Health Insurance in California for Small Business: Your Guide to Affordable Coverage

Health Insurance in California for Small Business is essential for providing coverage to employees and complying with state regulations. It offers comprehensive health benefits tailored to the needs of small business owners and their employees.

Small businesses must offer health insurance in California and can purchase group coverage through insurance companies, the California Healthcare Marketplace, or a Professional Employer Organization (PEO). With various options available, small businesses can find cost-effective plans that prioritize the health and well-being of their employees.

Additionally, having health insurance can enhance job satisfaction and attract top talent to the company. Companies looking for small business health insurance in California should explore the different plans offered by various insurers to find the most suitable and affordable coverage for their employees.

Credit: www.simplyinsured.com

Mandates And Regulations

Health Insurance mandates and regulations in California for small businesses are essential factors to consider. Understanding the requirements and regulations is crucial to ensure compliance and provide adequate coverage for employees. Working with an insurance provider that specializes in small business health plans in California can help you navigate these mandates and find affordable options for your business.

Health Insurance Requirements For California Small Businesses

In California, small businesses are mandated to provide health insurance to their employees.

- Businesses with 50 or more full-time employees must offer health coverage.

- Employers must contribute a minimum percentage or dollar amount towards employee premiums.

Cost Sharing And Contributions For Small Business Owners

Small business owners in California share health insurance costs with their employees.

- Employers typically cover a portion of employees’ premiums.

- Employees may also contribute towards their health insurance coverage.

Insurance Providers In California

BizInsure offers tailored health insurance solutions for small businesses in California. Anthem’s small business health insurance plans in California offer cost-saving coverage options for your employees.

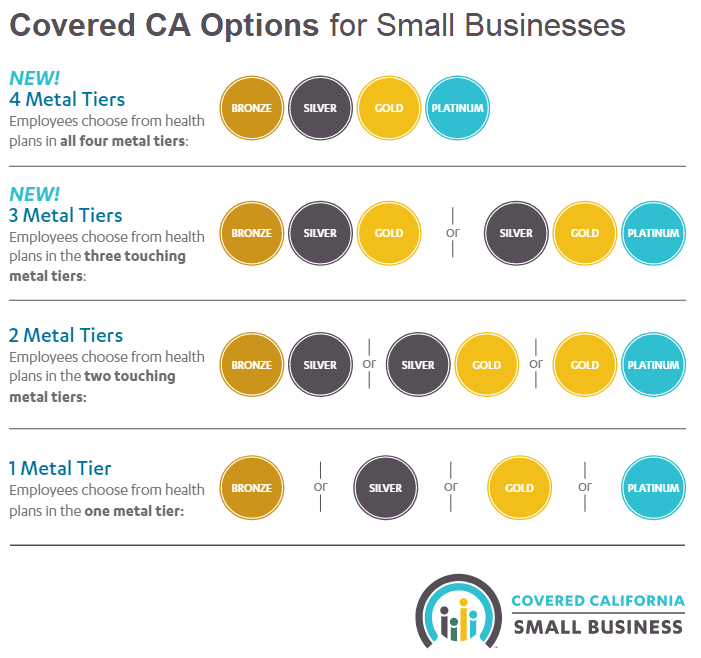

Insurance Providers in California When it comes to selecting a health insurance provider in California for your small business, several options are available. California boasts a variety of insurance providers that cater specifically to small businesses, offering specific plans and coverage options tailored to their needs. Top Health Insurance Providers for Small Businesses In California, small businesses have access to various health insurance providers, each offering unique plans and benefits. Some of the top health insurance providers include: – Blue Shield of California – Anthem – Covered California – BizInsure – and Justworks. These providers specialize in offering comprehensive health insurance plans specifically designed for small businesses, providing a range of coverage options and benefits to meet the diverse needs of small business owners and their employees. Offerings and Coverage Options When it comes to offerings and coverage options, small business health insurance providers in California offer a wide array of plans, including: 1. Comprehensive Health Insurance Plans: These plans encompass a range of medical services, including doctor visits, hospital stays, preventive care, and prescription drugs. 2. Dental Plans: Many insurance providers also offer dental coverage, which can be added as a standalone plan or as part of a comprehensive health insurance package. 3. Vision Coverage: Some providers include vision coverage options, ensuring that employees have access to eye care services and vision correction procedures. 4. Flexible Coverage Options: Small businesses in California can choose from various coverage options, including HMO, PPO, and EPO plans, allowing them to select the most suitable and cost-effective option for their employees. By partnering with reputable health insurance providers in California, small businesses can ensure that their employees have access to quality healthcare services, promoting their overall well-being and productivity. In conclusion, selecting the right health insurance provider is crucial for small businesses in California, and with a range of reputable options available, finding the most suitable coverage for your business and employees is well within reach.

Comparison Of Plans

When choosing health insurance plans for your small business in California, it’s essential to compare various options. Consider factors like coverage, premiums, and benefits to find the best fit for your employees’ healthcare needs. Assessing multiple plans can help you make an informed decision that aligns with your business’s budget and the health needs of your workforce.

Analyzing Costs And Coverage Benefits

When it comes to health insurance for small businesses in California, it’s crucial to analyze and compare the costs and coverage benefits of different plans. This step is essential to ensure that the plan you choose offers comprehensive coverage for your employees at a reasonable cost. Here are some key factors to consider while analyzing the costs and coverage benefits: 1. Premiums: Consider the monthly premium cost for each plan. It’s essential to find a balance between affordability and the coverage offered. 2. Deductibles: Compare the deductibles of the different plans. A deductible is the amount employees have to pay out of pocket before the insurance coverage kicks in. Lower deductibles may result in higher premiums, while higher deductibles may lower monthly costs but increase out-of-pocket expenses for employees. 3. Co-pays: Find out the co-pays required for doctor visits, prescription medications, and specialist consultations. Make sure to consider the frequency of these visits and the associated costs. 4. Network of Providers: Check if the plan has a network of healthcare providers that your employees prefer. This ensures that they can receive care from the doctors and hospitals they trust. 5. Coverage Benefits: Examine the coverage benefits for different services, such as preventive care, hospital stays, mental health services, and maternity care. Assessing these benefits will help you understand which plan offers the most comprehensive coverage for your employees’ needs. By carefully analyzing the costs and coverage benefits of various plans, you can make an informed decision that provides the best health insurance coverage for your small business in California.

Customizing Plans For Employee Needs

Customizing health insurance plans to cater to your employees’ specific needs is crucial for ensuring their satisfaction and well-being. Considering their diverse requirements can help you select a plan that offers the right coverage options. Here are some ways you can customize health insurance plans for your employees: 1. Flexible Plan Options: Look for insurance providers that offer a range of plan options with varying coverage levels. This allows employees to choose a plan that aligns with their individual healthcare needs. 2. Additional Benefits: Consider offering additional benefits such as vision or dental coverage, wellness programs, or telehealth services. These added perks can enhance your employees’ overall healthcare experience. 3. Healthcare Spending Accounts: Explore the option of offering Health Savings Accounts (HSAs) or Flexible Spending Accounts (FSAs). These accounts allow employees to set aside pre-tax dollars to cover eligible medical expenses, providing them with more control over their healthcare expenses. 4. Family Coverage: Evaluate if the plan provides affordable options to extend coverage to employees’ family members. This ensures that your employees can access adequate healthcare for their loved ones. 5. Employee Feedback: Regularly engage with your employees to understand their healthcare needs and preferences. Their valuable input can guide you in selecting the most suitable health insurance plan for your small business. By customizing health insurance plans to meet your employees’ specific needs, you can foster a healthier and more satisfied workforce. This personalized approach demonstrates your commitment to their well-being and highlights your dedication as an employer in California. In conclusion, comparing health insurance plans in California for small businesses requires analyzing costs and coverage benefits and customizing plans to accommodate employees’ unique needs. This thorough evaluation ensures that you provide optimal healthcare coverage for your workforce, enhancing their overall well-being and job satisfaction.

Credit: www.healthforcalifornia.com

Enrollment Process

The enrollment process for health insurance in California for small businesses is simple and efficient. Small business owners can easily navigate through the options and select a suitable plan for themselves and their employees. Choose from a variety of tailored insurance solutions to ensure the well-being of your business and employees.

Step-by-step Guide To Enrolling In Small Business Health Insurance

Enrolling in health insurance for your small business in California is a crucial step in ensuring the well-being of your employees. The enrollment process can seem daunting, but breaking it down into manageable steps can simplify the journey.

- Research available health insurance providers in California.

- Compare plans, benefits, and costs to determine the best fit for your business.

- Contact selected providers to request quotes and additional information.

- Gather necessary documentation, such as employee information and payroll details.

- Apply for the chosen health insurance plan.

Important Deadlines And Considerations

Understanding the deadlines and considerations involved in enrolling your small business in health insurance is crucial to avoid any delays or complications.

| Deadline | Consideration |

|---|---|

| Open Enrollment Period | Ensure timely enrollment during the annual open enrollment window. |

| New Employee Waiting Period | Consider any waiting periods for new employees before they become eligible for coverage. |

| Qualifying Life Events | Be aware of special enrollment periods triggered by qualifying life events, such as marriage or the birth of a child. |

Benefits And Incentives

Health insurance for small businesses in California offers various benefits and incentives that can help attract and retain top talent while promoting the well-being of employees. From wellness programs to tax credits, these incentives are designed to support both the employees and the business.

Wellness Programs And Additional Benefits

Offering wellness programs as part of the health insurance package can lead to a healthier and more motivated workforce. These programs can include gym memberships, nutritional counseling, mental health support, and preventative health screenings. Additionally, providing additional benefits such as dental and vision coverage can contribute to overall employee satisfaction and well-being.

Tax Credits And Savings Opportunities

Small businesses in California may qualify for tax credits and savings opportunities when offering health insurance to their employees. The Small Business Health Care Tax Credit, for example, can alleviate some of the financial burden associated with providing healthcare coverage. Moreover, participating in a Health Savings Account (HSA) or a Flexible Spending Account (FSA) can provide tax benefits for both the business and its employees.

Managing Employee Health

Ensuring the well-being of your employees is crucial for a thriving business. From promoting health and wellness in the workplace to handling employee health insurance concerns, small businesses in California must prioritize managing employee health effectively.

Promoting Health And Wellness In The Workplace

- Encourage Physical Activity: Organize group fitness classes or set up designated walking areas.

- Healthy Eating Options: Provide nutritious snacks and promote healthy eating habits among employees.

- Mental Health Support: Offer resources such as counseling services or mental health days.

Handling Employee Health Insurance Concerns

- Clear Communication: Communicate insurance benefits clearly to employees to address any confusion or concerns.

- Accessible Resources: Provide employees with easy access to insurance information and support.

- Regular Updates: Keep employees informed about any changes to the health insurance plans.

Credit: www.simplyinsured.com

Frequently Asked Questions

Do Small Businesses Have To Offer Health Insurance in California for Small Business?

Small businesses in California are not required to offer health insurance to their employees.

Can I Buy My Own Health Insurance in California for Small Business?

You can buy individual health insurance in California from insurance companies, licensed agents, or Covered California.

How Much Does An Employer Have To Pay For Health Insurance in California for Small Business?

Employers in California must contribute at least 50% of the employee’s premium for health insurance.

How Much Does Health Insurance Cost For A Small Business Per Employee Usa?

The cost of health insurance for a small business in the USA varies per employee. To get an accurate estimate, you can contact insurance companies or use online resources like eHealth or Covered California. Prices depend on factors like the age, location, and health needs of the employees.

Conclusion

Navigating health insurance options for small businesses in California can be complex. Understanding your needs and leveraging resources such as Covered California can help you find the right plan. It’s crucial to stay informed about eligibility, costs, and coverage to make the best decision for your business and employees.