Lucent Health Insurance: Top Benefits & Savings

Lucent Health Insurance is a leading third-party administrator that provides data-driven and customized health plans for self-insured employers in Austin, Texas, and across the United States. With a focus on cost-saving healthcare decisions and personalized care management, Lucent Health advocates for individuals and families throughout their healthcare journey.

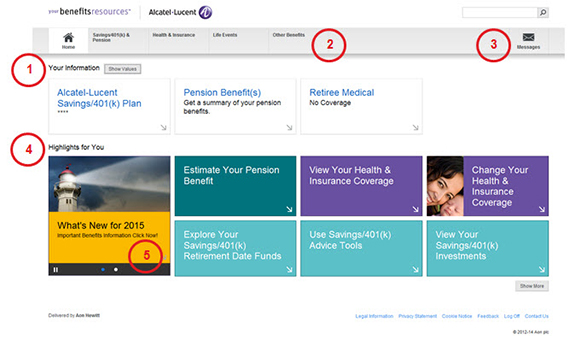

Whether you’re looking for comprehensive insurance coverage or need assistance with claims and benefits, Lucent Health is dedicated to providing top-rated solutions and resources for its members. With a user-friendly member website and a provider portal for easy access to information and services, Lucent Health ensures a seamless healthcare experience for all.

Credit: www.benefitanswersplus.com

The Importance Of Health Insurance

Discover the vital role of health insurance with Lucent Health Insurance. Safeguard your well-being and finances with tailored coverage options for a secure future. Find peace of mind knowing your healthcare needs are prioritized and accessible when needed.

Ensuring Access To Quality Healthcare

Health insurance is crucial in ensuring individuals have access to high-quality healthcare services. With the rising costs of medical treatments and services, having health insurance provides a safety net for individuals to seek timely medical attention without financial constraints. Whether it’s preventative care, routine check-ups, or specialized treatments, access to quality healthcare is essential for overall well-being.

Financial Protection In Times Of Need

Health insurance also provides significant financial protection during unexpected medical emergencies and illnesses. It safeguards individuals from incurring overwhelming medical expenses, potentially leading to economic distress. By having adequate health insurance coverage, individuals can mitigate the risk of facing dire financial consequences due to unforeseen health challenges. In an unpredictable world, the importance of health insurance cannot be underestimated. It is an essential asset that promotes access to healthcare and is a crucial safeguard against financial burdens associated with medical care. Whether ensuring access to quality healthcare or providing financial protection, health insurance is indispensable for maintaining health and well-being.

Overview Of Lucent Health Insurance

Company Background

Lucent Health is a health insurance provider based in Austin, Texas, United States. Known initially as Cypress Benefit Administrators, Lucent Health has a strong presence in the healthcare industry, offering comprehensive and customizable health plans for self-insured employers nationwide.

Insurance Options And Coverage

Lucent Health provides a range of tailored and data-driven health insurance options for employers looking to provide cost-effective and high-quality healthcare benefits to their employees. With a focus on care management and personalized solutions, Lucent Health ensures its members can access a vast network of healthcare providers and resources to navigate their healthcare journey effectively.

Advantages Of Choosing Lucent Health Insurance

Choose Lucent Health Insurance for comprehensive and cost-effective healthcare coverage. With customized plans tailored to your needs, Lucent Health ensures that you and your family receive the best care at a lower cost.

When selecting health insurance, choosing a provider that offers comprehensive coverage, a network of trusted healthcare providers, and excellent customer service is essential. Lucent Health Insurance checks all these boxes, making it a top choice for individuals and families seeking reliable healthcare coverage.

Comprehensive Coverage

Lucent Health Insurance offers a range of robust coverage options that cater to the diverse needs of its members. Whether you need essential healthcare services or more specialized treatments, Lucent Health covers them. Their comprehensive plans ensure access to the necessary medical services, from preventive care and routine check-ups to prescription medications and hospital stays.

Network Of Healthcare Providers

With Lucent Health Insurance, you can access an extensive network of healthcare providers, including doctors, specialists, hospitals, and clinics. This network is carefully curated to ensure you receive high-quality care from trusted professionals in your area. Plus, the convenience of having a wide array of providers means you can easily find a healthcare professional who meets your specific needs and preferences.

Customer Service Excellence

Lucent Health Insurance goes above and beyond to provide superior customer service to its members. Their dedicated team of representatives is available to assist you every step of the way, helping you navigate the complexities of healthcare and addressing any questions or concerns you may have. Whether you need help understanding your benefits, filing a claim, or finding a healthcare provider, Lucent Health’s customer service team ensures a seamless and positive experience.

Comparing Lucent Health Insurance With Competitors

Lucent Health Insurance stands out against competitors with its data-driven and human-focused approach to healthcare. Based in Austin, Texas, it offers customized, configurable health plans to provide better care at a lower cost for employers and their employees.

With a strong emphasis on care management, Lucent Health aims to help members and their families navigate the healthcare journey.

Coverage Offered

Lucent Health Insurance provides comprehensive coverage for a range of healthcare needs.

Premium Rates And Affordability

Lucent Health Insurance offers competitive premium rates, ensuring affordability for individuals and families.

Understanding The Claims Process With Lucent Health Insurance

Navigating through Lucent Health Insurance’s claims process is made simple and efficient, ensuring a smooth experience for policyholders. With a strong focus on customer care, Lucent Health Insurance provides valuable support in understanding and managing the claims journey, putting the policyholders’ needs at the forefront.

Submitting Claims

Submitting claims with Lucent Health Insurance is a simple process. Whether you’ve had a hospital visit, received medical treatment, or purchased prescription medications, you can easily file a claim and get reimbursement for your expenses. Here’s a step-by-step guide to help you navigate the claims submission process:

- Collect all the necessary documentation: Gather all the documents related to your medical expenses, such as bills, receipts, and any supporting medical reports.

- Please complete the claim form. You can obtain it from Lucent Health’s website or contact their customer service for assistance. Fill out the form accurately, providing all the required information.

- Attach supporting documents: Attach all the supporting documents to your claim form. This includes the bills, receipts, and medical reports you collected in step one.

- Submit your claim: Once you have completed the form and attached all the necessary documents, submit your claim to Lucent Health. Depending on the preferred method specified by the insurance provider, you can do this electronically or by mail.

By following these simple steps, you can ensure a smooth and hassle-free claim submission process with Lucent Health Insurance. Remember to keep copies of all the submitted documents for your records.

Claims Approval And Reimbursement

After successfully submitting your claim to Lucent Health Insurance, you may wonder how long it will take for your claim to be approved and reimbursement to be issued. While the exact timeline can vary, Lucent Health strives to process claims quickly and efficiently. Here’s what you can expect:

- Claim review and assessment: Once your claim is received, it will undergo a thorough review by the claims department at Lucent Health. This process ensures that all the necessary information and documentation is in order.

- Approval determination: After completing the review, Lucent Health will determine whether your claim is approved. If there are any discrepancies or missing information, they may contact you for clarification.

- Reimbursement process: Lucent Health will initiate the reimbursement process if your claim is approved. The reimbursement amount will be based on your policy coverage and the eligible expenses outlined in your plan.

- Receipt of reimbursement: Once the reimbursement is processed, you will receive the approved amount through direct deposit or a physical check, depending on your chosen reimbursement method.

Lucent Health aims to provide timely claim approvals and reimbursements, ensuring you receive the financial coverage you deserve. If you have any questions or concerns about the status of your claim, you can always reach out to their dedicated customer service team for support.

Credit: www.benefitanswersplus.com

Customer Reviews And Satisfaction With Lucent Health Insurance

Discover what customers have to say about their experiences with Lucent Health Insurance.

Positive Experiences

Customers cherish the prompt and helpful customer service Lucent Health Insurance representatives provide.

Areas For Improvement

Some customers desire more transparent communication on policy details and coverage.

Tips For Maximizing Your Lucent Health Insurance Benefits

Lucent Health Insurance offers a comprehensive range of benefits to its policyholders. To make the most of your coverage, it’s essential to understand how to utilize the services effectively and efficiently. Here are some tips for maximizing your Lucent Health Insurance benefits:

Utilizing Preventive Services

Preventive care plays a crucial role in maintaining overall health and well-being. With Lucent Health Insurance, you can access various preventive services, including screenings, immunizations, and wellness programs. Take advantage of these services to stay proactive about your health and identify potential issues early on. By attending regular check-ups and screenings, you can prevent severe health conditions and reduce your long-term healthcare costs.

Navigating In-network Providers

When seeking medical care, visiting in-network providers is essential to maximize your Lucent Health Insurance benefits. In-network providers have established contracts with the insurance company, offering discounted rates and minimizing your out-of-pocket costs. Make sure to verify the network status of healthcare providers before scheduling appointments or undergoing treatments. This proactive approach can help you avoid unexpected expenses and maximize your health insurance coverage.

Credit: lucenthealth.com

Future Trends In Health Insurance: The Role Of Lucent Health Insurance

As the healthcare industry evolves, staying abreast of the latest trends impacting health insurance is essential. Lucent Health Insurance represents a leading player in this rapidly changing landscape, shaping the future direction of health insurance with its innovative approaches and adaptable strategies. Let’s delve into Lucent Health Insurance’s pivotal role in shaping future trends in the industry.

Innovations In Coverage Options

Lucent Health Insurance stands out for its commitment to innovative coverage options that cater to the diverse needs of individuals and organizations. Through collaborative partnerships and data-driven insights, Lucent Health has been able to craft flexible and personalized coverage solutions that adapt to its members’ ever-changing healthcare requirements. This adaptable approach ensures that individuals and employers can access pertinent coverage options tailored to their unique health needs.

Adapting To Changing Healthcare Landscape

In a dynamic healthcare landscape, Lucent Health Insurance has demonstrated remarkable adaptability. By embracing technological advancements, healthcare reforms, and evolving consumer preferences, Lucent Health continually redefines its offerings to align with the evolving market demands. This responsive approach enables Lucent Health to effectively navigate and address the challenges posed by the changing healthcare ecosystem, ensuring its continued relevance and effectiveness in providing comprehensive health insurance solutions.

Frequently Asked Questions On Lucent Health Insurance

What Type Of Plan Is Lucent Health?

Lucent Health offers data-driven care management for self-insured employers. They tailor health plans to meet employees’ needs for better care at a lower cost.

What Is Lucent Health Formerly Known As?

Lucent Health was formerly known as Cypress Benefit Administrators.

Is Lucent Health The Same As Cypress?

Yes, Lucent Health is the same as Cypress Benefit Administrators. Lucent Health completed the brand transition from Cypress.

What Is The Phone Number For Lucent Health Benefits?

The phone number for Lucent Health Benefits is not provided in the given information.

Conclusion

Lucent Health Insurance is a trusted provider that offers highly customizable and cost-effective healthcare plans for self-insured employers. With a data-driven approach and a focus on personalized care, Lucent Health aims to help individuals and their families navigate the complexities of the healthcare system.

From online resources and member portals to a dedicated provider network, Lucent Health is committed to delivering high-quality healthcare solutions. Contact Lucent Health today to explore their comprehensive insurance options and make informed decisions about your healthcare needs.