Can You Add a Parent to Your Health Insurance: Explained

Can You Add a Parent to Your Health Insurance: plan through a qualifying life event. Adding a parent to your health insurance can provide them with necessary coverage and peace of mind.

This process usually involves submitting the required documentation to your insurance provider within a specific timeframe. Your parent can access the necessary healthcare services without worrying about the financial burden. We will explore how to add a parent to your health insurance plan, the benefits, and the steps involved.

Let’s dive in and learn more about this critical aspect of healthcare coverage.

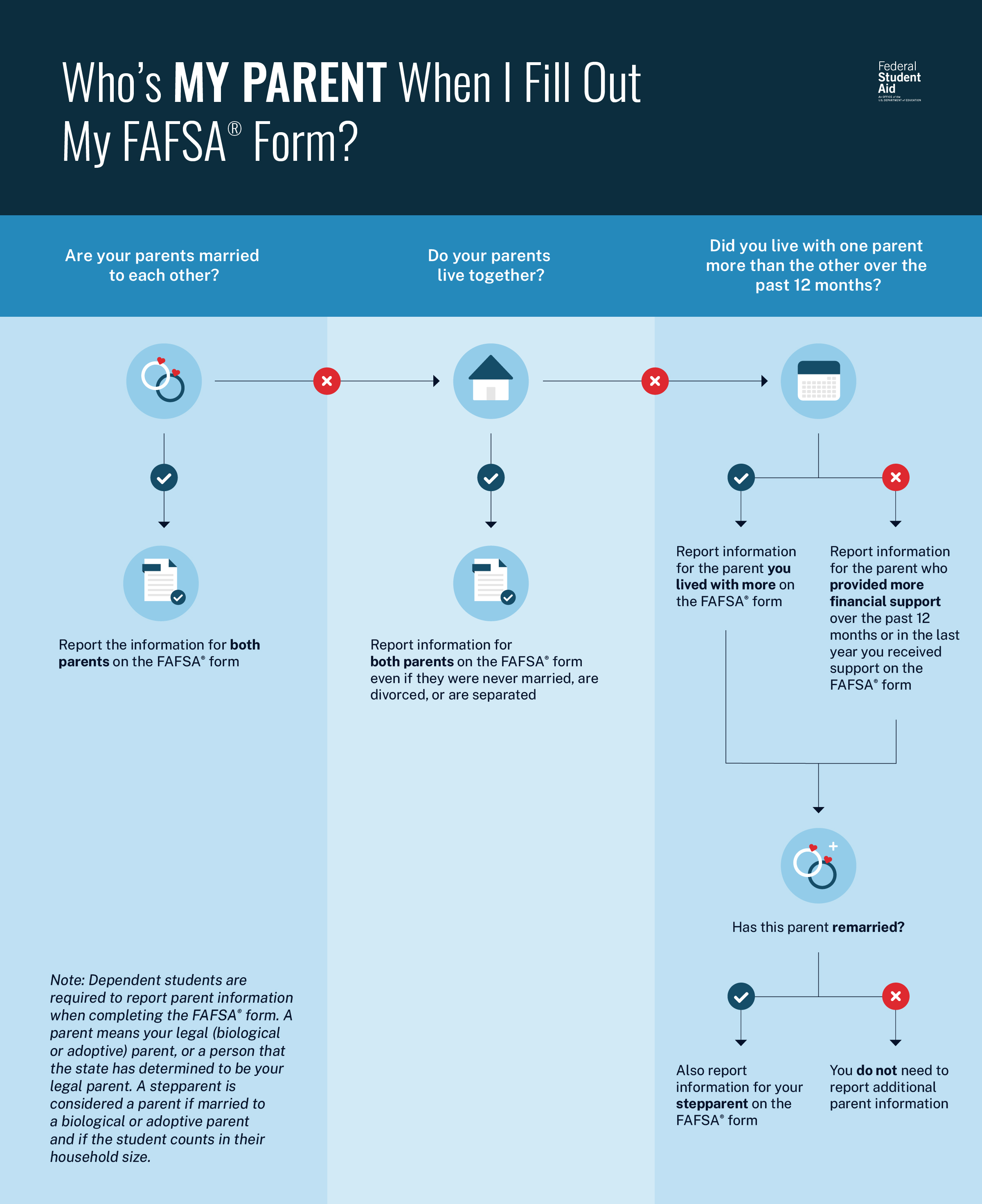

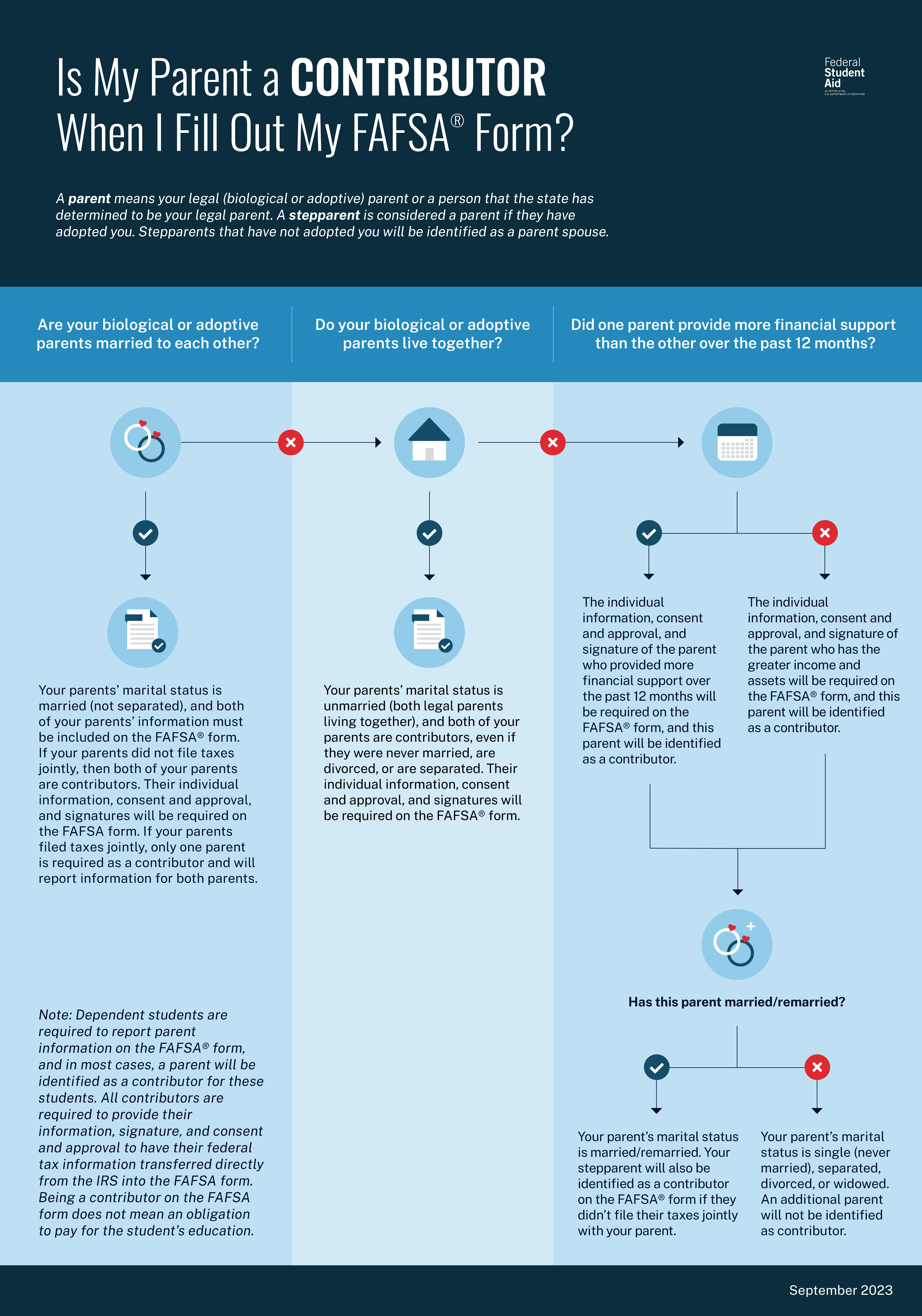

Credit: studentaid.gov

1. Eligibility For Adding A Parent To Health Insurance

To add a parent to your health insurance, you must meet specific criteria, such as age and financial dependency. Many insurance companies have specific requirements for adding a parent to a health insurance plan, so reviewing your policy details and contacting your provider for eligibility information is essential.

Adding a parent to your health insurance can provide them with the necessary coverage they need, ensuring their well-being is taken care of. However, specific eligibility criteria must be met before adding your parent as a dependent on your health insurance plan.

1.1 Age Limitations

One of the critical considerations when adding a parent to your health insurance is their age. Most insurance providers have specific age restrictions in place. Typically, the parent should be under a certain age to be eligible for coverage. However, these age requirements may vary from one insurance provider to another. It is essential to check with your insurance company to see if your parent falls within the age range.

1.2 Relationship Requirement

In addition to age limitations, insurance companies often require a specific relationship between the policyholder and the parent being added. Generally, insurance providers will only allow you to add your biological or legally adoptive parent. Step-parents, grandparents, or other relatives may not meet the criteria outlined by the insurance company. Could you verify the relationship requirement specified in your health insurance plan?

1.3 Existing Coverage Considerations

Before adding your parent to your health insurance, it is essential to consider any existing coverage they might have. Some insurance providers may have restrictions if your parent already has their health insurance policy. In such cases, they may not be eligible for coverage under your plan. Please review the terms and conditions of your health insurance plan and consult with your insurance provider to understand the potential impact of existing coverage on your eligibility for adding your parent. When considering whether you can add a parent to your health insurance, familiarising yourself with the eligibility requirements set by your insurance provider is crucial. Age limitations, relationship requirements, and existing coverage considerations should all be considered before deciding. By understanding these eligibility factors, you can ensure a smooth process and secure the health coverage your parent needs.

2. Steps To Add A Parent To Health Insurance

When you need to add a parent to your health insurance, follow these four essential steps:

2.1 Check Insurance Provider’s Policy

First, please review your insurance provider’s policy to ensure they allow adding parents to your plan.

2.2 Gather Necessary Documents

Collect all required documents, such as your parent’s identification, proof of relationship, and any other documents specified by your insurance provider.

2.3 Submit Request And Application

Could you complete and submit the necessary request and application forms to add your parent to your health insurance plan?

2.4 Await Confirmation

After submission, patiently wait for your insurance provider to confirm the successful addition of your parent to your health insurance.

3. Potential Benefits Of Adding A Parent To Health Insurance

Adding a parent to your health insurance can bring several benefits. Various advantages exist, from access to better coverage to financial assistance and peace of mind.

3.1 Access To Better Coverage

Access more comprehensive medical services and treatments for your parent.

3.2 Financial Assistance

Receive financial support by sharing the cost of premiums and out-of-pocket expenses.

3.3 Improved Healthcare Options

Benefit from a more comprehensive network of healthcare providers and facilities. Consider the financial implications of this addition

3.4 Peace Of Mind

Enjoy peace of mind knowing your parent has health insurance coverage.

4. Considerations Before Adding A Parent To Health Insurance

4. Considerations Before Adding a Parent to Health Insurance

4.1 Cost Analysis

One crucial factor is cost analysis when considering adding your parent to your health insurance plan. Before you make any decisions, please think about what this addition involves. This includes evaluating any increases in premiums or deductibles due to adding a parent to your plan.

4.2 Impact On Existing Coverage

Adding a parent to your health insurance can also impact your existing coverage. Understanding how this addition might affect your current benefits and coverage levels is essential. Please consult your insurance provider to see if there are any changes to your plan’s network of healthcare providers, prescription drug coverage, or other vital aspects of your policy.

4.3 Coverage Limitations

It’s crucial to be aware of any potential coverage limitations that may apply when adding a parent to your health insurance plan. Some plans may have specific restrictions or limitations for dependent parents, such as age limitations or requirements for financial dependence. I want you to know that understanding these limitations will help you make an informed decision regarding your parent’s inclusion in your health insurance coverage.

4.4 Tax Implications

Lastly, could you consider the tax implications of adding a parent to your health insurance plan? Depending on your country’s tax laws, certain deductions or exemptions may be available when providing healthcare coverage for a dependent parent. Consulting with a tax professional or researching applicable tax regulations will ensure you understand the potential tax implications and any potential benefits or advantages.

5. Alternatives To Adding A Parent To Health Insurance

5. Alternatives to Adding a Parent to Health Insurance

5.1 Medicaid

Medicaid can be an alternative for parents who cannot be added to their children’s health insurance. Eligibility for Medicaid is determined by income and household size, and it provides low-cost or free health coverage to those who qualify.

5.2 medicare

For parents aged 65 and older, Medicare may be a viable option. Medicare is a federal health insurance program primarily covering people over 65, specifically younger individuals with disabilities.

5.3 Individual Health Insurance

Individual health insurance plans can be purchased directly from insurers or through the Health Insurance Marketplace. This option allows parents to obtain coverage separate from their children’s policy.

5.4 Health Savings Account

A Health Savings Account (HSA) can be utilised to cover medical expenses for parents. Contributions to an HSA are tax-deductible, and the funds can be used to pay for qualified medical expenses.

6. Commonly Asked Questions About Adding A Parent To Health Insurance

Start of blog post section about 6. Commonly Asked Questions about Adding a Parent to Health Insurance

Many questions can arise when managing your health insurance, especially when considering adding a parent to your plan. Let’s take a look at some of the most frequently asked questions to give you more clarity on this.

6.1 Can I Add My Stepparent To My Health Insurance?

If you have a stepparent, you may wonder if they can be added to your health insurance plan. You’ll need to check with your insurance provider since policies can vary. In many cases, you can add your stepparent as a dependent as long as they meet the criteria set by your insurance provider.

6.2 Can I Add A Parent-in-law To My Health Insurance?

Adding a parent-in-law to your health insurance is a common query. Similar to adding a stepparent, it’s crucial to consult your insurance provider for specific details. Some providers may allow the addition of a parent-in-law under certain circumstances, while others may not accommodate this option.

6.3 How Does Adding A Parent To My Health Insurance Affect My Premiums?

When considering adding a parent to your health insurance, you may wonder how it could impact your premiums. Typically, adding a dependent could increase your premiums. However, the exact effect on your premiums will depend on your insurance plan and provider. You must contact your provider to understand how this addition may affect your premiums.

6.4 What Happens If I Lose My Job And My Parent Is Still On My Health Insurance?

In the event of job loss, you may have concerns about maintaining your parent’s coverage. It’s essential to review the terms and conditions of your insurance coverage as different plans may have varying provisions in such scenarios. Some plans may offer options such as COBRA to continue coverage, while others may not provide such options. Verify the available courses of action with your insurance provider to understand your options.

7. Exploring Other Insurance Options For Parents

Discover other insurance options for parents and explore adding them to your health insurance plan. Ensure your loved ones have the coverage they need while considering different choices.

When it’s time to consider insurance options for your parents, it’s essential to understand the range of choices available to ensure their well-being. Alongside adding them to your health insurance plan, several other avenues exist. In this section, we’ll delve into three different insurance options that may provide the coverage your parents need.

7.1 State-specific Programs

State-specific programs offer a solution for parents who aren’t eligible for Medicare or Medicaid. These programs, often known as state health insurance assistance programs (SHIPs), aim to bridge the gap by providing affordable coverage options tailored to each state’s regulations and requirements. To determine if your parent qualifies for a state-specific program, you can visit the official website of your state’s insurance department or consult an insurance agent.

7.2 Private Insurance For Seniors

Private insurance companies now offer specialised plans designed specifically for seniors. These plans often provide comprehensive coverage, including hospital stays, doctor visits, prescription drugs, and preventive care. Opting for private insurance tailored to seniors ensures your parent receives medical attention without financial strain.

7.3 Long-term Care Insurance

Long-term care insurance is an essential consideration for parents who may require extended medical care due to chronic illness or age-related conditions. This insurance covers nursing home care, assisted living, and in-home care. By securing a long-term care insurance policy for your parent, you can ensure they have access to quality care and protect your financial stability in the long run.

Credit: studentaid.gov

8. Final Thoughts And Conclusion

Consider adding a parent to your health insurance policy as a beneficial option for increased coverage and support. It can provide peace of mind and access to necessary medical care for your loved ones. Please look at your specific needs and contact your insurance provider for detailed guidance on this possibility.

As you navigate the process of adding a parent to your health insurance, it is essential to consider the key factors outlined above. You can ensure a smooth and successful transition by weighing the pros and cons, making an informed decision, and communicating effectively with your insurance provider.

8.1 Weighing The Pros And Cons

Consider the financial implications and coverage benefits before adding a parent to your health insurance. Could you evaluate how it will impact your premiums and overall coverage?

8.2 Making An Informed Decision

Before deciding, gather all necessary information regarding costs, limitations, and eligibility criteria. Consult with your insurance provider if needed.

8.3 Communication With Insurance Provider

Maintain open communication with your insurance provider to ensure smooth and efficient enrollment. Clarify any doubts or concerns promptly.

:max_bytes(150000):strip_icc()/pros-and-cons-of-listing-dad-on-the-birth-certificate-2997291_FINAL-b94093598abb453b9975975353ffb52b.png)

Credit: www.verywellfamily.com

Frequently Asked Questions On Can You Add A Parent To Your Health Insurance

Can I Add My Parent To My Health Insurance Plan?

You can often add your parent to your health insurance plan if they meet specific eligibility requirements. I want you to know that many insurance providers offer this option, but you’ll need to check with your particular plan for details on how to do so and any associated costs.

What Are The Eligibility Criteria For Adding A Parent To My Health Insurance?

Eligibility criteria for adding a parent to your health insurance plan can vary by insurer. Typically, they may need to meet specific age and dependency requirements. Some insurers also require proof of financial support. Please reach out to your insurance provider for precise details on eligibility criteria.

Are There Additional Costs For Adding A Parent To My Health Insurance?

Adding a parent to your health insurance plan may incur additional costs, such as higher premiums or out-of-pocket expenses. It’s essential to know about any financial implications before you make this decision if you don’t mind. Could you speak with your insurance provider to gain clarity on potential added costs?

Will Adding A Parent To My Health Insurance Affect My Coverage?

Adding a parent to your health insurance plan may impact your coverage, including potential changes to your benefits and costs. I’d like you to please review the specifics with your insurer to understand any possible effects on your coverage entirely.

Conclusion

Adding a parent to your health insurance can provide essential coverage and peace of mind. By exploring your options, such as dependent coverage or government programs, you can extend your plan’s benefits to include your parent. Could you consult with your insurance provider to understand the requirements and limitations?

By taking these steps, you can navigate the complexities of health insurance and ensure your loved ones are protected.