Best Health Insurance in Idaho: Get Affordable Coverage Now!

The best Health Insurance in Idaho includes Blue Cross Blue Shield and Kaiser Permanente, which offer top-rated coverage. Idahoans can also consider PacificSource Health Plans, which offer Silver PPO plans at affordable prices.

When considering health insurance in Idaho, it is crucial to navigate the various providers to find a plan that suits your needs. Blue Cross of Idaho and Kaiser Permanente stand out for their quality plans and affordability. PacificSource Health Plans also offer Silver PPO plans, making them ideal for those seeking cost-effective coverage.

Understanding the diverse coverage options available can help individuals and families make informed decisions when selecting the best health insurance in Idaho. By exploring the range of plans offered by reputable insurers, Idaho residents can secure reliable healthcare coverage tailored to their requirements.

The Importance Of Health Insurance

Health insurance is an essential component of a person’s financial well-being and overall health. It provides a safety net that protects individuals and families from unexpected, high medical costs. Without health insurance, individuals may delay seeking necessary medical care, leading to worsened health outcomes and potential financial hardships. Let’s explore the crucial benefits of having health insurance.

Financial Protection

Health insurance serves as a shield against exorbitant medical expenses, especially in the event of unforeseen illnesses or accidents. Having coverage can prevent individuals from facing substantial financial burdens that could impact their livelihood and savings. In essence, health insurance ensures that individuals can access necessary medical care without fear of financial ruin.

Access To Quality Healthcare

With adequate health insurance, individuals can access quality healthcare services without worrying about the cost. This promotes proactive health management and the ability to seek preventative care, leading to better overall well-being and reduced health complications in the long run.

Credit: healthcareinsider.com

UnderstanIdaho’saho’s Health Insurance MarIdaho’saho’s health insurance market offers residents a variety of options. Understanding the available insurance providers and the types of plans is essential for making informed decisions about healthcare coverage.

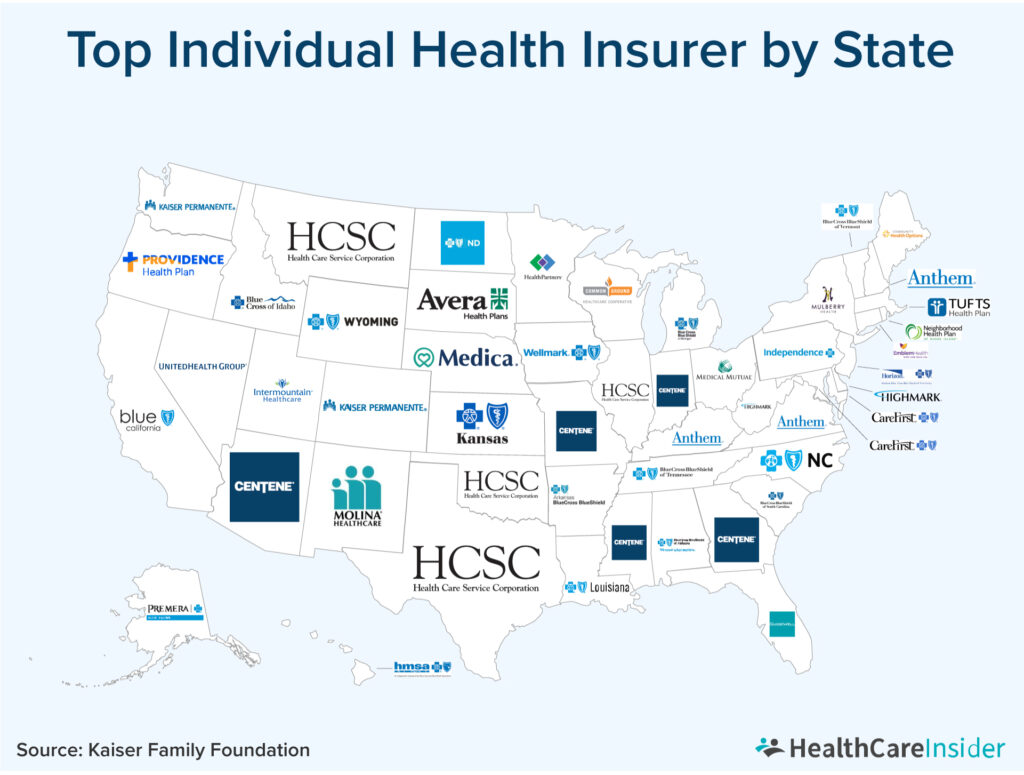

Available Insurance Providers

When it comes to health insurance in Idaho, some of the top providers include:

- Kaiser Permanente: Known for cheap and highly rated plans

- Blue Cross Blue Shield: Offers flexibility in coverage

- Oscar: Known for health management programs

- Aetna CVS Health: Best for same-day care

Types Of Plans

Idaho residents can choose from a variety of health insurance plans to suit their needs:

- Silver PPO Plans by PacificSource Health Plans: Considered the top pick for overall quality in Idaho

- Medicare Solutions by Blue Cross of Idaho: Trusted health partner for individual and family plans

- Employer-Sponsored Plans: Offered by various insurers to cater to different workplace needs

By understanding the available insurance providers and types of plans in Idaho, individuals can make informed decisions to ensure they have the best health insurance coverage for their needs.

Comparison Of Top Health Insurance Companies In Idaho

Dive into the comparison of top health insurance companies in Idaho to find the best coverage for your needs. Discover top-rated insurers like Kaiser Permanente and Blue Cross Blue Shield, offering affordable plans with quality benefits and varied coverage options.

Choose the right plan for optimal healthcare security.

When it comes to choosing a health insurance provider, it’s essential to consider the options available to you. In Idaho, several companies offer reliable and comprehensive health insurance plans. In this article, we will compare the top health insurance companies in Idaho, including Blue Cross of Idaho, PacificSource Health Plans, and SelectHealth. Each of these companies has its unique offerings and benefits that make them stand out in the market.

Blue Cross Of Idaho

Blue Cross of Idaho is a trusted health partner in Idaho, offering a range of individual and family plans and Medicare solutions. Their healthcare insurance plans are designed to cater to the specific needs of Idahoans, ensuring that they receive the coverage they deserve. Whether you are an individual, a family, or an employer, Blue Cross of Idaho has options that suit your requirements. With their extensive network of healthcare providers, you can rest assured that you will receive quality care when you need it.

pacific source Health Plans

PacificSource Health Plans is another top health insurance company in IdMoneyGeek’seek’s top pick for the best health insurance in Idaho for Silver PPO plans is PacificSource Health Plans. They offer two Silver PPO plans, providing comprehensive coverage for individuals and families. With PacificSource Health Plans, you can expect quality healthcare services and access to a vast network of doctors and specialists. Their plans are designed to meet the diverse healthcare needs of Idaho residents, ensuring that you receive the best care possible.

Select health

SelectHealth is a trusted health insurance provider in Idaho, offering a range of health insurance plans for individuals, families, and employers. With SelectHealth, you can access a vast network of healthcare providers and receive the quality care you deserve. Their plans are designed to provide comprehensive coverage and flexibility, ensuring that you have the freedom to choose the healthcare services that are best suited to your needs. SelectHealth is committed to helping Idahoans live healthier lives by providing them with the insurance coverage they need.

In conclusion, when comparing the top health insurance companies in Idaho, it is clear that each company has its strengths and offerings. Blue Cross of Idaho, PacificSource Health Plans, and SelectHealth all provide reliable and comprehensive health insurance plans designed to meet the unique needs of Idaho residents. Whether you are an individual, a family, or an employer, there is a health insurance plan available to you. It is essential to evaluate your own healthcare needs and preferences to determine which company and plan best suits you.

Credit: www.google.com

Factors To Consider When Choosing Health Insurance

When choosing health insurance in India, it’s essential to consider factors such as coverage options, a network of providers, premiums, and deductibles. Compare plans from reputable companies like Blue Cross of Idaho, PacificSource Health Plans, and SelectHealth to find the best fit for your needs and budget.

Protect your health and finances with the right health insurance plan for you.

Premium Costs

Understanding the factors that influence premium costs is crucial when selecting health insurance in Idaho. Premium costs refer to the amount you pay each month for your health insurance coverage. Several elements contribute to determining the premium costs of insurance plans. Typically, individual plans cost less than family plans, as they cover only one person.

In Idaho, factors such as age, location, and the level of coverage you choose also influence the premium costs. Older individuals tend to pay higher premiums, while younger ones may access more affordable rates. The region you reside in, Idaho, might also impact premium costs due to variations in healthcare expenses and provider networks.

Coverage Options

Another crucial factor to consider when selecting health insurance in Idaho is the coverage options available. Coverage options determine the extent to which insurance pays for healthcare expenses. Different insurers offer various plans with varying coverage levels.

Standard coverage options in Idaho include basic plans, which cover essential healthcare needs, and comprehensive plans, which provide more extensive coverage. Additionally, some plans offer specialized coverage for specific conditions or treatments, catering to individual needs. It’s essential to carefully assess your healthcare requirements and compare the coverage options provided by different insurers to find the most suitable plan for you.

Provider Networks

Provider networks are a crucial aspect to consider when choosing health insurance in Idaho. Provider networks refer to the group of doctors, hospitals, and healthcare facilities that have agreed to provide medical services to insured individuals under the health insurance plan.

Understanding the size and accessibility of the provider network is essential to ensure prompt and quality health care. You’ll want to make sure that the healthcare providers you prefer are included in the network, allowing you to receive services conveniently and avoid out-of-network charges.

Some health insurance plans in Idaho offer a broader network with a more significant number of participating providers, while others may have a more limited network. Carefully reviewing and comparing the provider networks of different plans is necessary to ensure you have access to the healthcare providers you desire.

Affordable Health Insurance Options

Are you looking for the best health insurance options in Idaho? EHealth offers affordable plans from top providers, including Blue Cross of Idaho, PacificSource Health Plans, and SelectHealth. With our marketplace, you can explore various choices to find coverage that suits your needs and budget.

Best Cheap Health Insurance Plans

When it comes to finding affordable health insurance options in India, it’s essential to consider the best cheap health insurance plans available. These plans can provide comprehensive coverage while still fitting into your budget. Here are some top options to consider:

- PacificSource Health Plans: PacificSource Health Plans offers a range of affordable options, including Silver PPO plans that provide excellent coverage and value.

- Blue Cross of Idaho: Blue Cross of Idaho is a trusted health insurance provider in the state, offering individual and family plans that are cost-effective and provide comprehensive coverage.

- Regence BlueShield of Idaho: Regence BlueShield of Idaho offers various affordable health insurance plans, including Bronze plans that are designed to have lower monthly premiums.

- Mountain Health CO-OP: Mountain Health CO-OP is a non-profit health insurance provider that focuses on affordability and community involvement. They offer a variety of plans to suit different budget needs.

Eligibility For Tax Credits

In addition to the affordable health insurance plans available, it’s essential to explore eligibility for tax credits. These credits can significantly reduce your monthly premiums and make healthcare coverage even more affordable. To determine if you are eligible for tax credits, you can visit the official Idaho health insurance marketplace, Your Health Idaho. They provide information and assistance in finding the right coverage for your needs, and they are the only place where you can save on monthly premiums with a tax credit. By exploring the best cheap health insurance plans and understanding your eligibility for tax credits, you can find the most affordable options for your healthcare needs. Don’t hesitate to take advantage of these resources and secure the coverage you need at a price that works for you.

Understanding Different Types Of Health Insurance Plans

Hmo Vs. Ppo

When it comes to selecting a health insurance plan in India, it’s essential to understand the differences between HMO and PPO plans. An HMO, or Health Maintenance Organization, typically requires members to choose a primary care physician and receive all their healthcare services within the HMO network. On the other hand, a PPO, or Preferred Provider Organization, offers more flexibility, allowing members to visit out-of-network providers, although at higher costs than in-network providers. Understanding these distinctions can help individuals make the right choice based on their healthcare needs.

High-deductible Health Plans (hdhp)

High-Deductible Health Plans (HDHP) are another option to consider when exploring health insurance plans in Idaho. These plans feature lower monthly premiums but come with higher deductibles, which individuals must meet before the insurance coverage kicks in. HDHPs are often accompanied by Health Savings Accounts (HSAs), offering individuals the ability to save for qualified medical expenses on a tax-free basis. For those who are generally healthy and don’t anticipate significant medical expenses, an HDHP might be a cost-effective choice. However, it’s crucial to carefully evaluate the potential out-of-pocket costs before opting for this type of plan.

How To Enroll In A Health Insurance Plan In Idaho

Enrolling in a health insurance plan in Idaho is an important decision that ensures your and your family’s well-being. Navigating through the options and understanding the eligibility criteria contribute to making an informed choice.

Navigating Your Health Idaho Marketplace

When enrolling in a health insurance plan in Idaho, you can utilize the Your Health Idaho marketplace. It serves as the official platform for Idahoans to explore and select suitable coverage options, including individual and family plans as well as Medicare solutions.

Eligibility Criteria

Before enrolling in a health insurance plan at Idit, it’s essential to understand the eligibility criteria. These include factors such as residency, citizenship status, and not being eligible for another government-sponsored program. It’s also necessary to obtain detailed information on eligibility to ensure a smooth enrollment process.

Credit: www.prnewswire.com

Maximizing The Benefits Of Health Insurance

Maximizing the Benefits of Health Insurance:

Utilizing Preventive Care Services

Make the most of your health insurance by utilizing preventive care services early on. Regular check-ups and screenings can help catch potential health issues before they escalate.

Understanding Out-of-pocket Costs

Know your out-of-pocket costs to avoid any surprises. Understanding your deductibles, copayments, and coinsurance can help you budget and plan for healthcare expenses.

Frequently Asked Questions

How Much Does Health Insurance Cost Per Month In Idaho?

The average cost of health insurance in Idaho per month depends on various factors like age, coverage, and insurance company. For a 40-year-old, it could be around $400 to $600. Different plans and providers will offer various options and costs.

Which Health Insurance Company Has The Best Benefits?

The best health insurance company for benefits is Kaiser Permanente, offering cheap and highly rated plans. Blue Cross Blue Shield is also a good option with more coverage flexibility. Other top insurers in Idaho include PacificSource Health Plans and SelectHealth.

What Are The Top 3 Best Health Insurance in Idaho?

The top 3 health insurances are Blue Cross Blue Shield, Kaiser Permanente, and Oscar.

Which Insurer Is Best For Health Insurance?

Kaiser Permanente and Blue Cross Blue Shield are top choices for health insurance benefits.

Conclusion

When choosing the best health insurance in Idaho, consider companies like Kaiser Permanente and Blue Cross Blue Shield for quality coverage options. Compare plans to find the right fit for your needs and budget in Idaho’s health insurance marketplace. Make an informed decision for your health.