Can You Have Two Health Insurances: Maximizing Coverage

Can You Have Two Health Insurances? Also, having multiple health insurance can offer extra coverage and reduce out-of-pocket expenses.

It is important to note that having multiple health insurance means you can only double claim for the same treatment or service. Instead, it allows you to coordinate benefits between the two policies, ensuring a higher overall coverage level.

However, before signing up for two health insurances, it is crucial to carefully review the policies, understand their coverage limits, and consider any potential duplication of services. This will help you make an informed decision and maximize the benefits of having multiple health insurance plans.

Credit: google.com

Benefits Of Having Multiple Health Insurances

Multiple health insurance can provide enhanced protection and financial security for your healthcare needs. This setup ensures you are well-covered in various medical scenarios, offering a range of advantages.

More Comprehensive Coverage

You can access a broader array of medical services with multiple insurances, including specialists and additional treatments that a single policy may not cover.

Lower Out-of-pocket Costs

Having multiple insurances can help reduce the amount you have to pay for healthcare expenses, minimizing out-of-pocket costs and easing the financial burden associated with medical care.

Credit: m.facebook.com

How To Have Two Health Insurance

Employer-sponsored Plans

You can enroll in your employer’s health insurance and a secondary individual plan. Please check with both insurance providers for details on coverage.

Individual Plans

If your employer’s plan doesn’t meet all your health needs, consider getting an additional individual health insurance plan. Compare benefits and costs carefully.

Spouse’s Or Partner’s Plan

If your spouse or partner has health insurance, you may be able to be covered under their plan as a dependent. Could you evaluate the benefits of both plans to maximize coverage?

Coordination Of Benefits

Coordinating benefits from two health insurance plans can help cover more of your medical expenses. Having dual health insurance can reduce out-of-pocket costs, allowing you to take advantage of both benefits. Could you check with both providers to understand how the coordination of benefits works for you?

Primary and secondary insurance: Primary insurance is the first plan that pays your medical claims. In contrast, secondary insurance is the second plan that helps cover the remaining costs after the primary insurance has paid its share. The coordination of benefits is how these two insurances work together to ensure you receive the maximum coverage for your healthcare expenses. Here’s how the primary and secondary insurance coordination works: 1. When you have two health insurance plans, the primary insurance is responsible for processing and paying the medical claims first. They typically pay according to their terms and conditions, deductibles, copayments, and coinsurance. 2. Once the primary insurance has been paid, the secondary insurance comes into play. It helps cover the additional costs that still need to be fully paid by the primary insurance. The secondary insurance provider looks at what the primary insurance paid and calculates the remaining amount they need to cover. 3. The coordination of benefits ensures you do not receive more than 100% of your medical expenses. The total reimbursement between the primary and secondary insurance cannot exceed the actual cost of the healthcare service. Reimbursement process

The Reimbursement Process For Having Two Health Insurance Involves Both The Primary And Secondary Insurance Providers Working Together To Ensure You Receive The Maximum Possible Coverage. Here’s How The Process Typically Works: 1. After Receiving Medical Services, You Are Required To Submit Insurance Claims To Your Primary Insurance Provider. They Will Review And Process The Claim According To Their Rules And Reimbursement Policies. 2. Once The Primary Insurance Has Paid Its Share, You Will Receive An Explanation Of Benefits (EOB) Statement Detailing The Amount Paid And Any Outstanding Balance. It Is Important To Keep Copies Of All Eobs For Your Records. 3. After Receiving The EOB, You Can Then Submit The Remaining Balance To Your Secondary Insurance Provider. They Will Review The Claim And Calculate Their Portion Of The Reimbursement Based On Their Coverage Rules. 4. The Secondary Insurance Provider Will Then Reimburse You For The Remaining Balance That The Primary Insurance Did Not Cover Up To The Limits Of Their Coverage. You must follow the proper procedures and submit the necessary documentation to both insurance providers to avoid delays or claim denials. Please keep in mind that the coordination of benefits can sometimes be a complex process, and you should contact the insurance companies directly for guidance in navigating this process. Having two health insurance companies can provide you with increased coverage and reduce your out-of-pocket expenses. However, It Is Crucial To Understand The Coordination Of Benefits And Reimbursement Process To Make The Most Of This Dual Coverage.

Factors To Consider

Factors to consider when having two health insurance include costs, coverage limitations, and network restrictions. Understanding these factors is crucial in determining whether having dual health insurance benefits you.

Costs

Having two health insurance may increase costs, as you could pay premiums for both plans. It’s essential to weigh the total costs against the benefits provided by the additional coverage.

Coverage Limitations

When you have two health insurance, there may be limitations on the coverage provided. Some treatments or services may not be fully covered by either plan, leaving you with out-of-pocket expenses. It’s essential to understand the specific limitations of each plan.

Network Restrictions

Network restrictions are another factor to consider. While one insurance plan may have a broad network of healthcare providers, the other may be more limited. This could impact your ability to access preferred healthcare providers or specialists.

Potential Drawbacks Of Having Two Health Insurances

When considering having more than one health insurance plan, it’s essential to be aware of the potential drawbacks associated with this decision. While dual coverage may seem advantageous in providing additional protection and reducing out-of-pocket costs, it can come with challenges that warrant careful consideration. Understanding the possible downsides can help individuals make informed choices when evaluating the prospect of maintaining two health insurance policies.

Increased Administrative Tasks

Having two health insurance plans can lead to increased administrative responsibilities. Individuals with dual coverage may manage multiple claims, coordinate benefits, and ensure that both insurance providers have up-to-date information. This additional administrative burden can create complications and consume more time and effort, potentially leading to frustration and inefficiency.

Potential Confusion

Dealing with multiple health insurance policies can introduce complexity that may need to be clarified for policyholders. It can be challenging to navigate the differences in coverage, deductible requirements, and provider networks between two plans. This complexity may lead to uncertainty about which insurance to use for specific medical services and prescription medications. The potential for confusion may also extend to healthcare providers, who may need help determining the primary payer and correctly processing claims.

Verifying Eligibility And Claims

I would like to know how to verify your eligibility and navigate the claims process effectively regarding having two health insurances. Confirming coverage and submitting claims is crucial to ensuring you receive the maximum benefits from both insurances. Let’s explore each of these steps in more detail:

Confirming Coverage

Before proceeding with two health insurances, confirming that you are eligible for coverage under both policies is essential. You can do this by contacting each insurance provider and letting them know your policy details. They will then assess your eligibility based on your employment status, relationship status, and existing health conditions. Remember that different insurances may have specific criteria for eligibility, so it’s essential to cross-check and double-confirm with each provider.

Submitting Claims

Once you have established your eligibility, the next step is to submit claims to each insurance provider independently. This involves providing the necessary documentation and information to support your claim, such as medical bills, receipts, and other required forms. To ensure a smooth process, please follow each insurance company’s specific guidelines when submitting claims. This may include completing claim forms online or mailing them to a designated address.

Moreover, it’s crucial to understand that coordination of benefits is essential in preventing potential conflicts or confusion between the two insurances. Benefits coordination helps determine which insurance is primary and which is secondary for each claim. This ensures that you stay within the total coverage limits and that both insurances work together seamlessly to provide you with the maximum possible benefits.

Remember, when submitting claims for two health insurances, you must communicate with both providers to ensure timely claims processing. Additionally, keep track of all your claims to ensure that payments and reimbursements are received correctly from both insurances.

Understanding Insurance Terminology

Understanding insurance terminology:

Deductible

A deductible is the amount you must pay before your insurance kicks in.

Premium

The premium is the fee you pay to your insurance company for coverage.

Copay

A copay is a fixed amount you pay for medical services or prescriptions.

Coinsurance

Coinsurance is the percentage you pay for covered services after you meet your deductible.

Out-of-pocket Maximum

You must pay the most out-of-pocket maximum for covered services in a year.

Consulting With Insurance Professionals

Seeking Guidance

It’s crucial to seek expert advice from insurance professionals for clarity.

Exploring Options

Understand the various options available through dual health insurance coverage.

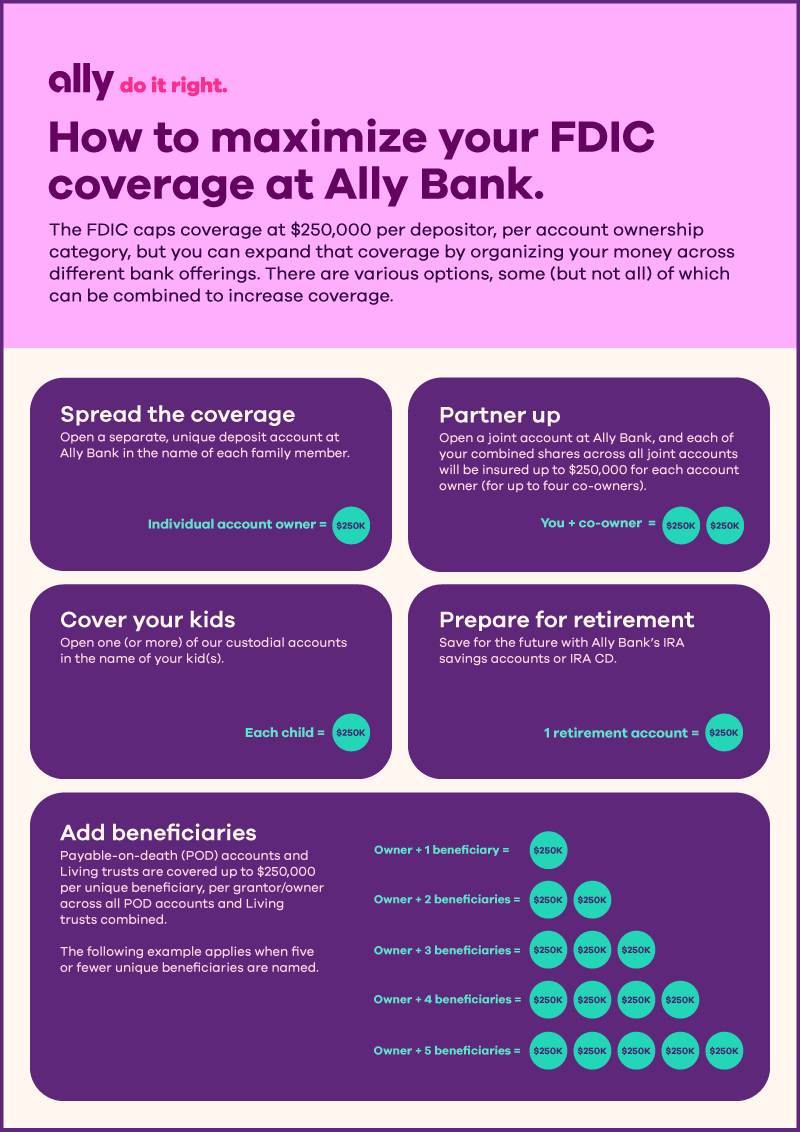

Credit: www.ally.com

Frequently Asked Questions Of Can You Have Two Health Insurances

Can You Have Two Health Insurances At The Same Time?

Yes, it’s possible to have multiple health insurance policies to broaden coverage and reduce out-of-pocket expenses. However, coordination of benefits is crucial to avoid overpayment and potential fraud. Please make sure your primary and secondary insurance work together for maximum benefits.

What are the advantages of having dual Health Insurance?

Two health insurance policies provide better coverage, lower out-of-pocket costs, and increased access to a broader network of healthcare providers. It offers protection against gaps in coverage and higher expenses, providing peace of mind for unexpected medical situations.

Will Having Two Health Insurances Impact Claim Processing?

The coordination of benefits ensures smooth claim processing when you have two health insurance companies. The primary insurer will settle the claim first, and the secondary insurer will cover the remaining costs according to the policy terms. Proper coordination avoids delays and confusion in claim settlements.

Are There Any Drawbacks To Having Dual Health Insurances?

While having two health insurances offers several advantages, it’s essential to consider potential drawbacks such as higher premiums and the complexity of coordinating benefits. Understanding both policies’ terms and conditions is crucial to fully leveraging the benefits.

Conclusion

Two health insurance can provide extra coverage and protect you against a broader range of medical expenses. However, it’s essential to carefully review your policies and understand the coordination of benefits to avoid unnecessary fees or conflicts. Consider factors such as premium costs, deductibles, copayments, and network coverage to determine if having dual health insurance is worth it for your specific needs.

Always consult an insurance professional for personalized advice on the best health insurance options.