License for Health Insurance: Your Comprehensive Guide

License for Health Insurance in the USA, complete state-specific prelicensing education, pass the insurance exam and meet state requirements. Getting a health insurance license involves completing an education program, passing an exam, and fulfilling state criteria such as background checks.

In Austin, Texas, candidates can undertake prelicensing courses, take the Texas licensing exam, get fingerprinted, apply for the license, and complete continuing education credits. Meanwhile, in Florida, aspiring agents need to follow a similar process of education, such as exams, fingerprinting, licensing applications, and continuing education.

Understanding these steps is crucial to starting a successful career as a licensed health insurance agent.

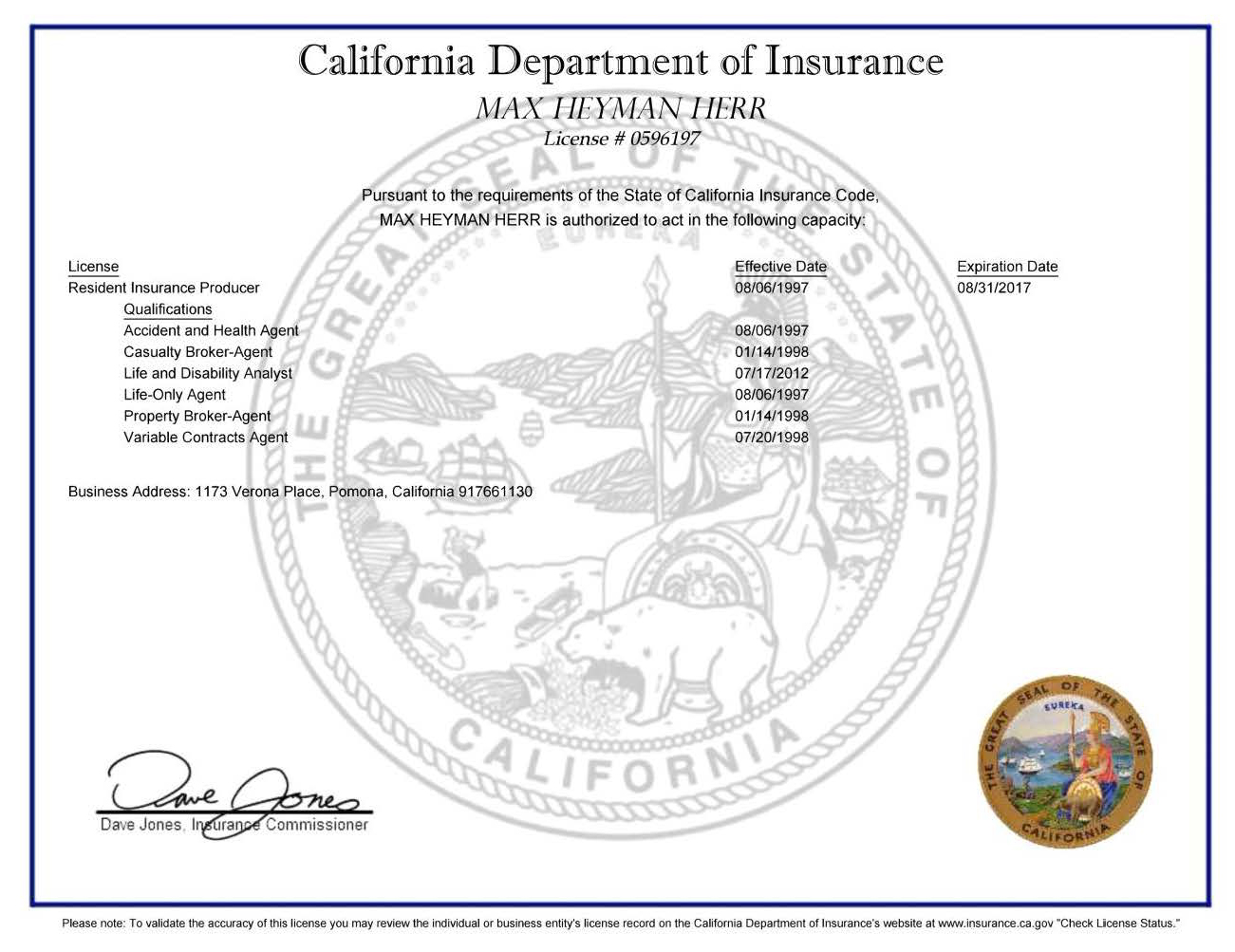

Credit: maxherrinsuranceservices.com

Understanding Health Insurance Licensing

Understanding health insurance licensing is vital for individuals who wish to pursue a career in the insurance industry. Health insurance licensing is a requirement for insurance agents, brokers, and adjusters to sell and assist clients with health insurance policies. This article aims to shed light on the importance of health insurance licensing and the process of obtaining a health insurance license.

The Importance Of Health Insurance License

Health insurance licensing is crucial for individuals working in the insurance industry. It ensures that professionals have the necessary knowledge and expertise to assist clients with their health insurance needs. Possessing a health insurance license demonstrates competency and compliance with state regulations, which builds trust and credibility with clients.

Obtaining A Health Insurance License

To obtain a health insurance license, individuals are typically required to complete prelicensing education specific to their state’s requirements. This education is followed by passing a state insurance exam and meeting additional requirements mandated by the state’s Department of Insurance. For instance, in Texas, individuals must complete an insurance prelicensing course, pass the licensing exam, get fingerprinted, and apply for the Texas insurance license. Similar procedures apply in other states, such as Florida.

Certifications and registrations play a crucial role in the licensing process, allowing individuals to sell various types of insurance, including health insurance for small business employers and Medicare supplemental insurance. It is essential to be aware of and comply with the specific licensing requirements of the state in which one intends to operate.

Licensing Requirements By State

When obtaining a health insurance license, licensing requirements vary by state. Let’s explore the Licensing Requirements by State below:

Texas Licensing Requirements

- Complete an Insurance Prelicensing Course

- Pass the Texas Licensing Exam

- Undergo Fingerprinting Process

- Apply for a Texas Insurance License

- Complete Required Continuing Education Credits

Florida Licensing Requirements

- Complete an Insurance Prelicensing Course

- Pass the Florida Licensing Exam

- Undergo Fingerprinting Process

- Apply for a Florida Insurance License

- Complete Required Continuing Education Credits

Steps To Obtain A Health Insurance License

To obtain a health insurance license, complete state-specific prelicensing education, pass the insurance exam and fulfill all requirements outlined by the Department of Insurance. Completing an insurance course, passing the licensing exam, and applying for the license are essential steps in the process.

Completing Prelicensing Education

In order to obtain a health insurance license, candidates must first complete prelicensing education specific to their state’s requirements. This education provides individuals with the necessary knowledge and understanding of insurance laws, regulations, and policies. It covers topics such as insurance fundamentals, ethics, and customer service.

Passing The State Insurance Exam

After completing the prelicensing education, aspiring health insurance agents must pass a state insurance exam. This exam evaluates their understanding of insurance principles, practices, and regulations. It is crucial to thoroughly prepare for the exam by studying the recommended materials and practicing sample questions. Passing the exam demonstrates the candidate’s competence and eligibility to sell health insurance in their respective state.

Meeting Other State Requirements

In addition to completing the prelicensing education and passing the state insurance exam, candidates must meet other requirements set forth by their state’s Department of Insurance. These requirements may include background checks, fingerprinting, and applying for a health insurance license. It is essential to review and fulfill all these requirements to ensure a smooth licensing process.

Obtaining a health insurance license may seem like a daunting task, but by following the necessary steps, individuals can become licensed health insurance agents. Completing prelicensing education, passing the state insurance exam, and meeting other state requirements are essential for obtaining a health insurance license. With determination and dedication, aspiring agents can enter the rewarding world of health insurance and begin assisting individuals with their insurance needs.

Credit: staterequirement.com

Costs And Application Process

If you are looking to obtain a health insurance license in your state, it is essential to understand the costs involved and the application process. Read on to find out more about what you need to do to become a licensed health insurance agent.

Cost Of Getting Licensed

The cost of getting a health insurance license varies depending on the state you are in. In Texas, for example, the fee is $50[1]. It is essential to check with your state’s Department of Insurance for the specific fee in your region. Additionally, keep in mind that there may be additional costs associated with prelicensing education courses and fingerprinting requirements.

Application Process

The application process for obtaining a health insurance license usually involves several steps. Here is a general outline of the process:

- Complete an Insurance Prelicensing Course: Candidates are typically required to complete state-specific prelicensing education courses to gain the necessary knowledge and skills.

- Pass Your Licensing Exam: After completing the prelicensing course, you will need to pass a state insurance exam to demonstrate your understanding of insurance laws and regulations.

- Get Fingerprinted: Many states require agents to undergo a fingerprinting process to ensure their background is free of criminal activity.

- Apply for a Health Insurance License: Once you have passed the licensing exam and completed the fingerprinting process, you can submit an application to your state’s Department of Insurance for a health insurance license.

- Complete Continuing Education (CE) Credits: After obtaining your license, you will need to fulfill any required continuing education credits to maintain your license and stay up-to-date with industry changes.

Keep in mind that the specific requirements and application process may vary from state to state. It is crucial to visit your state’s Department of Insurance website for detailed information on how to become a licensed health insurance agent in your area.

By completing the necessary education, passing state exams, and following the application process, you can obtain a health insurance license and start your career in the insurance industry.

References:

Certifications And Training

When it comes to selling health insurance, obtaining the necessary certifications and training is crucial. This not only establishes your credibility as an insurance agent but also ensures that you have the knowledge and skills to provide the best advice and service to your clients. In this article, we will discuss the certifications required for selling health insurance and the training explicitly needed for selling Medicare supplemental insurance.

Certifications For Selling Health Insurance

To sell health insurance, you must earn the relevant certifications and registrations. These certifications vary from state to state, so it’s essential to check your state’s specific requirements. In Texas, for example, you can obtain a General line – life, accident, and health license. This license allows you to sell health insurance, along with life and accident policies. To become licensed, you must complete an Insurance Prelicensing Course offered by Kaplan Financial Education. Once you complete the course, you can then apply for a Texas Insurance License through the Texas Department of Insurance’s official website. It’s worth noting that you may also need to meet additional requirements, such as completing fingerprinting and continuing education credits.

Additionally, you can get certified to specialize in selling health insurance to small business employers. This certification enables you to provide health insurance solutions tailored to the specific needs of small businesses.

Training For Selling Medicare Supplemental Insurance

If you are interested in selling Medicare supplemental insurance, you need to complete specific training to become certified. Medicare supplemental insurance, also known as Medigap, helps cover the gaps in original Medicare coverage. To sell these policies, you must first obtain a General line – life, accident, and health license, as mentioned earlier. Once licensed, you can then pursue additional Medicare supplemental insurance training.

Selling Medicare supplemental insurance typically involves in-depth knowledge about the different Medigap plans, their benefits, and the regulations surrounding Medicare. It is essential to stay up-to-date with the ever-changing rules and policies surrounding Medicare to assist your clients effectively. The training courses are designed to provide you with comprehensive knowledge in this specialized field, ensuring that you can confidently advise clients on the appropriate Medigap plans to suit their needs.

By obtaining the necessary certifications for selling health insurance and undergoing specialized training for selling Medicare supplemental insurance, you can position yourself as a trusted and knowledgeable insurance agent in the industry. This not only builds trust with your clients but also enhances your credibility and ability to provide the best possible insurance solutions.

Becoming An Insurance Agent

To become an insurance agent selling health insurance in the USA, candidates must complete state-specific prelicensing education, pass a state insurance exam, and meet the requirements set by the Department of Insurance. This process includes completing a prelicensing course, passing the licensing exam, submitting fingerprints, and applying for the license.

Are you interested in becoming an insurance agent? It’s a rewarding career that allows you to help individuals and businesses navigate the complex world of health insurance. But before you can start selling policies and providing valuable coverage, you need to obtain a health insurance license. Here’s a step-by-step guide to becoming a licensed insurance agent.

Enrolling In the Relicensing Education Course

The first step towards becoming a licensed insurance agent is enrolling in a prelicensing education course. These courses are designed to provide you with the knowledge and skills needed to pass the state insurance exam. Each state has its requirements for prelicensing education, so make sure to research and choose a course that meets your state’s specific requirements.

Here are a few things to keep in mind when enrolling in a prelicensing education course:

- Check the course provider’s credentials and reputation.

- Ensure the course covers the necessary topics for the health insurance license.

- Review the course duration and format (in-person or online).

Registering For The Exam

Once you have completed the prelicensing education course, the next step is to register for the state insurance exam. This exam evaluates your knowledge and understanding of health insurance policies, regulations, and ethics. To register for the exam, you will typically need to submit an application and pay an exam fee.

Here are a few key points to consider when registering for the exam:

- Check the exam dates and locations provided by the state’s Department of Insurance.

- Review the exam guidelines and requirements to ensure you are adequately prepared.

- Consider utilizing study materials and practice exams to increase your chances of success.

Applying For An Insurance License

Once you have successfully passed the state insurance exam, the final step is to apply for an insurance license. The application process varies by state, but generally, you will need to use, provide documentation (such as proof of education and exam completion), and pay a licensing fee.

Here are a few tips to keep in mind when applying for an insurance license:

- Read and follow the instructions provided by your state’s Department of Insurance carefully.

- Gather all the required documentation and ensure it is accurate and up-to-date.

- Submit your application and fees within the specified timeframe.

Once your application is approved, you will receive your health insurance license, allowing you to legally sell insurance policies and provide valuable coverage to individuals and businesses. Congratulations on becoming a licensed insurance agent!

Selling Health Insurance

Selling health insurance can be an excellent career opportunity for those who are passionate about helping others with their health needs and are looking for a rewarding profession in the insurance industry. As a health insurance agent, you play a crucial role in guiding individuals and families toward securing the right health coverage that meets their specific needs. Understanding the process and the resources available for selling health insurance is essential for success in this field.

The Process Of Selling Health Insurance

When it comes to selling health insurance, the process typically involves completing prelicensing education, passing a state insurance exam, and fulfilling any additional requirements set forth by the local Department of Insurance. These requirements may vary from state to state, so it’s essential to familiarize yourself with the specific criteria in your area.

Online Resources For Selling Health Insurance

Accessing online resources can be invaluable for those venturing into the health insurance sales business. Websites such as Kaplan Financial Education offer comprehensive prelicensing courses for various insurance lines, including life, accident, health, and HMO. Additionally, the Texas Department of Insurance provides certification programs that enable agents to sell health insurance for small businesses and Medicare supplemental insurance, enhancing their professional credentials and expanding their client base.

Credit: pt.slideshare.net

Conclusion And Advice

To obtain a health insurance license in the USA, you must complete state-specific prelicensing education, pass the insurance exam, and meet other requirements from the Department of Insurance. In Texas, the cost to get your insurance license is $50, while the process in Florida includes passing the licensing exam and submitting an application for the permit.

For more details on obtaining a license in Texas, visit the Texas Department of Insurance website.

Final Thoughts On Obtaining A Health Insurance License

Obtaining a health insurance license is a crucial step toward a rewarding career in the insurance industry. It requires dedication and compliance with state-specific requirements.

Advice For Prospective Health Insurance Agents

- Conduct thorough research on your state’s licensing requirements.

- Enroll in a reputable prelicensing education course.

- Prepare rigorously for the state insurance exam.

- Stay updated with the latest advancements in the health insurance industry.

- Cultivate strong communication and interpersonal skills.

Frequently Asked Questions

How Do I Get A Health Insurance License in the US?

To get a health insurance license in the USA, you must complete state-specific prelicensing education, pass a state insurance exam, and meet other state Department of Insurance requirements, including fingerprinting and continuing education. Costs and requirements vary by state, so check with your state’s Department of Insurance for details.

How Much Does It Cost To Get Your Insurance License In Texas?

The cost to get your insurance license in Texas is around $50. You need to complete prelicensing education, pass the state insurance exam, and meet other state requirements.

How Do I Get My Insurance License In Texas?

To get your insurance license in Texas, follow these steps: 1. Complete an Insurance Prelicensing Course. 2. Pass the Texas Licensing Exam. 3. Get fingerprinted. 4. Apply for a Texas Insurance License. 5. Complete required Insurance Continuing Education (CE) Credits. These steps will qualify you to sell health insurance, life insurance, accident insurance, and more.

How Do I Get A Florida License for Health Insurance?

To obtain a Florida health insurance license, complete a prelicensing course, pass the Florida licensing exam, get fingerprinted, apply for the license, and fulfill continuing education requirements.

Conclusion

Obtaining a health insurance license is a structured process involving education, exams, and state requirements. Whether in Texas, Florida, or elsewhere, following the steps diligently sets the foundation for a successful insurance career. Stay informed on continuing education to excel in this dynamic field.