Short Term Health Insurance Blue Cross Blue Shield: The Ultimate Solution for Immediate Coverage

Short Term Health Insurance Blue Cross Blue Shield provides temporary coverage for those between plans or experiencing life changes. Blue Cross Blue Shield offers flexible short-term health insurance options for individuals and families.

This coverage can be a good solution for those needing temporary protection against unexpected medical expenses. With short-term plans, you can have peace of mind knowing you have coverage for unforeseen health issues. Blue Cross Blue Shield provides various benefits and services, including access to a vast network of healthcare providers and the ability to tailor your coverage to meet your needs.

By choosing short-term health insurance from Blue Cross Blue Shield, you can ensure you are protected when you need it most.

Credit: www.forbes.com

Understanding Blue Cross Blue Shield

When understanding Blue Cross Blue Shield, it’s essential to grasp the scope of this reputable health insurance provider. Blue Cross Blue Shield has a long-standing reputation for offering comprehensive health coverage to individuals, families, and businesses, focusing on delivering high-quality healthcare services and financial protection.

Overview Of Blue Cross Blue Shield

Blue Cross Blue Shield is a widely recognised healthcare provider across the United States. With a strong network of healthcare professionals and facilities, Blue Cross Blue Shield offers a range of health insurance products tailored to meet the diverse needs of its members. The organisation is committed to ensuring access to quality care, promoting wellness, and delivering innovative health solutions.

Services Offered By Blue Cross Blue Shield

Blue Cross Blue Shield provides comprehensive health insurance plans, including short-term health insurance. These plans offer flexibility and protection for individuals facing temporary gaps in coverage, such as recent graduates or those between jobs. Additionally, they provide various services, such as preventive care, prescription drug coverage, emergency care, and access to a vast network of healthcare providers and facilities.

Short-Term Health Insurance Blue Cross Blue Shield

Short-term health insurance from Blue Cross Blue Shield provides temporary coverage for individuals who are between health plans or experiencing a coverage gap. This type of insurance offers flexibility and allows individuals to select coverage for a specific duration, typically one month to one year.

Blue Cross Blue Shield’s short-term health insurance covers essential medical services, including doctor visits, hospital stays, and emergency care. Additionally, it may include benefits such as prescription drug coverage and access to a network of healthcare providers.

The cost of short-term health insurance from Blue Cross Blue Shield varies based on the chosen coverage duration, the individual’s age, and the selected benefits. This type of insurance is known for its affordability, making it an attractive option for those seeking temporary coverage.

Enrolling In Short Term Health Insurance Blue Cross Blue Shield

Applicants must be US citizens or legal residents to qualify for Short-Term Health Insurance from Blue Cross Blue Shield.

The Short-Term Health Insurance application process with Blue Cross Blue Shield is straightforward.

- Fill out the online application form with your personal and health information.

- Select the coverage options that best suit your needs.

- Submit any required documents for verification.

After enrolling in Short Term Health Insurance from Blue Cross Blue Shield, there may be a waiting period before coverage becomes effective.

Comparing Short-Term Health Insurance With Other Insurance Options

Several options are available to individuals and families when choosing the right health insurance. Short-term health insurance offered by reputable providers like Blue Cross Blue Shield is among these options. Short-term health insurance is designed to provide coverage for a limited period, typically 1 to 12 months, making it an appealing choice for those between jobs, recent graduates, or individuals waiting for their Medicare coverage to start.

Differences Between Short Term Health Insurance And Traditional Plans

Short-term health insurance differs from traditional plans in several ways:

- Duration: Traditional plans typically provide coverage for a year or longer, while short-term health insurance offers temporary coverage for a shorter period.

- Benefits: Traditional plans must cover a range of essential health benefits, while short-term health insurance usually provides more limited coverage.

- Pre-existing conditions: Traditional plans cannot deny coverage or charge higher premiums based on pre-existing conditions, while short-term health insurance may exclude coverage for pre-existing conditions.

- Cost: Short-term health insurance plans generally have lower premiums than traditional plans but may also have higher deductibles and out-of-pocket costs.

Advantages And Disadvantages Of Short Term Health Insurance

Short-term health insurance has its own set of advantages and disadvantages:

- Advantages:

- Flexibility: Short-term health insurance offers flexibility in terms of coverage duration, allowing individuals to bridge the gap between other insurance plans.

- Lower cost: Short-term health insurance premiums are often more affordable than traditional plans, making it a cost-effective option for those on a tight budget.

- Fast enrollment: Short-term health insurance is quick to enrol in, with few or no medical underwriting requirements.

- Disadvantages:

- Limited coverage: Short-term health insurance typically offers more limited coverage than traditional plans, including a narrower network of healthcare providers.

- Exclusion of pre-existing conditions: Short-term health insurance may not cover pre-existing conditions, so individuals with ongoing health issues may not find it suitable.

- No essential health benefits: Short-term health insurance may not cover essential health benefits, such as preventive services or mental health care.

When Short-Term Health Insurance Is A Good Fit

Short-term health insurance can be a good fit in certain situations:

- If you are between jobs and need temporary coverage until your employer-sponsored plan begins.

- If you missed the open enrollment period for traditional plans and need coverage until the next enrollment period.

- If you are a recent graduate and no longer covered by your parent’s insurance.

- If you are waiting for Medicare coverage to start and need temporary coverage in the meantime, I want you to know that understanding these factors will help you make an informed decision and make sure

Considerations For Choosing Short-Term Health Insurance

When it comes to choosing short-term health insurance, there are several considerations that you should keep in mind. Understanding these factors will help you make an informed decision and ensure your chosen plan meets your needs.

Take a look at

Determining Your Coverage Needs

Before selecting a short-term health insurance plan from Blue Cross Blue Shield, it’s essential to determine your coverage needs. Consider factors such as your current health condition, pre-existing conditions, and the type of medical services you typically require. Additionally, consider the duration of coverage you need, as short-term health plans usually provide coverage for a limited period.

In-network Providers And Coverage Limitations

Another crucial aspect to consider when choosing short-term health insurance is the availability of in-network providers and any coverage limitations. Please check the Blue Cross Blue Shield network to ensure your preferred healthcare providers are included. Also, please examine the plan’s coverage limitations, such as waiting periods for certain services or exclusions for specific treatments.

Prescription Drug Coverage And Other Benefits

One of the critical factors to consider is the prescription drug coverage provided by the short-term health insurance plan. Confirm that the plan includes coverage for any medication you currently take or may need in the future. Furthermore, consider the plan’s additional benefits, such as preventive care services, mental health coverage, or maternity care.

By considering these factors when selecting a short-term health insurance plan from Blue Cross Blue Shield, you can choose one that meets your coverage needs and provides the required benefits.

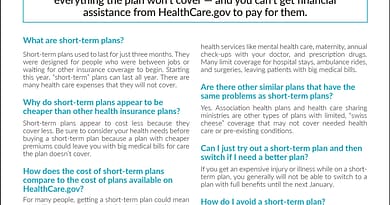

Credit: www.northcarolinahealthnews.org

Frequently Asked Questions On Short-Term Health Insurance Blue Cross Blue Shield

What Is Short-Term Health Insurance?

Short Term Health Insurance is a temporary health insurance plan that provides coverage for a brief period, typically up to 12 months. It is designed to bridge the coverage gap for individuals between jobs, waiting for employer coverage to start, or needing coverage during a transition period.

Are Blue Cross Blue Shield Short-Term Health Insurance Plans Reliable?

Blue Cross Blue Shield Short-Term Health Insurance plans are reliable and trusted. Blue Cross Blue Shield is a reputable and well-known insurance provider with a strong network of healthcare professionals and facilities. Their short-term health insurance plans offer comprehensive coverage and peace of mind during temporary gaps in coverage.

What Benefits Does Blue Cross Blue Shield Short-Term Health Insurance Provide?

Blue Cross Blue Shield Short-Term Health Insurance plans provide various benefits, including coverage for doctor visits, hospital stays, prescription medications, and emergency care. These plans also offer access to a network of healthcare providers and the flexibility to choose the coverage period that fits your needs.

Can I Customize My Blue Cross Blue Shield Short-Term Health Insurance Plan?

You can customise your Blue Cross Blue Shield Short-Term Health Insurance plan to fit your needs. With different coverage options and coverage periods available, you can choose the plan that best aligns with your budget and healthcare requirements.

Conclusion

Short-term health insurance from Blue Cross Blue Shield offers flexibility and coverage for unforeseen medical expenses. With a range of plans, you can find one that suits your needs and budget. Don’t hesitate to explore the options available to protect your health and well-being.

Choose Blue Cross Blue Shield for peace of mind.

What Is Short-Term Health Insurance?

Blue Cross Blue Shield provides short-term health insurance and temporary coverage for individuals needing a short-term solution. It is designed to bridge gaps in coverage during transition or unexpected circumstances.

Definition Of Short Term Health Insurance

Short Term Health Insurance is a temporary healthcare plan that provides coverage for a limited period, typically up to 364 days. It is intended for individuals needing immediate health insurance coverage for a short duration.

Benefits Of Short Term Health Insurance

- Flexible Coverage: Short-term health insurance offers flexibility in coverage duration.

- Cost-Effective: It is usually more affordable than long-term health insurance plans.

- Quick Enrollment: Individuals can enrol in short-term plans swiftly, providing immediate coverage.

Credit: www.umc.edu

Understanding Blue Cross Blue Shield

When understanding Blue Cross Blue Shield, it’s essential to grasp the scope of this reputable health insurance provider. Blue Cross Blue Shield has a long-standing reputation for offering comprehensive health coverage to individuals, families, and businesses, focusing on delivering high-quality healthcare services and financial protection.

Overview Of Blue Cross Blue Shield

Blue Cross Blue Shield is a widely recognised healthcare provider across the United States. With a strong network of healthcare professionals and facilities, Blue Cross Blue Shield offers a range of health insurance products tailored to meet the diverse needs of its members. The organisation is committed to ensuring access to quality care, promoting wellness, and delivering innovative health solutions.

Services Offered By Blue Cross Blue Shield

Blue Cross Blue Shield provides comprehensive health insurance plans, including short-term health insurance. These plans offer flexibility and protection for individuals facing temporary gaps in coverage, such as recent graduates or those between jobs. Additionally, they provide various services, such as preventive care, prescription drug coverage, emergency care, and access to a vast network of healthcare providers and facilities.

Short-Term Health Insurance Blue Cross Blue Shield

Short-term health insurance from Blue Cross Blue Shield provides temporary coverage for individuals who are between health plans or experiencing a coverage gap. This type of insurance offers flexibility and allows individuals to select coverage for a specific duration, typically one month to one year.

Blue Cross Blue Shield’s short-term health insurance covers essential medical services, including doctor visits, hospital stays, and emergency care. Additionally, it may include benefits such as prescription drug coverage and access to a network of healthcare providers.

The cost of short-term health insurance from Blue Cross Blue Shield varies based on the chosen coverage duration, the individual’s age, and the selected benefits. This type of insurance is known for its affordability, making it an attractive option for those seeking temporary coverage.

Enrolling In Short Term Health Insurance Blue Cross Blue Shield

Applicants must be US citizens or legal residents to qualify for Short-Term Health Insurance from Blue Cross Blue Shield.

The Short-Term Health Insurance application process with Blue Cross Blue Shield is straightforward.

- Fill out the online application form with your personal and health information.

- Select the coverage options that best suit your needs.

- Submit any required documents for verification.

After enrolling in Short Term Health Insurance from Blue Cross Blue Shield, there may be a waiting period before coverage becomes effective.

Comparing Short-Term Health Insurance With Other Insurance Options

Several options are available to individuals and families when choosing the right health insurance. Short-term health insurance offered by reputable providers like Blue Cross Blue Shield is among these options. Short-term health insurance is designed to provide coverage for a limited period, typically 1 to 12 months, making it an appealing choice for those between jobs, recent graduates, or individuals waiting for their Medicare coverage to start.

Differences Between Short Term Health Insurance And Traditional Plans

Short-term health insurance differs from traditional plans in several ways:

- Duration: Traditional plans typically provide coverage for a year or longer, while short-term health insurance offers temporary coverage for a shorter period.

- Benefits: Traditional plans must cover a range of essential health benefits, while short-term health insurance usually provides more limited coverage.

- Pre-existing conditions: Traditional plans cannot deny coverage or charge higher premiums based on pre-existing conditions, while short-term health insurance may exclude coverage for pre-existing conditions.

- Cost: Short-term health insurance plans generally have lower premiums than traditional plans but may also have higher deductibles and out-of-pocket costs.

Advantages And Disadvantages Of Short Term Health Insurance

Short-term health insurance has its own set of advantages and disadvantages:

- Advantages:

- Flexibility: Short-term health insurance offers flexibility in terms of coverage duration, allowing individuals to bridge the gap between other insurance plans.

- Lower cost: Short-term health insurance premiums are often more affordable than traditional plans, making it a cost-effective option for those on a tight budget.

- Fast enrollment: Short-term health insurance is quick to enrol in, with few or no medical underwriting requirements.

- Disadvantages:

- Limited coverage: Short-term health insurance typically offers more limited coverage than traditional plans, including a narrower network of healthcare providers.

- Exclusion of pre-existing conditions: Short-term health insurance may not cover pre-existing conditions, so individuals with ongoing health issues may not find it suitable.

- No essential health benefits: Short-term health insurance may not cover essential health benefits, such as preventive services or mental health care.

When Short-Term Health Insurance Is A Good Fit

Short-term health insurance can be a good fit in certain situations:

- If you are between jobs and need temporary coverage until your employer-sponsored plan begins.

- If you missed the open enrollment period for traditional plans and need coverage until the next enrollment period.

- If you are a recent graduate and no longer covered by your parent’s insurance.

- If you are waiting for Medicare coverage to start and need temporary coverage in the meantime, I want you to know that understanding these factors will help you make an informed decision and make sure

Considerations For Choosing Short-Term Health Insurance

When it comes to choosing short-term health insurance, there are several considerations that you should keep in mind. Understanding these factors will help you make an informed decision and ensure your chosen plan meets your needs.

Take a look at

Determining Your Coverage Needs

Before selecting a short-term health insurance plan from Blue Cross Blue Shield, it’s essential to determine your coverage needs. Consider factors such as your current health condition, pre-existing conditions, and the type of medical services you typically require. Additionally, consider the duration of coverage you need, as short-term health plans usually provide coverage for a limited period.

In-network Providers And Coverage Limitations

Another crucial aspect to consider when choosing short-term health insurance is the availability of in-network providers and any coverage limitations. Please check the Blue Cross Blue Shield network to ensure your preferred healthcare providers are included. Also, please examine the plan’s coverage limitations, such as waiting periods for certain services or exclusions for specific treatments.

Prescription Drug Coverage And Other Benefits

One of the critical factors to consider is the prescription drug coverage provided by the short-term health insurance plan. Confirm that the plan includes coverage for any medication you currently take or may need in the future. Furthermore, consider the plan’s additional benefits, such as preventive care services, mental health coverage, or maternity care.

By considering these factors when selecting a short-term health insurance plan from Blue Cross Blue Shield, you can choose one that meets your coverage needs and provides the required benefits.

Credit: www.northcarolinahealthnews.org

Frequently Asked Questions On Short-Term Health Insurance Blue Cross Blue Shield

What Is Short-Term Health Insurance?

Short Term Health Insurance is a temporary health insurance plan that provides coverage for a brief period, typically up to 12 months. It is designed to bridge the coverage gap for individuals between jobs, waiting for employer coverage to start, or needing coverage during a transition period.

Are Blue Cross Blue Shield Short-Term Health Insurance Plans Reliable?

Blue Cross Blue Shield Short-Term Health Insurance plans are reliable and trusted. Blue Cross Blue Shield is a reputable and well-known insurance provider with a strong network of healthcare professionals and facilities. Their short-term health insurance plans offer comprehensive coverage and peace of mind during temporary gaps in coverage.

What Benefits Does Blue Cross Blue Shield Short-Term Health Insurance Provide?

Blue Cross Blue Shield Short-Term Health Insurance plans provide various benefits, including coverage for doctor visits, hospital stays, prescription medications, and emergency care. These plans also offer access to a network of healthcare providers and the flexibility to choose the coverage period that fits your needs.

Can I Customize My Blue Cross Blue Shield Short-Term Health Insurance Plan?

You can customise your Blue Cross Blue Shield Short-Term Health Insurance plan to fit your needs. With different coverage options and coverage periods available, you can choose the plan that best aligns with your budget and healthcare requirements.

Conclusion

Short-term health insurance from Blue Cross Blue Shield offers flexibility and coverage for unforeseen medical expenses. With a range of plans, you can find one that suits your needs and budget. Don’t hesitate to explore the options available to protect your health and well-being.

Choose Blue Cross Blue Shield for peace of mind.