Health Insurance Certificate : Your Guide to Securing Coverage

Health Insurance Certificate is a document that provides evidence of your insurance coverage. It typically includes details about the insurance policy, such as the insurance company’s name, identification number, policy type, and coverage limits.

Health insurance certificates are essential for proving your coverage in various situations, such as when obtaining medical services or meeting specific contractual requirements. When an individual or business entity requests a certificate, they should ensure that the details match the insurance coverage accurately.

This document acknowledges the contractual relationship between the insured individual or entity and the insurance provider. Understanding the specifics of a health insurance certificate is crucial for navigating the complexities of the healthcare system and ensuring appropriate coverage for medical expenses.

Credit: www.linkedin.com

Understanding Certificates

A health insurance certificate is a printed description of the benefits and coverage provisions forming the contract between the carrier and the customer. The client must ensure the insured’s name matches precisely with the company or contractor under consideration.

When you request proof of health insurance coverage, you ask for a certificate that shows your Medicaid coverage.

What Is A Certificate Of Insurance (COI)?

A Certificate of Insurance (COI) is a document that serves as proof of insurance coverage.

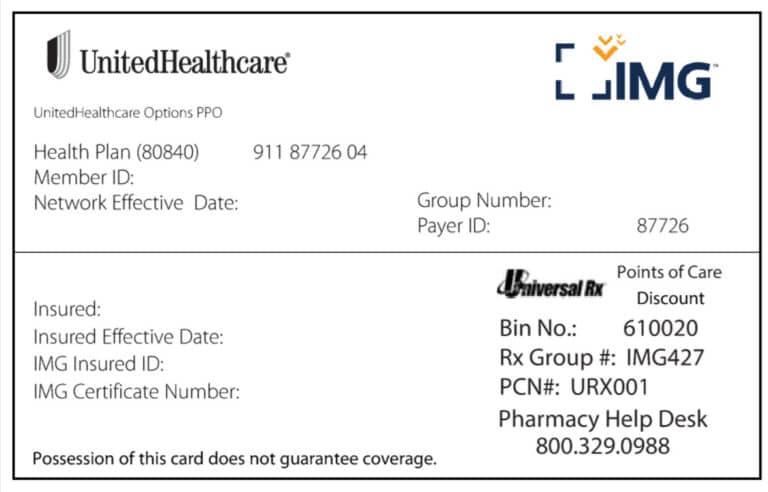

Sample Certificate Of Insurance

A sample certificate of insurance typically includes the name of the insurance company, policy identification number, type of policy, and coverage limits.

Proof Of Health Insurance Letter

Proof of health insurance letter verifies an individual’s health insurance coverage.

Acquiring Coverage

Acquiring coverage is essential in securing health insurance to protect your well-being and financial stability. Understanding the process of developing a Health Insurance Certificate is crucial, as it ensures you have the necessary documentation to address your healthcare needs.

How To Request A Certificate Of Insurance?

Liaising directly with the insurance company to initiate the process is pivotal when seeking a Certificate of Insurance. The client should ensure the insured name on the certificate matches the individual or organization requiring coverage. Typically, clients should request the insurance company rather than the business owner or contractor to expedite the process.

Securing A US Certificate Of Coverage

If an individual is in a situation where a Social Security agreement designates coverage to the United States, the Social Security Administration will issue a U.S. Certificate of Coverage. This certificate is evidence of exemption from paying Social Security taxes to a foreign country, assuring coverage and compliance.

Obtaining Proof Of Health Insurance

Proof of health insurance is a vital document, especially when it comes to tax or Medicaid requirements. It can be attained through requesting a certificate of insurance coverage, which serves as an official statement of the benefits and coverage provided in the insurance policy, ensuring compliance and peace of mind.

Benefits And Coverage

A Health Insurance Certificate is a document that outlines the benefits and coverage provided by the insurance policy. It serves as proof of the contract between the insurance carrier and the customer, detailing the services that will be covered.

Understanding The Certificate Of Insurance

When it comes to health insurance, it’s important to understand the details of your coverage. One key document that provides essential information about your policy is the Certificate of Insurance. This document serves as a printed description of the benefits and coverage provisions between you, the customer, and the insurance carrier. A Certificate of Insurance contains crucial details, including the insurance company’s name, the policy identification number, and the type of insurance policy included. It also outlines the limits of liability covered by the policy. Think of it as a summary of your health insurance plan in a concise and easy-to-understand format.

Certificate Of Coverage And Summary Of Benefits

In addition to the Certificate of Insurance, you may also come across the Certificate of Coverage and Summary of Benefits. These documents provide more specific information about the benefits and coverage you can expect from your health insurance plan. The Certificate of Coverage gives a comprehensive overview of your policy, including details about deductibles, copayments, and the services covered under your plan. It may also include information about pre-existing conditions, exclusions, and any limitations to coverage. On the other hand, the Summary of Benefits is a condensed version of the Certificate of Coverage. It highlights the key features of your health insurance plan, making it easier to understand and compare different options. The Summary of Benefits often includes essential information such as preventive care coverage, prescription drug benefits, and emergency services. Understanding these documents is necessary for making informed decisions about your healthcare. It lets you know what is covered and what you might be responsible for in out-of-pocket expenses. Being well-informed about your health insurance benefits and coverage can help you plan your healthcare needs effectively and avoid surprises. To summarize, the Certificate of Insurance, Certificate of Coverage, and Summary of Benefits are vital resources that provide essential information about your health insurance plan. Understanding these documents allows you to maximize your coverage and meet your healthcare needs.

Qualified Health Plans

A Qualified Health Plan (QHP) is a health insurance plan that meets specific Affordable Care Act (ACA) standards. These plans provide essential health benefits and meet other requirements to ensure adequate coverage for individuals and families.

What Is A Certificate Of Health Plan Coverage?

A Certificate of Health Plan Coverage is a document the insurance company provides outlining the details of the health insurance policy. It serves as proof of coverage and lists important information, such as the policyholder’s name, policy number, coverage limits, and effective dates.

Certificate Of Insurance Sample

A sample certificate of insurance should include the insurer’s name, policy identification number, type of coverage, and liability limits. This document verifies the existence of an insurance policy and provides information on the extent of coverage.

When requesting a certificate of insurance, it is essential to ensure that the documents’ details match the insured company or individual to avoid discrepancies.

A Certificate of Health Plan Coverage is a vital document that provides essential information about a health insurance policy, including coverage details and policy limits. Understanding the contents of this certificate is crucial for individuals to be aware of their healthcare benefits and rights.

Important Documents

Essential When it comes to your health insurance, it is necessary to understand and keep vital documents handy. Among these essential documents are:

Certificate Of Health Plan Coverage In Texas

A Certificate of Health Plan Coverage in Texas outlines the details of your health insurance policy tailored explicitly to Texas regulations.

Certificate Of Coverage (coc)

A Certificate of Coverage (CoC) provides a comprehensive overview of your health insurance plan’s benefits, terms, and conditions, ensuring you understand what is covered.

When obtaining an insurance certificate, it’s crucial to:

- Request the certificate directly from the insurance company.

- Ensure the insured name matches your information accurately.

A certificate of insurance sample typically includes the following:

- Name of the insurance company providing evidence of the policy.

- Identification number of the insurance policy.

- Type and limits of the insurance policy coverage.

A U.S. Certificate of Coverage is proof of exemption from foreign Social Security taxes for international cases.

Need proof of health insurance for taxes? Proof of health insurance letter verifies your coverage period.

The certificate of insurance acts as a contract description between the carrier and the customer, specifying benefits and coverage provisions.

Remember to keep your Certificate of Coverage and Summary of Benefits handy to stay informed about your health insurance details.

Credit: www.visitorguard.com

Credit: www.yumpu.com

Frequently Asked Questions

How To Get A Health Insurance Certificate?

Clients should request an insurance certificate directly from the insurance company. They should ensure that the insured name on the certificate matches the company or contractor they are considering. The certificate should include the insurance company’s name, policy identification number, type of insurance policy, and liability limits.

What Is A Sample Certificate Of Insurance?

A sample certificate of insurance includes the provider’s name, policy number, type of policy, and liability limits. It serves as proof of insurance coverage.

What Is A US Certificate Of Coverage?

A US Certificate of Coverage is issued by the Social Security Administration, exempting individuals and employers from foreign Social Security taxes.

What Is A Proof Of Health Insurance Letter?

A proof of health insurance letter verifies your coverage and benefits with your insurance provider.

Conclusion

Understanding the process of obtaining a health insurance certificate is crucial for clients and business owners. By ensuring that the certificate accurately reflects the insurance policy details, individuals can confidently navigate the complexities of the insurance landscape. Additionally, being well-informed about the significance of a certificate of insurance allows for better decision-making and risk management.