Best Health Insurance in Nh: Top Choices for Coverage

The best health insurance in NH is Blue Cross Blue Shield. Kaiser Permanente and Aetna also offer quality plans.

In New Hampshire, having access to reliable healthcare is crucial. With various health insurance companies available, residents can choose a plan that best suits their needs. From Blue Cross Blue ShielShield’s available options to Kaiser Permanente’s notch plans, there are choices for individuals, families, and young adults.

NH residents can also benefit from same-day care options by opting for Aetna. Making informed decisions about health insurance ensures peace of mind and access to quality healthcare services when needed. Let’s look at NH’s top health insurance providers to find the perfect coverage for your healthcare needs.

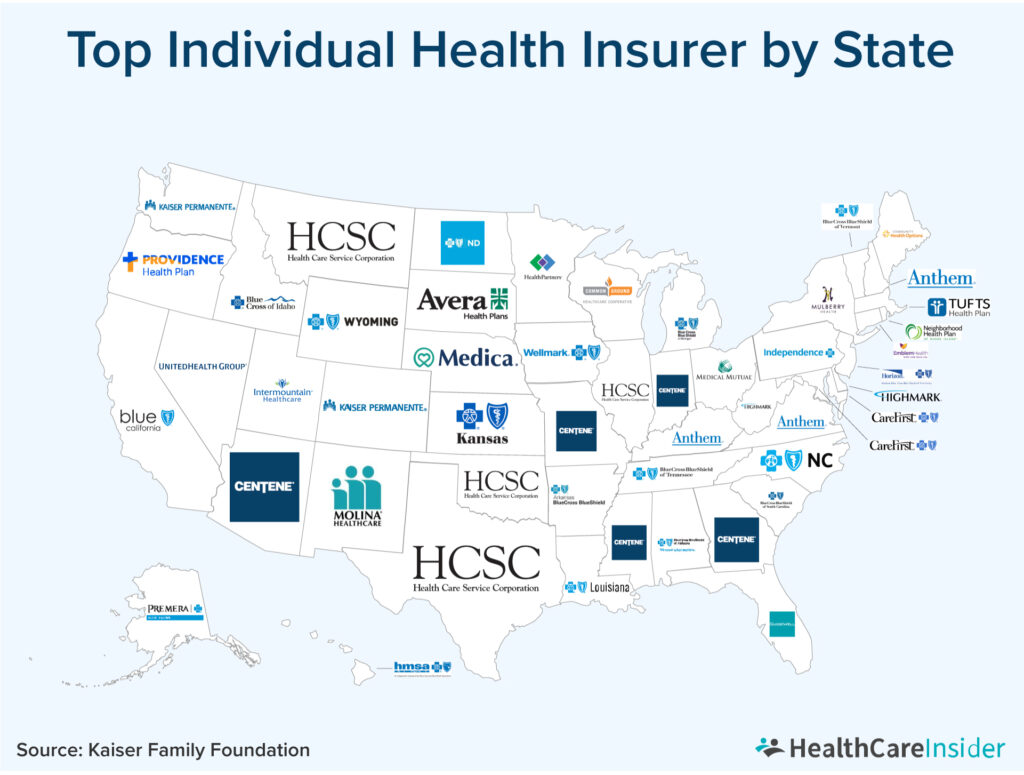

Credit: healthcareinsider.com

Best Health Insurance Providers

When choosing the best health insurance provider in New Hampshire, coverage, affordability, and customer satisfaction must be considered. Below are the top health insurance providers, each offering unique benefits to cater to different healthcare needs.

Blue Cross Blue Shield

Blue Cross Blue Shield is the best overall health insurance provider in New Hampshire. Comprehensive coverage and a vast network of healthcare providers offer peace of mind to individuals and families seeking reliable healthcare protection.

Kaiser Permanente

Kaiser Permanente is recognized for providing the highest-quality plans in New Hampshire. Its emphasis on preventive care and innovative health programs sets it apart, ensuring members can access top-notch medical services.

Oscar

Oscar Health Insurance is known for its extensive health management programs, making it a preferred choice for those seeking personalized healthcare solutions. Their focus on technology and member support enhances the overall healthcare experience.

Aetna Cvs Health

Aetna CVS Health excels in providing convenient same-day care options, which are ideal for individuals requiring immediate medical attention. Their integrated approach to healthcare delivery ensures efficient and effective services.

Credit: www.garnett-powers.com

Top Health Insurers In New Hampshire

When choosing the right health insurance provider in New Hampshire, it’s essential to consider the options available and find the one that best suits your needs. This article will explore the top health insurers in New Hampshire, highlighting their key features and benefits.

New India Assurance Co. Ltd.

New India Assurance Co. Ltd. is one of the leading health insurance companies in New Hampshire. With a wide range of plans, it offers comprehensive coverage for individuals and families. Its policies provide financial protection against medical expenses, hospitalization costs, and other healthcare needs. The company also offers a cashless facility, ensuring hassle-free claim settlements.

Oriental Insurance Co. Ltd.

Oriental Insurance Co. Ltd. is another reputable health insurance provider in New Hampshire. They offer a variety of health insurance plans that cater to different budget and coverage needs. Their policies cover medical expenses, including hospitalization, diagnostic tests, and treatments. Oriental Insurance Co. Ltd. also provides a cashless hospitalization facility, making it convenient for policyholders to avail of quality healthcare services.

United India Insurance Co. Ltd.

United India Insurance Co. Ltd. is known for its comprehensive health insurance plans, which offer extensive coverage for individuals and families. Policies include coverage for hospitalization, pre- and post-hospitalization expenses, ambulance charges, and more. The company also provides a vast network of hospitals and healthcare providers, ensuring easy access to quality medical services. United India Insurance Co. Ltd. is committed to providing affordable and reliable health insurance solutions.

Aditya Birla Health Insurance Co. Ltd.

Aditya Birla Health Insurance Co. Ltd. is a trusted name in the New Hampshire health insurance industry. It offers a range of health insurance plans designed to cater to different healthcare needs. Policies cover hospitalization, critical illnesses, daycare procedures, and more. Aditya Birla Health Insurance Co. Ltd. also offers wellness programs and other value-added services to promote a healthy lifestyle among policyholders.

Care Health Insurance Ltd.

Care Health Insurance Ltd. is a renowned health insurance provider in New Hampshire. It offers a diverse range of health insurance plans that provide comprehensive coverage for medical expenses. Policies cover hospitalization costs, doctor consultations, diagnostic tests, and more. Care Health Insurance Ltd. also offers a cashless hospitalization facility and a vast network of hospitals, ensuring easy access to quality healthcare services.

Manipalcigna Health Insurance Co. Ltd.

ManipalCigna Health Insurance Co. Ltd. is committed to providing innovative and comprehensive health insurance solutions in New Hampshire. Their health insurance plans offer coverage for hospitalization, critical illnesses, surgeries, and more. The company also provides various additional benefits, such as health assessments, online doctor consultations, and discounts on pharmacy bills. ManipalCigna Health Insurance Co. Ltd. aims to make healthcare accessible and affordable.

Niva Bupa Health Insurance Co. Ltd.

Niva Bupa Health Insurance Co. Ltd. is a leading health insurance provider in New Hampshire. It offers a wide range of plans that cater to different healthcare needs and budgets. Policies cover hospitalization costs, daycare procedures, pre- and post-hospitalization expenses, and more. Niva Bupa Health Insurance Co. Ltd. also provides value-added services like health assessments and wellness programs to promote a healthy lifestyle among policyholders.

Healthcare In New Hampshire

Experience the best healthcare in New Hampshire with top health insurance providers like Blue Cross Blue Shield, Kaiser Permanente, Oscar, and Aetna CVS Health. Find comprehensive coverage, health management programs, and same-day care options to meet your needs and budget.

Quality Of Healthcare In New Hampshire

New Hampshire is renowned for its high-quality healthcare system, ensuring residents can access top-notch medical services. The state consistently earns top rankings in state healthcare, reflecting its commitment to providing excellent healthcare facilities. The quality of healthcare in New Hampshire is a crucial factor to consider when selecting the best health insurance plan. By understanding the healthcare landscape in the state, individuals can make informed decisions to protect their well-being.

Health Insurance Companies Operating In New Hampshire

New Hampshire offers a variety of health insurance options provided by reputable companies. These insurance providers strive to meet the diverse healthcare needs of the patients. Here are some of the leading health insurance companies operating in New Hampshire:

- Aetna: https://www.aetna.com/

- Ambetter: https://www.ambetterhealth.com

- Anthem Blue Cross and Blue Shield: https://www.anthem.com

These companies offer a range of health insurance plans tailored to individual and family needs. It is essential to explore the options provided by each company to find the plan that best suits your requirements.

Credit: www.valuepenguin.com

Affordable Options

When searching for health insurance, finding affordable options is essential. In New Hampshire, several choices cater to individuals and families looking for cost-effective health insurance plans. Let’s learn about the cheapest health insurance plans in New Hampshire and the options for low-income individuals.

Cheapest Health Insurance Plans In New Hampshire

Regarding affordability, Anthem stands out as the provider of the cheapest health insurance plans in New Hampshire. Across all coverage tiers and in every county, Anthem offers cost-effective options to meet varying budget needs.

Options For Low-income Individuals

For low-income individuals, Ambetter is a top choice in New Hampshire. With competitive rates and a range of plan options, Ambetter caters to those looking for affordable health insurance solutions without compromising on coverage.

Choosing The Right Plan

When selecting your health insurance plan in New Hampshire, it’s vital to consider various factors to ensure you choose the right one to meet your needs. Understanding the available plan types and evaluating what each offers can significantly impact your healthcare coverage and financial well-being.

Factors To Consider When Selecting A Health Insurance Plan

- Cost: Determine monthly premiums, deductibles, copayments, and coinsurance that align with your budget.

- Coverage: Check if the plan includes services you need, such as prescription drugs, preventive care, and specialist visits.

- Network: Ensure your preferred doctors, hospitals, and healthcare providers are within the plan to avoid out-of-network costs.

- Additional Benefits: Evaluate extra perks like telemedicine, wellness programs, or vision and dental coverage.

- Copayment vs. Coinsurance: Understand the difference and choose based on your healthcare usage.

Available Plan Types In New Hampshire

| Plan Type | Description |

|---|---|

| Health Maintenance Organization (HMO) | You must select a primary care physician and obtain referrals for specialist visits. |

| Preferred Provider Organization (PPO) | Offers flexibility to see any provider but with lower costs for in-network services. |

| Exclusive Provider Organization (EPO) | Mandates care from in-network providers only, except for emergencies. |

| Point of Service (POS) | Combines aspects of HMO and PPO plans, allowing some out-of-network coverage. |

Health Insurance Enrollment

Enrolling in a health insurance plan is crucial to securing your well-being. Understanding the process and options available in New Hampshire is essential.

Process Of Enrolling In A Health Insurance Plan

Enrolling in a health insurance plan in New Hampshire is straightforward and can be done through various avenues.

- Consider your healthcare needs and budget.

- Research available insurance plans and providers.

- Visit the official Health Insurance Marketplace or insurance carrier websites.

- Compare plan benefits, coverage options, and costs.

- Select the plan that best suits your requirements.

- Complete the enrollment application online or through other specified methods.

- Submit any necessary documentation.

Health Insurance Marketplace In New Hampshire

In New Hampshire, the Health Insurance Marketplace is a platform where individuals, families, and small businesses can compare and enroll in health insurance plans.

| Marketplace | Website |

|---|---|

| Aetna | Visit Website |

| Ambetter | Visit Website |

| Anthem Blue Cross and Blue Shield | Visit Website |

Researching the available plans on the marketplace can help you make an informed decision based on your healthcare needs and budget constraints.

Frequently Asked Questions

What Is The Average Cost Of Best Health Insurance in Nh?

The average cost of health insurance in NH varies and depends on factors such as age, coverage, and health.

What Are The Top 3 Health Insurances?

The top three health insurance companies are Blue Cross Blue Shield, Kaiser Permanente, and Oscar. These companies are known for quality plans, management programs, and same-day care.

Which Insurer Is Best For Health Insurance?

Blue Cross Blue Shield is the best health insurance insurer, offering top-quality plans for individuals and families.

Does New Hampshire Have Good Healthcare?

New Hampshire offers quality healthcare with top-ranked health insurance companies like Anthem and Ambetter. Residents can access affordable, comprehensive health insurance plans with a robust healthcare network.

Conclusion

Finding the best health insurance in NH requires thorough research and comparison. Companies like Blue Cross Blue Shield, Kaiser Permanente, and others offer quality plans with varying features. It’s Crucial to consider individual needs and budget to select the most suitable coverage.

Take the time to explore available options and make an informed decision.