Does Health Insurance Cover Car Accidents : Understanding Your Coverage Options

Does Health Insurance Cover Car Accidents? Auto insurance usually handles these expenses. Car accidents are standard on the road and can result in significant medical costs for those involved.

Many people wonder whether their health insurance will cover these expenses in the event of an accident. Health insurance policies usually do not cover injuries sustained in car accidents. Instead, these costs are typically covered by auto insurance policies.

Understanding the distinction between health and auto insurance coverage is crucial to ensure that you are adequately protected in the event of a car accident. We will explore the details of health insurance coverage for car accidents and provide insights on navigating these scenarios effectively.

:max_bytes(150000):strip_icc()/4-types-of-insurance-everyone-needs.aspx-final-f954e12eb3074b178e4b53a882729526.jpg)

Credit: www.investopedia.com

What Is Health Insurance?

Health insurance covers various medical expenses, but car accidents might require separate coverage. Reviewing your policy for specific details regarding car accident coverage is crucial. A comprehensive understanding of your health insurance benefits can help in unexpected situations like car accidents.

Health insurance is a type of coverage that provides financial protection against medical expenses. It is a contract between an individual and an insurance company, where the individual pays regular premiums in exchange for coverage of their medical costs. Health insurance is designed to help individuals manage high healthcare costs and ensure access to necessary medical treatments and services.

Coverage For Medical Expenses

Health insurance covers many medical expenses, including those resulting from car accidents. If you are injured in a car accident, your health insurance may help cover the costs of your medical treatments, hospital stays, surgeries, and medications. Knowing that your health insurance will support you during a time of need can give you peace of mind.

It reviews our health insurance policy to understand the specific coverage available for car accidents. Some plans must have restrictions or limitations on coverage, such as particular networks of healthcare providers or pre-authorization requirements for specific treatments. Familiarize yourself with these details to ensure you receive the maximum benefits.

Types Of Health Insurance Plans

There are different health insurance plans, each offering varying coverage and benefits. Here are a few common types:

- Health Maintenance Organization (HMO): These plans require the choice of primary care physicians and generally provide coverage for services within a specific network of healthcare providers.

- Preferred Provider Organization (PPO): PPO plans offer more flexibility in choosing healthcare providers. You can see both in-network and out-of-network providers bu, but they have higher out-of-pocket costs for out-of-network care.

- Point of Service (POS): POS plans to combine features of HMOs and PPOs, allowing you to choose a primary care physician and providing coverage for both in-network and out-of-network care. However, out-of-network care will typically have higher costs.

- High-Deductible Health Plan (HDHP): HDHPs have lower monthly premiums but higher deductibles. They are often paired with a health savings account (HSA) to help individuals save for medical expenses.

When considering health insurance coverage for car accidents, it is essential to understand the specifics of your plan and how it aligns with your needs. Consulting with your insurance provider can provide the necessary information to make informed decisions about your coverage options.

Credit: sinasdramis.com

Understanding Car Accidents

Car accidents can significantly affect individuals, including potential injuries requiring medical attention. Understanding the causes of car accidents and the types of injuries that can result is crucial for navigating health insurance coverage in such situations.

Causes Of Car Accidents

- Driver distraction

- Speeding

- Drunk driving

- Weather conditions

- Vehicle defects

Types Of Injuries In Car Accidents

- Whiplash

- Broken bones

- Head injuries

- Internal bleeding

- Spinal cord injuries

Does Health Insurance Cover Car Accidents?

Health insurance coverage in a car accident can be crucial for managing medical expenses. While health insurance primarily focuses on healthcare needs, it may provide some coverage for injuries sustained in car accidents. Understanding the extent of coverage and potential limitations is essential.

Primary Coverage Provided By Health Insurance

Health insurance is the primary source of coverage for medical expenses resulting from car accidents. This includes hospital visits, surgeries, medications, and other healthcare services required for treatment.

Limits And Exclusions

Health insurance coverage for car accidents may have limits and exclusions to consider. These limits could affect the total amount covered or specific services excluded from coverage.

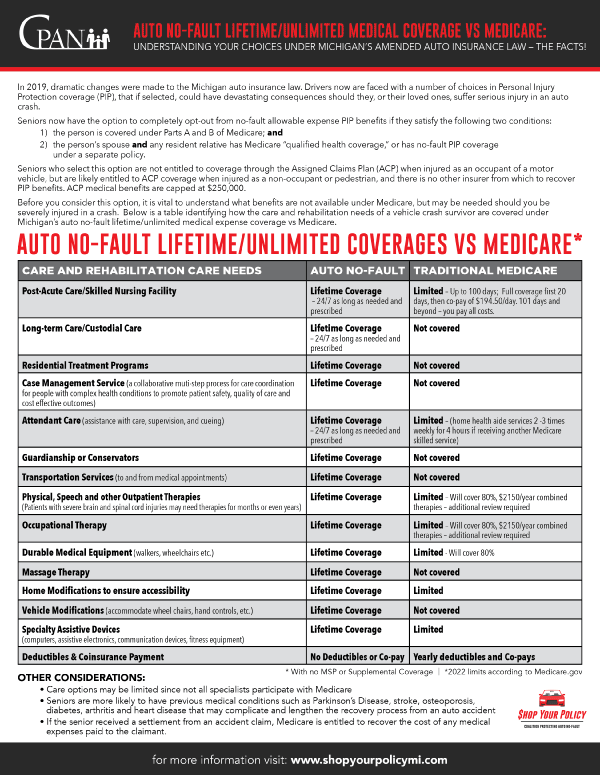

Coordination Of Benefits With Auto Insurance

Coordinating benefits between health and auto insurance is essential to ensure comprehensive coverage. Understanding how these policies work together can help maximize coverage while minimizing out-of-pocket expenses.

Steps To Take After A Car Accident

Experiencing a car accident can be traumatic and unsettling. In addition to tending to any injuries sustained, taking specific steps to protect yourself legally and financially is crucial. By following these guidelines, you can ensure you receive the necessary medical attention, correctly contact your health insurance provider, and coordinate with your auto insurance for a smoother claims process.

Seeking Immediate Medical Attention

Following a car accident, your health and well-being should be your top priority. Regardless of the severity of your injuries, seeking immediate medical attention is imperative. This allows medical professionals to assess and treat any injuries you may have, even those that may not be immediately apparent.

Contacting Your Health Insurance Provider

Once you have received the necessary medical care, promptly contact your health insurance provider about the car accident. Contacting them as soon as possible helps ensure that you understand your coverage and any potential limitations or requirements. Insurance coverage can vary depending on the specific policy, so it’s crucial to understand the terms and conditions thoroughly.

Coordinating With Auto Insurance

In addition to notifying your health insurance provider, coordinating with your auto insurance is essential to ensure you explore all available coverage options. While health insurance may cover medical expenses from a car accident, your auto insurance may provide additional benefits or coverage for related damages.

When contacting your auto insurance provider, be prepared to provide them with all the details about the car accident. By doing so, you can expedite the claims process and ensure that you receive the appropriate coverage for any medical expenses or property damage resulting from the accident.

Options For Additional Coverage

Regarding car accidents, health insurance may not cover all the costs associated with injuries. To bridge the gap, individuals can consider additional coverage options to ensure they are financially protected. Here are some essential options for additional coverage to consider:

Medical Payments Coverage

Medical payment coverage, often called MedPay, is an optional add-on to car insurance policies. It helps pay for medical expenses resulting from a car accident, regardless of who was at fault. This coverage can be used to pay for medical bills, ambulance fees, surgery, X-rays, and doctor’s visits, providing a valuable supplement to standard health insurance.

Personal Injury Protection

Personal Injury Protection (PIP) is another form of coverage that can help offset the costs of medical expenses, lost wages, and other damages resulting from a car accident. PIP coverage is designed to provide broader protection than MedPay, as it can also cover rehabilitation expenses and funeral costs in the event of a fatality.

Umbrella Insurance

Umbrella insurance provides extra liability protection beyond the standard car and health insurance limits. In the case of a car accident resulting in severe injuries or extensive property damage, umbrella insurance can offer added financial security. It covers many situations and can be especially beneficial in high-stakes accidents.

Considerations For Uninsured Motorists

However, suppose health insurance might cover the medical expenses if you’re uninsured and involved in a car accident; in that case, it’s essential to know the limitations and exclusions in your policy and understand the state’s regulations on uninsured motorists. Ensuring you have adequate coverage is crucial to avoid potential financial burdens.

Considerations for Uninsured Motorists Health Insurance Options State Laws and Requirements When involved in a car accident, health insurance coverage can be crucial in managing medical expenses. However, when dealing with car accidents involving uninsured motorists, it’s essential to understand the various considerations related to health insurance coverage. Health Insurance Options In the unfortunate event of a car accident with an uninsured motorist, having the right health insurance coverage can make a significant difference in covering medical expenses. It’s imperative to review the health insurance options available, such as: – Employer-Sponsored Health Insurance: Many individuals are covered under their employer’s health insurance plan, which may offer extensive coverage for injuries sustained in car accidents. – Individual Health Insurance Policies: For those not covered by employer-sponsored plans, individual health insurance policies can provide the necessary coverage for medical expenses resulting from car accidents. – Medicare and Medicaid: Eligible individuals may also receive coverage for car accident injuries through government-funded health insurance programs like Medicare and Medicaid. Understanding the specifics of each health insurance option is crucial to ensure adequate coverage in the event of an accident involving an uninsured motorist. State Laws and Requirements State laws and requirements regarding uninsured motorist coverage can vary, impacting how health insurance applies to car accidents. Each state may have different regulations concerning uninsured motorist coverage, affecting how health insurance handles the associated medical expenses. In some states, uninsured/underinsured motorist coverage may be mandatory, offering protection in the event of a car accident with an uninsured driver. Understanding your state-specific laws and requirements is essential to ensure you have the necessary coverage through health insurance or other means. When navigating the complexities of health insurance and car accidents involving uninsured motorists, it’s crucial to be informed about available options and the applicable state laws. By being proactive and knowledgeable, individuals can better prepare themselves for scenarios involving uninsured motorist accidents.

Appealing Claim Denials

HavHealth insurance provides financial protection in case of unexpected medical emergencies, including car accidents. However, there may be instances where your health insurance claim for a car accident is denied. When this happens, it can feel disheartening and frustrating. Fortunately, there are steps you can take to appeal the denial and potentially get the coverage you deserve. Understanding the reasons for refusal, gathering supporting documentation, and following the appeals process is essential in successfully appealing claim denials.

Understanding Denial Reasons

Before you proceed with the appeals process, it is crucial to understand the reasons behind the denial of your health insurance claim for a car accident. Common reasons for denial include:

- Lack of medical necessity: Your insurance provider may assert that the medical treatment you received following the car accident was unnecessary for your recovery.

- Pre-existing condition: If you have a pre-existing condition that is not directly related to the car accident, your insurance provider may deny coverage for treating that condition.

- Out-of-network provider: Your claim may be denied if you sought medical treatment from a healthcare provider outside your insurance network.

- Failure to report promptly: Insurance companies often have specific timelines for reporting car accidents and submitting claims. If you fail to report the accident or file the claim within the given timeframe, your claim may be denied.

Note: These are just a few examples, and it’s essential to review your insurance policy carefully to understand the specific reasons for your claim denial.

Gathering Supporting Documentation

When appealing a denied health insurance claim for a car accident, having robust supporting documentation can significantly increase your chances of success. Be sure to collect and organize the following:

- Medical records: Obtain a comprehensive copy of all medical records related to your car accident treatment, including doctor visits, diagnostic tests, surgeries, and prescriptions.

- Receipts and bills: Gather all invoices and receipts for the medical services you received, including hospital bills, medication costs, and rehabilitation expenses.

- Police report: If a police report was filed at the car accident scene, include a copy as part of your supporting documentation.

- Witness statements: If there were witnesses to the car accident, gather their statements detailing the events and any injuries they observed.

Following The Appeals Process

Once you understand the reasons for the denial and have gathered all the supporting documentation, it is time to initiate the appeals process. Follow these steps:

- Contact your insurance provider: Start by contacting your insurance provider to inquire about the specific process for appealing a denied claim. They will provide instructions on how to proceed.

- Submit a written appeal: Prepare a concise, well-documented written appeal that clearly outlines why you believe the denial was unjustified. Include copies of all supporting documentation and highlight relevant policy provisions that support your case.

- Follow up: Stay proactive by following up regularly with your insurance provider to ensure they have received your appeal and are actively reviewing it. This will demonstrate your dedication and determination to resolve the issue.

Important: Remember to keep copies of all correspondence and documentation related to your appeal.

Credit: www.tdi.texas.gov

Frequently Asked Questions Of Does Health Insurance Cover Car Accidents

Does Health Insurance Cover Car Accidents?

Health insurance typically covers medical expenses from car accidents, including emergency room visits, surgeries, and rehabilitation. However, coverage may vary depending on your policy, so reviewing your plan details and consulting with your insurance provider for specific information is essential.

Will Health Insurance Cover My Injuries If I Was At Fault In A Car Accident?

Yes, in most cases, your health insurance will cover your injuries, regardless of fault in a car accident. It’s essential to understand the terms of your policy and any potential limitations or exclusions related to car accidents. Consult with your insurance provider to understand the specifics of your coverage.

What Should I Do If The At-fault Driver’s Insurance Denies My Claim?

If the at-fault driver’s insurance denies your claim, your health insurance should still cover your medical expenses related to the car accident. You may need to provide documentation of the denial to your health insurance provider and follow their guidelines for submitting the claim.

It’s important to stay proactive and informed throughout the process.

Can I Use My Health Insurance And Car Insurance Coverage For The Same Accident?

You can typically use your health and car insurance coverage for the same accident. Your health insurance will cover medical expenses, while your car insurance may help with costs not covered by health insurance, such as lost wages or other non-medical expenses.

It’s essential to understand the coordination of benefits between the two policies.

Conclusion

Ultimately, the extent to which health insurance covers car accidents depends on various factors, such as your coverage type and the terms and conditions of your policy. While some aspects of medical care may be covered, it’s crucial to fully understand your policy and consider obtaining additional insurance, like personal injury protection, to ensure adequate coverage for car accident-related expenses.

Consulting with an insurance professional can clarify and guide you in navigating this complex topic. Remember, being proactive and informed is critical to protecting not only your health but also your finances in the event of a car accident.