Life Insurance Vs Health Insurance: Best Pick for You?

Life Insurance Vs Health Insurance provides financial support to beneficiaries after the policyholder’s death, while health insurance covers medical costs for the insured during their lifetime. Deciding between the two depends on individual circumstances and needs.

Navigating the complexities of insurance, many find themselves weighing the benefits of life insurance against health insurance. Life insurance aims to offer financial security to your loved ones in the event of your untimely death, settling debts, and providing income replacement.

Health insurance, conversely, safeguards against the financial strain of unexpected medical expenses, ensuring access to necessary healthcare services. Both types of insurance are vital, serving as critical financial safety nets. Still, they cater to different scenarios – one preparing for future economic stability and the other addressing immediate health concerns. Understanding these insurance policies’ distinct roles and advantages is critical to making an informed choice tailored to your long-term financial planning and health needs.

Credit: www.business2community.com

Understanding Life Insurance

At its core, life insurance is a safeguard, a protective measure you can take to ensure your loved ones’ financial security after you’re gone. Unlike health insurance, which covers medical expenses, life insurance is about preparing for the economic future and offering peace of mind.

What Is Life Insurance?

Life insurance is a contract between an individual and an insurance company. You pay premiums, and in exchange, the insurance company provides a lump-sum payment, known as a death benefit, to beneficiaries upon the insured’s death.

Types Of Life Insurance

- Term Life Insurance provides coverage for a specific period. The beneficiary receives the death benefit if the insured dies within the term.

- Whole Life Insurance: Offers coverage for the insured’s entire lifetime and a cash value accumulation.

- Universal Life Insurance: Offers lifetime coverage with flexible premiums and can accumulate cash value.

Importance Of Life Insurance

Life insurance is more than just a payout; it’s a strategy for financial stability. Here are key reasons why life insurance is critical:

| Reason | Description |

|---|---|

| Income Replacement | Supports family’s lifestyle and daily needs after losing an income earner. |

| Debt Coverage | It helps pay off debts, such as mortgages or loans, preventing financial burdens on the family. |

| Education Funds | Sets aside money for children’s education costs. |

| End-of-Life Expenses | It covers costs associated with end-of-life care, such as funeral expenses, avoiding the stress of unexpected financial strain. |

Understanding Health Insurance

When safeguarding your financial health, understanding health insurance is critical. It’s a tool that protects us against the high costs of medical care. Let’s dive in and decode what health insurance is, its various types, and why it’s crucial.

What Is Health Insurance?

Health insurance is a plan that pays for medical services. When you become sick or injured, it helps cover the costs. This includes doctor visits, hospital stays, and medications. With insurance, you pay a premium. In return, you get financial support for health costs.

Types Of Health Insurance

- 1. Individual Plans: You buy these yourself.

- 2. Group Plans: Employers often offer these.

- 3. Government-sponsored Programs like Medicare and Medicaid.

- 4. Managed Care Plans: These provide a network of healthcare providers.

- 5. High-Deductible Health Plans (HDHPs): Plans with lower premiums and higher deductibles.

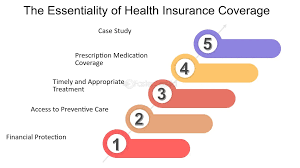

Importance Of Health Insurance

The importance of health insurance can’t be overstated. It helps you stay healthy by covering preventative care. It also protects your wallet from unexpected, high medical costs. Without it, a single illness can be financially devastating.

- Preventive Services: Routine check-ups and screenings.

- Financial Security: Keeps savings safe from medical bills.

- Access to Care: Better access to quality healthcare providers.

Coverage

Understanding the different protections life and health insurance provide is crucial. Each serves a unique purpose and offers specific coverage. Let’s delve into what each type of insurance covers.

Coverage Offered By Life Insurance

Life insurance provides financial support to beneficiaries after the policyholder’s death. This coverage can be essential for families or dependents, ensuring economic stability. Here’s what life insurance typically includes:

- Death benefit: A lump sum paid to beneficiaries upon the policyholder’s death.

- Permanent policies may offer a cash value component that grows over time.

- Term policies: Provide coverage for a set period.

- Riders: Optional benefits like critical illness or disability coverage.

Coverage Offered By Health Insurance

Health insurance protects against the financial impact of medical expenses. Whether it’s routine check-ups or unexpected illnesses, health insurance covers you. Key aspects include:

- Preventive services: Immunizations and wellness check-ups that prevent diseases.

- Medical treatment: Hospital stays, surgeries, and doctor visits.

- Prescriptions: Medications prescribed for both acute and chronic conditions.

- Mental health services: Includes counseling and psychotherapy sessions.

Credit: www.forbes.com

Cost

Understanding the cost of insurance helps you make better decisions. Both life and health insurance come with their own set of cost factors. By knowing these, you can plan better for your financial security. Let’s break down the cost elements for each insurance type.

Cost Factors For Life Insurance

The cost of life insurance can vary widely based on several factors:

- Age: The younger you are, the lower the premiums typically are.

- Health: Good health often results in lower costs.

- Lifestyle: Smokers or high-risk hobbyists usually pay more.

- Policy length: Long-term policies tend to cost more.

- Coverage amount: Higher coverage means higher premiums.

- Policy type: Term life is generally cheaper than whole life insurance.

Cost Factors For Health Insurance

Different components influence health insurance costs:

| Factor | Description |

|---|---|

| Plan Type | HMOs may be cheaper than PPOs. |

| Deductible | Plans with higher deductibles often have lower premiums. |

| Copayments | The fixed amount you pay for covered healthcare services. |

| Coinsurance | Your share of the costs after your deductible is met. |

| Network | Out-of-network services can cost more. |

| Income | Subsidies can lower premiums for those who qualify. |

Beneficiaries

Life insurance and health insurance cover different aspects of life. One protects your family after you’re gone, and the other covers your medical costs while you are alive. An essential element of both types of insurance is the “beneficiaries.” Let’s explore who benefits from these policies.

Beneficiaries in Life Insurance

Beneficiaries In Life Insurance

Life insurance beneficiaries are the individuals you choose to receive the benefits of your policy after your passing. This is a critical choice, as these are the people or entities that will directly receive the financial support from the policy.

- Spouse: Often the primary beneficiary for many policies.

- Children: They can receive support for expenses like education and living costs.

- Relatives or Friends: You might choose someone financially dependent on you.

- Trusts: Sometimes set up to manage the benefits for minors or others.

Beneficiaries in Health Insurance

Beneficiaries In Health Insurance

Health insurance beneficiaries are typically the individuals covered under the policy. This coverage extends to a variety of medical expenses.

- You, as the policyholder, are the primary beneficiary.

- Dependents, like spouses and children, are covered by the policy.

- Parents or other dependents, if included in your plan.

Each policy has rules about who can be included as a covered beneficiary.

:max_bytes(150000):strip_icc()/hmo.asp-Final-9f9b68a2060f44c2b28782a83e14764a.jpg)

Credit: www.investopedia.com

Claims

Understanding the claim processes of life and health insurance policies is crucial for policyholders. Navigating the procedures ensures timely payout and fewer hassles during stressful times. Learn quickly about the differences in claims between life insurance and health insurance.

Claim Process For Life Insurance

The life insurance claim process begins after the insured person passes away. The beneficiaries must follow a series of steps:

- Notify the insurer as soon as possible.

- Submit the claim form and required documents, such as a death certificate and proof of identity.

- Wait for the policy review by the insurance company.

- Once approved, receive the death benefit. This process can take a few weeks to months.

Claim Process For Health Insurance

Filing a claim for health insurance follows a different set of steps:

- Contact the insurer or T.P.A. (Third Party Administrator) to inform about the hospitalization.

- Complete the pre-authorization form if it’s a planned hospitalization.

- Provide all the necessary documents, such as medical bills and ID proof.

- For cashless treatments, the insurer directly settles the bills with the hospital. Otherwise, pay upfront and file for reimbursement later.

Note: Ensure all provided information is accurate to avoid delays or denials in your claim.

Making The Right Choice

Choosing between life and health insurance can be like picking between a safety net and a health shield. Both are vital. One safeguards your family after you’re gone, and the other covers medical bills when unwell. Let’s help you decide!

Factors to consider when choosing Life Insurance

Factors To Consider When Choosing Life Insurance

Life insurance is a promise, a way to protect your loved ones. But making the right choice needs thought:

- Type of Policy: Should you go for a term or whole life?

- Coverage Amount: How much will your family need?

- Premiums: Can you afford these over time?

- Policy Duration: How long do you need coverage?

- Health Conditions: Your health can affect choices.

Factors to consider when choosing Health Insurance

Factors To Consider When Choosing Health Insurance

Good health insurance acts like a financial cushion for medical expenses. Consider these before choosing:

- Plan Type: HMO, PPO, or something else?

- Benefits: What kinds of care are covered?

- Out-of-pocket Costs: Can you handle the deductibles and co-pays?

- Network Restrictions: Are your favorite doctors in-network?

- Prescription Coverage: Does it cover the medicines you need?

Frequently Asked Questions For Life Insurance Vs Health Insurance

What Is More Important: Life Insurance Or Health Insurance?

Life and health insurance are vital; each serves a different essential role. Health insurance covers medical expenses, and life insurance provides financial support after you pass away. Choose based on your current life stage and economic needs.

What Is The Main Disadvantage Of Life Insurance?

The main disadvantage of life insurance is its expense, which can strain personal finances.

Is Life Insurance Always Worth It?

Life insurance’s value depends on individual financial responsibilities and dependents’ needs. It’s not essential for everyone.

Is Life Insurance For The Living Or The Dead?

Life insurance is primarily for the living, providing financial support to beneficiaries after the policyholder’s death.

Conclusion

Deciding between life insurance and health insurance is critical. Both serve vital yet distinct roles in safeguarding your financial future. Remember, life insurance offers peace of mind for tomorrow, while health insurance protects your well-being today. Choose wisely to ensure comprehensive coverage for all of life’s uncertainties.

Embrace a balanced approach to stay prepared for the inevitable while caring for your health needs now.