Medica Health Insurance: Your Key to Quality Coverage

Medica Health Insurance offers comprehensive coverage across several U.S. States. Its plans cater to individuals, families, and businesses.

Navigating the intricate world of health insurance can be daunting for many. Medica Health Insurance simplifies this journey with various plans tailored to diverse healthcare needs. Medica is a non-profit organization committed to community well-being, providing tailored health plans in states like Minnesota, Iowa, and Nebraska.

Recognized for its individual, family, employer-sponsored, Medicaid, and Medicare plans, Medica stands out with a strong regional presence and a focus on customer-centric care. Access to a broad network of healthcare providers ensures that members receive quality medical attention suited to their lifestyles. This blend of affordability, variety, and accessibility makes Medica a competitive choice for health insurance in its service areas. A user-friendly online platform allows members to quickly sign up, manage their accounts, or select new plans to match their evolving needs.

Coverage Options

Understanding your health insurance coverage is critical to making the best choices for your healthcare needs. Medica Health Insurance offers a range of coverage options designed to fit various lifestyles and budgets. Let’s explore the different plans and what they include or exclude.

Types of Plans Available

Types Of Plans Available

Medica provides a variety of health insurance plans to meet individual and family needs. Each plan caters to specific preferences and financial situations. Here’s a glance at the different types:

| Plan Type | Description |

|---|---|

| Individual & Family Plans | These are perfect for anyone not covered by employer insurance. |

| Medicare | For those aged 65 or older or with specific disabilities. |

| Medicaid | For low-income individuals and families. |

| Employer Plans | Provided by an employer to their employees. |

Inclusions and Exclusions

Inclusions And Exclusions

Each Medica plan comes with specific inclusions and exclusions. Knowing what is covered and what isn’t can save you from unexpected costs. Below is a simplified breakdown of typical inclusions and exclusions:

- Inclusions:

- Doctor’s visits and preventative care.

- Hospital stays and emergency services.

- Prescription drugs and lab tests.

- Exclusions:

- Cosmetic procedures.

- Non-prescription drugs.

- Services deemed non-essential.

For a detailed list of what your specific plan covers, refer to your policy documents or contact Medica Customer Support.

Choosing The Right Plan

Health insurance plans are crucial to family well-being. Medica Health Insurance offers varied options to meet individual needs. Selecting the right coverage involves careful comparison. Key aspects include services, costs, and network breadth. To make an informed decision, consider the following factors.

Factors To Consider

- Plan Types: From HMOs to PPOs, each has unique benefits.

- Costs: Look at premiums, deductibles, and out-of-pocket limits.

- Network: Ensure preferred doctors and hospitals are covered.

- Prescriptions: Check the coverage for necessary medications.

- Extras: Some plans offer wellness programs or discounts.

Comparison With Other Insurers

Medica Health Insurance stands out in the market.

| Feature | Medical Health Insurance | Other Insurers |

|---|---|---|

| Network Size | Extensive in select states | Varies significantly |

| Plan Options | Customizable plans | Standardized plans |

| Customer Support | Highly rated service | Mixed reviews |

| Cost Effectiveness | Competitive Pricing | Can be costly |

| Additional Benefits | Wellness incentives | Less emphasis on wellness |

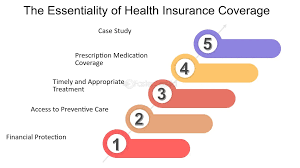

Benefits Of Medica Health Insurance

Choosing the right health insurance is crucial for peace of mind and well-being. Medica Health Insurance offers coverage that balances cost with care. Let’s explore critical benefits that can significantly impact your life.

Financial Security

Health emergencies strike without warning, and medical bills add up quickly. Medica Health Insurance provides robust protection against unforeseen healthcare costs. This means you can focus on getting better without worrying about your finances.

- Preventive care is covered at no extra cost

- Plans with low premiums and out-of-pocket maximums

- Discounts on prescriptions to lower your healthcare spending

Access To Quality Healthcare

With Medica, you have access to top-notch medical providers, ensuring you get the care you need when you need it.

| Feature | Benefit |

|---|---|

| Vast network of doctors | Choose from many healthcare professionals. |

| Specialized care | Get treatments from experts in various fields. |

| Online resources | Manage your health easily with online tools. |

:max_bytes(150000):strip_icc()/health_care_sector.asp_Final-a32bc5773ace4e71b4e7dbbfd9b697f2.jpg)

Credit: www.investopedia.com

Claims Process

Understanding the Claims Process with Medica Health Insurance is crucial for a smooth experience. This section will guide you through two essential stages: Submitting Claims and Claim Settlement. It ensures you know what to expect and how to handle each step effectively.

Submitting Claims

The first step in managing your healthcare expenses is to submit a claim. Medica’s process is straightforward:

- Obtain a detailed bill from your provider.

- Complete Medica’s claim form with accurate information.

- Attach the necessary documentation, such as receipts and medical reports.

- Send the package to Medica’s claims department within the time limit.

Online submissions are also an option. Log in to your Medica member account and follow the upload instructions. Act promptly to avoid delays.

Claim Settlement

Once Medica receives your Claim, they review it against youClaimicy benefits. Take note of the following:

- Medica’s turnaround time for claim review is typically quick.

- You will receive an Explanation of Benefits (EOB).

- The EOB outlines what Medica will pay and what you owe.

- Ensure the EOB reflects the care you received and the coverage you have.

If you agree with the EOB, Medica will process payment directly to your provider. You are responsible for any remaining amount. If there are discrepancies, contact Medica promptly. Communication is critical to a timely settlement.

| Step | Action Required | Expected Outcome |

|---|---|---|

| 1. Submit Claim | Document submission | Claim uClaimreview |

| 2. Review Process | Medica evaluates Claim | Issuance of EOB |

| 3. Payment | Claim any dues | Final settlement |

Customer Support

Struggling with health insurance queries? Medica Health Insurance offers a robust customer support system to guide you through your concerns. Quick, reliable, and crafted with care, their support services ensure every customer feels heard and assisted. Let’s explore how Medica Health Insurance stands by your side, from contact options to online resources.

Contact Information

Reach out to Medica Health Insurance swiftly and conveniently. Their representatives are ready to help you with personalized advice and solutions. Here is the essential contact information:

- Customer Service Number: Dial for fast, voice-assisted service.

- Email Support: Send your queries and get detailed responses.

- Physical Address: Visit their local offices for in-person assistance.

Online Assistance

Do you prefer digital convenience? Medical Health Insurance’s online support system is just a click away. Explore the different ways you can use their online assistance:

- Member Portal: Manage your account and access services 24/7.

- Live Chat: Chat in real-time with a customer service agent.

- FAQ Section: Find quick answers to common insurance questions.

Credit: www.uhc.com

Wellness Programs

Medica Health Insurance prioritizes its members’ health and well-being. Its wellness programs offer a variety of resources to support physical and mental health. Designed to motivate and educate, these programs empower members to take charge of their health.

Promotion Of Health

Medica believes in the power of maintaining a healthy lifestyle. Their health promotion activities provide tools and resources to support members’ journey to wellness.

- Nutrition advice and plans to eat healthy

- Exercise programs for all fitness levels

- Stress management techniques to boost mental health

Preventive Care Initiatives

Preventing illness is critical to Medica’s approach. Their initiatives focus on early detection and routine check-ups.

| Preventive Care Service | Benefit |

|---|---|

| Vaccinations | Keeps diseases at bay |

| Health Screenings | Early disease detection |

| Annual Check-ups | Monitors overall health |

Future Of Medica Health Insurance

The future of Medica Health Insurance looks bright with the integration of advanced technology and strategic growth. As we peer into the horizon, Medica stands prepared to improve healthcare experiences and extend its reach. Let’s delve into the innovations and expansion plans Medica will roll out.

Technological Advancements

Medica continuously seeks to pioneer health tech solutions. This healthcare provider is investing in cutting-edge systems to streamline patient care. For example:

- Telemedicine services are expanding, allowing patients to consult doctors from home.

- Mobile health apps provide real-time health tracking for users.

- Artificial Intelligence (A.I.) aids in predictive analysis for personalized care plans.

These tech advancements ensure patients receive efficient and personalized healthcare.

Expansion Plans

With a robust expansion strategy, Medica aims to broaden its impact. Here are the key focus areas:

- New markets: Medica plans to extend services beyond current states.

- Partnerships: Collaborations with local clinics and hospitals will improve accessibility.

- Health plan variety: More options will be available to cater to diverse needs.

These steps will help more people get top-notch health insurance coverage.

Credit: www.commonwealthfund.org

Frequently Asked Questions On Medica Health Insurance

Is Medica The Same As Medicare?

No, Medica is not the same as Medicare. Medica is a private health insurance provider, while Medicare is a federal health insurance program.

Is Medica A Good Company?

Medica is well-regarded for its non-profit health services across multiple U.S. states. Customer reviews often highlight satisfaction with their coverage and customer service.

What States Have Medica Insurance?

Medical insurance is available in the following states: Arizona, Iowa, Kansas, Minnesota, Missouri, Nebraska, North Dakota, Oklahoma, South Dakota, and Wisconsin.

How Long Has Medica Insurance Been Around?

Medical Insurance has been providing health plans since 1975.

Conclusion

Choosing a health insurance provider is a pivotal decision. Medica’s dedication to the community and non-profit status makes it a compelling choice. Medica is a significant player in the industry and is present in multiple states. As you consider your options for health coverage, reflect on the comprehensive benefits Medica offers.

Their commitment to members shines through in their service provision – something to remember when selecting your insurer.