Temporary Health Insurance between Jobs : Secure Your Coverage

Temporary health insurance between jobs provides short-term coverage for individuals transitioning between employers. It offers essential benefits to bridge the gap until they secure a new employer-sponsored plan or a long-term solution.

Life transitions, such as changing jobs, can leave individuals without health insurance for some time. During this time, temporary health insurance can serve as a crucial safety net, ensuring individuals remain covered for unexpected health issues. This type of coverage is designed to be affordable and accessible, allowing individuals to maintain peace of mind during their employment transition.

By understanding the critical aspects of temporary health insurance, individuals can make informed decisions to safeguard their health and finances during this transitional period.

The Importance Of Temporary Health Insurance

Coverage Gap

When transitioning between jobs, it’s common to experience a coverage gap where you are without health insurance. This period can leave you vulnerable and unprotected in the event of unexpected medical expenses or emergencies. Temporary health insurance bridges this gap, providing essential coverage until you secure a new policy. It ensures you access necessary healthcare services and receive the care you need without facing excessive out-of-pocket costs.

Financial Protection

Temporary health insurance not only provides coverage for medical services but also offers financial protection. Medical bills can quickly accumulate, causing a significant strain on your finances. With temporary health insurance, you can have peace of mind knowing you are protected from these unforeseen expenses. Whether routine check-ups, prescription medications, or emergency treatments, having the right coverage can alleviate the financial burden and help you maintain financial stability during this transitional phase.

Understanding Temporary Health Insurance

Definition

Temporary health insurance, orShort-Term short-term health insurance, provides individuals with limited access to medical care for a specific period. It is designed to bridge the gap between comprehensive health insurance plans, especially when someone is transitioning, such as between jobs or waiting for employer-provided coverage to start.

Limitations

Temporary health insurance has specific limitations that individuals need to be aware of. These limitations include restricted coverage for pre-existing conditions, preventive care, maternity care, and mental health services. Additionally, these plans may not meet the Affordable Care Act (ACA) requirements and may not offer essential benefits required by the law.

Eligibility For Temporary Health Insurance

Temporary health insurance is a valuable option for individuals who are between jobs and need coverage for a limited period. Understanding the eligibility criteria for temporary health insurance is crucial in determining if you qualify for this type of coverage.

Qualifications

To be eligible for temporary health insurance, individuals typically need to meet specific criteria, such as:

- Being between jobs or experiencing a gap in employer-sponsored coverage

- Not being eligible for Medicare or Medicaid

- Being under the age of 65

- Having proof of loss of coverage or a qualifying event

Duration

The temporary health insurance coverage duration varies depending on the provider and the specific plan. However, it is typically offered for a short-term period, ranging from 30 days to 12 months. It’s important to note that temporary health insurance only provides long-term coverage and is intended to bridge the gap between jobs once a more permanent solution is obtained.

Credit: www.facebook.com

Benefits Of Temporary Health Insurance

Temporary health insurance is a valuable option for individuals between jobs or going through a transition in their healthcare coverage. This short-term solution provides crucial benefits that can help bridge the gap and ensure continued access to healthcare services. In this article, we will explore the various benefits of Temporary Health Insurance.

Affordability

One of the significant advantages of Temporary Health Insurance is its affordability. This type of insurance typically offers lower premium rates than long-term plans, making it a cost-effective option for individuals needing temporary coverage. With the rising healthcare costs, having a budget-friendly solution can be a significant relief for anyone experiencing a gap in insurance coverage.

Customisation

Temporary Health Insurance offers customisation options, allowing individuals to select coverage that fits their needs. Unlike many long-term plans with predetermined coverage levels, temporary insurance plans allow policyholders to tailor their coverage to best suit their current healthcare requirements. This flexibility ensures that individuals can access the necessary medical services without paying for unnecessary or excessive coverage.

In addition, temporary insurance plans often allow individuals to choose their preferred healthcare providers. This means that policyholders can continue receiving care from their trusted doctors and specialists, ensuring the continuity of their treatment plans. Customising coverage and choosing preferred providers gives individuals peace of mind and control over their healthcare decisions during the transitional period.

Temporary Health Insurance offers both affordability and customisation, making it a desirable option for individuals in interim healthcare situations. With a lower premium cost and the ability to tailor coverage to individual needs, this type of insurance provides the necessary safety net to bridge the gap between jobs or transitions in healthcare coverage.

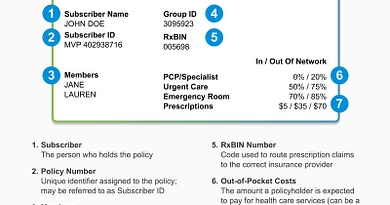

Choosing The Right Temporary Health Insurance Plan

When faced with a gap in health coverage due to job transition, selecting the appropriate temporary health insurance plan becomes crucial. Comparing plans and understanding their inclusions and exclusions will help you make an informed decision.

Comparing Plans

- Consider the coverage period and any waiting periods before benefits kick in.

- Compare premiums, deductibles, copayments, and coinsurance across plans.

- Look into network coverage to ensure your preferred healthcare providers are included.

Inclusions And Exclusions

- Review what medical services, treatments, and medications are covered under the plan.

- Paying attention to exclusions such as pre-existing conditions and specific procedures is vital.

- Understand any coverage limits, like maximum benefit amounts or visit restrictions.

Credit: www.postercompliance.com

How Temporary Health Insurance Works

Temporary health insurance provides coverage for brief periods when transitioning between jobs.

Enrollment Process

Enrolling in temporary health insurance is a simple and quick process.

Coverage Period

Temporary health insurance typically covers you for a short period, usually up to 6 months.

Considerations Before Opting For Temporary Health Insurance

Before choosing temporary health insurance between jobs, consider the coverage period, limitations, and costs. Look for plans that offer essential benefits and flexibility, ensuring you have suitable coverage during the transition. Conduct thorough research and compare options to find the best fit for your needs.

Temporary health insurance can provide a safety net during transitional periods when regular coverage is unavailable. Before deciding, it’s essential to consider a few key factors that can impact your coverage and overall healthcare needs. These considerations include:

Existing Health Conditions

Assessing how temporary health insurance will address your specific needs is crucial if you have existing health conditions. While temporary plans may provide some coverage for pre-existing conditions, there are typically limitations and waiting periods to consider. Consider the coverage level offered, any exclusions, and the impact on your current treatment or medications. Consult your healthcare provider to determine if temporary health insurance adequately meets your medical requirements.

Future Job Prospects

Before you can opt for temporary health insurance between jobs, you should evaluate your future job prospects. If you’re anticipating finding a new job shortly, review the potential benefits packages offered by prospective employers. Compare these benefits to the coverage and costs associated with temporary health insurance. It may be more cost-effective to seek health insurance through your next employer rather than relying on a temporary policy. Also, please look at the time you anticipate between jobs, as temporary plans are typically designed for shorter durations. I’d appreciate it if you’re looking at your future job prospects, and it will help you determine the best option for maintaining health coverage.

Alternatives To Temporary Health Insurance

When in between jobs, you may consider alternatives to temporary health insurance to ensure continuous coverage. From COBRA coverage to exploring marketplace options, there are several avenues to explore in times of transition.

Cobra Coverage

COBRA, or the Consolidated Omnibus Budget Reconciliation Act, allows workers and their families to keep their employer-sponsored health insurance for a limited time after leaving their jobs. This can provide a bridge to a new job or insurance coverage.

Marketplace Options

The health insurance marketplace, established by the Affordable Care Act, offers a variety of plans that you can choose from. You may qualify for a Special Enrollment Period due to your change in employment, allowing you to sign up for a plan outside the annual Open Enrollment Period.

Credit: www.federalregister.gov

Frequently Asked Questions Of Temporary Health Insurance Between Jobs

What Is Temporary Health Insurance Between Jobs?

Temporary health insurance provides short-term coverage for individuals during job transitions or gaps in insurance. It offers protection for unexpected medical expenses until permanent coverage is obtained.

How Long Can You Have Temporary Health Insurance Between Jobs?

The duration of temporary health insurance coverage varies but typically ranges from 30 days to 12 months. It offers a temporary solution to bridge the gap until secure employment insurance is available.

Is Temporary Health Insurance Between Jobs Affordable?

Temporary health insurance is usually more affordable than standard comprehensive plans. However, costs vary based on coverage options, duration, and individual factors. It provides a budget-friendly solution for short-term needs.

Can You Customize Temporary Health Insurance Plans?

Many temporary health insurance plans allow customisation to suit individual needs. Options may include coverage limits, deductibles, and additional benefits. Tailoring the plan ensures adequate protection during the transition period.

Conclusion

In a time of transition between jobs, temporary health insurance provides a crucial safety net. Its flexible coverage options and affordable premiums ensure that you and your loved ones remain protected during this uncertain period. By understanding the benefits and limitations of temporary health insurance, you can make an informed decision that meets your specific needs.

Remember, health should be a priority, regardless of your employment status. So, explore your options and secure your well-being today.