Federal Life Health Insurance : Top Benefits and Coverage.

Federal Life Group, Inc. is an insurance company based in Austin, Texas. It offers a range of life, health, and annuity insurance products. As the parent company of Federal Life Insurance Company, Federal Life Group provides independently operated services to customers.

Focusing on quality, they strive to meet the insurance needs of individuals and families.

:max_bytes(150000):strip_icc()/4-types-of-insurance-everyone-needs.aspx-final-f954e12eb3074b178e4b53a882729526.jpg)

Credit: www.investopedia.com

What Is Federal Employee Health Insurance?

Federal Employee Health Insurance, part of the Federal Life Health Insurance program, provides coverage for government workers. It includes benefits for medical and wellness services tailored to the needs of federal employees and their families. Competitive plans ensure quality healthcare solutions for eligible individuals.

History Of Federal Employee Health Insurance

The history of Federal Employee Health Insurance dates back to the late 19th century when the U.S. government first started providing health benefits to federal employees. The concept evolved, and in 1960, the Federal Employees Health Benefits (FEHB) Program was established, offering a range of health insurance options to federal employees and retirees.

Options And Coverage

Under the Federal Employee Health Insurance, participants have access to a diverse array of coverage options, including health maintenance organizations (HMOs), preferred provider organizations (PPOs), and high-deductible health plans (HDHPs). These plans cover a wide range of medical services, including preventive care, hospitalization, prescription drugs, and mental health services, offering participants flexibility and choice in their healthcare coverage.

Benefits Of Federal Employee Health Insurance

Federal Employee Health Insurance, offered through Federal Life Group, provides a range of quality life, health, and annuity insurance products. This insurance is exclusive to federal employees and is often available at an affordable or even free rate, offering customizable coverage options not typically found in other insurance plans.

Comprehensive Coverage

Federal Employee Health Insurance provides comprehensive coverage encompassing various medical services and treatments. This includes doctor visits, hospital stays, prescription medications, preventative care, and mental health services. The extensive coverage ensures that policyholders can access their care without financial strain.

Cost-effective Options

One key benefit of Federal Employee Health Insurance is that it offers cost-effective options for federal employees and their families. The plans are designed to be affordable, with various levels of coverage to suit different budget needs. Additionally, the government subsidizes some of the premium costs, making it an even more attractive and budget-friendly option for policyholders.

Portability And Accessibility

Federal Employee Health Insurance offers portability and accessibility to its policyholders. This means that employees can maintain their coverage even if they change jobs or retire, providing a sense of security and continuity. Moreover, the insurance plans give accessibility to a vast network of healthcare providers, ensuring that policyholders can easily access quality medical care when needed, no matter where they are situated.

Eligibility And Enrollment Process

Federal Life Health Insurance offers comprehensive insurance products for individuals and families. This section will discuss the eligibility criteria and the enrollment process for Federal Life Health Insurance. Whether you are looking for health insurance coverage for yourself or your family, understanding the eligibility requirements and the enrollment process is crucial in making the right decision for your healthcare needs.

Who Is Eligible?

Eligibility for Federal Life Health Insurance varies depending on several factors. The insurance coverage is available to:

- United States citizens

- Legal residents

- People residing in Austin, Texas

- Individuals and families looking for quality life, health, and annuity insurance products

It is important to note that specific eligibility criteria may apply, so it is recommended to consult with a Federal Life Insurance representative to determine your eligibility status.

Enrollment Process

The enrollment process for Federal Life Health Insurance is simple. Here is a step-by-step guide to help you get started:

- Contact a Federal Life Insurance representative.

- Schedule an appointment to discuss your insurance needs and eligibility.

- Gather all the necessary documents, including proof of citizenship or legal residency.

- Complete the application form provided by the Federal Life Insurance representative.

- Submit the application form along with any required documents.

- Wait for a confirmation of your enrollment status.

- Once approved, review the details of your coverage and payment options.

- Make your first premium payment to activate your health insurance coverage.

Keep in mind that the enrollment process may vary based on individual circumstances. It is always advisable to consult with a Federal Life Insurance representative for personalized guidance and assistance throughout the enrollment process.

By following these simple steps, you can ensure a smooth and hassle-free enrollment experience with Federal Life Health Insurance.

Secure your health and well-being with Federal Life Health Insurance today!

Comparison With Private Health Insurance

Federal Life Health Insurance policies may offer varied coverage compared to private health insurance plans. While private insurers may have different coverage options, Federal Life provides unique benefits tailored to specific healthcare needs.

When comparing Federal Life Health Insurance and private health insurance costs, premiums, deductibles, and out-of-pocket expenses must be considered. Federal Life aims to offer competitive pricing while ensuring policyholders have comprehensive coverage.

Federal Life Health Insurance provides a network of healthcare providers from which policyholders can choose. This network may include hospitals, doctors, and specialists. Private health insurance plans may offer different provider options, so avoiding network coverage based on individual preferences is essential.

Challenges And Criticisms

While Federal Life Health Insurance offers a range of benefits and coverage options, it also faces some challenges and criticisms that potential policyholders should be aware of. These challenges primarily revolve around limited plan options, administrative restrictions, and out-of-pocket costs.

Limited Plan Options

One of the main challenges with Federal Life Health Insurance is the limited number of plan options available. Federal Life Health Insurance has a more limited selection than other insurance providers, which offer a wide range of plans to cater to different needs and budgets. This limitation may make it more difficult for individuals to find a plan that perfectly aligns with their specific requirements.

Administrative Restrictions

Another criticism of Federal Life Health Insurance relates to administrative restrictions. Some policyholders have reported difficulties in reaching customer service representatives and receiving timely responses to their inquiries. This lack of responsiveness from the administrative staff can be frustrating and potentially hinder the smooth administration of policies.

Out-of-pocket Costs

Out-of-pocket costs are another area where Federal Life Health Insurance faces criticism. Some policyholders have expressed concerns about high deductibles, copayments, and co-insurance amounts. These costs can add up and become a financial burden for individuals and families, especially those who require frequent medical care or have pre-existing conditions.

Despite these challenges and criticisms, it is essential to note that Federal Life Health Insurance has strengths and advantages. Potential policyholders must carefully evaluate their needs and compare different insurance providers to make an informed decision.

Credit: www.facebook.com

Future Trends And Considerations

As the landscape of health insurance continues to evolve, federal employees must stay updated on the future trends and considerations that may impact their health coverage. Understanding the potential legislative changes, reforms, and their impact is essential for making informed decisions regarding Federal Life Health Insurance.

Legislative Changes

The health insurance industry is subject to constant legislative changes, and federal employees must remain vigilant to understand and adapt to these alterations. The implications of legislative changes on health insurance can affect coverage, costs, and regulations, thereby impacting the suitability of Federal Life Health Insurance for employees.

Potential Reforms

Potential reforms in the healthcare sector could significantly change how health insurance operates for federal employees. Assessing the potential impact of these reforms on Federal Life Health Insurance is vital to ensure its continued efficacy in meeting employees’ Employees.

Understanding how the legislative changes and potential reforms may affect federal employees is essential. Federal employees must be well informed about the impact of these changes on their access to healthcare, costs, and overall coverage under Federal Life Health Insurance.

Essential Features Of Federal Employee Health Insurance

Federal Employee Health Insurance offers a range of essential features to support the well-being of federal employees and their families. These features provide comprehensive coverage and support for a healthy lifestyle and mental well-being.

Employee Assistance Programs

Employee Assistance Programs (EAPs) are vital for Federal Employee Health Insurance. They offer confidential counseling and support services to help employees with personal or work-related challenges. EAPs provide resources for mental health, financial counseling, work-life balance, and more, contributing to a positive work environment and employee well-being.

Wellness Initiatives

Wellness Initiatives encompass various programs and resources to promote healthy lifestyles and prevent illness. These may include fitness programs, nutrition counseling, smoking cessation support, and preventive screenings. Wellness initiatives empower employees to take control of their health, leading to increased productivity and reduced healthcare costs for both employees and the organization.

Mental Health Coverage

Mental Health Coverage under Federal Employee Health Insurance ensures access to comprehensive mental health services, including therapy, counseling, and psychiatric care. Employees can receive the support they need by prioritizing mental health and improving overall well-being and work performance.

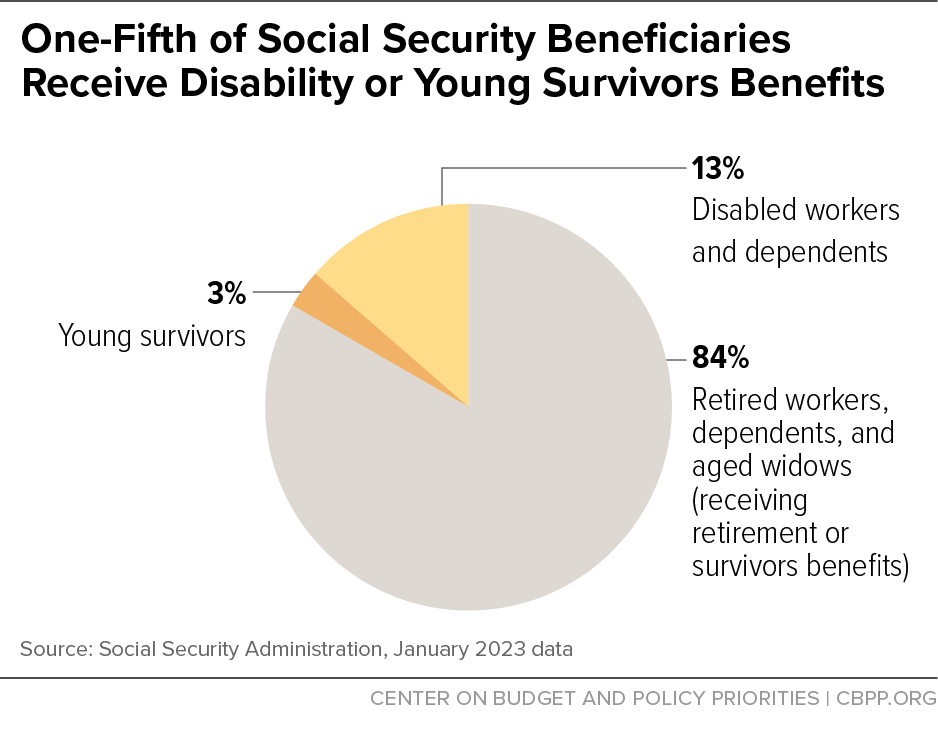

Credit: www.cbpp.org

Frequently Asked Questions On Federal Life Health Insurance

Does Federal Life Offer Health Insurance?

Federal Life offers health insurance, quality life insurance, and annuity insurance products.

Is Federal Life Insurance Good?

Federal life insurance offers FEGLI at affordable or accessible rates for federal employees. However, coverage amounts may be low. Term life insurance costs more but provides better, customizable coverage for the general public.

How Does Federal Life Insurance Work?

Federal Life Insurance, offered by Federal Life Group, provides quality life, health, and annuity products.

What Is Federal Health Insurance Called?

Federal health insurance is provided through the Federal Employees Health Benefits (FEHB) Program. This program offers federal employees quality life, health, and annuity insurance products and provides coverage through various insurance providers.

Conclusion

With a focus on providing high-quality life, health, and annuity insurance products, Federal Life Group, Inc., the parent company of Federal Life Insurance Company, is a reliable choice for your insurance needs. Their offerings are customizable and available to the general public, allowing for more excellent coverage options than their exclusive FEGLI counterparts.

Take advantage of Federal Life Insurance and gain peace of mind with comprehensive coverage. Contact them today to learn more about their Medicare Supplement plans and other insurance offerings.