Health Insurance Audit: Uncovering Fraud, Abuse, and Waste

A health insurance audit is a comprehensive review of treatment to identify fraud, abuse, and waste in the healthcare industry. It ensures proper protection from risks and threats while affecting premium adjustments.

Health insurance audits play a vital role in uncovering potential fraud and abuse in the healthcare industry. These audits may be triggered by various factors such as complaints, coding issues, or unclear Medicare coverage. Understanding the intricacies and potential penalties of health insurance audits is essential for healthcare providers and individuals.

Proper preparation for an audit, including maintaining accurate and complete medical records, is crucial to mitigate any negative repercussions. As healthcare evolves, all stakeholders must stay informed and compliant with health insurance audit regulations. Understanding the nuances of health insurance audits and the potential financial implications is vital in today’s healthcare environment.

Triggers For Audits

Health insurance audits are triggered by various factors that indicate the need for a comprehensive review of claims and processes. Understanding these triggers is essential for healthcare providers to stay compliant and avoid potential issues.

Complaints And Breach Reports

Complaints and breach reports play a significant role in initiating health insurance audits. Any complaints, potential HIPAA violations, or data breaches can prompt an audit process.

Coding Issues In Claims Processing

Coding issues in claims processing can also trigger audits. Common problems like upcoding and undercoating in therapy clinics can raise red flags during the audit.

Credit: enterslice.com

Consequences Of Avoiding Audits

Health insurance audits are essential for ensuring compliance and accuracy in claims processing. Avoiding audits can lead to severe consequences for policyholders. Let’s delve into the potential outcomes of sidestepping health insurance audits.

Premium Increase

Failure to undergo a health insurance audit can result in a premium increase. This increase can sometimes be substantial, significantly impacting your monthly or annual insurance expenses. By avoiding audits, policyholders risk facing the financial burden of inflated premiums.

Policy Cancellation

One of the gravest outcomes of neglecting health insurance audits is the possibility of policy cancellation. Insurance companies may cancel a policy if the policyholder fails to comply with audit requirements. This can leave individuals or businesses without the crucial coverage they need for unexpected medical expenses.

Types Of Health Insurance Audits

Health insurance audits include pre-payment and post-payment reviews. A pre-payment review occurs before the insurance company pays for a service, while a post-payment review happens after the service has been paid for. These audits help identify fraud, abuse, and waste in the healthcare industry.

When it comes to health insurance audits, providers should be aware of two main types: pre-payment review and post-payment review. These audits serve different purposes and involve different processes.

Pre-payment Review

A pre-payment review is conducted before an insurance company pays a claim. It involves thoroughly examining the documentation submitted with the claim to ensure that the services provided meet the necessary criteria for coverage. This type of audit aims to prevent fraud and abuse by identifying any discrepancies or irregularities in the claims.

During a pre-payment review, the insurance company assesses the medical records, coding, and billing documentation to verify the medical necessity of the services and the accuracy of the coding. The claim may be denied or subject to further investigation if any issues or discrepancies are found.

Post-payment Review

A post-payment review, on the other hand, is conducted after the insurance company has paid the claim. It involves a retrospective evaluation of the allegations and supporting documentation to ensure the payment is accurate and appropriate. The objective of a post-payment audit is to detect any instances of overpayment, improper coding, or fraudulent billing.

During a post-payment review, the insurance company examines the claims and supporting documentation to verify the services’ accuracy, medical necessity, and compliance with coding and billing guidelines. If any discrepancies are identified, the insurance company may request repayment of the overpaid amount or take further action, such as imposing penalties or initiating legal proceedings.

In conclusion, understanding the different types of health insurance audits is crucial for healthcare providers to ensure compliance with billing and coding regulations. Both pre-payment and post-payment audits play a vital role in preventing fraudulent activities and ensuring the accuracy and appropriateness of payments. Providers should be prepared for these audits and maintain accurate and detailed documentation to support the services rendered and billed.

Credit: bluemark.net

Complex Audits

Health insurance audits involve thoroughly examining healthcare treatment to detect fraud, abuse, and waste. Complex audits may be necessary when Medicare coverage is unclear, prompting a careful review of medical records for proper payment. Handling an insurance audit is crucial for protecting businesses from risks and maintaining adequate coverage.

Medicare Coverage Challenges

Medicare Coverage Challenges are often a significant factor in complex health insurance audits. Due to the complexities and intricacies of Medicare coverage policies, health insurance providers usually face challenges in determining whether a particular service is covered. This can lead to confusion and uncertainty, requiring auditors to review medical records and other documentation to make a payment decision.

Medical Records Review

Medical record review plays a crucial role in complex health insurance audits. Auditors meticulously examine medical records to ensure that the services billed align with the documented patient care. They assess the coding accuracy, investigate any potential instances of upcoding or undercoding, and verify that the medical necessity criteria are met for each service provided. By conducting a comprehensive medical records review, auditors strive to identify fraudulent or improper activities and potential instances of waste or abuse within the healthcare system. Healthcare providers must maintain accurate and up-to-date medical records to navigate these complex audits successfully. This includes capturing detailed and precise documentation of patient encounters, diagnosis codes, treatment plans, and any supporting documentation. A well-organized and comprehensive medical record acts as a defense mechanism during an audit, providing evidence of the services offered and their medical necessity. Complex health insurance audits can be challenging due to the ambiguity surrounding Medicare coverage and the detailed analysis required during medical record reviews. Healthcare providers should strive to maintain accurate and comprehensive medical records to minimize the risk of audit errors and ensure compliance with healthcare regulations. By doing so, they can protect their practice and patients while providing quality healthcare services.

Preparing For An Audit

Preparing for a health insurance audit is essential to ensure a smooth and successful process. Organizing and reviewing your documentation beforehand can alleviate potential stress and mitigate the risk of discrepancies. Understanding the required documentation and implementing practical tips and strategies can make the audit handling process more manageable.

Documentation Required

Specific documentation is indispensable to facilitate a health insurance audit. This may include but is not limited to:

- Claims records

- Policy details

- Medical records

- Authorization forms

- Billing and coding information

Ensuring the accuracy and completeness of these documents is imperative for a successful audit process.

Tips For Successful Audit Handling

When preparing for a health insurance audit, adhering to the following tips can significantly enhance the handling and outcome of the audit:

- Organize and categorize your documentation systematically.

- Thoroughly review and validate all the provided information to minimize discrepancies.

- Stay informed about the audit procedures and timelines to ensure timely responses.

- Seek professional guidance from experts in health insurance audits to navigate the process effectively.

By implementing these strategies, you can streamline the audit process and demonstrate compliance with the insurance regulations.

Industry Insights

Health insurance audits play a crucial role in ensuring the integrity and efficiency of the healthcare system. They are essential to identifying and preventing industry fraud, abuse, and wastage, ultimately safeguarding patient care and financial resources.

Payor Trends In Audits

- Insurance audits are often triggered by coding issues in claims processing.

- Common problems like upcoding and undercoding can lead to scrutiny by auditors.

- Understanding and complying with coding regulations is essential to avoid audit triggers.

Expert Recommendations

- Ensure accurate and detailed documentation in medical records to support billing claims.

- Regularly assess and update coding practices to avoid errors that may lead to audits.

- Collaborate with coding experts and compliance officers to maintain audit readiness.

Regulatory Compliance

Regulatory Compliance:

Aicpa Guidelines

AICPA guidelines ensure that health insurance audits are conducted according to the highest industry standards and ethical practices.

Cciio Examinations And Reviews

CCIIO examinations and reviews scrutinize health insurance processes to ensure compliance with regulatory requirements and safeguard consumer rights.

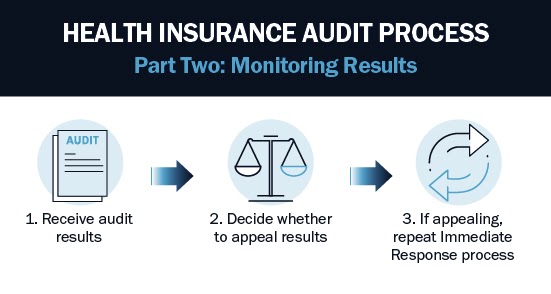

Credit: www.kerr-russell.com

Frequently Asked Questions

What Is An Audit For Health Insurance?

A health insurance audit reviews treatments to identify healthcare service fraud, abuse, and waste.

What Happens When An Insurance Company Audits You?

During an insurance audit, your premium may change, and you may owe more or receive a refund. Be prepared for adjustments to ensure proper coverage and compliance with regulations.

What Triggers An Audit In Healthcare?

Complaints, potential HIPAA violations, or data breaches can trigger healthcare audits. It is essential to address and document these incidents promptly. Coding issues in claims processing, such as upcoding and undercoding, can trigger audits. Additionally, payors may request itemized bills and medical records before payment, causing claims to be held up.

What Happens If I Don’t Do An Insurance Audit?

Avoiding an insurance audit can lead to increased premiums or policy cancellation. It’s crucial to comply to maintain coverage.

Conclusion

Health insurance audits are crucial for identifying fraud and abuse in the healthcare industry. They ensure proper business protection and prompt completion, which can prevent premium increases or policy cancellations. Understanding the triggers and processes of these audits is essential for healthcare providers and patients.