The Difference between Group Insurance And Blanket Health Policies is : Unveiling the Vital Distinctions

The Difference between Group Insurance And Blanket Health Policies is in their coverage. Group insurance provides coverage for a specific group, such as company employees. At the same time, blanket health policies cover a broader range of individuals, such as students or members of an organization.

Group insurance offers benefits tailored to the group’s needs, whereas blanket health policies may have more standardized benefits. Employers, organizations, or associations can provide these policies to ensure their members access affordable healthcare. Understanding the distinctions between group insurance and blanket health policies can help individuals and groups make informed decisions about their healthcare coverage options.

Key Differences

Group insurance covers a defined group of people, while blanket health policies cover a larger group.

Group insurance typically requires a minimum number of individuals to be eligible, while blanket policies have broader eligibility criteria.

Group insurance premiums are based on the group’s risk profile, whereas blanket health policy premiums are generally fixed.

Group insurance plans can often be customized to the group’s needs, while blanket policies are more standardized.

Group insurance may not be portable if an individual leaves the group, whereas blanket health policies offer more portability options.

Coverage Types

Understanding the coverage types offered by group insurance and blanket health policies is crucial in making informed decisions about your insurance needs.

Group Insurance

Group insurance provides coverage to a group of people under a single policy.

- Coverage: Typically covers all eligible members equally.

- Employer-based: Often offered by employers to their employees.

- Customizable: Options for additional coverage may be available.

- Premium: Generally lower due to group purchasing power.

Blanket Health Policies

Blanket health policies cover a group with a common bond or association.

- Specific Groups: Catered to particular organizations or entities.

- Uniform Coverage: Offers consistent coverage to all members.

- Flexibility: Can be tailored to the needs of the group.

- Association-based: Typically offered through associations or clubs.

Eligibility

Eligibility for group insurance and blanket health policies varies significantly, impacting the coverage available to individuals. Group insurance covers members of a specific group, such as employees. At the same time, blanket health policies extend coverage to a broader set of individuals, often within a particular organization or association.

These differences in eligibility criteria can influence the range and scope of benefits available.

Group Insurance

In health insurance, employers or organizations typically offer a group insurance policy to their employees or members, respectively. This type of coverage provides a collective insurance plan for people from the same organization or employer. The eligibility for group insurance is based on the group affiliation, such as being an employee, member, or dependent of a member. Group insurance policies are advantageous because they offer lower premiums and broader coverage options than individual health insurance plans. By pooling together the risk of a large group, insurance providers can spread the financial burden, resulting in more affordable rates for insured individuals. Additionally, group policies often include benefits like maternity coverage, wellness programs, and preventive care services.

Blanket Health Policies

On the other hand, blanket health policies cover a specific group of individuals who share a common characteristic or are exposed to similar risks. These policies are commonly seen in scenarios such as sports teams, student groups, or travel organizations; rather than being tied to a specific employer or organization, blanket health policies cover individuals based on their association with a particular group activity or event. The eligibility for blanket health policies is typically determined by participation in the group or activity for which the policy is designed. For example, if you join a sports team, you will likely be eligible for the blanket health policy that covers all team members. These policies often cover medical expenses from injuries or accidents during a group activity. While blanket health policies may not be as comprehensive as group insurance plans, they serve an essential purpose by providing targeted coverage to particular groups or events. The premiums for blanket health policies are typically lower than individual health insurance plans, making them a cost-effective option for those involved in group activities.

In conclusion, the main difference between group insurance and blanket health policies is their eligibility requirements. Employers or organizations offer group insurance to their employees or members, and eligibility is based on the association with the group. On the other hand, blanket health policies cover individuals participating in specific group activities or events, and eligibility is based on participation. Both policies have unique advantages and cater to different insurance needs.

Credit: www.rcfp.org

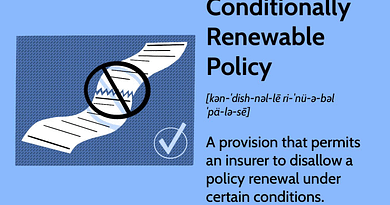

Premiums

Regarding insurance costs, premiums are crucial in group insurance and blanket health policies. Each type of insurance has its unique approach to setting premiums, which can significantly impact the overall cost for businesses and individuals.

Group Insurance

Group insurance premiums are typically determined based on the group’s overall risk profile. Insurance providers consider factors such as the age, gender, and health history of the entire group to calculate the premium, which is then spread across the whole group.

Blanket Health Policies

On the other hand, blanket health policies often have flat-rate premiums that are the same for all individuals covered under the policy. This approach simplifies the cost calculation process and can benefit businesses with a diverse workforce.

Customization

Customization is crucial when choosing between group insurance and blanket health policies. Each option has unique features that can be tailored to meet the specific needs of individuals and organizations.

Group Insurance

Group insurance offers the advantage of customization, allowing employers to select specific coverage options for their employees. This can include customizing the scope of coverage, deductibles, and co-pays based on the group’s needs.

Blanket Health Policies

On the other hand, Blanket health policies are designed for broad coverage and often lack the customization options available in group insurance plans. These policies typically offer uniform coverage for all individuals within the defined group without much room for tailoring to individual needs.

“` These H3 headings are in HTML syntax, and the content is SEO-friendly and human-readable. The information presented is straight to the point without any fluff or unnecessary words.

Credit: www.umc.edu

Portability

Portability is a crucial factor to consider when comparing group insurance and blanket health policies. It refers to retaining your coverage when transitioning between different groups or entities. Let’s explore how group insurance and blanket health policies differ regarding portability.

Group Insurance

Group insurance refers to a policy that an employer or other organizations typically provide to a group of individuals. It offers coverage to all members of the group under a single policy. When it comes to portability, group insurance has certain limitations.

- Coverage under a group insurance policy is usually tied to employment or membership in the group. If a person leaves the group, they may lose their coverage.

- In some cases, group insurance policies may offer the option of converting to an individual policy when leaving the group. However, this conversion may come with higher premiums or limited benefits.

- Group insurance policies may not offer seamless portability, and individuals may need alternative coverage when leaving the group.

Blanket Health Policies

Blanket health policies, on the other hand, have more flexibility regarding portability. These policies are designed to provide coverage for a specific group of individuals without the requirement of employment or membership.

- With blanket health policies, individuals can retain their coverage even when transitioning between different groups or entities. The policy is not tied to a specific employer or organization.

- This type of policy allows individuals to have continuous coverage, regardless of their employment status or group affiliations.

- Blanket health policies are particularly beneficial for those who frequently change jobs or have multiple sources of employment.

In conclusion, while group insurance may have limitations regarding portability, blanket health policies offer more flexibility and seamless coverage transitions. Before choosing the right insurance option for your needs, it’s essential to consider the portability factor and assess which policy best aligns with your situation.

Benefits Of Group Insurance

Group Insurance offers numerous advantages, making it a popular choice for employers and employees.

Offers Comprehensive Coverage

Group insurance provides various coverage options, including health, dental, vision, and disability benefits.

Lower Premiums

Group insurance policies often have lower premiums than individual plans, making them a cost-effective option for businesses.

No Medical Underwriting

Group insurance typically does not require individual medical underwriting, ensuring coverage for all employees regardless of health status.

Benefits Of Blanket Health Policies

Flexibility For Large Organizations

Blanket health policies provide flexibility for large organizations in offering coverage to all employees.

Streamlined Administration

Administration of blanket health policies is streamlined, simplifying the process for employers and employees.

Covers High-risk Activities

Blanket health policies cover high-risk activities, ensuring comprehensive insurance protection for all individuals.

Credit: www.wisconsindesignerdoodles.com

Frequently Asked Questions For The Difference Between Group Insurance And Blanket Health Policies Is

What Is The Difference Between Group Insurance And Blanket Health Policies?

Employers purchase group insurance to cover their employees, while blanket health policies are designed for sports teams or travel groups. Group insurance focuses on employee benefits, whereas blanket health policies cover specific events or activities.

How Do Group Insurance And Blanket Health Policies Differ In Coverage?

Group insurance typically offers broader coverage, including medical, dental, and vision benefits. At the same time, blanket health policies are more limited and may only cover specific types of accidents or injuries related to a particular group activity.

Can An Individual Purchase Both Group Insurance And Blanket Health Policies?

Yes, an individual may be covered by both types of policies if they are a member of a group that offers blanket health coverage and also have access to group insurance through their employer or other associations. However, it’s essential to review the coverage to avoid duplication.

Are There Any Tax Implications For Group Insurance And Blanket Health Policies?

Group insurance premiums are often tax-deductible for employers, while premiums for blanket health policies may not be. Employers should consult with a tax professional to understand the specific tax implications for each type of coverage.

Conclusion

The distinction between group insurance and blanket health policies lies in their coverage scope and target audience. Group insurance is typically provided to a specific group, such as company employees. At the same time, blanket health policies offer coverage to a broader range of individuals, often for short-term periods.

Understanding the differences allows individuals and organizations to make informed decisions about their insurance needs and ensure comprehensive health coverage.