Average Cost of Health Insurance in Illinois Per Month: Uncover the Affordable Options

Average Cost of Health Insurance in Illinois Per Month varies depending on age, coverage level, and insurance provider. Residents can expect to pay between $300 and $600 monthly for individual coverage.

When calculating the average cost of health insurance in Illinois, various factors that can impact the monthly premiums must be considered. Factors such as age, gender, location, and coverage level play a significant role in determining how much individuals will pay for health insurance in the state.

Understanding these factors can help individuals make informed decisions when selecting a health insurance plan that best fits their needs and budget. In Illinois, monthly health insurance costs can range from $300 to $600 for individual coverage, depending on the selected plan and provider. It is recommended that different options be compared and coverage benefits considered before deciding.

Factors Affecting Health Insurance Costs

Location Impact

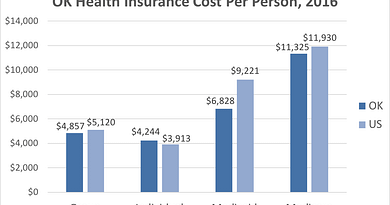

Location plays a significant role in determining health insurance costs in Illinois. Urban areas tend to have higher health insurance premiums than rural areas due to increased medical service accessibility and cost of living.

Age And Gender Influence

The age and gender of an individual also impact health insurance expenses. Generally, older individuals and females may experience higher health insurance costs due to increased healthcare needs and utilization.

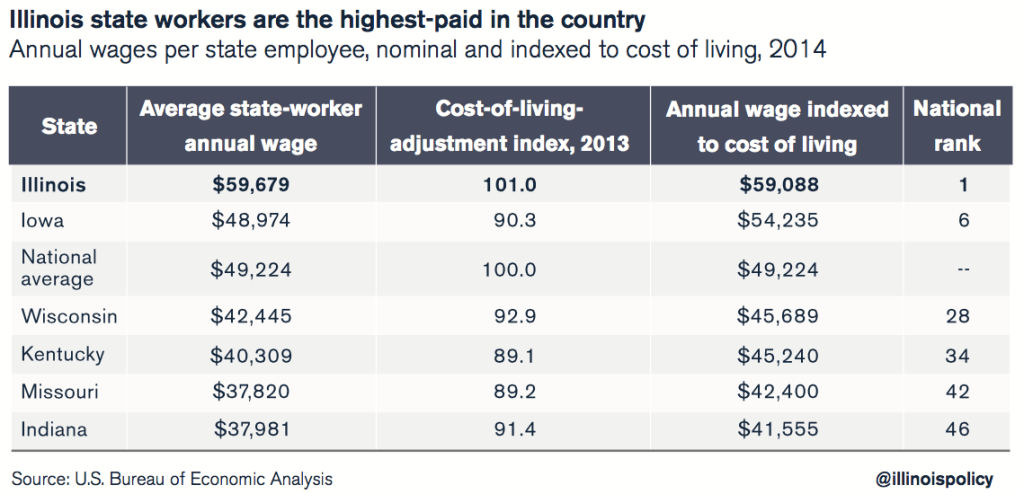

Credit: www.illinoispolicy.org

Average Cost Of Health Insurance In Illinois

Understanding Illinois’s average cost of health insurance is crucial when planning your budget. This information can help you make informed decisions and choose the best coverage that suits your financial capabilities. This article will explore the statewide trends and variations among Illinois providers for health insurance costs.

Statewide Trends

Like many states, Illinois experiences fluctuation in health insurance premiums. The average cost of health insurance in Illinois per month can vary based on factors such as age, location, and the level of coverage. For instance, a young individual in Chicago may have health insurance costs that are different from those of a middle-aged person living in a rural area.

Variation Among Providers

Substantial variation among health insurance providers in Illinois leads to different pricing structures and coverage options. It’s essential to compare plans from various providers to identify the best balance between cost and coverage. Some providers may offer lower monthly premiums but higher deductibles, while others provide comprehensive coverage with higher premiums.

Popular Coverage Options

Individual Plans

The average cost of health insurance in Illinois per month for individual plans varies based on factors like age, health status, and coverage type. Below are some popular coverage options for individual plans:

- Basic Plan: Offers essential coverage at an affordable monthly premium.

- Silver Plan: Provides a balanced coverage option with moderate costs.

- High-Deductible Plan: Lower monthly premiums but higher out-of-pocket expenses.

Family Plans

Family health insurance plans in Illinois offer coverage for multiple family members. Here are some standard coverage options for family plans:

- Family Coverage: Comprehensive plan that includes all family members.

- Premium Plan: Higher cost but offers extensive coverage for the entire family.

- HSA-Compatible Plan: Allows families to save for healthcare expenses with tax advantages.

Government Assistance Programs

Various government assistance programs are available in Illinois for individuals and families who may struggle to afford health insurance. These programs aim to provide financial support to eligible individuals and help them access the healthcare they need. Two notable government assistance programs in Illinois are Medicaid and Subsidies.

Medicaid

Medicaid is a government-funded program that provides health coverage to low-income individuals and families. In Illinois, the Medicaid program is known as the Illinois Medical Assistance Program (IMAP). IMAP offers comprehensive coverage, including doctor visits, preventive care, hospital stays, prescription medications, and more.

Individuals must meet specific income and other eligibility criteria to qualify for Medicaid in Illinois. The income limits vary depending on the household size, with higher limits for families with children. Pregnant women, individuals with disabilities, and older adults may also qualify for Medicaid.

Applying for Medicaid in Illinois is straightforward. You can apply online through the Illinois Application for Benefits Eligibility (ABE) website, by phone, or in person at your local Department of Human Services office.

Subsidies

Another form of government assistance for health insurance in Illinois is through subsidies. The Affordable Care Act (ACA) offers premium subsidies to help offset the cost of health insurance for eligible individuals and families who purchase coverage through the Health Insurance Marketplace.

These subsidies, also known as Advanced Premium Tax Credits (APTCs), are based on a person’s income and the cost of the benchmark plan in their area. They can significantly reduce the monthly premium cost for qualifying individuals and families.

You can use the Kaiser Family Foundation’s Health Insurance Marketplace Calculator to determine your subsidy eligibility and estimate your potential subsidy amount. This tool considers factors such as your income, family size, and location to estimate the financial assistance you may be eligible for.

When applying for health insurance through the Marketplace, you can apply for subsidies along with your application. The Marketplace will assess your eligibility and inform you of the subsidy amount you qualify for, which will be used for your monthly premium.

It’s important to note that subsidies are only available for health insurance plans purchased through the Health Insurance Marketplace. If you buy insurance outside the Marketplace, you will not be eligible for these premium subsidies.

Government assistance programs like Medicaid and subsidies make health insurance more affordable and accessible to individuals and families in Illinois. By exploring these programs and understanding your eligibility, you can find the financial help you need to secure the healthcare coverage you and your loved ones deserve.

Tips For Lowering Health Insurance Costs

Ensure that regular check-ups are scheduled to prevent costly medical issues.

Compare different health insurance plans to find the best coverage at the lowest cost.

Credit: www.valuepenguin.com

Implications Of Cost On Healthcare Access

Health insurance plays a crucial role in healthcare access, yet the cost of health insurance can have significant implications on individuals’ ability to access necessary healthcare services. In Illinois, the average cost of health insurance per month can impact uninsured rates and healthcare utilization, thereby influencing the overall accessibility and affordability of healthcare services for the state’s residents.

Impact On Uninsured Rates

The average cost of health insurance in Illinois per month directly affects the uninsured rates in the state. High insurance premiums can lead individuals to forgo insurance coverage, resulting in more uninsured individuals. Conversely, affordable health insurance options can help lower the uninsured rates and improve overall access to healthcare services for the population.

Healthcare Utilization

The cost of health insurance in Illinois can also influence healthcare utilization. With high insurance costs, individuals may delay or avoid seeking necessary medical care due to financial constraints. On the other hand, affordable health insurance plans can encourage individuals to utilize healthcare services, leading to better health outcomes and improved access to medical care for the population.

Future Trends In Health Insurance Costs

As we move forward, it’s essential to monitor the trends shaping health insurance costs in Illinois. Understanding these trends will help individuals and businesses secure reliable and affordable health coverage. Let’s explore some critical factors expected to influence the average cost of health insurance in Illinois in the coming years.

Technological Advancements

Rapid advancements in technology are poised to revolutionize the healthcare and insurance industries. From adopting telemedicine and digital health platforms to utilizing big data and artificial intelligence, innovative technologies are expected to streamline processes, improve efficiency, and enhance patient care. This shift towards tech-driven solutions can impact health insurance costs by optimizing administrative tasks, reducing overhead expenses, and promoting preventive care, ultimately contributing to more cost-effective insurance plans.

Regulatory Changes

Regulatory changes within the healthcare landscape can significantly influence the pricing and availability of health insurance. Reforms in policies and regulations, such as adjustments to the Affordable Care Act or new state mandates, may directly impact the cost structure of insurance plans. Consumers and insurers must stay informed about these developments as they navigate the evolving regulatory environment and its potential implications on health insurance premiums and coverage options.

Credit: www.google.com

Frequently Asked Questions

What Is The Average Cost of Health Insurance in Illinois Per Month?

Illinois’s average cost of health care varies depending on factors such as age, income, and coverage type. However, the average monthly price of health insurance for a single person in Illinois is estimated to be around $473.

This cost can be further reduced with financial assistance through the ACA Marketplace.

How Much Is Health Insurance A Month For A Single Person In The US?

The average monthly cost of health insurance for a single person in the US varies. Depending on location, age, and coverage type, it can range from around $200 to $600 monthly.

How Much Is Insurance A Month In Illinois?

In Illinois, insurance costs an average of $473 per month for health coverage. Residents can qualify for financial assistance through the ACA Marketplace.

Is $200 A Month Good For Health Insurance?

Yes, $200 a month is a good amount for health insurance, offering coverage at an affordable rate.

Conclusion

Navigating health insurance costs in Illinois can be complex. Understanding average monthly rates can aid in decision-making and financial planning. With various resources available, individuals can compare and select affordable plans. Explore options through reputable platforms to find a suitable health insurance plan that aligns with your needs.