Does Health Insurance Cover Dermatologist? Find Out Now!

Does Health Insurance Cover Dermatologist? Health insurance typically covers dermatologist visits for medically necessary treatments and procedures. As part of maintaining overall health and wellness, it’s essential to ensure that skin-related concerns receive proper attention and treatment.

Dermatologists play a crucial role in diagnosing and managing various skin conditions, from acne and eczema to skin cancer and psoriasis. However, the necessity of such visits raises the question: Does health insurance cover dermatologist appointments? Understanding the extent of coverage provided by health insurance for dermatological services is vital for individuals seeking appropriate skin care.

This article delves into the aspects of insurance coverage for dermatology, addressing commonly asked questions such as the inclusion of dermatologist visits in health insurance plans and the specific skin issues covered. Understanding these key points can aid in making informed decisions regarding seeking professional dermatological care while leveraging health insurance benefits.

Credit: google.com

The Basics Of Health Insurance And Dermatologist Coverage

In today’s healthcare landscape, understanding the intersection of health insurance and dermatologist coverage is essential for ensuring optimal skin health. Let’s delve into how health insurance plays a role in covering dermatologist visits.

What Is Health Insurance?

Health insurance is a financial tool that helps individuals manage and mitigate the costs associated with medical care, including visits to healthcare providers such as dermatologists.

Importance Of Dermatologist Visits

Regular visits to a dermatologist are crucial for maintaining healthy skin and detecting potential issues early on. Dermatologists can diagnose and treat various skin conditions, from acne to skin cancer, contributing to overall well-being.

In today’s healthcare landscape, understanding the intersection of health insurance and dermatologist coverage is essential for ensuring optimal skin health. Let’s delve into how health insurance plays a role in covering dermatologist visits.

What Is Health Insurance?

Health insurance is a financial tool that helps individuals manage and mitigate the costs associated with medical care, including visits to healthcare providers such as dermatologists.

Importance Of Dermatologist Visits

Regular visits to a dermatologist are crucial for maintaining healthy skin and detecting potential issues early on. Dermatologists can diagnose and treat various skin conditions, from acne to skin cancer, contributing to overall well-being.

Understanding Health Insurance Coverage For Dermatologist Visits

When visiting a dermatologist, understanding your health insurance coverage is essential to ensure you receive care without unexpected costs. Dermatologists specialize in diagnosing and treating skin conditions, ranging from acne and eczema to skin cancer.

In-network Vs. Out-of-network Dermatologists

In-Network: Dermatologists in your health insurance provider’s network typically cost less for consultations and treatments.

Out-of-Network: While you can still visit out-of-network dermatologists, you may incur higher out-of-pocket expenses as they are not contracted with your insurance company.

Types Of Dermatologist Visits Covered

- Preventive Visits: Yearly skin exams for early skin cancer detection are often covered.

- Medical Treatments: Diagnosis and treatment of skin conditions such as eczema and psoriasis are usually covered.

- Cosmetic Procedures: Procedures like Botox or chemical peels are typically not covered by insurance.

Navigating Co-pays, Deductibles, And Coinsurance

UnCoinsurance: Understanding how your health insurance covers dermatologist visits can be complex. To make things easier, navigate the terms related to co-pays, deductibles, and coinsurance coinsurance. These financial factors significantly determine your out-of-pocket costs when seeking dermatological care.

Co-pay For Dermatologist Visits

A co-pay, also known as a copayment, is a fixed copayment made during your dermatologist visit. It is a predetermined fee, typically a small percentage of the overall cost, that you need to contribute towards your medical expenses. The co-pay for dermatologist visits may vary based on your health insurance plan. Some plans may require a higher co-pay for specialist visits like dermatology than primary care visits.

When scheduling an appointment with a dermatologist, you should check with your insurance provider about the specific co-pay amount applicable to your plan. This way, you can be prepared and ensure you have the necessary funds available.

Deductible Requirements

A deductible is the amount you need to pay out of pocket before your health insurance begins to cover your medical expenses. The annual cost resets at the beginning of each calendar year. The deductible requirement for dermatologist visits may vary depending on your insurance plan.

For example, you have a health insurance plan with a $1,000 deductible. If your dermatologist visit costs $200, you must pay that amount entirely until you reach the deductible. Once you get the deductible, your insurance will start covering some expenses, such as througcoinsurancece or coinsucoinsuranceentsCoinsurancececopaymentsanceoinsurance reinsurance percentage of the medical costs that you are responsible for paying after meeting your deductible. You share the portion of the costs with your insurance company. ThCoinsurancearies depend on your health insurance plan.

For example, if your health insurance covers 80% of the costs and you have met your deductible, you will only be responsible for paying the remaining 20% of your insurance.

| CoinsurCoinsurance | on |

|---|---|

| Co-Pay | A fixed amount is paid at each visit. |

| Deductible | The amount paid out of pocket before insurance coverage kicks coinsurance |

| E | The insurance costs are shared between the insured person and the insurance company. |

You understand co-pays, deductibles, ancoinsurancece pe-coinsurances is crucial when managing healthcare expenses. By knowing these financial terms, you can make informed decisions about your dermatology visits and ensure that you are prepared for any out-of-pocket costs that may arise.

Credit: apollo-insurance.com

Special Considerations For Dermatological Procedures

Yes, health insurance often covers medically necessary dermatological procedures and treatments, including diagnosis and treatment of skin conditions. However, elective cosmetic surgery and procedures performed solely for beauty may not be covered. It’s essential to check with your insurance provider to understand the specific coverage for dermatology services.

Cosmetic Vs. Medical Procedures

It’s essential to differentiate between cosmetic and medical procedures when considering dermatological procedures. Medical procedures are typically done to diagnose and treat skin conditions, such as acne, eczema, or skin cancer, and are often covered by health insurance. On the other hand, cosmetic procedures focus on enhancing appearance, such as Botox injections or laser hair removal, and may not be covered by insurance.

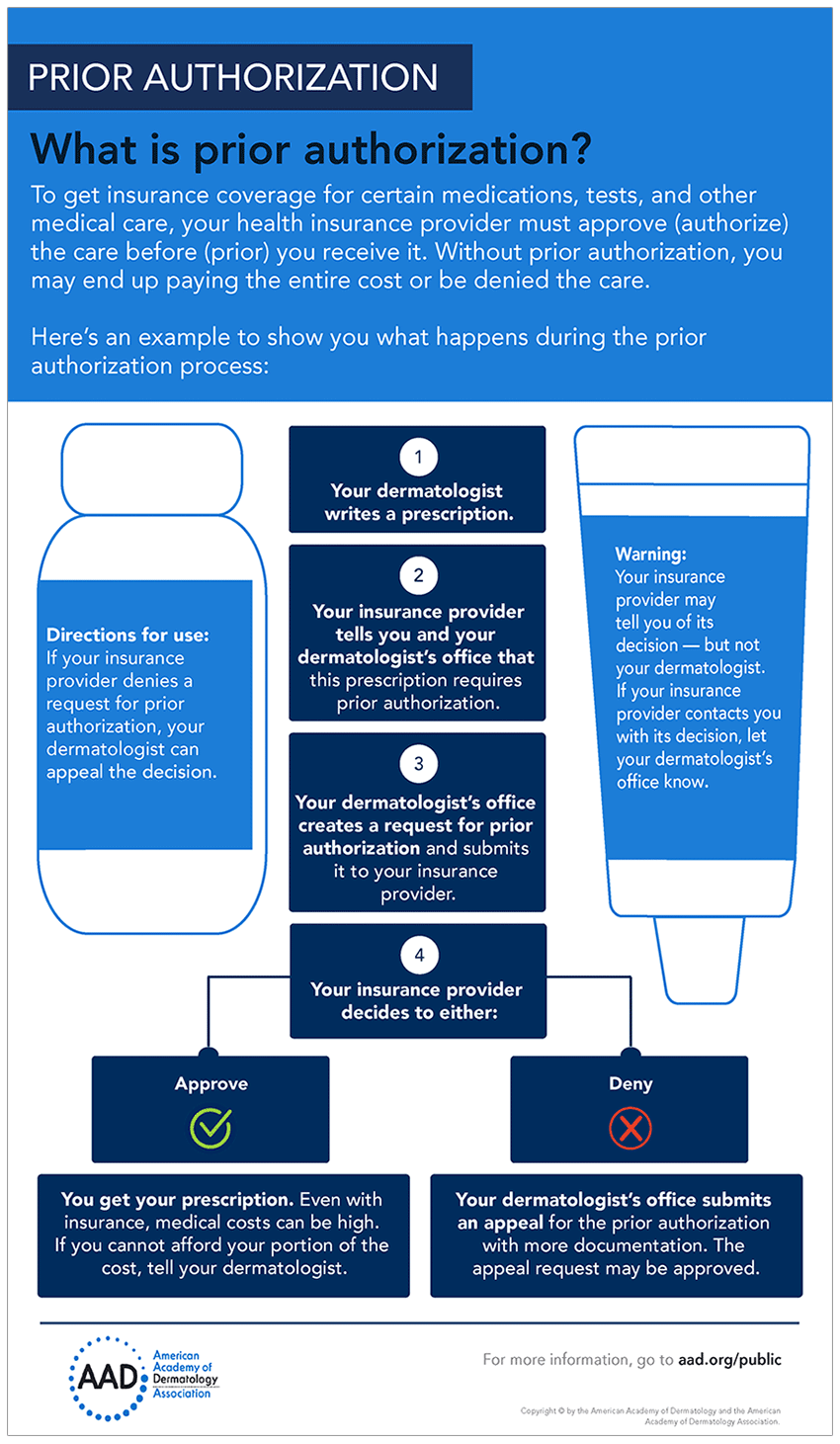

Pre-approval Requirements

Before undergoing dermatological procedures, you must know if your health insurance provider requires pre-approval. Consult your insurance plan to understand if pre-authorization is necessary for specific treatments or if certain conditions must be met for the procedure to be covered.

Factors Affecting Coverage

The policy’s terms, medical necessity, and in-network providers influence health insurance coverage for dermatologists. Specific treatments are covered, but elective cosmetic procedures may not be included. Understanding your insurance plan specifics is essential for optimal coverage.

Insurance Plan Type

Health insurance coverage for dermatology services depends on the type of insurance plan you have. Most insurance plans, including employer-sponsored, individual, and government-issued plans like Medicare and Medicaid, typically provide coverage for medically necessary dermatological procedures and treatments.

However, reviewing your specific insurance plan to understand the extent of coverage is essential. Some insurance plans may have specific limitations or require prior authorization for certain dermatology services.

Referral Requirements

Some insurance plans may have referral requirements for dermatology visits. This means you may need a referral from your primary care physician or a designated healthcare provider before seeing a dermatologist. Referral requirements help ensure that the visit is medically necessary and may determine the level of coverage provided by your insurance plan.

If your insurance plan has referral requirements, it is essential to schedule an appointment with your primary care physician first to discuss your dermatological concerns. Your primary care physician can assess your condition and determine whether a dermatology referral is appropriate.

Out-of-network Coverage

We recommend checking whether your chosen dermatologist is in-network or out-of-network with your insurance plan. In-network providers have negotiated discounted rates with the insurance company, lowering out-of-pocket expenses for you. On the other hand, out-of-network providers may have higher costs or not be covered.

If you prefer a specific dermatologist who is out-of-network, you may still receive some coverage. Still, it may be subject to higher deductibles, copayments, and coinsurance Pre-authorization.

Verifying your insurance coverage and obtaining pre-authorization are crucial steps before seeking dermatology services. Contact your insurance provider or review your insurance plan documents to understand the requirements for verification and pre-authorization.

By verifying your coverage, you can confirm the covered services, potential limitations or exclusions, and estimated costs. Pre-authorization ensures that your insurance plan approves the specific dermatology treatment or procedure before it is performed, minimizing the risk of claim denials or unexpected expenses.

Cost-sharing Responsibilities

While health insurance covers dermatology services, there are often cost-sharing responsibilities for policyholders. These responsibilities typically include deductibles, copayments, and coinsurancecopymetsnsurance is the amount you must pay out of pocket before your insurance coverage begins. Copayments are fixed. Copayments pay for each visit or service received, while coicoinsurance is the total cost you are responsible for after the deductible.

Understanding your cost-sharing responsibilities beforehand can help you budget and prepare for the financial implications of dermatology services.

Credit: www.aad.org

When Coverage May Not Apply

The road to comprehensive health insurance coverage for dermatological treatments may hit a bump in the form of exclusions and limitations. Policyholders need to understand the circumstances under which coverage may not apply.

Exclusions And Limitations

- Elective cosmetic procedures usually fall outside the coverage provided by health insurance.

- Specific experimental or investigational treatments may not be covered.

- Pre-existing skin conditions not disclosed at the policy commencement might be excluded.

Out-of-pocket Maximums

Policyholders should be aware of out-of-pocket maximums, as once this limit is reached, the insurance company typically covers all remaining eligible expenses for the policy period. Therefore, understanding these maximums is crucial for predicting potential costs.

Maximizing Health Insurance Benefits For Dermatologist Visits

Leveraging your health insurance benefits for dermatologist visits can help save costs and ensure you receive the necessary care. Maximizing your insurance coverage for dermatology services is crucial for maintaining healthy skin. Here are some strategies to optimize your health insurance benefits for dermatologist appointments.

Utilizing Preventive Care Benefits

- Schedule regular check-ups with your dermatologist for early detection.

- Utilize covered services like skin cancer screenings and mole checks.

- Follow your insurance plan’s guidelines for preventive care to avoid additional costs.

Negotiating Costs With Providers

- Review your insurance policy to understand coverage for dermatology services.

- Inquire about in-network providers to reduce out-of-pocket expenses.

- Discuss payment options and potential discounts with your dermatologist.

Final Tips For Managing Dermatologist Visits With Health Insurance

When it comes to managing dermatologist visits with health insurance, understanding the intricacies of your policy is crucial. Here are some final tips to help you navigate and optimize the coverage provided by your health insurance.

Reviewing Policy Documents

- Review your policy documents carefully to understand specific coverage for dermatologist visits.

- Take note of any co-pays, deductibles, or limitations that may apply to dermatology services.

- Confirm the network of dermatologists covered by your insurance plan to avoid unexpected costs.

- Keep your policy documents handy for easy reference during appointments.

Appealing Coverage Denials

- If your insurance denies coverage for a dermatologist visit, understand the reason for the denial.

- Gather supporting documents, such as medical records or doctor’s recommendations, to help your appeal.

- Submit your appeal promptly and follow up with your insurance provider for updates.

- Seek assistance from a patient advocate or healthcare professional to strengthen your appeal.

Frequently Asked Questions On Does Health Insurance Cover Dermatologist?

What Health Benefits Do Dermatologists Get?

Dermatologists receive health benefits like sick leave, paid vacation, health insurance, and retirement plans. Self-employed dermatologists must provide their own insurance and retirement plans.

How Often Should I See A Dermatologist?

You should see a dermatologist once a year for a full-body skin exam. If you are at higher risk of skin cancer, consider more frequent visits.

Does Medicare Cover Dermatology Issues?

Medicare covers medically necessary dermatology services, excluding elective cosmetic surgery and non-symptomatic skin cancer screenings.

Why Should I See A Dermatologist?

A dermatologist can help identify and treat skin conditions like acne, eczema, and skin cancer. They can also guide skincare routines and offer preventive measures to keep your skin healthy. Regular visits to a dermatologist can help catch any potential issues early on and ensure proper treatment.

Conclusion

Understanding your health insurance coverage is essential for dermatological services. Knowing what procedures and treatments are included in your plan can help you make informed decisions about your skin health. By taking the time to research and inquire about your insurance coverage, you can ensure proper care for your skin without unnecessary financial stress.

It’s essential to stay informed to get the dermatological care you need.