Health Insurance Alaska: Your Guide to Affordable Coverage

Health Insurance Alaska, it’s important to note the limited competition among providers, high compensation for specialty physicians, and above-average hospital profit margins contributing to expensive healthcare costs. Alaska’s unique market dynamics explain the higher healthcare costs experienced there.

Alaska’s healthcare system is characterized by limited competition among providers, especially in specialty areas, and high compensation for providers, particularly those performing procedures. These dynamics drive up the costs of healthcare for Alaskans. The state faces significant healthcare cost challenges, with hospital profit margins in urban Alaska being higher than national averages.

Understanding the distinct factors in Alaska’s healthcare landscape is essential for anyone seeking health insurance in the state. Additional insights into the market and coverage options can help individuals and businesses navigate the unique healthcare environment in Alaska.

Credit: www.aarp.org

The Importance Of Health Insurance

Health insurance is vital in ensuring individuals have access to necessary medical services without facing financial hardships.

Coverage For Medical Expenses

Health insurance covers various medical expenses, including doctor visits, hospital stays, prescription medications, and preventive care.

Access To Medical Services

Health insurance grants individuals access to a wide range of medical services, ensuring timely treatment and care when needed.

Health insurance is not just a safety net but a fundamental necessity for well-being.

Credit: turuhi.com

Challenges In The Alaska Health Insurance Market

High healthcare costs in Alaska are due to limited competition among providers, especially specialty physicians, and high compensation for procedures. Furthermore, urban Alaska‘s hospital profit margins surpass national averages, contributing to the expensive health insurance market.

Limited Options For Individual Plans

Alaska residents face limited choices when selecting individual health insurance plans.

- Restricted: Options for individual plans in Alaska are sparse.

- Few: Insurers offer individual plans in Alaska, resulting in limited choice.

- Accessibility: Finding suitable individual plans in Alaska can be challenging.

High Premiums

Alaskans encounter the issue of high premiums when attempting to secure health insurance coverage.

- Expensive: Premiums for health insurance in Alaska are notably high.

- Financial Burden: Alaska residents face a significant financial strain due to high premiums.

- Costly: The cost of health insurance premiums in Alaska is exorbitant.

Types Of Health Insurance In Alaska

Understanding the various types of health insurance in Alaska is crucial for individuals and families to make informed decisions about their healthcare coverage. Whether through employer-sponsored plans, government-funded programs, or individual options, Alaskans can access various options tailored to their needs.

Employer-sponsored Health Insurance

Employer-sponsored health insurance is a common way for individuals and families to secure comprehensive coverage. Employers typically offer this type of insurance as part of their employee benefits package. It provides access to healthcare services at a group rate, often with the employer sharing the cost of premiums with employees.

Medicaid And Chip

Medicaid and the Children’s Health Insurance Program (CHIP) are vital government-funded health insurance programs that provide coverage to low-income individuals, families, and children in Alaska. These programs offer benefits such as doctor visits, hospital stays, preventive care, and other essential services for eligible enrollees at little to no cost.

Individual Health Insurance

Individual health insurance plans are purchased directly by individuals to provide coverage for themselves and their families. These plans are tailored to the specific needs and budget of the individual, offering a wide range of coverage options, including medical, dental, and vision care.

Understanding The Alaska Health Insurance Exchange

The Alaska Health Insurance Exchange, or the Marketplace, is an online platform where Alaska residents can explore and purchase health insurance plans that meet their needs. Through the Exchange, individuals and families can access various insurance options to find coverage that fits their budget and requirements.

How The Exchange Works

The Alaska Health Insurance Exchange is a centralized marketplace where various insurance carriers offer purchase plans. Individuals can visit the Exchange website and compare policies based on coverage, cost, and provider networks. This allows them to make an informed decision and choose a plan that best suits their healthcare needs.

To start the process, individuals can create an account on the Exchange website or contact the designated phone number for assistance. From there, they can fill out an application, providing necessary information about themselves and their household. This information is then used to determine their eligibility for subsidies and tax credits that can help make insurance more affordable.

Once the application is complete, individuals are presented with a list of available plans that match their criteria. They can compare the details of each plan, such as deductibles, copayments, and coverage limits, to make an informed decision. Once they have chosen a plan, they can proceed with enrollment. It’s important to note that the Exchange has an open enrollment period, typically from November to December each year, during which individuals can sign up for or switch their health insurance coverage.

Subsidies And Tax Credits

One key benefit of the Alaska Health Insurance Exchange is the availability of subsidies and tax credits. These financial assistance programs are designed to help lower-income individuals and families afford health insurance coverage.

Subsidies, or premium tax credits, are provided on a sliding scale based on income. Individuals and families whose income falls within a specific range may be eligible for these subsidies, which can significantly reduce the monthly cost of their insurance premiums.

Tax credits, on the other hand, can help offset the cost of out-of-pocket expenses, such as copayments and deductibles. These credits are available to individuals and families whose income falls within a specific range, providing additional financial support to manage healthcare costs.

During the application process, individuals must provide accurate information about their income and household size to determine eligibility for subsidies and tax credits. The Exchange website guides applicants through this process and calculates the amount of financial assistance they may qualify for.

Individuals and families can make informed decisions about their health insurance coverage by understanding how the Alaska Health Insurance Exchange operates and the availability of subsidies and tax credits. The Exchange provides valuable resources and transparency, making it easier for Alaskans to access the healthcare they need at an affordable cost.

Key Factors To Consider When Choosing Health Insurance In Alaska

When choosing the right health insurance plan in Alaska, several key factors must be carefully considered to ensure the coverage meets your specific needs and budget. Understanding the different aspects of health insurance and how they apply to Alaska’s unique healthcare landscape can help you make an informed decision. Below are some of the essential factors to keep in mind when selecting health insurance in Alaska.

Premium Costs

Premium costs play a crucial role in determining the affordability of a health insurance plan. When evaluating options, it’s essential to compare the monthly premium rates of different plans and assess how they fit into your budget. In Alaska, premiums may vary based on factors such as age, location, and the level of coverage.

Network Coverage

Network coverage is another vital aspect to consider when choosing health insurance in Alaska. The network of healthcare providers and facilities included in your plan can significantly impact care accessibility. It’s essential to ensure that your preferred doctors, specialists, and hospitals are part of the network to avoid out-of-network expenses.

Prescription Drug Coverage

Prescription drug coverage is an essential health insurance component, especially for individuals who require ongoing medications. When comparing plans, reviewing the formulary to see which prescription drugs are covered and at what cost is crucial. Note any restrictions or requirements, such as prior authorization, to ensure your medications are easily accessible.

Credit: www.meetbreeze.com

Tips For Navigating The Alaska Health Insurance Enrollment Process

Enrolling in health insurance in Alaska can be a complex process, but understanding the options and assistance programs available can make it easier. This article will explore tips to help you navigate the Alaska health insurance enrollment process smoothly.

Open Enrollment Period

The Open Enrollment Period is a specific time frame for individuals to sign up for or change their health insurance plans. In Alaska, the Open Enrollment Period typically begins on November 1st and ends on December 15th each year. During this period, you can review different health insurance plans and choose the one that best suits your needs.

Special Enrollment Periods

If you miss the Open Enrollment Period, you may still be eligible to enroll in a health insurance plan during a Special Enrollment Period. Special Enrollment Periods are for individuals who experience certain qualifying life events, such as getting married, having a baby, losing other health coverage, or moving to a new area. It’s essential to be aware of these Special Enrollment Periods and take advantage of them if you qualify.

Assistance Programs

In Alaska, various assistance programs are available to help individuals navigate the health insurance enrollment process. One such program is Medicaid, which provides healthcare coverage to low-income individuals and families. The income limit for Alaska Medicaid varies depending on household size and income. You can check the Alaska Department of Commerce, Community, and Economic Development website for more information on the income limits and how to apply.

Other programs, such as the Alaska Children’s Health Insurance Program (CHIP) and the Premium Payment Program, can provide financial assistance to eligible individuals and families. These programs aim to make health insurance more affordable and accessible for those who qualify.

When enrolling in health insurance in Alaska, it’s essential to understand your coverage options and the enrollment process. By familiarizing yourself with the Open Enrollment Period, Special Enrollment Periods, and available assistance programs, you can make informed decisions about your health insurance coverage and ensure you and your family have the necessary protection.

Common Health Insurance Terms And Concepts

Discovering standard health insurance terms and concepts in Alaska reveals essential guidelines for coverage understanding. Providers and profit margins significantly shape the state’s unique healthcare landscape. Understand Alaska’s health insurance options to navigate its complex system efficiently.

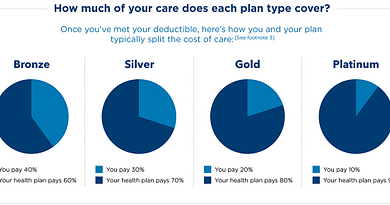

Common Health Insurance Terms and Concepts Navigating the world of health insurance can be overwhelming, especially with the array of terms and concepts involved. Understanding these terms is crucial in making informed decisions about your healthcare coverage. Deductibles and Copayments In health insurance, deductibles refer to the amount you must pay out of pocket before your insurance starts covering costs. Conversely, copayments are fixed amounts you pay for healthcare services after you have met your deductible. Out-of-Network Providers When you visit healthcare providers outside your insurance network, it may lead to higher costs as your insurance plan may not fully cover the services. Understanding the coverage for out-of-network providers is essential to avoid unexpected bills. Preventive Care Coverage: Preventive care includes screenings, vaccinations, and check-ups to prevent illnesses or detect them early. Many insurance plans cover preventive care at no cost, promoting overall health and well-being. By grasping these standard health insurance terms and concepts, such as deductibles, copayments, out-of-network providers, and preventive care coverage, you can make informed decisions about your healthcare and maximize the benefits of your insurance plan.

The Future Of Health Insurance In Alaska

Alaska’s health insurance landscape is evolving, paving the way for significant changes in the future. From potential reforms to innovative telehealth services and addressing healthcare costs, the future of health insurance in Alaska holds promise for improved accessibility and affordability.

Potential Reforms

Alaska is considering reforms that could enhance the efficiency and effectiveness of its health insurance system. These reforms aim to improve coverage options and promote greater healthcare accessibility for all residents.

Telehealth Services

Telehealth services, a growing trend in healthcare, are set to revolutionize how Alaskans access medical care. Individuals can receive quality healthcare remotely by leveraging technology, providing convenience and faster treatment.

Addressing Healthcare Costs

Addressing healthcare costs is critical to ensuring sustainable health insurance in Alaska. The state aims to mitigate residents’ financial burdens by implementing cost-saving measures and encouraging transparency.

Frequently Asked Questions Of Health Insurance Alaska

Why Is Alaska Healthcare So Expensive?

Alaska HealthCare is expensive due to limited provider competition, high specialist compensation, and above-average hospital profits.

What Is The Income Limit For Alaska Medicaid?

The income limit for Alaska Medicaid varies based on family size and income level.

Does Alaska Have Obamacare?

Alaska has health insurance plans under the Affordable Care Act (ObamaCare) for its residents.

What Is The 80th Percent Rule In Alaska?

The 80th percent rule in Alaska requires insurance providers to cover at least 80% of the allowed charges for covered services. The insurance company must pay at least 80% of the cost for covered medical procedures or treatments, while the policyholder is responsible for the remaining 20%.

Conclusion

Health insurance can be costly in Alaska due to limited provider competition and high healthcare costs. However, understanding your coverage options is vital. With the help of eHealth and Premera Blue Cross Blue Shield, finding an affordable plan can be made more accessible.

Take control of your health and financial well-being by exploring available options.