Is the Non Custodial Parent Responsible for Health Insurance: Decoding Legal Obligations

Is the Non Custodial Parent Responsible for Health Insurance?

Credit: www.facebook.com

Legal Obligations

Non-custodial parents are often legally obligated to provide health insurance for their children. This responsibility ensures the child’s medical needs are met and that both parents share the financial burden. I would like you to understand the requirements outlined in the custody agreement to comply with the legal obligations.

Court Orders

“` When the court issues a custody order, it may outline responsibilities for health insurance coverage. State Laws “`HTML

State Laws

“` State laws may vary regarding the non-custodial parent’s obligation to provide health insurance. – Court orders dictate parental responsibilities. – State laws determine non-custodial parent obligations. In some cases, the non-custodial parent must provide health insurance for the child.

Credit: m.facebook.com

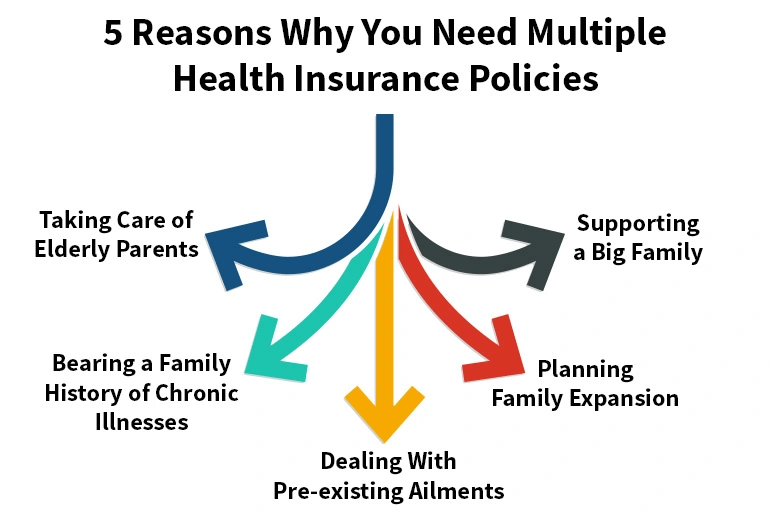

Determining Responsibility

In the case of health insurance, determining responsibility between custodial and non-custodial parents can vary depending on several key factors.

Custody Agreement

The custody agreement is crucial in establishing who is responsible for the child’s health insurance coverage.

Financial Ability

The financial ability of each parent is considered when assigning responsibility for health insurance.

Health Insurance Coverage

Health insurance coverage ensures children’s well-being, especially for non-custodial parents. It raises questions about the non-custodial parent’s responsibility in providing health insurance and the various options available to them. Here, we delve into three main categories of health insurance coverage: employer-sponsored insurance, private insurance, and government programs.

Employer-sponsored Insurance

One option for non-custodial parents to consider is employer-sponsored insurance. Many individuals are fortunate enough to access health insurance through their employers. In such cases, non-custodial parents should explore this option as it often provides comprehensive coverage for their children. It is important to note that the availability of employer-sponsored insurance varies between jobs and companies. In some instances, the non-custodial parent may be required to contribute to the premiums, while the employer may cover the entire cost in others.

Private Insurance

Private insurance is another avenue for non-custodial parents to secure health insurance coverage for their children. This type of insurance can be purchased directly from insurance companies or marketplaces. Private insurance plans often offer a range of options to suit different needs and budgets. It is crucial for non-custodial parents to carefully consider the coverage, premiums, deductibles, and any co-pays associated with private insurance plans. Comparing multiple plans can help them choose the most suitable option for their children’s healthcare needs.

Government Programs

Government programs are an essential resource for non-custodial parents facing financial constraints. These programs aim to provide health insurance coverage to low-income individuals and families. Medicaid is a federal and state program offering eligible individuals free or low-cost health insurance. The Children’s Health Insurance Program (CHIP) is another government program specifically designed to cover children from low-income households. Non-custodial parents should explore these options and assess their eligibility criteria to ensure their children receive health insurance coverage.

Implications For The Non-Custodial Parent

There are various important factors to consider regarding the implications for the non-custodial parent regarding health insurance responsibilities. From financial burden to potential legal consequences, non-custodial parents must understand the impact of their children’s health insurance responsibilities.

Financial Burden

Non-custodial parents may face a significant financial burden when providing health insurance for their children. In addition to paying child support, covering health insurance costs can strain the non-custodial parent’s financial resources. This may include premiums, co-pays, and deductibles, adding to the overall cost of supporting their children’s well-being. As such, this additional financial responsibility can impact the non-custodial parent’s ability to meet other financial obligations.

Legal Consequences

Failure to fulfill health insurance responsibilities as a non-custodial parent can result in legal consequences. Courts may enforce compliance with health insurance provisions outlined in the custody agreement, potentially leading to legal actions such as fines, wage garnishment, or even contempt of court charges. Non-custodial parents must understand the legal ramifications of neglecting their health insurance responsibilities, which can have long-term consequences for their financial well-being and their relationship with their children.

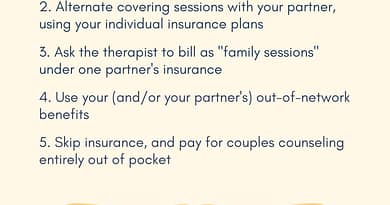

Negotiating Health Insurance Coverage

In the case of divorce or separation, negotiating health insurance coverage for children can be a complex and sensitive issue. Non-custodial parents often wonder about their responsibilities towards providing health insurance for their children. Let’s explore the essential aspects of negotiating health insurance coverage and the options available for non-custodial parents.

Communication With The Custodial Parent

Open and effective communication with the custodial parent is essential when negotiating health insurance coverage. Discussing the options and finding common ground can result in a mutually beneficial arrangement. Both parents should be transparent about their abilities to provide and contribute to the health insurance costs. Cooperation and understanding are crucial for reaching an agreement that serves the child’s best interests.

Mediation Or Legal Assistance

If communication with the custodial parent becomes challenging, seeking mediation or legal assistance can help facilitate the negotiation process. Professional mediation can provide a neutral platform for both parents to express their concerns and work towards a resolution. In some cases, involving legal professionals may be necessary to ensure that the child’s health insurance needs are adequately addressed within the framework of the law.

Credit: www.bryanfagan.com

Alternate Options

Regarding the child’s health insurance responsibility, the noncustodial parent may have various alternate options to consider. These alternatives can help establish a fair and suitable arrangement that financially benefits both parents. Let’s explore some of the alternate options:

Shared Responsibility

One potential solution is for both parents to share the responsibility of providing health insurance for their children. This can be achieved by either splitting the cost of the insurance premium evenly or by allocating the responsibility based on each parent’s income. Sharing the financial burden ensures that the child’s health needs are adequately covered and avoids placing an undue financial strain on a single parent.

Health Savings Accounts

Another option to consider is utilizing health savings accounts (HSAs). HSAs are tax-advantaged savings accounts specifically designed to cover qualified medical expenses. Noncustodial parents can contribute to an HSA to help cover healthcare costs for their children. By setting up an HSA, they can ensure that funds are readily available for medical expenses, such as co-pays, prescriptions, and routine check-ups.

- An HSA offers the flexibility to save and allocate funds for healthcare expenses.

- Contributions made to an HSA are tax-deductible, reducing the noncustodial parent’s taxable income.

- Any unspent funds in the HSA can roll over to the following year, allowing for future healthcare needs.

Utilizing an HSA can provide a practical and tax-efficient way for the noncustodial parent to contribute to their child’s healthcare expenses without purchasing a separate insurance plan.

Frequently Asked Questions On Is The Non-Custodial Parent Responsible For Health Insurance

Is The Non-custodial Parent Required To Provide Health Insurance For The Child?

Yes, the non-custodial parent may be required to provide health insurance for the child as part of their child support obligations. Health insurance coverage is often included in the custodial agreement to meet the child’s medical needs.

Can The Custodial Parent Be Responsible For Obtaining Health Insurance For The Child?

Yes, the custodial parent can be responsible for obtaining health insurance for the child, especially if it is specified in the custody agreement. The custodial parent may need to ensure the child has adequate coverage through their employer or other means.

What Happens If The Non-custodial Parent Refuses To Provide Health Insurance?

If the non-custodial parent refuses to provide health insurance as required by the custody agreement, they may face legal consequences. This could include enforcement actions by the court to compel compliance or even potential custody agreement modification.

Are there any exceptions to non-custodial parents’ inability to provide health insurance?

In some cases, there may be exceptions where the non-custodial parent is not required to provide health insurance, such as financial hardship or inability to obtain affordable coverage. However, these exceptions are subject to the court’s discretion and should be addressed through legal channels.

Conclusion

Ultimately, the responsibility for health insurance coverage of a child lies with both parents, including the non-custodial parent. While the specifics may vary depending on the court order or agreement, the non-custodial parent often shares the financial burden of providing health insurance coverage for their child.

Both parents must understand their obligations and work together to ensure the child’s well-being. By prioritizing the child’s health, parents can navigate the complexities of health insurance and provide the necessary care for their child.