Dual Health Insurance Coverage Rules: Unlocking the Benefits

Dual Health Insurance Coverage Rules mean you are insured under two health insurance plans. While multiple policies provide added coverage, you must still pay copays, coinsurance, and out-of-pocket costs.

However, having a secondary plan can help cover deductibles and coinsurance from the primary plan. The drawback of dual insurance is paying separate premiums and dealing with complex filing procedures. Understanding the primary plan is crucial to know who will pay for covered services first.

Coordination of benefits is essential when you have more than one health insurance plan to avoid confusion and delays in reimbursement.

Credit: mbaileygroup.com

The Concept Of Dual Health Insurance Coverage

Dual health insurance coverage is when an individual is covered by two health insurance plans simultaneously. This typically occurs when a person is eligible for coverage under their plan and is included as a dependent under a spouse or parent’s plan. Understanding the rules and benefits of having dual health insurance is essential to maximize coverage and minimize out-of-pocket costs.

Understanding Dual Health Insurance

Dual or multiple health insurance coverage occurs when multiple health insurance plans cover an individual. The coordination of benefits (COB) rules determine the order in which the plans pay for services, ensuring that the overall coverage is utilized efficiently. Knowing how these rules work is essential to optimizing the benefits offered by both plans.

Benefits Of Having Dual Health Insurance

Having dual health insurance can offer several advantages, including reduced out-of-pocket costs, broader coverage for a more comprehensive range of medical services, and the potential for accessing higher-quality healthcare providers. Additionally, if one plan doesn’t fully cover a particular service, the second plan may provide additional coverage, offering a safety net for unexpected medical expenses.

Primary Vs. Secondary Insurance

Dual health insurance coverage can be a valuable asset in ensuring comprehensive healthcare coverage for individuals. Understanding the distinction between primary and secondary insurance is essential for navigating the complexities of dual coverage.

Determining The Primary Insurance

Primary insurance is the first payer for healthcare services, and its coverage must be exhausted before the secondary insurance kicks in.

Insurance companies determine the primary coverage based on coordination of benefits rules to avoid duplicating payments.

Role Of Secondary Insurance

Secondary insurance complements the primary coverage by covering costs that exceed the limits of the primary insurance.

It steps in after the primary insurance has paid its share to provide additional financial support for healthcare expenses.

Rules And Regulations

Navigating Dual Health Insurance Coverage Rules can be tricky. Having coverage under two plans may not mean free healthcare. You may still incur copays and out-of-pocket costs, as each plan may have its own coverage rules. Be aware of the pros and cons before choosing multiple policies.

Coordination Of Benefits

When an individual has coverage under two health insurance plans, it is essential to understand the rules and regulations surrounding the coordination of benefits. Coordination of benefits refers to determining which plan will be primary and which will be secondary in terms of paying for covered services. The primary insurance plan is responsible for paying for the services up to the plan limits. In contrast, the secondary insurance plan covers the remaining unpaid balance up to its plan limits. Determining which insurance plan is primary and which is secondary depends on several factors outlined by the benefits provided by each plan. The primary plan pays first according to its benefits, and the secondary plan pays any remaining unpaid balance according to its benefits. This process ensures that both policies contribute to the overall coverage of the individual without duplicating payments.

State Laws Regarding Dual Coverage

It is important to note that state laws regarding dual health insurance coverage may also come into play. Each state may have its rules and regulations regarding the coordination of benefits and the rights and responsibilities of individuals with multiple insurance plans. These laws can vary from state to state, so it is crucial to familiarize oneself with the specific requirements and guidelines of the state where the individual resides. Some states may have specific provisions regarding the coordination of the benefits process, while others may impose limitations or exclusions on certain types of coverage. Awareness of state laws can help individuals navigate the dual coverage landscape more effectively and ensure they receive the maximum benefits from both insurance plans.

In conclusion, understanding the rules and regulations surrounding dual health insurance coverage is crucial for individuals with coverage under two insurance plans. Coordination of benefits determines which plan will be primary and secondary, and state laws may also come into play. By familiarizing themselves with these rules and regulations, individuals can make informed decisions about their healthcare coverage and optimize the benefits provided by their insurance plans.

Practical Implications

The practical implications of dual health insurance coverage rules mean that despite having coverage under two insurance plans, you will still need to pay copays, coinsurance, and other out-of-pocket costs, as multiple policies won’t nullify these requirements. Additionally, having multiple health insurance plans may lead to complexities in filing procedures and reimbursement delays.

Claim Process With Multiple Insurances

The process can be a bit complex when it comes to filing claims with multiple health insurance plans. The primary step is to inform both insurance companies about your dual coverage and provide them with the necessary documents. Each insurer will evaluate the claim independently and determine their respective responsibilities. Here’s a step-by-step breakdown of the claim process:

- Notify both insurers: Inform each insurance company about your dual coverage and provide them with copies of your health insurance cards.

- Submit the claim form: Fill out the claim form provided by the healthcare provider and submit it to the primary insurance company.

- Wait for primary insurance adjudication: The primary insurance company will assess your claim and provide an Explanation of Benefits (EOB) detailing the services covered and the amounts payable.

- Forward EOB to secondary insurance: Once you receive the EOB from the primary insurer, submit it along with any other required documentation to the secondary insurance company.

- Secondary insurance adjudication: The secondary insurer will review the EOB and process the claim based on their coordination of benefits rules.

- Pay the remaining balance: After both insurers have processed the claim, you are responsible for paying any outstanding balance not covered by either insurer.

Financial Considerations

Having dual health insurance coverage can provide some financial advantages, but there are also important considerations to remember. Here are a few key points to consider:

- Separate premiums and deductibles: If you have multiple insurance policies, you’ll generally have to pay separate premiums and deductibles for each plan. This means you may have higher monthly costs and more out-of-pocket expenses.

- Coordination of benefits: Understanding each insurance provider’s coordination of benefits rules is crucial. This ensures that both insurers work together to cover your medical expenses without overpaying or duplicating coverage.

- Reimbursement delays: Filing claims with multiple insurers can lead to longer processing times and reimbursement delays. Be prepared for potential delays in receiving payment for your medical expenses.

- Out-of-pocket costs: Despite having dual coverage, you’re still responsible for copays, coinsurance, and other out-of-pocket expenses. It’s essential to understand your policy’s coverage limits and ensure you budget accordingly.

These financial considerations will help you navigate the complexities of managing dual health insurance coverage. By understanding the claim process and being aware of potential economic implications, you can make informed decisions about your healthcare and optimize the benefits of your dual coverage.

Pros And Cons Of Dual Health Insurance

Having dual health insurance coverage can have its advantages and disadvantages. It’s essential to weigh the pros and cons before choosing multiple health insurance policies. Let’s take a closer look at the advantages and disadvantages of dual health insurance.

Advantages Of Multiple Health Insurances

There are several advantages to having multiple health insurance plans:

- Enhanced Coverage: With dual health insurance, you can enjoy broader coverage for various medical expenses.

- Lower Out-of-Pocket Costs: Having multiple health insurance plans can lower your out-of-pocket expenses, as one plan may cover what the other does not.

- Access to Preferred Providers: With dual health insurance, you may have access to a more extensive network of healthcare providers, giving you more options for your medical needs.

Disadvantages And Complications

However, there are also some disadvantages and complications to consider:

- Premiums and Deductibles: Having multiple health insurance plans means paying separate premiums and deductibles for each policy, which could increase healthcare costs.

- Complicated Filing Procedures: Managing multiple health insurance plans can be complex, requiring navigating through different filing procedures and paperwork.

- Reimbursement Delays: Dealing with multiple insurance companies may delay receiving reimbursements for your medical expenses.

Credit: www.forbes.com

Managing Dual Health Insurance

When managing dual health insurance, it’s crucial to understand the rules and best practices to ensure comprehensive coverage without any complications. Dual health insurance coverage can provide additional benefits but requires careful management to avoid confusion and maximize the advantages. Here are some important considerations and best practices for managing multiple policies.

Best Practices For Managing Multiple Policies

- Regularly review and understand the specifics of each policy to effectively utilize the benefits they offer.

- Notify healthcare providers of both insurance policies to ensure accurate billing and avoid potential delays in claim processing.

- To facilitate coordination between the two policies, keep detailed records of healthcare expenses, including copays, deductibles, and out-of-pocket costs.

- Communicate with both insurance carriers to clarify any potential coverage overlaps or gaps.

Understanding Coverage Limits

Understanding the coverage limits of each policy is essential to avoid misunderstandings or unexpected costs. Ensure you know the primary and secondary insurance designations to facilitate the effective coordination of benefits. Remember, both primary and secondary insurance will cover up to plan limits. After the secondary insurance has paid its share, you may be responsible for any remaining costs, subject to the provisions of both policies.

Prevalence And Common Scenarios

Dual health insurance coverage has become increasingly prevalent in today’s healthcare landscape. Many individuals find themselves in common scenarios where they have coverage under two insurance plans. In these situations, it is essential to understand the rules and implications of having dual coverage.

Everyday Situations Of Dual Coverage

Several common scenarios lead individuals to have dual health insurance coverage and navigate its complexities. These include:

- Enrollment in employer-sponsored plans for both spouses

- Dependent coverage under both parents’ insurance policies

- Retirees receiving coverage from both their former employer and Medicare

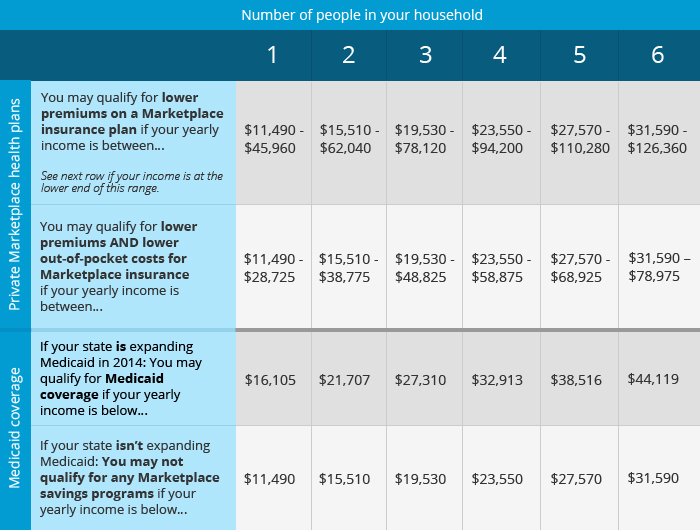

- Individuals eligible for coverage from both Medicaid and a private insurance plan

Increasing Trend Of Having Two Insurances

The trend of having dual health insurance coverage is on the rise as more individuals seek to maximize their healthcare benefits and minimize out-of-pocket expenses. With the increasing availability of multiple coverage options, individuals often can access complementary benefits from each plan, providing a more comprehensive safety net in the event of medical needs.

.png)

Credit: www.insurebc.ca

Considerations For Individuals And Employers

Dual health insurance coverage rules have implications for both individuals and employers.

Individual Considerations

- Coverage Costs: Having two insurance plans doesn’t guarantee free healthcare.

- Out-of-Pocket Expenses: Despite dual coverage, individuals may still need to pay copays and coinsurance.

- Specialist Visits: Most plans require copays for specialist visits, even with multiple policies.

Implications For Employer-provided Health Plans

- Coordinated Benefits: Group health insurance plans in some states coordinate benefits.

- Claims Coverage: Employees enrolled in multiple plans may receive coverage under both plans.

- Primary vs. Secondary Insurer: Determining which primary plan is crucial for proper claims processing and benefit utilization.

Frequently Asked Questions

What Happens If A Patient Has Coverage Under Two Insurance Plans?

When patients have coverage under two insurance plans, they still need to pay copays and out-of-pocket costs. Dual insurance can cover deductibles and coinsurance but may lead to separate premiums and complicated filing procedures. The primary plan pays first, while the secondary plan pays any remaining balance.

What Are The Disadvantages Of Dual Health Insurance Coverage Rules?

Having dual insurance can lead to paying separate premiums and deductibles, complicated filing procedures, and reimbursement delays. Additionally, it won’t nullify copays or coinsurance requirements.

How Does Dual Health Insurance Work?

Dual health insurance coordinates benefits between two plans. You can have coverage under both plans, each sharing the cost of claims. It’s important to note that having multiple plans doesn’t necessarily mean your healthcare will be free.

What Determines Which Insurance Is Primary?

The insurer pays for covered services first, based on the plan’s benefits, to determine which insurance is primary. The other insurer pays secondary, covering the remaining unpaid balance based on its plan’s benefits.

Conclusion

Merging multiple health insurance policies may not wholly eliminate out-of-pocket costs. Understand the coordination of benefits to maximize coverage benefits without redundancy. Be informed about the pros and cons of maintaining dual health insurance coverage to make the most cost-effective decisions for your healthcare needs.