Health Insurance Trends: Key Insights

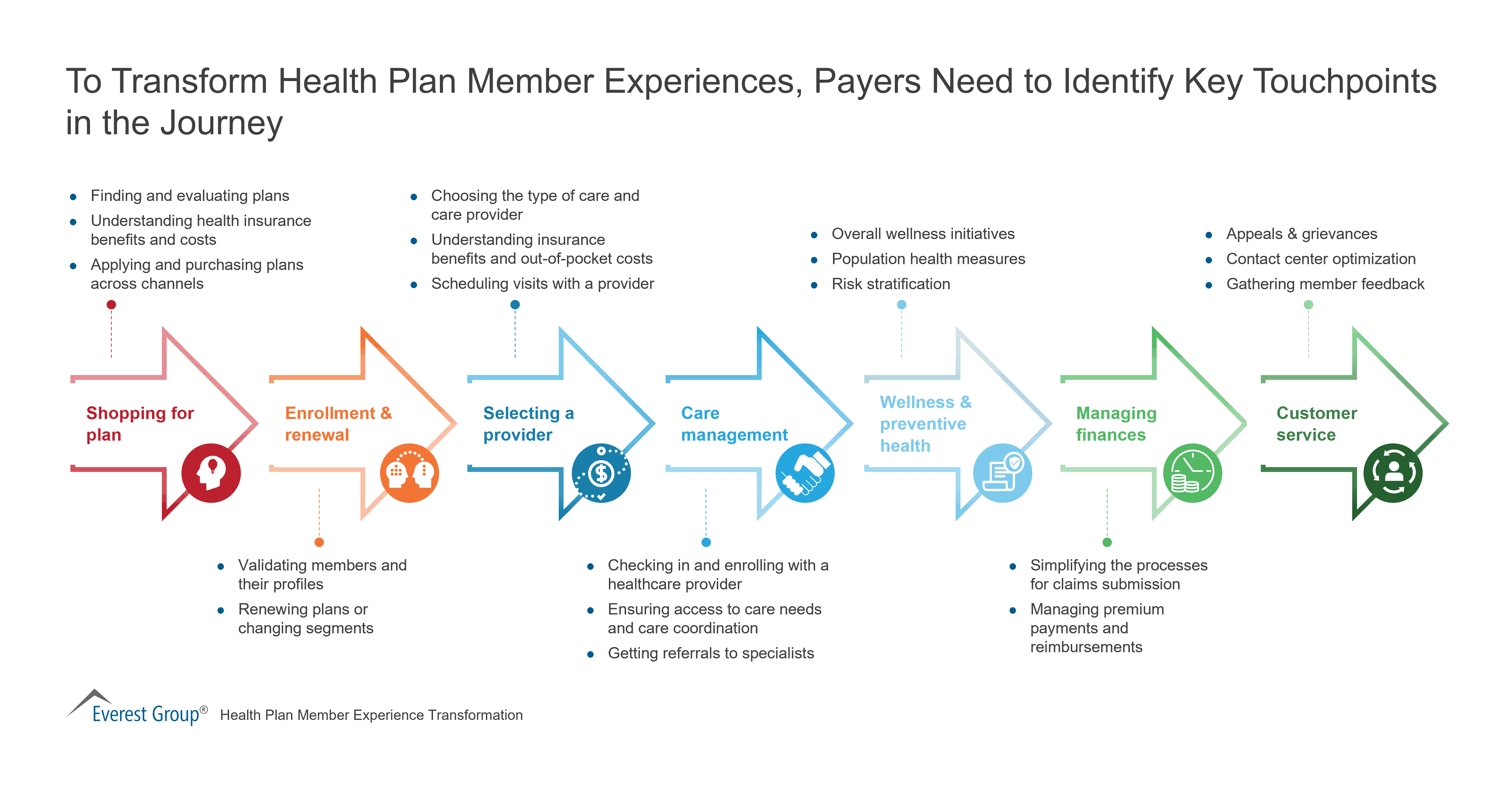

Health insurance trends indicate a stable future with rising healthcare costs and evolving employer-based coverage. Recent developments focus on leveraging ecosystem partnerships and adapting to changes in the market to ensure a competitive edge for health plans.

Analysis reports emphasize the importance of understanding medical trends and addressing cost escalation year by year. Companies are exploring innovative strategies, such as reinsurance and collaboration, to navigate the shifting landscape. With a focus on Medicare Advantage and patient-centric services, the industry is witnessing significant transformations to meet the evolving healthcare needs of individuals and businesses alike.

By staying informed and proactive, stakeholders can better navigate the complexities of the health insurance landscape and optimize their coverage options for the future.

Credit: www.everestgrp.com

The Evolution Of Health Insurance

Throughout history, health insurance has undergone significant changes and adaptations to meet the evolving needs of individuals and communities. Understanding the origins and critical milestones in health insurance history sheds light on how this vital industry has developed. Let’s take a closer look at the fascinating journey of the health insurance landscape.

Origins Of Health Insurance

Health insurance has its roots in ancient civilizations, where communities and guilds provided financial assistance to members during illness or injury. These early forms of health coverage were often based on mutual aid and social solidarity principles.

In more modern times, health insurance began to take shape in the late 19th century. In 1850, the Franklin Health Assurance Company of Massachusetts became the first to provide accident insurance coverage. This marked a significant turning point in the conceptualization of health-related financial protection.

Critical Milestones In Health Insurance History

Over the years, several key milestones have shaped the evolution of health insurance:

- The Birth of Blue Cross and Blue Shield: In 1929, the first Blue Cross plan was established to help individuals cover the cost of hospital services. This was later expanded to include physicians’ services, giving rise to our current Blue Cross and Blue Shield plans.

- Employer-Sponsored Health Insurance: The introduction of employer-sponsored health insurance gained momentum after World War II. The Revenue Act of 1942 provided tax incentives to employers offering health benefits to employees, leading to a significant increase in employer-based coverage.

- Medicare and Medicaid: In 1965, the federal government introduced Medicare and Medicaid, which provided health coverage for elderly and low-income individuals, respectively. These programs helped expand access to healthcare for vulnerable populations.

- Affordable Care Act (ACA): The passage of the ACA in 2010 brought about comprehensive healthcare reform in the United States. It introduced measures such as the individual mandate, health insurance exchanges, and expanding Medicaid to increase health insurance access and affordability for millions of Americans.

These milestones represent just a fraction of the countless developments and innovations that have shaped the health insurance industry. As the landscape continues to evolve, it is essential to stay informed about the trends and changes in health insurance to make informed decisions about coverage and healthcare options.

Current Trends In Health Insurance

Health insurance is an ever-evolving industry influenced by various economic, technological, and social factors. Staying up-to-date with current trends is crucial for individuals and businesses to make informed decisions regarding their healthcare coverage. This article will explore two significant trends shaping the health insurance landscape today: the rise of telemedicine services and the growing popularity of high-deductible health plans.

Rise Of Telemedicine Services

Telemedicine services have gained immense popularity in recent years, revolutionizing healthcare delivery. This trend has been further accelerated by the COVID-19 pandemic, where virtual consultations became the norm. Telemedicine allows individuals to consult with healthcare professionals remotely, eliminating the need for in-person visits. This saves time and money and improves access to medical care, especially for individuals in rural or underserved areas.

Telemedicine offers a wide range of benefits, including:

- Convenience: With telemedicine, individuals can receive medical advice and treatment from the comfort of their homes, eliminating the need to travel to a medical facility.

- Cost-effectiveness: Virtual consultations are often more affordable than in-person visits, as they eliminate travel expenses and other associated costs.

- Expanded access: Telemedicine allows individuals in remote areas or those with limited mobility to consult healthcare professionals without extensive travel.

- Efficient healthcare delivery: Virtual consultations reduce wait times and enable healthcare providers to attend to more patients in a shorter period.

Growing Popularity Of High-deductible Health Plans

High-deductible health plans (HDHPs) have become increasingly popular in recent years, often offered by employers as a cost-saving option. These plans require individuals to pay a higher deductible before insurance coverage. While the higher deductible may seem daunting, HDHPs often come with lower monthly premiums, making them an attractive choice for individuals looking to save on healthcare costs.

The key advantages of high-deductible health plans include:

- Lower premiums: Compared to traditional health insurance plans, HDHPs generally offer lower monthly premiums, making them more affordable for individuals and businesses.

- Controlled healthcare spending: HDHPs encourage individuals to be more cost-conscious and engage in price comparisons, leading to more informed healthcare decisions and potentially lower expenses.

- HSA compatibility: HDHPs are often accompanied by a Health Savings Account (HSA), allowing individuals to save tax-free money for eligible medical expenses.

- In-network benefits: Many HDHPs provide comprehensive coverage for in-network services, ensuring individuals can access a wide range of healthcare providers.

It is important to note that while HDHPs can benefit specific individuals and families, they may not be the best fit for everyone. Before enrolling in a high-deductible health plan, individuals should carefully consider their healthcare needs, existing medical conditions, and financial situation.

Technological Innovations Impacting Health Insurance

Technological advancements are revolutionizing the health insurance industry as the healthcare landscape evolves. These innovations are reshaping how insurance providers operate, from health tracking devices to artificial intelligence (AI) processing claims.

Advancements In Health Tracking Devices

Health insurance trends are witnessing a surge in health tracking devices that offer real-time data on individuals’ wellness. These devices, including fitness trackers and smartwatches, allow insurers to incentivize policyholders to maintain healthy habits.

Utilization Of Artificial Intelligence In Claims Processing

Artificial intelligence is streamlining claims processing in the health insurance sector. By leveraging AI algorithms, insurers can automate claim validation, reduce errors, and expedite policyholder reimbursement.

Credit: www.linkedin.com

Impact Of Legislative Changes On Health Insurance

Legislative changes significantly impact the health insurance landscape, shaping the accessibility, affordability, and scope of coverage. Understanding how these changes influence the healthcare sector is crucial for industry professionals and policyholders.

Affordable Care Act Reforms

Since its implementation, the Affordable Care Act (ACA) has been a central force in reshaping health insurance regulations. Enacted in 2010, the ACA introduced several key provisions, including expanding Medicaid, establishing health insurance marketplaces, and implementing essential health benefits. These reforms aimed to increase the number of insured individuals, improve coverage quality, and regulate insurance practices, such as prohibiting discrimination based on pre-existing conditions.

State-level Initiatives In Health Insurance Regulation

States play a pivotal role in shaping the regulatory framework for health insurance. In recent years, state-level initiatives have focused on consumer protection, network adequacy, and premium rate review processes. Through legislation and regulatory actions, states have sought to address local healthcare needs and market dynamics, leading to variations in insurance requirements and coverage options across different regions.

Challenges And Opportunities In The Health Insurance Industry

The health insurance industry faces evolving trends that present both challenges and opportunities. As healthcare costs rise, insurers innovate with new plans and technologies to meet consumer needs and effectively navigate market shifts. Staying ahead in this dynamic landscape requires constant adaptation and strategic planning.

Addressing Healthcare Disparities

One of the significant challenges in the health insurance industry is addressing healthcare disparities. These disparities create barriers to healthcare access for specific populations, leading to unequal health outcomes. Health insurance providers can positively impact by implementing initiatives to reduce these disparities and ensure all individuals have equal access to affordable and comprehensive healthcare coverage.

Expanding Coverage For Mental Health Services

Another critical area that poses challenges and opportunities for the health insurance industry is expanding coverage for mental health services. The growing awareness of mental health issues has brought to light the need for comprehensive coverage of mental healthcare services. This presents an opportunity for health insurance providers to revamp their offerings and include expanded coverage for mental health treatments, thus supporting the overall well-being of their members.

Global Perspectives On Health Insurance Trends

Discover the latest global perspectives on health insurance trends, providing insights into the industry’s future. Gain valuable knowledge on the evolving landscape of health insurance and how it impacts individuals and organizations. Stay informed on the changing trends and make informed decisions about your health coverage needs.

Comparison Of Health Insurance Models Across Countries

Various countries implement distinct health insurance models, impacting affordability and coverage.

Considering the intricacies of models globally allows for valuable insights into effectiveness and shortcomings.

International Collaborations For Health Insurance Innovation

Innovative health insurance solutions are fostered through cross-border collaborations.

- Sharing best practices and technologies

- Enhancing efficiency in healthcare delivery

- Encouraging global knowledge exchange

Consumer Behavior And Decision-making In Health Insurance

Various industry trends influence consumer behavior and decision-making in health insurance. Understanding these trends can help individuals make informed choices about their healthcare coverage. From rising healthcare costs to the evolution of healthcare delivery, staying up-to-date with the latest trends can help consumers navigate the complex world of health insurance.

Shifts In Consumer Preferences

Consumer preferences in the health insurance industry have significantly shifted in recent years. With more options available and increased access to information, individuals are now actively involved in the decision-making process when selecting a health insurance plan. In the past, consumers might have relied solely on their employer’s offerings or opted for the most affordable plan without considering their specific needs. However, the current trend shows that consumers seek more personalized and flexible options that cater to their unique requirements.

One major shift in consumer preferences is the increased demand for health insurance plans with comprehensive coverage. Previously, individuals may have been content with minimal coverage as long as it met the basic requirements. However, consumers today are more concerned about protecting themselves against unexpected medical costs, leading to a growing interest in plans that cover a wide range of services, including preventive care, mental health, and prescription drugs.

Another shift in consumer preferences is the desire for greater transparency and cost-consciousness. With rising healthcare costs, individuals are becoming more price-sensitive and are actively searching for affordable options. They are now more likely to compare prices, evaluate deductibles and copayments, and carefully consider the overall value they receive from their health insurance plan.

Factors Influencing Health Insurance Selection

Several factors come into play when individuals decide about their health insurance coverage. Understanding these factors can help insurance providers tailor their plans to better meet consumer needs and preferences. The following are some key factors influencing health insurance selection:

- Cost: Affordability is a primary concern for consumers when choosing a health insurance plan. Individuals evaluate premiums, deductibles, copayments, and out-of-pocket expenses to find the best value for their money.

- Provider Network: The availability of preferred healthcare providers can significantly impact a consumer’s decision. Individuals often prioritize having access to their current doctors or specialists when selecting a health insurance plan.

- Coverage and Benefits: Consumers look for plans that offer comprehensive coverage, including preventive care, hospitalization, prescription drugs, and specialized services, such as mental health or maternity care.

- Flexibility: As individuals aim for more personalized options, a health insurance plan’s flexibility becomes crucial. This includes choosing providers outside the network, accessing telemedicine services, or customizing coverage according to specific needs.

- Customer Service: Consumers highly value a seamless and responsive customer service experience. Good customer service can significantly impact consumers’ satisfaction with their health insurance provider.

Considering these factors, insurance providers can better understand and meet consumers’ evolving expectations, ultimately leading to more satisfied policyholders.

Future Outlook For Health Insurance

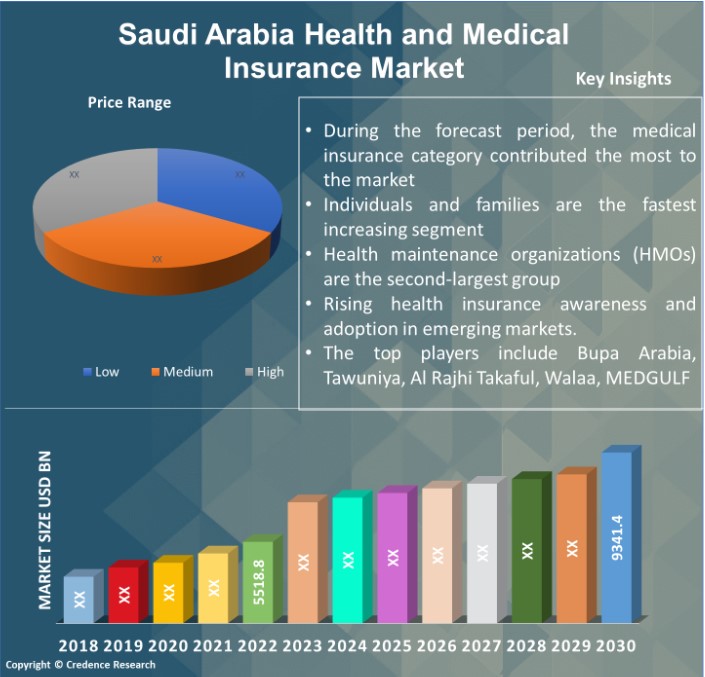

The future outlook for health insurance shows a stable market, with predictions indicating a rise in healthcare costs over the next policy year. The industry is witnessing an evolution in delivery and navigation, focusing on ecosystem partnerships and advantage Medicare plans in a shifting market landscape.

Potential Impact Of Big Data Analytics

Big Data Analytics has the potential to revolutionize the health insurance industry in the future. Insurance providers can gain valuable insights into customer behavior, utilization patterns, and healthcare outcomes by analyzing vast amounts of data collected from various sources. This can lead to more personalized and efficient healthcare services, improved risk assessments, and better cost management. One of the critical advantages of utilizing big data analytics is the ability to identify high-risk individuals and intervene early to prevent costly healthcare interventions. Insurers can proactively identify individuals at risk of developing chronic conditions by analyzing data from wearable devices, electronic health records, and even social media platforms. This enables them to offer preventive measures like lifestyle interventions, wellness programs, and targeted health screenings. By integrating preventive health measures into insurance plans, insurers can reduce healthcare costs in the long run and improve overall population health.

Integration Of Preventive Health Measures

The integration of preventive health measures is becoming increasingly important in the future of health insurance. With rising healthcare costs and an aging population, a growing focus is on taking proactive steps to maintain good health and prevent diseases. Insurance providers are recognizing the value of offering wellness programs, health education resources, and access to preventive screenings as part of their coverage. By encouraging individuals to take charge of their health and adopt healthy behaviors, insurers can reduce the burden of chronic diseases and improve their bottom line. Preventive measures such as vaccinations, routine screenings, and healthy lifestyle choices can help individuals avoid expensive medical treatments and hospitalizations.

Moreover, insurers can shift the focus from reactive care to proactive health management by emphasizing preventive health measures. This can lead to a more sustainable healthcare system, better health outcomes, and improved overall population health. Overall, the future outlook for health insurance is promising. With the potential impact of big data analytics and the integration of preventive health measures, insurance providers can adapt to changing healthcare trends and offer their customers more personalized, cost-effective, and proactive healthcare solutions. By embracing these trends, the health insurance industry can be crucial in improving population health and ensuring access to quality healthcare for all.

Credit: www.credenceresearch.com

Frequently Asked Questions About Health Insurance Trends

What Are The Health Insurance Trends In 2024?

In 2024, health insurance trends include increased digital services, personalized plans, and a focus on mental health support.

What Is The Future Of The Health Insurance Industry?

The future of the health insurance industry is expected to be stable, with trends indicating a rise in healthcare costs. Industry players focus on partnerships, navigation services, and Medicare Advantage plans to adapt to the shifting market. (48 words)

What Is Medical Trend In Insurance?

Medical trends in insurance refer to predicting the rise in healthcare costs for the upcoming policy year. They are used to calculate renewal rates for health plans and stop-loss insurance. Understanding medical trends is crucial in determining their impact on insurance renewals.

What Are Four Trends In Healthcare?

Four trends in healthcare include telemedicine expansion, personalized medicine advancements, data analytics utilization, and increased focus on mental health services.

Conclusion

The health insurance industry trends point towards stability and strategic healthcare partnerships. Understanding these trends can navigate insurance renewals effectively. Stay informed to optimize benefits and adapt to evolving healthcare landscapes. Partnering with industry experts can ensure efficient cost management and sustainable coverage.