Health Insurance Kansas City: Your Guide to Affordable Coverage

Health Insurance Kansas City Kansas City, consult trusted providers like Kansas City Life Insurance Company and Senior Benefits Plus LLC. These agencies offer various health insurance plans tailored to meet your needs, ensuring you have access to quality care when needed most.

With affordable options and excellent customer service, securing health insurance in Kansas City is straightforward and prioritizes your well-being and peace of mind. Whether you are exploring group or individual plans, these reputable agencies strive to make your health insurance decisions seamless and beneficial for you and your loved ones.

Plan and protect your health with reliable coverage in Kansas City.

Credit: www.kansascitycurrent.com

The Importance Of Health Insurance

Health insurance is a vital component of a person’s overall well-being. It provides financial protection and peace of mind, ensuring that individuals and families can access quality healthcare when needed. In a rapidly changing world where unexpected medical emergencies can arise, having health insurance can make all the difference in securing your health and financial stability.

Securing Your Health

Securing your health through health insurance is essential for receiving timely and necessary medical care. It enables individuals to proactively manage their health by accessing preventive services, regular check-ups, and treatments for various illnesses and conditions. Health insurance lets you prioritize your well-being and address health concerns without unnecessary delays or financial strain.

Financial Protection

Health insurance provides financial protection against the high costs of medical care. In the event of unexpected illnesses, accidents, or chronic conditions, having insurance coverage can prevent individuals from facing substantial medical bills and potential debt. It offers a safety net, ensuring that healthcare expenses do not jeopardize your financial stability or lead to undue stress.

Key Factors To Consider

When considering health insurance in Kansas City, there are several crucial factors that individuals and families need to keep in mind to ensure they make an informed decision that meets their specific needs. To help you navigate this process, it’s essential to understand the following key factors:

Coverage Options

Coverage options play a pivotal role in determining the adequacy of a health insurance plan. When evaluating different plans, it’s essential to carefully review what is covered, including prescription medications, preventive care, and specialist visits, to ensure your specific healthcare needs are addressed.

Network Providers

Network providers are essential as they determine which doctors and healthcare facilities you can visit with your insurance plan. It’s vital to ensure that your preferred medical professionals are part of the plan’s network to avoid out-of-network costs.

Cost Considerations

Cost considerations encompass various aspects, including premiums, deductibles, co-pays, and out-of-pocket maximums. Evaluating these costs helps in understanding the financial aspects of the insurance plan and how it aligns with your budget and healthcare needs. In addition to these critical factors, individuals should also consider the reputation and customer service of the insurance provider, as well as any specific requirements related to pre-existing conditions or chronic illnesses.

Understanding Health Insurance In Kansas City

Having the right health insurance is crucial when taking care of your health. Understanding the ins and outs of health insurance is especially important in a city like Kansas City. In this article, we will explore the regulations, requirements, and local insurance providers in Kansas City, helping you make an informed decision about your health coverage.

Regulations And Requirements

In Kansas City, some specific regulations and requirements govern health insurance. Understanding these can be key to ensuring you have the coverage you need. Here are some crucial points to keep in mind:

- Health Insurance Marketplace: Consumers may apply for health insurance through the Health Insurance Marketplace, accessible through HealthCare.gov. This platform allows you to explore different insurance plans, compare prices, and choose a plan that fits your needs and budget.

- Medicaid: Another option for obtaining health insurance in Kansas City is through kancare.ks.gov, which provides coverage for eligible individuals through the Medicaid program. Medicaid is a government-run program that prioritizes low-income individuals and families.

- Insurance Department: The Kansas Insurance Department is a resource for understanding health and life insurance in Kansas. Visit their website at insurance.kansas.gov for more information about regulations, licensing, and consumer protection.

Local Insurance Providers

In Kansas City, you have a variety of options when it comes to local insurance providers. Here are a few well-known companies that offer health insurance coverage in the area:

| Company Name | Contact Information |

|---|---|

| Kansas City Life Insurance Company | (816) 753-7000 |

| Senior Benefits Plus LLC | (816) 793-3880 |

| Ford Health | (678) 753-9506 |

These companies offer a range of health insurance plans to cater to different needs and budgets. Contacting them directly will allow you to learn more about their offerings and coverage options. Regarding health insurance in Kansas City, understanding the regulations and requirements and exploring local insurance providers is essential. By doing your homework and weighing your options, you can find a health insurance plan that provides the coverage you need to care for your health.

Navigating The Enrollment Process

Understanding the enrollment process is crucial to securing health insurance in Kansas City. Whether you seek coverage during the Open Enrollment Period or have Special Enrollment Circumstances, this guide will help you navigate the system effectively.

Open Enrollment Period

During the Open Enrollment Period, individuals can select health insurance plans without a qualifying event. This period typically runs from November to December, providing ample time for consumers to review their options and make informed decisions regarding their healthcare coverage.

Special Enrollment Circumstances

Exceptional Enrollment Circumstances allow individuals to enroll in or change their health insurance plans outside the standard enrollment period. Everyday qualifying events include job loss, marriage, or the birth of a child. Understanding the specific criteria that apply to your situation is essential to take advantage of this option.

Comparing Different Health Insurance Plans

Various health insurance plans are available, each with its benefits and features. Understanding the differences between these plans can help you decide which one is right for you. This article will compare two common types of health insurance plans: HMO and PPO. We will also discuss deductibles and premiums, giving you a comprehensive overview of how these factors affect your coverage.

Hmo Vs. Ppo

There are two main types of health insurance plans: Health Maintenance Organization (HMO) and Preferred Provider Organization (PPO). Let’s take a look at the differences between these two options:

| HMO | PPO |

|---|---|

| In an HMO plan, you must choose a primary care physician (PCP) to coordinate your healthcare services. Your PCP will refer you to specialists if needed. | In a PPO plan, you are not required to choose a PCP. You can see any healthcare provider you want, both in-network and out-of-network. |

| In an HMO plan, you usually need a referral from your PCP to see a specialist. Without a referral, the services may not be covered. | In a PPO plan, you can see a specialist without a referral. However, you may have higher out-of-pocket costs for out-of-network providers. |

| HMO plans typically have lower premiums and lower out-of-pocket costs. However, you may have limited options when choosing healthcare providers. | PPO plans generally have higher premiums and higher out-of-pocket costs. However, you have more freedom and flexibility in choosing healthcare providers. |

Deductibles And Premiums

When comparing health insurance plans, it’s essential to consider deductibles and premiums. Here’s what you need to know:

- Deductibles: A deductible is the money you need to pay out-of-pocket before your insurance coverage kicks in. Plans with higher deductibles usually have lower monthly premiums, while plans with lower deductibles tend to have higher premiums. Consider your healthcare needs and budget when deciding on a plan.

- Premiums: Premiums are the monthly payments you make to maintain your health insurance coverage. Higher premiums often result in lower out-of-pocket costs, while lower premiums may require you to pay more when you need healthcare services. Evaluate your financial and healthcare needs to determine which premium amount suits you best.

Comparing health insurance plans can be overwhelming, but understanding the key differences between HMO and PPO plans and considering deductibles and premiums can help you make an informed decision. Take the time to assess your healthcare needs and budget, and consult with an insurance professional if needed. By doing so, you can find a health insurance plan that meets your needs and provides you with the coverage you deserve.

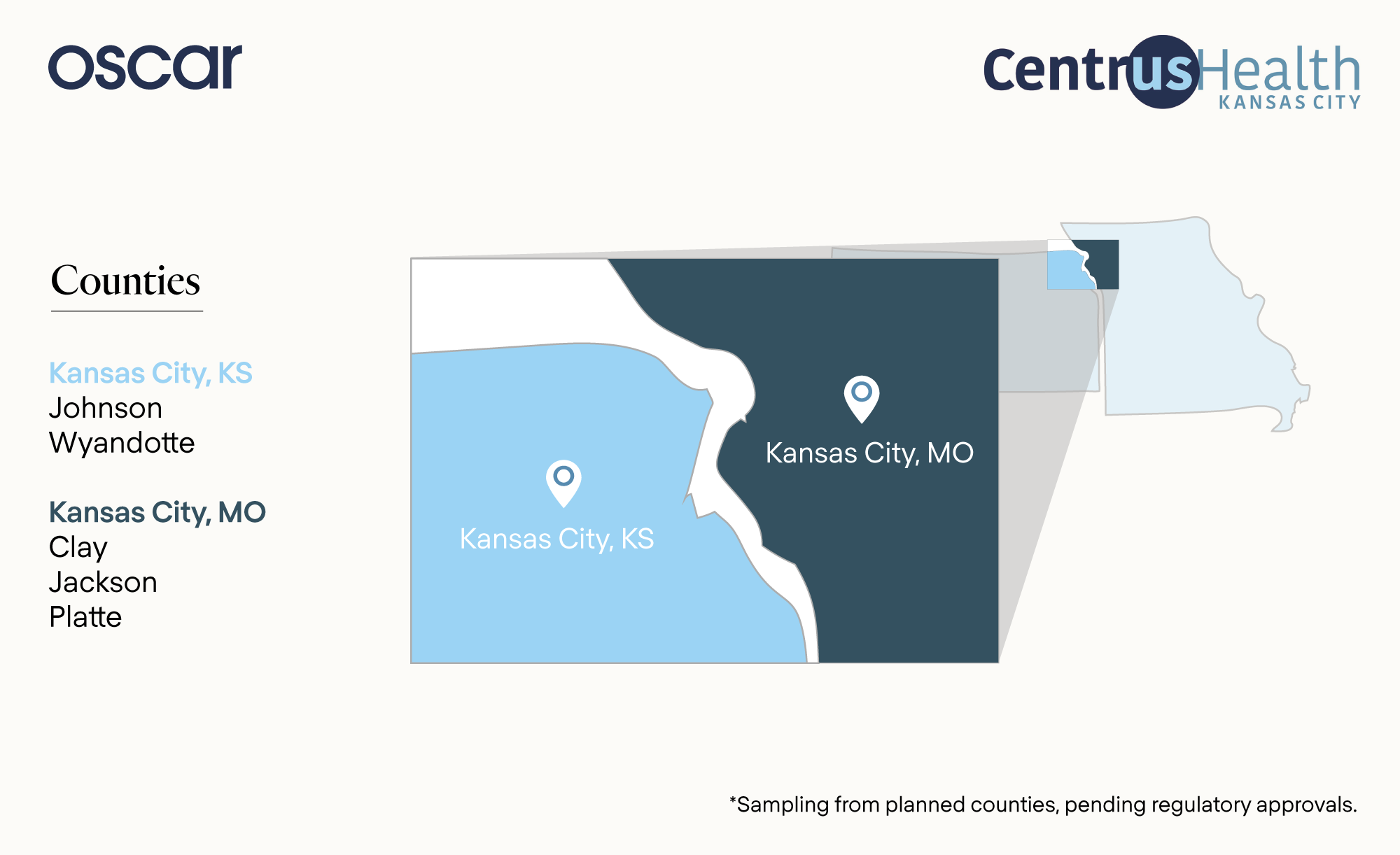

Credit: www.hioscar.com

Utilizing Health Insurance Benefits

Utilizing Health Insurance Benefits includes access to preventive care services like regular check-ups, vaccinations, and screenings to maintain good health. Your health insurance plan covers sudden illnesses or accidents requiring immediate medical attention in emergencies.

Tips For Maximizing Your Health Insurance

Discover essential tips for maximizing your health insurance in Kansas City. Understand your coverage options, network providers, and preventive care benefits to make the most of your health plan. Prioritize regular check-ups and consultations to stay healthy and save on medical expenses.

Understanding Co-payments

When choosing a health insurance plan, it’s essential to understand the concept of co-payments. A co-payment is a fixed amount for a covered healthcare service, typically due at the time of the appointment. Check your policy for the exact co-payment amount for doctor visits, prescription medications, and specialist appointments. Being aware of these costs ensures you can budget effectively for health expenses.

Utilizing In-network Providers

Maximize your health insurance benefits by utilizing in-network providers. In-network healthcare providers have contracted with your insurance company to provide services at a lower, negotiated rate. Choosing in-network providers can significantly reduce out-of-pocket expenses, as these providers have agreed-upon rates with your insurance company. Before seeking medical care, you must check whether the healthcare provider is in your insurance network to avoid unexpected costs.

Planning For Long-term Health Needs

Planning for long-term health needs is an essential aspect of maintaining your well-being. It involves ensuring you have the right health insurance to cover your medical expenses, especially when it comes to chronic conditions that may require ongoing treatment and care.

Coverage For Chronic Conditions

Having comprehensive health insurance is crucial when it comes to managing chronic conditions. Whether you have diabetes, heart disease, or any other long-term health condition, you need a health insurance plan that covers the necessary medications, specialist visits, and other related services. With the right health insurance plan, you can have peace of mind knowing that your chronic condition is covered, and you won’t have to worry about the financial burden of managing your health. It’s important to carefully review your policy to ensure that it includes coverage for the specific care and treatments you require.

Future Financial Planning

Long-term health needs also extend to future financial planning. While it’s crucial to have health insurance coverage for your current medical needs, it’s equally important to consider future care costs. Your health needs may change as you age and require additional care or services. This could include long-term care facilities, home healthcare, or specialized treatments. Planning and considering these potential expenses can help you ensure that you have the necessary financial resources to meet your future health needs. To prepare for these potential costs, you may explore long-term care insurance, savings plans, or investment strategies to help you build a financial safety net. Consulting with a financial advisor can guide you on the best approach for your situation.

| Benefits | Explanation |

|---|---|

| Peace of mind | Knowing that your health needs are covered can give you peace of mind and reduce stress. |

| Financial preparedness | Planning for future health expenses can help you financially prepare for potential medical costs. |

| Access to necessary care | With proper planning, you can ensure access to the necessary care and treatments for your long-term health needs. |

Overall, planning for long-term health involves securing the right health insurance coverage for your current and future medical needs. By considering coverage for chronic conditions and engaging in future financial planning, you can protect your well-being and ensure that you are well-prepared for any health challenges that may arise.

Credit: www.bluekc.com

Frequently Asked Questions

How Much Is Health Insurance In Kansas City, Mo?

The cost of health insurance in Kansas City varies based on age and the plan provider. To find specific prices, it’s best to contact insurance agencies in the area for quotes. Additionally, individuals can explore options through the Health Insurance Marketplace or Medicaid.

What Is The Cheapest Health Insurance In Missouri?

The cheapest health insurance in Missouri varies based on factors like age, location, and coverage. Blue Cross Blue Shield, Aetna CVS Health, and others offer affordable options. Consider your needs and compare quotes to find the best choice for you.

What Are The Top 3 Health Insurances Health Insurance Kansas City?

Blue Cross Blue Shield, Kaiser Permanente, and Oscar are the top three health insurance options. They offer good-quality plans and health management programs.

How To Get Health Insurance In Kansas?

You can apply through the Health Insurance Marketplace on HealthCare to get health insurance in Kansas. Gov or through skincare. Ks. Gov for Medicaid. Finding one for you and your youth’s needs is essential to your options.

Conclusion is essential

In Kansas City, health insurance options are diverse and accessible through various providers. Blue KC offers comprehensive plans for individuals and families, efficiently promoting health and well-being. With a range of benefits, local expertise, and quality care, securing health insurance in Kansas City is simple and essential.