Memorial Health Plan Insurance: Expert Tips for Coverage Success

Memorial Health Plan Insurance is a health insurance provider based in Austin, Texas. It offers affordable health insurance plans, including Medicare Advantage plans and wellness programs. Memorial Health Plan Insurance is known for its vast network of healthcare providers and quality customer service.

However, some customers have reported issues with obtaining medications and provider relations that do not offer timely help. Memorial Hermann Advantage HMO is one of their Medicare Advantage plans that contract with Medicare to provide Part A and B benefits.

They have a large member base and accept various insurance plans to ensure their customers get the most out of their health coverage.

Credit: enhancv.com

History Of Memorial Health Plan Insurance

Memorial Health Plan Insurance has a rich history that spans several decades, influencing the healthcare landscape in the Austin, Texas, area. Understanding Memorial Health Plan’s establishment and key milestones is crucial to appreciating its significant contributions to the healthcare industry.

Establishment Of Memorial Health Plan

Memorial Health Plan Insurance was established in the Austin, Texas, area to provide comprehensive health insurance solutions to the community. Its inception marked a significant milestone in making quality healthcare more accessible and affordable for the region’s residents.

Key Milestones

- 1993: Memorial Health Plan Insurance was founded under the Memorial Hermann Health System, aiming to offer innovative insurance plans.

- 2005: The introduction of the Memorial Hermann Advantage HMO health plan further expanded the coverage options, catering to various healthcare needs.

- 2010: Memorial Hermann Health Plan extended its services by offering different types of Medicare health insurance plans, providing various options for individuals.

- 2015: The Memorial Hermann Health Plan gained recognition for its exemplary customer service and timely decision-making regarding appeals, culminating in positive reviews and ratings by satisfied customers.

- 2020: Memorial Hermann Health Solutions continued to evolve, bringing affordable health insurance, including Medicare Advantage plans and wellness programs, to Houston employers, brokers, and individuals.

Coverage And Benefits

Memorial Health Plan Insurance in Austin, Texas, offers a range of coverage and benefits for individuals, employers, and brokers. From affordable health insurance to Medicare Advantage plans, their goal is to provide comprehensive healthcare options for everyone.

Memorial Health Plan Insurance offers comprehensive coverage and benefits to ensure the well-being of its members. Understanding the specifics of coverage and benefits is crucial for individuals seeking quality healthcare. Let’s delve into the areas of coverage and benefits that Memorial Health Plan Insurance provides.

Inpatient Services

Memorial Health Plan Insurance covers many inpatient services, including hospitalizations, surgeries, and intensive care. Members can benefit from quality inpatient care at network hospitals and medical facilities.

Outpatient Services

Additionally, the insurance plan includes a comprehensive range of outpatient services such as diagnostic tests, consultations, therapies, and minor procedures. Members can conveniently access these services at affiliated outpatient centers and clinics.

Prescription Drug Coverage

Memorial Health Plan Insurance prioritizes the well-being of its members by offering extensive prescription drug coverage. The plan includes a formulary of medications, ensuring members can access essential prescriptions at affordable rates. In conclusion, Memorial Health Plan Insurance presents a robust package of coverage and benefits, from inpatient and outpatient services to prescription drug coverage, providing peace of mind to its members. Join Memorial Health Plan and experience peace of mind with comprehensive coverage and benefits.

Member Services And Support

The Member Services and Support at Memorial Health Plan Insurance cater to the needs of their members with prompt assistance and guidance, ensuring a streamlined experience for their beneficiaries. The seamless support system enhances the overall satisfaction and efficiency of the insurance services offered by Memorial Health Plan.

Customer Support Channels

At Memorial Health Plan Insurance, we prioritize providing exceptional customer support to our valued members. We understand that effective communication is vital in ensuring a seamless healthcare experience. That’s why we offer a range of customer support channels to address any questions or concerns you may have.

- Phone: You can reach our dedicated customer support team by calling (713) 338-5252 during business hours, which are 8 AM to 8 PM.

- Email: For non-urgent inquiries or general information, you can email us at [email protected]. We strive to respond to all emails promptly.

- Online Chat: Our website features a convenient live chat option, which allows users to chat with a representative in real-time. This is ideal for quick queries or clarifications.

No matter which channel you choose, we guarantee professional and friendly assistance from our knowledgeable staff. We are here to support you every step of the way.

Wellness Programs

At Memorial Health Plan Insurance, we believe that promoting wellness is essential to maintaining a healthy lifestyle. That’s why we offer a variety of wellness programs to our members. Our programs empower you to take control of your health and achieve your wellness goals. Here are some of the wellness programs we offer:

- Health Coaching: Our team of certified health coaches will provide personalized guidance and support to help you make positive lifestyle changes. Whether you want to lose weight, manage stress, or improve your overall well-being, our health coaches are here to assist you.

- Preventive Screenings: Regular preventive screenings are crucial in detecting potential health issues early on. We offer a comprehensive range of screenings, including blood pressure checks, cholesterol screenings, and cancer screenings, to ensure you stay on top of your health.

- Wellness Workshops: Our interactive workshops cover various topics, including nutrition, exercise, stress management, and more. These workshops provide valuable information and practical tips to help you lead a healthier lifestyle.

By participating in our wellness programs, you’ll have access to a support network that encourages and motivates you to make positive health choices. We are committed to helping you live your best and healthiest life.

Provider Network

In-network Providers

Accessing in-network providers with Memorial Health Plan Insurance ensures cost-effective healthcare services.

Out-of-network Coverage

While out-of-network coverage is available, utilizing in-network providers maximizes insurance benefits.

Costs And Premiums

Memorial Health Plan Insurance offers competitive rates for its policyholders, focusing on Costs and Premiums. Understanding the Costs and Premiums associated with your health insurance plan is crucial for making informed decisions about your healthcare needs.

Deductibles And Co-payments

Regarding Deductibles and Co-payments, Memorial Health Plan Insurance provides transparent information about the amounts you are responsible for paying before your insurance coverage kicks in.

Premium Structure

The Premium Structure of Memorial Health Plan Insurance is designed to offer affordable options for individuals and families, ensuring access to quality healthcare services without breaking the bank.

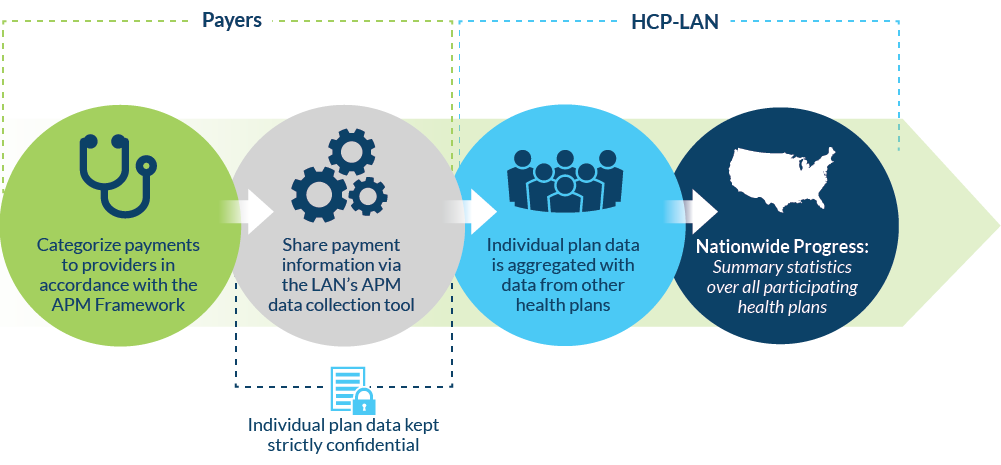

Credit: hcp-lan.org

Quality And Satisfaction

Memorial Health Plan Insurance ensures quality and satisfaction with various coverage options. Members can rely on the plan for efficient, timely service and comprehensive care. With Memorial Health, you can expect high standards and customer-focused solutions for all your insurance needs.

Ratings And Rankings

Memorial Health Plan Insurance is committed to providing quality healthcare coverage and ensuring member satisfaction. Its efforts have been recognized through various industry ratings and rankings.

Member Satisfaction Surveys

To ensure that its members are delighted with its insurance plans, Memorial Health Plan Insurance regularly conducts member satisfaction surveys. These surveys allow members to provide valuable feedback on their experiences, allowing the company to make improvements and better meet the needs of its members.

Table: Ratings And Rankings

| Organization | Rating/Ranking |

|---|---|

| U.S. News & World Report | Top-rated health insurance provider |

| Health Plan Radar | Positive customer reviews |

| Glassdoor | Highly rated employer |

– U.S. News & World Report has recognized Memorial Health Plan Insurance as a top-rated health insurance provider, highlighting its commitment to quality and member satisfaction. – According to Health Plan Radar, Memorial Health Plan Insurance has received positive customer reviews, indicating that members are delighted with their insurance coverage and services. – Glassdoor has rated Memorial Health Plan Insurance as an outstanding employer, a testament to the company’s dedication to providing a positive work environment. By consistently receiving positive ratings and rankings, Memorial Health Plan Insurance demonstrates its dedication to delivering high-quality healthcare coverage and ensuring member satisfaction. The company values the feedback from its members and continuously strives to improve its services based on their input.

Digital Tools And Technology

As a modern health insurance provider, Memorial Health Plan Insurance understands the importance of leveraging digital tools and technology to enhance the overall customer experience and make healthcare management more convenient and accessible. By adopting cutting-edge digital solutions, Memorial Health Plan Insurance ensures its members can access their health information, stay connected with their providers, and efficiently manage their insurance benefits.

Mobile App Features

The Memorial Health Plan Insurance mobile app offers comprehensive features designed to empower members to manage their healthcare on the go. The app provides real-time access to insurance information, allowing users to check their coverage, deductible status, and claims processing. In addition, users can schedule appointments, receive customized alerts for medication reminders and upcoming medical screenings, and securely communicate with their healthcare providers. The mobile app’s intuitive interface and seamless navigation make it effortless for members to stay informed and proactive about their health and insurance.

Online Member Portal

With the Memorial Health Plan Insurance online member portal, members have 24/7 access to a wealth of resources and tools for managing their insurance benefits. The portal lets members view and download digital ID cards, review their policy details, and track their healthcare expenses. Furthermore, the online portal facilitates secure messaging with customer service representatives, streamlining the resolution of queries and concerns. Through the online member portal, Memorial Health Plan Insurance prioritizes transparency and accessibility, ensuring members can stay informed and control their healthcare journey.

Credit: www.amazon.com

Future Outlook

The future outlook for Memorial Health Plan Insurance looks promising. The company will focus on adopting innovative trends and expanding its services to cater to a larger demographic. As the healthcare landscape continues to evolve, Memorial Health Plan is committed to staying at the forefront of advancements to ensure its members receive top-notch care and coverage.

Trends And Innovations

Memorial Health Plan Insurance is dedicated to embracing the latest trends and innovations in the healthcare industry. This includes implementing cutting-edge technology to streamline administrative processes and enhance patient care. Additionally, the plan continually evaluates new treatment modalities and therapies to provide comprehensive and adequate coverage for its members.

Expansion Plans

With a focus on growth and accessibility, Memorial Health Plan Insurance strategically plans its expansion to reach a wider audience. By expanding its network of healthcare providers and services, the plan aims to extend its coverage to more individuals and communities, ensuring access to quality healthcare for all.

Frequently Asked Questions Of Memorial Health Plan Insurance

What Type Of Coverage Is the Memorial Hermann Advantage Plan?

The Memorial Hermann Advantage Plan is an HMO Medicare Advantage plan that covers Part A and Part B benefits.

How Many Members Does Memorial Hermann Health Plan Have?

Memorial Hermann Health Plan has a [number] of members. For exact figures, please visit their official website.

Is Florida Blue Medicaid?

Florida Blue is not Medicaid; it offers Medicare Advantage plans like HMO, PPO, and HMO DSNP.

What Is The Payer ID for the Memorial Hermann Health Plan?

The payer ID for Memorial Hermann Health Plan is MHHP.

Conclusion

In today’s world, Memorial Health Plan Insurance in Austin, Texas, provides valuable health insurance options for individuals and employers. With various coverage options, including Medicare Advantage plans, Memorial Hermann Health Solutions offers affordable and comprehensive healthcare solutions.

By accepting a wide range of insurance plans, including private, Medicaid, and Medicare Advantage, they ensure you can get the most out of your health insurance. Don’t hesitate to contact Memorial Health Plan Insurance to explore your coverage options and secure the healthcare you deserve.