How to Get a Life And Health Insurance License: A Step-by-Step Guide

How to Get a Life And Health Insurance License? Complete a preprelicensingurse and pass the state exam. Obtaining a life and health insurance license in Austin, Texas, involves fulfilling the education hour requirements, taking the state exam, and submitting a license application.

Studying materials, signing up for the test, getting fingerprinted, and applying for the license while also considering the associated costs and time frames for processing the application is essential. The Texas insurance exam covers a comprehensive range of topics, and successful candidates can pursue a career as a licensed insurance agent.

Completing the required insurance continuing education (CE) credits is crucial for maintaining the license. By following the necessary steps, individuals can obtain a life and health insurance license in Texas and embark on a rewarding career in the insurance industry.

Credit: www.kaplanfinancial.com

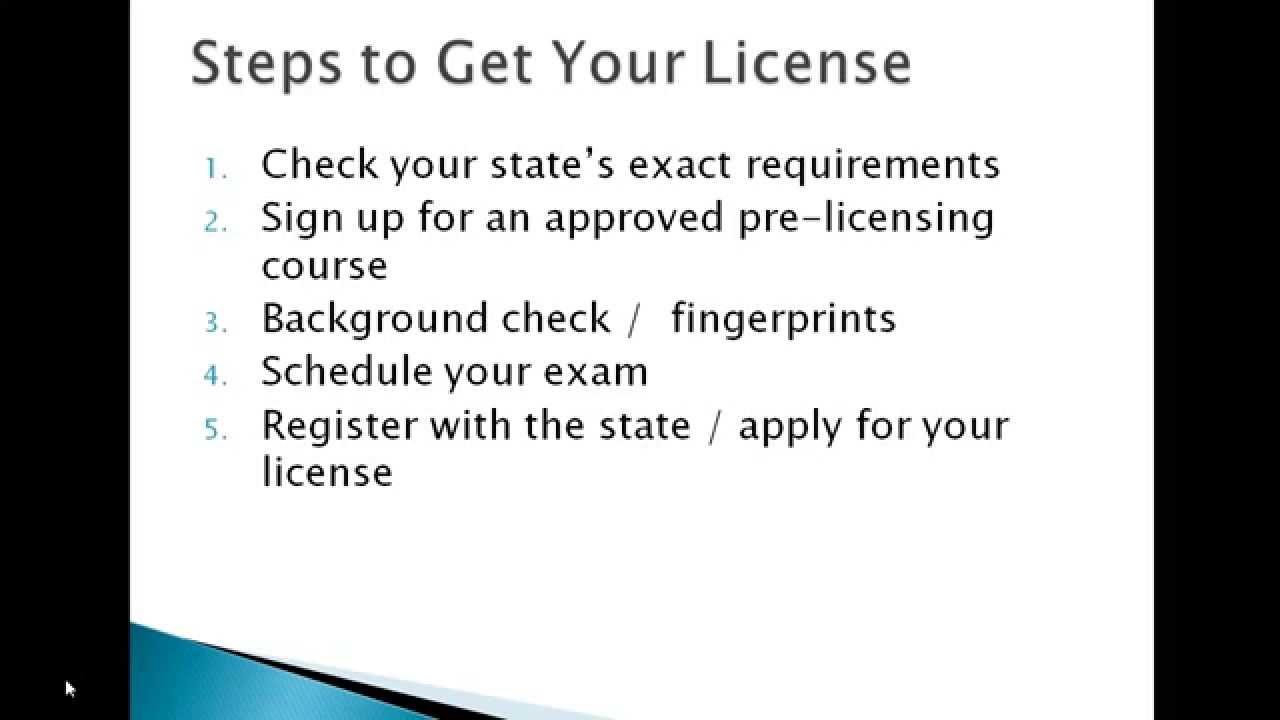

Steps To Get Licensed

Studying diligently is critical to passing the challenging state exam.

Enrolling in a preprelicensingurse offers comprehensive preparation.

Choose a convenient exam date to maximize your chances of success.

Utilize high-quality study resources to enhance your exam readiness.

Complete the application form accurately to initiate the licensing process.

Understanding The Exam

Understanding the Exam is crucial to preparing for your life and health insurance license. The Exam is designed to evaluate your understanding of the critical topics related to insurance and your ability to apply this knowledge in real-world scenarios. It is essential to have a clear grasp of the exam breakdown, key topics covered, and the challenges test-takers face to approach your preparation strategically.

Exam Breakdown

The Exam will typically consist of multiple-choice questions that assess various aspects of life and health insurance. Understanding the exam breakdown can help you allocate your preparation time effectively. It usually covers underwriting and delivering the life policy, types of life and health policies, state regulations, provisions, rules pertinent to an HMO, and field underwriting.

Key Topics Covered

Being familiar with the key topics covered in the Exam is essential for thorough preparation. The Exam will explore insurance underwriting, policy types, state regulations, and specific provisions. Mastery of these topics is critical for obtaining your life and health insurance license.

Challenges Faced By Test-takers

Many test-takers encounter challenges when preparing for the life and health insurance exam. The comprehensive nature of the Exam, coupled with the wide range of topics covered, can be daunting. It is vital to be aware of these challenges and devise effective strategies to overcome them during preparation.

Cost And Time

Obtaining a life and health insurance license requires both time and money. Understanding the cost and processing time for the license application is essential to plan effectively for this career path.

Cost Of Getting Licensed

The cost of getting a life and health insurance license in Texas is $50. This fee covers the application processing and the issuance of the permit once it is approved. However, this cost may vary depending on your state, so it is advisable to check with your local licensing authority for accurate information.

Processing Time For License Application

Once you have submitted your license application, processing typically takes one to five business days. The Texas Department of Insurance’s Agent & Adjuster Licensing Office will review your application during this period. You will receive an email notification once your application has been reviewed and approved.

It is important to remember that the processing time may vary depending on factors such as the volume of applications received and the accuracy of the information provided in your application. Therefore, it is essential to ensure that you fill out the application form correctly and provide all the necessary documentation to expedite the processing time.

Once your license application is approved, you can begin your career as a licensed life and health insurance agent. This license allows you to sell various insurance policies and help individuals and families protect their financial well-being.

Overall, the cost and time involved in getting a life and health insurance license are relatively affordable and efficient. While an initial investment is required, the potential earnings as a licensed insurance agent in Texas can be lucrative. So, with the proper preparation and dedication, you can embark on a fulfilling and rewarding career in the insurance industry.

Credit: www.youtube.com

Career Insights

Embark on an exciting journey in the insurance industry by obtaining your life and health insurance license. This rewarding career path offers various opportunities for growth and success.

Salary Expectations

- Entry-level agents in Texas can expect to earn around $45,000 annually.

- Experienced agents have the potential to earn six-figure incomes.

- Commissions and bonuses can significantly boost earning potential.

Opportunities For Licensed Agents

As a licensed agent, you can explore diverse career options:

- Sell life and health insurance policies to individuals and businesses.

- Work for insurance agencies, brokerage firms, or as independent agents.

- Specialize in niche markets such as health or life insurance.

Licensing Requirements In Texas

Before you can start a career as a life and health insurance agent in Texas, you need to meet certain licensing requirements. Understanding the specific criteria for getting licensed in Texas is essential to kickstarting your career in the insurance industry. Here are the critical licensing requirements you need to be aware of:

PrePrelicensingucation Hours

The Texas Department of Insurance states that candidates must complete several preprelicensingucation hours. Lifelifelth insurance includes at least 40 hours of preparation and insinuation to attain the license.

Fingerprinting Process

Candidates must undergo a fingerprinting process for a thorough background check as part of the licensing process. This is crucial in ensuring the trust and reliability of individuals seeking a license to sell life and health insurance in Texas.

Ce Credits For License Renewal

Once licensed, insurance agents in Texas must fulfill continuing education (CE) requirements for their license renewal. This typically involves completing a certain number of CE credits within a specific timeframe to keep the license active and stay updated with the latest industry developments.

Credit: staterequirement.com

Resources For Licensing

Find comprehensive resources on how to get a life and health insurance license in Texas. Learn about preprelicensingurses, exam preparation, costs, processing time, and more to help you successfully obtain your insurance license.

State Requirements Overview

Before pursuing a life and health insurance license, it is essential to understand the state requirements. Each state may have specific criteria and procedures for obtaining the permit.

Guidance From Texas Department Of Insurance

For individuals seeking a life and health insurance license in Texas, following the Texas Department of Insurance (TDI) guidelines is crucial. TDI offers valuable resources and information regarding the licensing process.

Frequently Asked Questions

How Much Does It Cost To Get My Insurance License In Texas?

It costs $50 to get your insurance license in Texas.

How Long Does It Take How to Get a Life And Health Insurance License In Texas?

It generally takes one to five business days to process a life insurance license application in Texas.

How Hard Is The Texas Life Insurance Exam?

The Texas life insurance exam is comprehensive and requires preparation due to its challenging nature.

How Much Does A Licensed Insurance Agent Make In Texas?

A licensed insurance agent in Texas can earn an average salary of $75,000 per year.

Conclusion

Obtaining a life and health insurance license in Texas requires dedication and thorough preparation. Following the outlined steps, individuals can embark on a rewarding career in the insurance industry, including completing the preprelicensingurse, passing the state exam, and applying for the license.

With a proper understanding of the process and commitment to continuous learning, success as a licensed insurance agent is within reach.