Health Insurance North Dakota: Find Affordable Coverage Now!

Health Insurance North Dakota offers a range of affordable plans for individuals and families. Medicaid is available for low-income residents.

Enrolling through the ACA Marketplace provides access to various health coverage options tailored to North Dakotans’ needs. Blue Cross Blue Shield and other trusted companies offer comprehensive health insurance plans in the state, ensuring quality care for all residents. Accessing healthcare coverage in North Dakota is made easier with online platforms like HealthCare.

Gov, aiding in comparing and purchasing suitable health plans. With a focus on individual and family health insurance, North Dakota prioritizes accessibility and affordability in healthcare protection.

Credit: www.insurance.nd.gov

Available Health Insurance Options

When it comes to healthcare, having access to quality health insurance is crucial for North Dakotans to ensure they are covered for medical expenses. There are various health insurance options available in North Dakota, including private health insurance companies and state-funded health insurance programs. Understanding the available health insurance options can help individuals and families make informed decisions about their healthcare coverage.

Private Health Insurance Companies

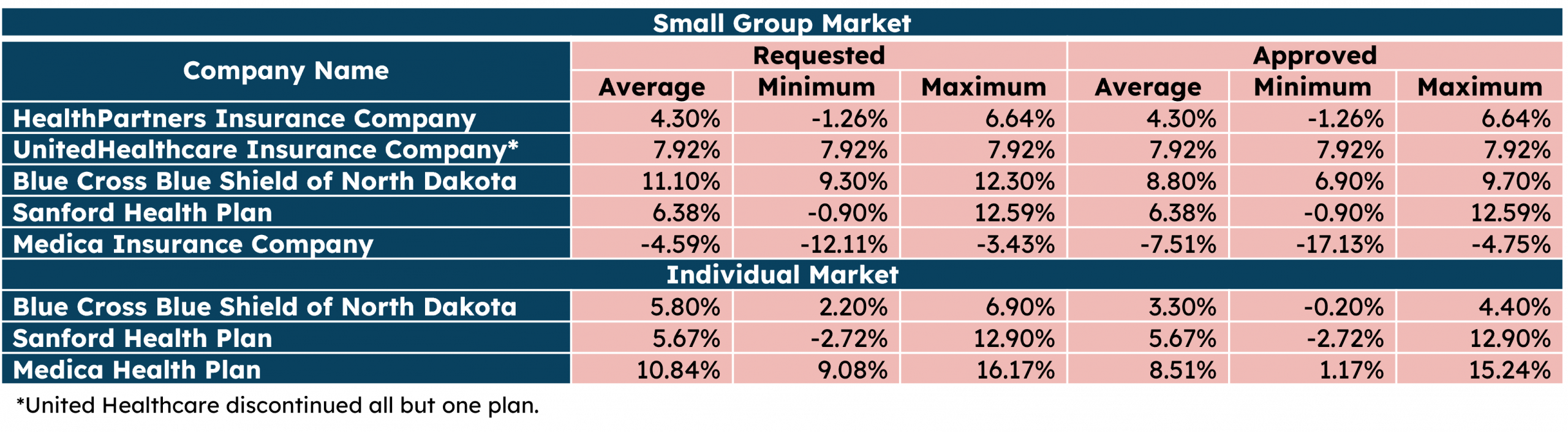

North Dakota offers a range of private health insurance options through reputable companies such as Blue Cross Blue Shield of North Dakota, Medica, and Sanford Health Plan. These companies provide a variety of health insurance plans tailored to meet the diverse needs of North Dakota residents. Individuals and families can explore different coverage options, including individual and family plans as well as Medicare supplements, ensuring they find the right insurance solution to meet their healthcare needs.

State-funded Health Insurance Programs

In addition to private health insurance companies, North Dakota also provides state-funded health insurance programs to assist low-income individuals and families in accessing essential healthcare services. One such program is Medicaid, which the state and federal governments jointly fund. Medicaid offers coverage for eligible low-income adults, children, pregnant women, older adults, and people with disabilities, ensuring that vulnerable populations have access to necessary medical care without financial burden.

Credit: www.google.com

Understanding Medicaid

Medicaid is a vital healthcare program in North Dakota that assists eligible individuals in accessing essential medical services.

Qualifying Criteria For Medicaid In North Dakota

- Must be a resident of North Dakota

- Meet income requirements

- Fall into specific categories such as low-income adults, pregnant women, children, older adults, or people with disabilities.

Benefits Of North Dakota Medicaid

- Access to preventive care services

- Coverage for doctor visits and hospital stays

- Prescription drug coverage

- Mental health services

- Long-term care for eligible individuals

North Dakota Medicaid provides a safety net for those in need, ensuring that healthcare services are accessible and affordable.

Enrolling In Health Insurance

Enrolling in health insurance in North Dakota is essential for individuals and families looking for affordable coverage. With options from top companies like Blue Cross Blue Shield of North Dakota and Medica, you can find a plan that suits your needs.

Using ACA Marketplace

Enrolling in health insurance is an essential step towards protecting your health and well-being. In North Dakota, one option for enrolling in health insurance is through the ACA Marketplace. The ACA Marketplace, or HealthCare.gov, is an online platform that allows you to shop, compare, and buy health plans. It provides a convenient way to explore different coverage options and find the plan that best suits your needs.

Accessing Private Health Insurance Plans

In addition to the ACA Marketplace, you can also access private health insurance plans in North Dakota. Various insurance companies offer private health insurance plans and provide a range of coverage options. These plans may offer additional benefits and flexibility compared to plans available through the ACA Marketplace. To find private health insurance plans in North Dakota, you can visit the websites of insurance companies such as Blue Cross Blue Shield of North Dakota, Medica, or Sanford Health Plan.

When accessing private health insurance plans, it’s essential to review the coverage and costs associated with each plan carefully. Consider factors such as premiums, deductibles, co-pays, and out-of-pocket maximums to determine which plan offers the best value for your healthcare needs. You may also want to consider additional factors such as network coverage, prescription drug coverage, and any extra benefits or services offered by the insurance company.

Overall, enrolling in health insurance provides you with financial protection and access to necessary healthcare services. Whether you choose to use the ACA Marketplace or access private health insurance plans, it’s essential to consider your specific healthcare needs and compare different options to find the plan that best meets your requirements.

Specific Health Insurance Providers

When it comes to health insurance in North Dakota, it’s crucial to explore the specific providers available in the state. Different insurance providers offer various plans and coverage options, providing residents with a range of choices for their healthcare needs. Understanding the offerings from leading providers can help individuals and families make informed decisions when selecting health insurance plans.

Blue Cross Blue Shield Of North Dakota

Blue Cross Blue Shield of North Dakota (BCBSND) is a prominent health insurance provider in the state. It offers a wide array of individual and family health insurance plans, ensuring comprehensive coverage for various medical needs. BCBSND is known for its extensive network of healthcare providers, enabling members to access quality care from trusted professionals.

UnitedHealthcare Plans In North Dakota

UnitedHealthcare is another leading health insurance provider offering its services in North Dakota. The company provides diverse health insurance plans tailored to meet the specific requirements of individuals and families. With a focus on innovation and customer-centric solutions, UnitedHealthcare aims to ensure access to quality healthcare services for its members across the state.

Choosing The Right Plan

When it comes to health insurance in North Dakota, choosing the right plan is crucial for ensuring you have adequate coverage for your healthcare needs. With various options available, it’s essential to consider several factors before making a decision.

Factors To Consider When Selecting A Health Insurance Plan

When choosing a health insurance plan in North Dakota, consider factors like premium costs, deductibles, copaycopaymentsvider networks, and coverage limits. Understanding these elements will help you select a plan that best suits your healthcare needs and financial situation.

Comparing Coverage Options

It’s important to compare coverage options offered by different health insurance plans in North Dakota. Look at the types of services covered, including preventive care, prescription medications, hospital stays, and specialized treatments. Assessing the comprehensiveness of coverage will ensure you are prepared for any health-related expenses that may arise.

Costs And Premiums

Understanding the costs and premiums of health insurance in North Dakota is crucial for making informed decisions about coverage. By delving into the average costs and gaining a better understanding of premium structures, individuals can more effectively navigate the complexities of health insurance.

Average Health Insurance Costs In North Dakota

Understanding the average health insurance costs in North Dakota is essential for individuals and families seeking affordable coverage. In 2021, the average monthly premium for an individual health insurance plan in North Dakota was approximately $450, while family plans averaged around $1,200 per month. These costs can vary based on factors such as age, location, and the level of coverage desired.

Understanding Premium Structures

Several factors, including age, tobacco use, and the type of plan chosen, influence health insurance premiums in North Dakota. The premium structure often involves a combination of monthly premiums, deductibles, co-pacopayments, and co-insurance. Individuals must comprehend how these elements interact to determine their overall healthcare costs and financial responsibilities.

Credit: www.google.com

Frequently Asked Questions

What Is The Average Cost Of Health Insurance North Dakota?

The average cost of health insurance in North Dakota varies depending on factors such as age, coverage options, and insurance provider. To find affordable plans and get free quotes, you can visit websites like eHealthInsurance and HealthCare. Gov. Medicaid is also available for qualifying low-income individuals.

Some health insurance companies in North Dakota are Blue Cross Blue Shield of North Dakota, Medica, and Sanford Health Plan.

What Health Insurance Companies Are In North Dakota?

Blue Cross Blue Shield of North Dakota, Medica, and Sanford Health Plan are health insurance companies in North Dakota.

Does North Dakota Have State Health Insurance?

Yes, North Dakota offers Medicaid, a state and federally-funded program for low-income individuals. You can also enroll in ACA Marketplace plans through HealthCare. Gov. Various health insurance companies, such as Blue Cross Blue Shield and Medica, offer coverage options in the state.

How To Get Insurance In North Dakota?

To get insurance in North Dakota, visit HealthCare. Gov to enroll in an ACA Marketplace plan. This online platform allows you to compare and buy health plans. Additionally, you can explore coverage options from health insurance companies like Blue Cross Blue Shield and Medica.

Conclusion

Securing reliable health insurance in North Dakota is crucial for individuals and families. By exploring various plans and providers, finding suitable coverage becomes more manageable. Remember to consider costs, coverage options, and the benefits each plan offers to ensure your health needs are met effectively in North Dakota.