How Do Health Insurance Subsidies Work: Insightful Guide

How Do Health Insurance Subsidies Work? These subsidies are tax credits applied directly to premiums, reducing the cost of coverage for eligible individuals.

Understanding the intricacies of health insurance can be daunting, especially when exploring the financial assistance options available. Subsidies are a critical component designed to make healthcare more affordable for those with lower to middle-income levels. Offered through the Marketplace, these subsidies help bridge the gap between rising healthcare costs and what families can reasonably afford.

Eligibility for these savings depends on Income, household size, and insurance purchase through the Health Insurance Marketplace. With the correct subsidy, many find they can obtain quality health insurance without breaking the bank. Subsidies ease the financial strain of health coverage and ensure more people have access to the healthcare services they need.

What Are Health Insurance Subsidies?

Understanding health insurance subsidies can help lower costs and improve healthcare affordability. Let’s unwrap the concept and purpose of health insurance subsidies.

Definition

Health insurance subsidies are a form of financial aid that makes healthcare more accessible. The government provides these subsidies, which help pay for health insurance premiums. Subsidies are available through health insurance marketplaces. Qualifying depends on Income and family size.

The purposive goal of health insurance subsidies is clear: to reduce healthcare costs for individuals and families, to make insurance affordable for more people, and to help prevent the choice between health and other essentials.

Credit: www.povertyactionlab.org

Who Qualifies For Health Insurance Subsidies?

Health insurance subsidies make coverage more affordable. They help lower costs for those who qualify. Eligibility depends on Income and other factors.

InIncomeequirements

To qualify for subsidies, a person must meet specific income criteria. Below are the main points:

- Household Income: Must fall between 100% and 400% of the Federal Poverty Level (FPL).

- No subsidies above 400% FPL.

- Sliding scale approach: The closer to 100% FPL, the more substantial the subsidy.

Citizenship And Immigration Status

Status in the U.S. affects eligibility.

| Status | Eligibility |

|---|---|

| U.S. Citizens | Eligible |

| Lawful Residents | Eligible |

| Undocumented Immigrants | Not Eligible |

Certain immigration statuses also may qualify. These include refugees and asylees.

Types Of Health Insurance Subsidies

Navigating the world of health insurance can sometimes feel daunting. Subsidies are key to making health insurance more affordable. Understanding the different types of subsidies available is crucial. These financial aids can significantly lower the cost of health care for qualified individuals.

Premium Subsidies

Premium Subsidies come as a relief to many. They reduce monthly payments for health coverage, known as premiums. The amount varies and is based on Income and household size. Here is how they calculated using a sliding scale.

- Available to individuals and families with incomes between 100% and 400% of the federal poverty line.

- Applied directly to monthly premium costs.

Eligible enrollees will feel immediate financial easing. This subsidy is advanceable, so you won’t have to wait until tax time to benefit.

Cost-sharing Reductions

Separate from premium assistance are Cost-Sharing Reductions, which lower out-of-pocket expenses, including deductibles, copayments, and coinsurance.

- Designed for Silver plans on the Health Insurance Marketplace.

- Income must fall between 100% and 250% of the federal poverty line.

Reducing the amount you pay when receiving medical care ensures better access to health services. They bring peace of mind to those worried about high healthcare costs.

How Do Premium Subsidies Work?

They understand how premium subsidies work and can unlock affordable health insurance. Premium subsidies, a form of financial assistance, help individuals and families pay for their health insurance. Let’s unravel the specifics, from who’s eligible to how these subsidies directly reduce insurance costs.

Eligibility Criteria

Not everyone qualifies for a premium subsidy. Eligibility depends on three main factors:

- The income level must fall between 100% and 400% of the federal poverty level.

- Access to other coverage—If affordable coverage is available through work or a government program, you may not qualify.

- Filing status—You must file taxes, and certain filing statuses, like ‘Married Filing Separately, ‘ may affect eligibility.

Calculating The Subsidy Amount

The subsidy amount hinges on your Income and the insurance cost in your area. Let’Incomek down the steps:

- Find your household income as a percentage of the federal poverty level.

- Use the Health Insurance Marketplace to identify the silver plan with the second-lowest cost.

- Calculate your expected Contribution, which increases as your Income does.

- The difference between the plan and Income Your Contribution is your subsidy amount.

This table summarizes the expected contributions:

| Income (% of Federal Poverty Level) | Expected Contribution (% of Income) |

|---|---|

| 100% – 133% | 2% – 3% |

| 133% – 150% | 3% – 4% |

| Income 200% | 4% – 6.3% |

| 200% – 250% | 6.3% – 8.05% |

| 250% – 300% | 8.05% – 9.5% |

| 300% – 400% | 9.5% |

Note: premium subsidies are available only through the Marketplace. They are not accessible for plans purchased outside of it.

Understanding Cost-sharing Reductions

Health insurance subsidies make coverage more affordable. Among these ways, Cost-Sharing Reductions (CSRs) stand out. CSRs lower the amount you pay for health care services. Let’s explore CSRs and how you can qualify for them.

What Are Cost-sharing Reductions?

Cost-sharing reductions are discounts that lower the amount you pay for deductibles, copayments, and coinsurance. These are special savings only available with Silver health insurance plans.

- Lower Deductibles: Less you pay before insurance kicks in.

- Reduced Copayments: Pay less for doctor visits.

- Smaller Coinsurance: Pay a lower percentage for services.

Qualifying For Cost-sharing Reductions

To qualify for CSRs, you must enroll in a Silver plan through the Health Insurance Marketplace. Your Income must fall between 100% and 250% of the poverty level.

| Income as % of Federal Poverty Level | CSR Eligibility |

|---|---|

| 100% – 150% | Eligible |

| 150% – 200% | Eligible |

| 200% – 250% | Eligible |

When you apply for Marketplace coverage, you’ll find out if you qualify for CSRs. No extra applications are needed—they are all done through the Marketplace.

Applying For Health Insurance Subsidies

Understanding how to apply for health insurance subsidies can save you money. These subsidies help make health insurance more affordable. Let’s look at the steps to use and what documents you’ll need.

Marketplace Enrollment

The first step is to enroll in a plan through the Health Insurance Marketplace. You must apply during an open enrollment period or qualify for a Special Enrollment Period. Follow these steps:

- Create an account on HealthCare.gov or your state’s Marketplace website.

- Fill out the application with your personal and financial information.

- Review your eligibility results for subsidies or other savings.

- Choose a health plan that fits your needs and budget.

- Enroll in the plan and see your savings applied.

Required Documents

Gather these documents before you start:

| Type of Document | Description |

|---|---|

| Proof of Income | Tax returns, W-2s, or pay stubs show your earnings. |

| Citizenship or Residency | A passport, birth certificate, or green card confirms your status. |

| Social Security Numbers | Needed for all family members applying for coverage. |

| Policy Numbers | For any current health plans, include the policy number. |

Keep these documents handy. They prove you qualify for health insurance subsidies. The Marketplace will tell you what to submit and how to upload or mail them.

Common Misconceptions About Health Insurance Subsidies

Health insurance subsidies aim to help lower costs. Some ideas create confusion, so let’s dispel these misconceptions and understand how subsidies work.

Subsidy Repayment

Many believe you never pay back subsidies. Truth differs. You might repay some or all subsidy amounts during tax time if your income increases. Stay informed about income changes to avoid surprises.

Comparing Subsidies To Medicaid

Subsidies and Medicaid are often confused. Unlike Medicaid, a state-run program with specific eligibility, subsidies help pay for private insurance and are based on a sliding income scale.

The following points will clarify these two key areas:

- Subsidy Repayment: Adjust with income changes.

- Medicaid Comparisons: Understand distinct rules.\

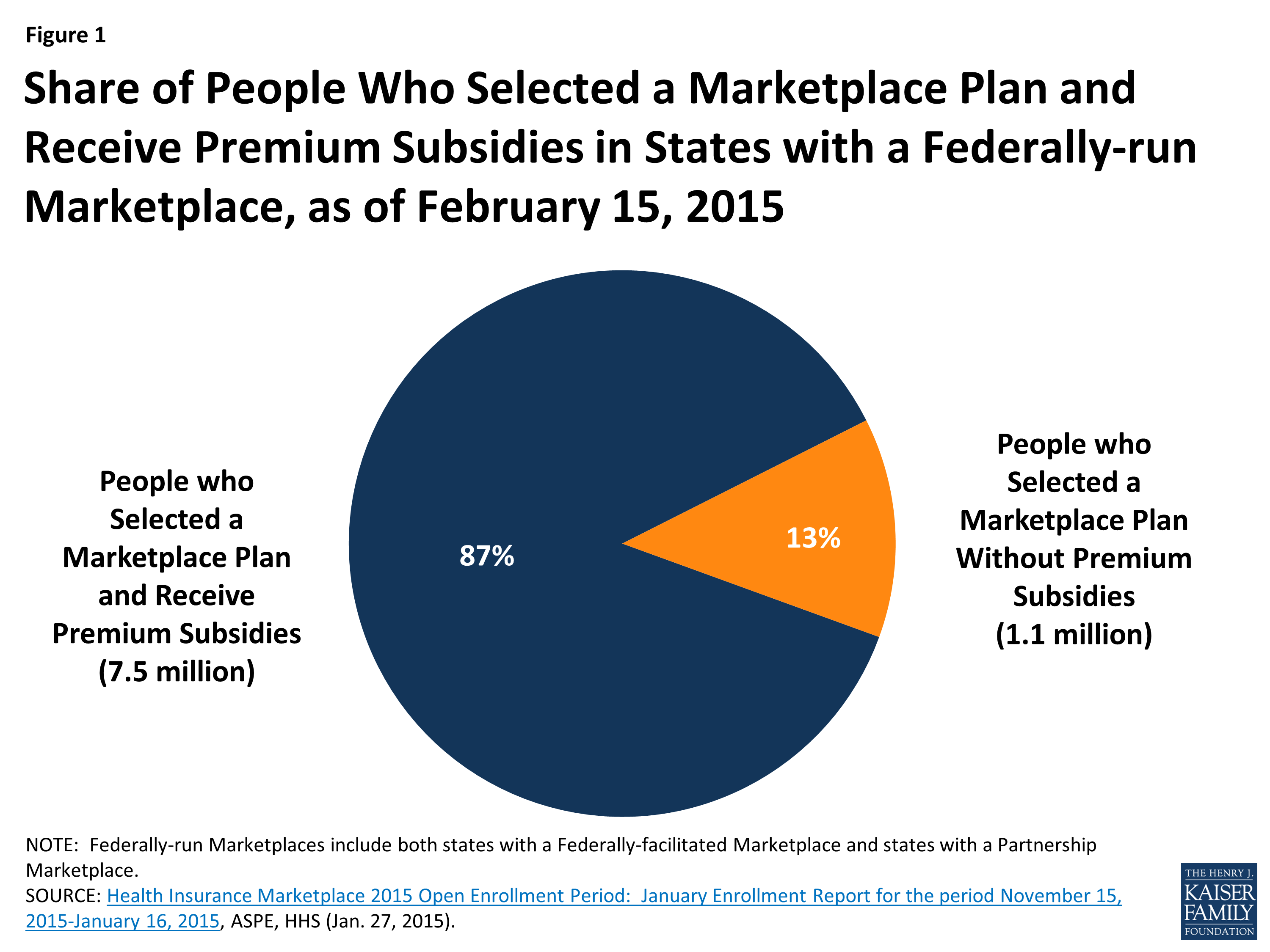

Credit: www.kff.org

Benefits And Limitations Of Health Insurance Subsidies

Health insurance subsidies can make health care affordable for many. They offer financial help to lower costs. Yet, understanding their benefits and limitations is crucial.

Improved Affordability

Access to health care becomes more accessible with subsidies. Families and individuals can pay less for their monthly premiums. This leads to significant cost savings. It opens the door to quality health care for those who may struggle to afford full-priced insurance plans. Subsidies are like a discount on insurance costs and are often available to those with lower to middle incomes.

- Monthly premiums reduced

- Healthcare services become more accessible

- Financial security in the face of medical needs

Potential Coverage Gaps

Subsidies don’t always cover all expenses. Some may find that the plans with subsidies don’t fully match their health needs. There might be high out-of-pocket costs or deductibles. Choosing a plan carefully ensures it covers necessary services and medications.

- Some services or medications may not be covered

- Out-of-pocket costs can remain high

- Eligibility requirements may exclude some individuals

Credit: www.povertyactionlab.org

Frequently Asked Questions For How Do Health Insurance Subsidies Work

What Is A Subsidy Health Insurance?

A subsidy health insurance plan is a health policy where the government provides financial assistance to lower the cost of premiums for eligible individuals.

Do Subsidies Have To Be Paid Back?

Subsidies generally do not require repayment as they are aid or financial support the government provides to businesses or individuals.

Do I Have To Pay Back Obamacare Subsidies?

Yes, you may have to repay Obamacare subsidies if your income increases, exceeding eligibility levels during a tax year. Report income changes to avoid potential repayment.

What Income Is Used To Calculate Healthcare Subsidies?

Healthcare subsidy calculations use your expected annual Modified Adjusted Gross Income (MAGI), which includes wages, salary, foreign Income, interest, dividends, and Social Security income.

Navigating the maze of health insurance subsidies can be daunting. Yet, it’s clear that these financial aids are vital for making healthcare more accessible. Remember, your eligibility hinges on Income and the cost of plans in your area. StayiIncomeormed and seeking guidance can ensure you secure the assistance needed for your healthcare coverage.