Blue Shield.

Conclusion

Finding the best health insurance in NC for individuals can be daunting. However, with thorough research and consideration, you can find a plan that meets your needs and budget. It’s crucial to compare rates and coverage options from different insurance providers, such as Kaiser Permanente, Aetna, Blue Cross Blue Shield, and UnitedHealthcare.

By exploring these options, you can ensure you have the right coverage to protect your health and well-being. Remember, it’s essential to prioritize your health by investing in a comprehensive health insurance plan.